This version of the form is not currently in use and is provided for reference only. Download this version of

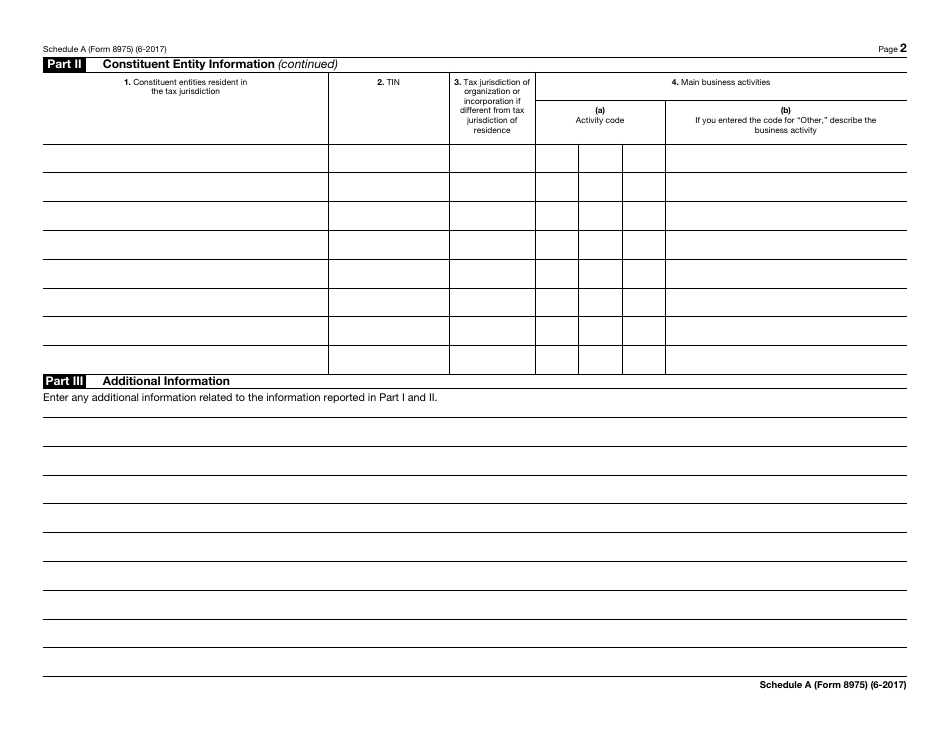

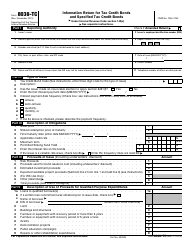

IRS Form 8975 Schedule A

for the current year.

