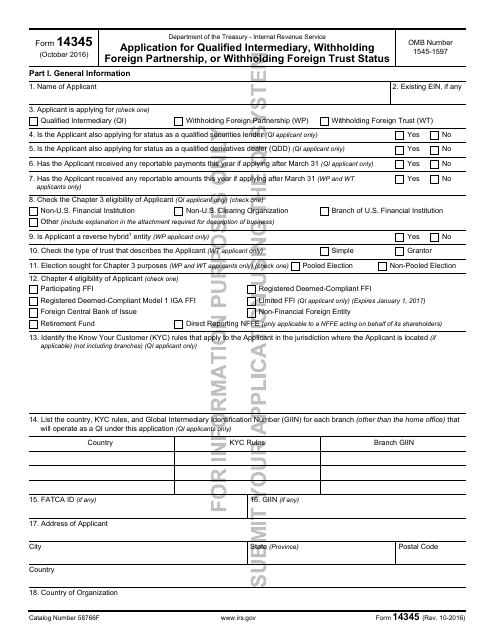

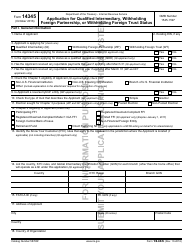

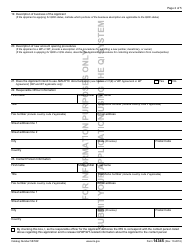

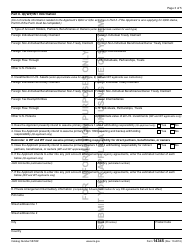

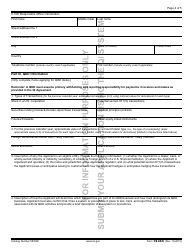

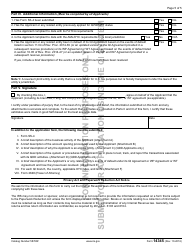

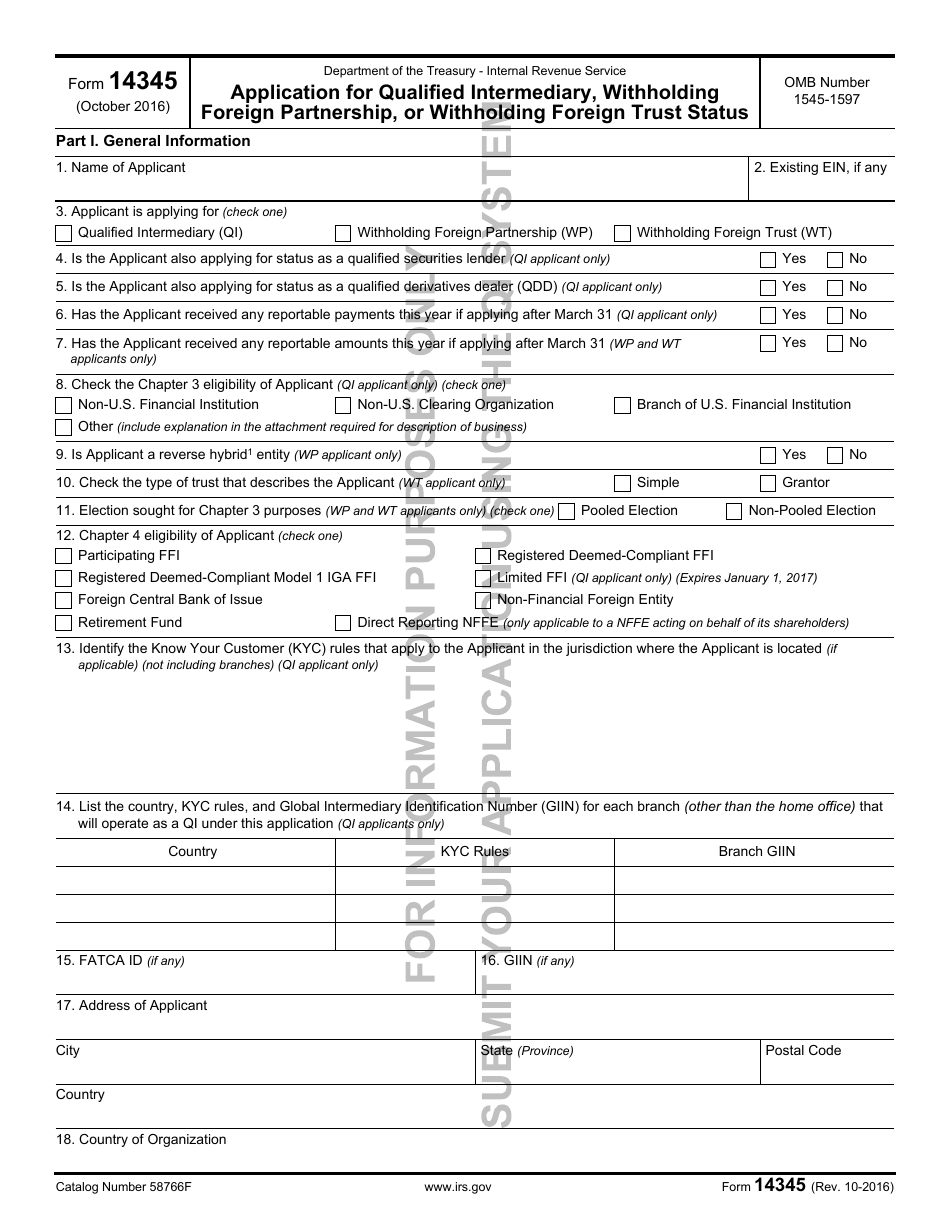

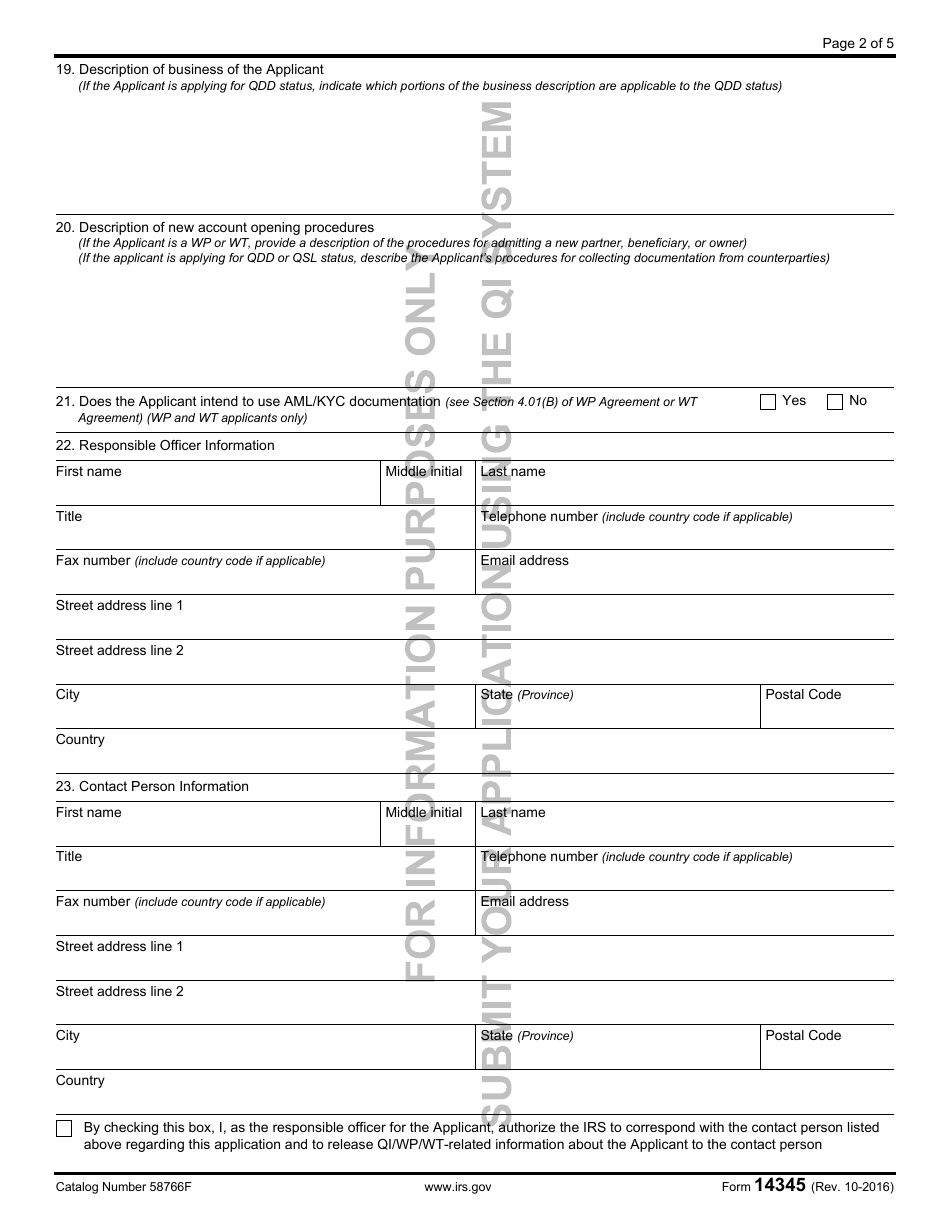

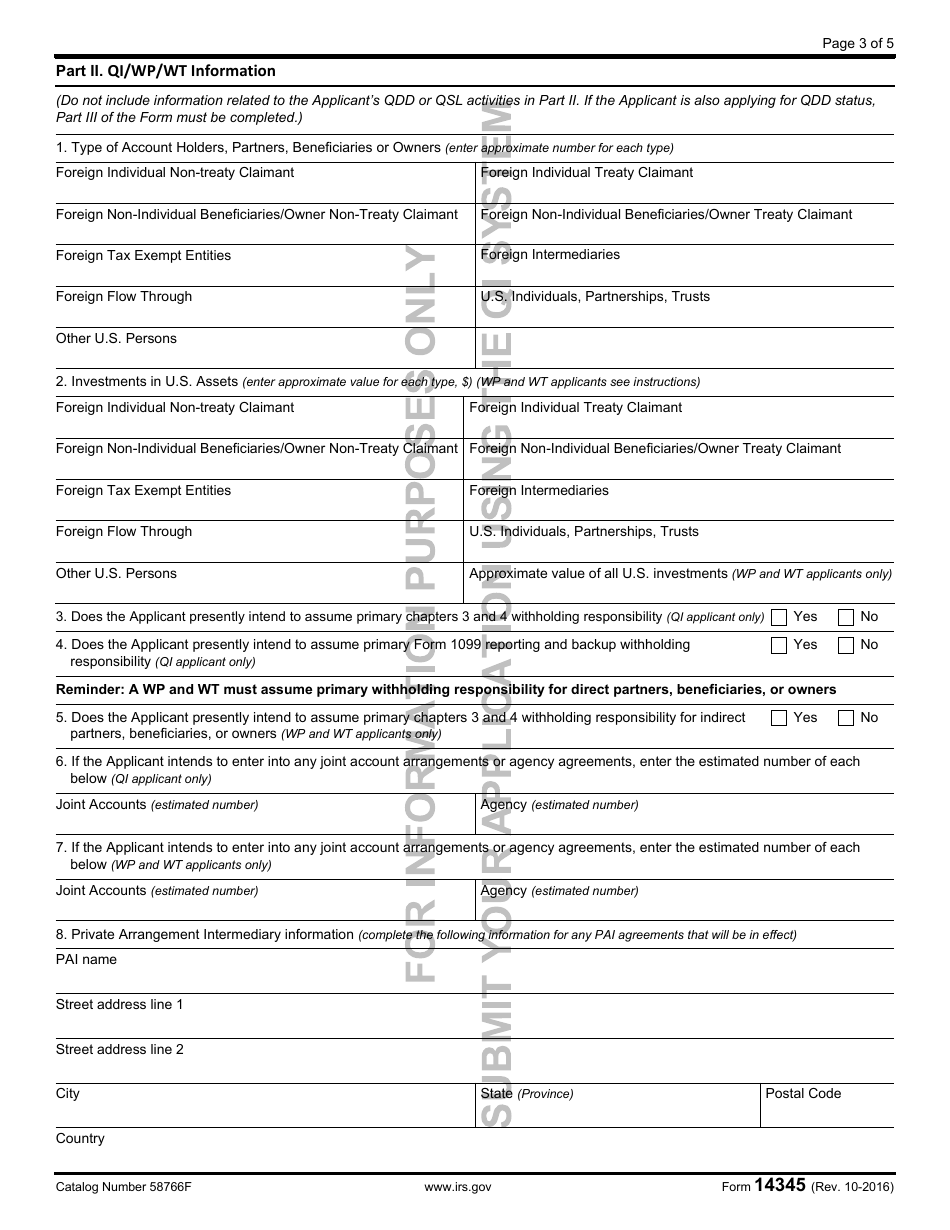