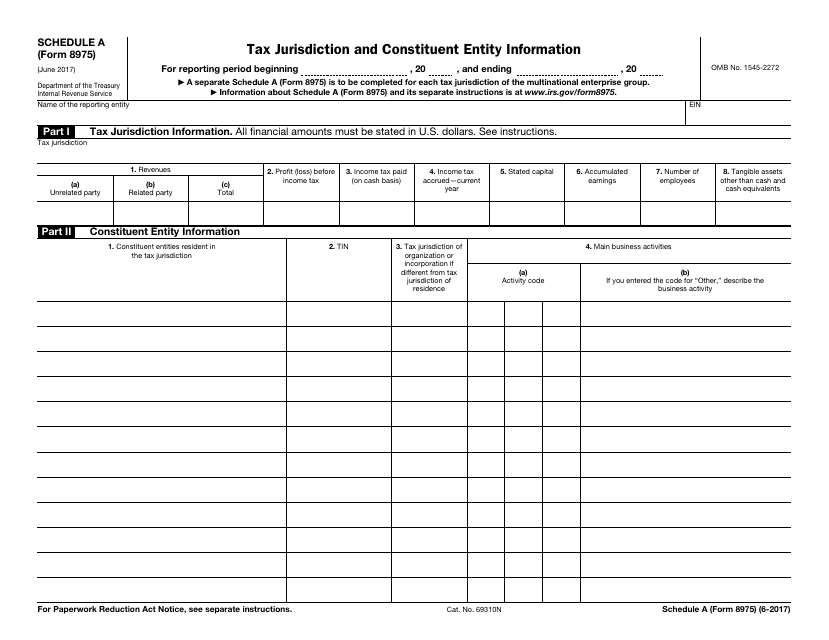

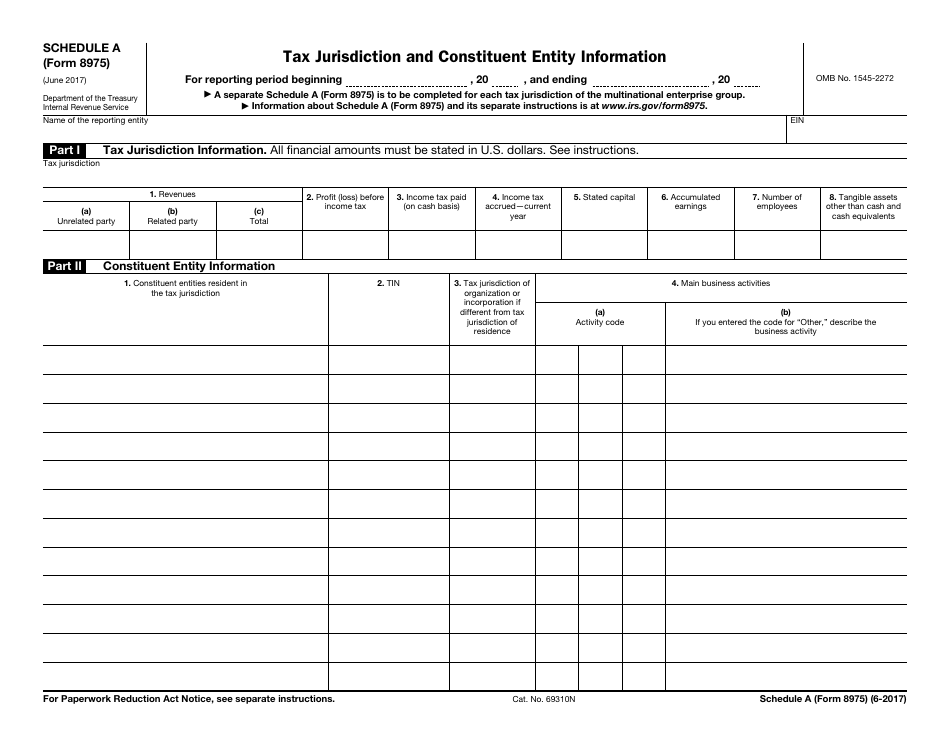

IRS Form 8975 Schedule A Tax Jurisdiction and Constituent Entity Information

What Is IRS Form 8975 Schedule A?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury on June 1, 2017. The document is a supplement to IRS Form 8975, Country-By-Country Report. Check the official IRS-issued instructions before completing and submitting the form.

FAQ

Q: What is IRS Form 8975?

A: IRS Form 8975 is a form used to report tax jurisdiction and constituent entity information.

Q: What is Schedule A?

A: Schedule A is a part of IRS Form 8975 where you provide tax jurisdiction and constituent entity information.

Q: What is tax jurisdiction information?

A: Tax jurisdiction information refers to the details of the jurisdictions where the constituent entities are subject to tax.

Q: What is constituent entity information?

A: Constituent entity information refers to the details of each entity that is included in the filing, such as its name, address, and tax jurisdiction.

Q: Who needs to file IRS Form 8975?

A: Certain multinational enterprises (MNEs) are required to file IRS Form 8975 if they meet the filing threshold set by the IRS.

Q: What is the purpose of filing IRS Form 8975?

A: The purpose of filing IRS Form 8975 is to provide the IRS with information about the tax jurisdiction and constituent entities of MNEs.

Q: Is IRS Form 8975 Schedule A applicable to individuals?

A: No, IRS Form 8975 Schedule A is not applicable to individuals. It is specifically for multinational enterprises (MNEs).

Q: What are the penalties for not filing IRS Form 8975?

A: The penalties for not filing IRS Form 8975 vary depending on the circumstances, but they can include monetary penalties and potential audit or enforcement actions by the IRS.

Q: When is the deadline to file IRS Form 8975?

A: The deadline to file IRS Form 8975 is generally the same as the filing deadline for the MNE's federal income tax return, including any extensions.

Form Details:

- A 2-page form available for download in PDF;

- Actual and valid for filing 2023 taxes;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 8975 Schedule A through the link below or browse more documents in our library of IRS Forms.