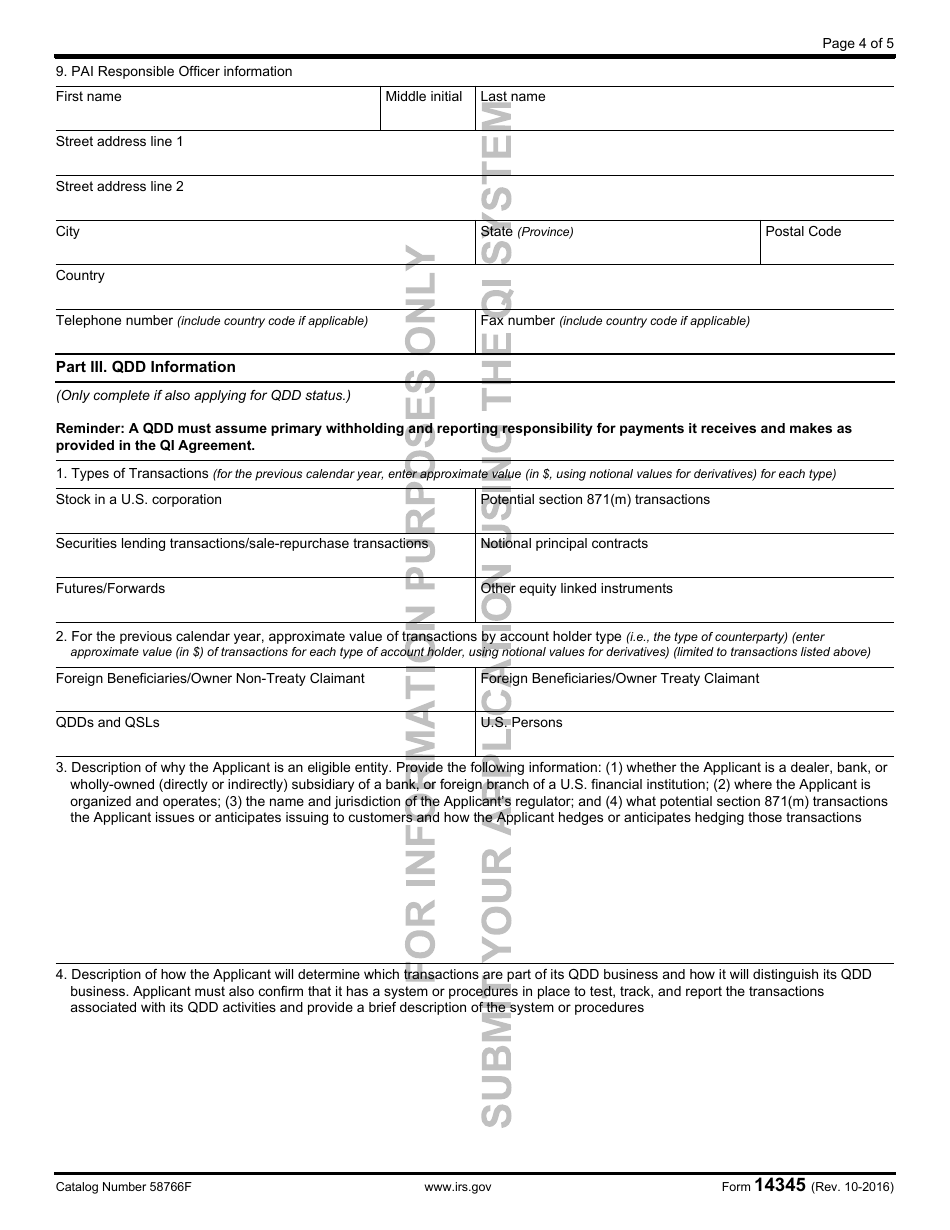

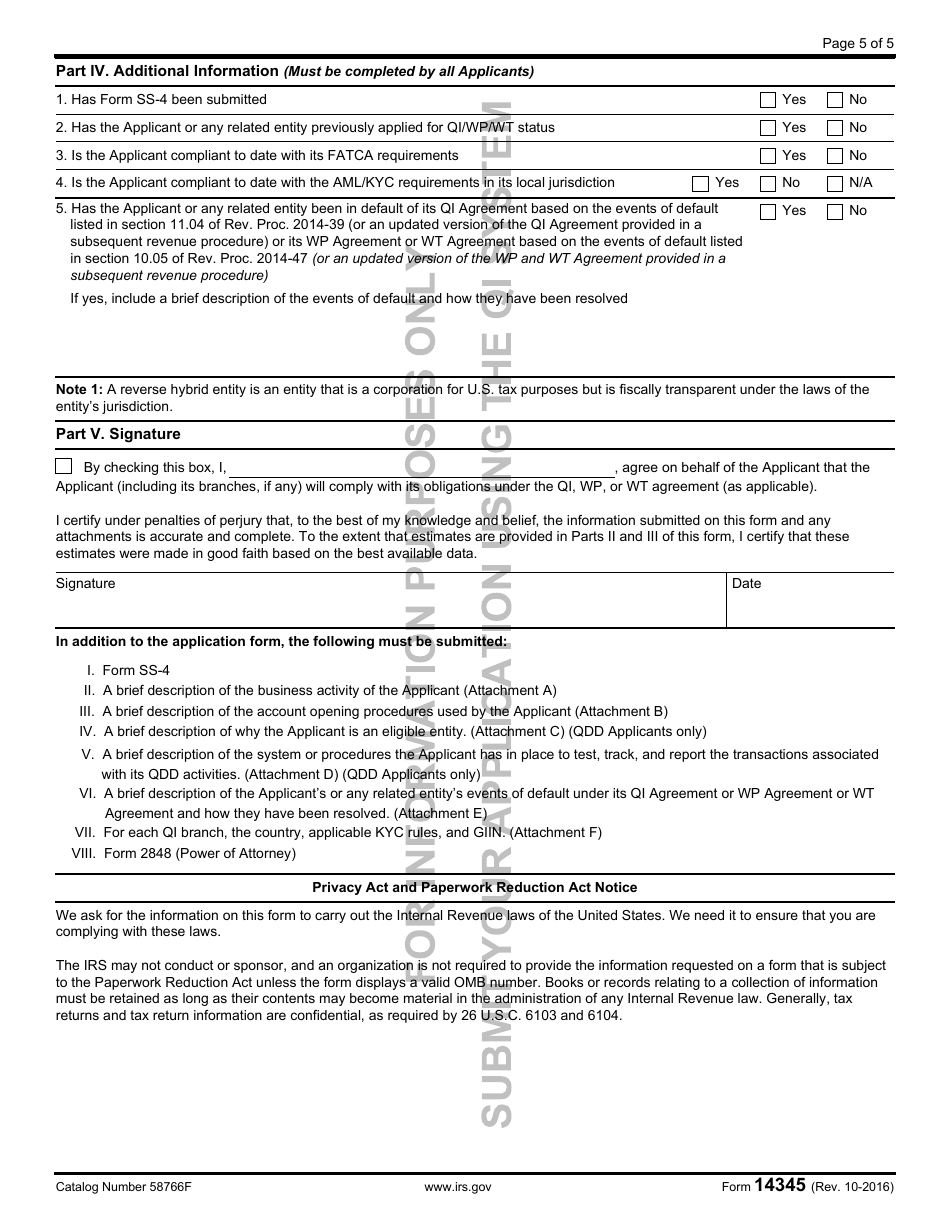

IRS Form 14345 Application for Qualified Intermediary, Withholding Foreign Partnership, or Withholding Foreign Trust Status

What Is IRS Form 14345?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury on October 1, 2016. As of today, no separate filing guidelines for the form are provided by the IRS.

FAQ

Q: What is IRS Form 14345?

A: IRS Form 14345 is the Application for Qualified Intermediary, Withholding Foreign Partnership, or Withholding Foreign Trust Status.

Q: Who needs to file IRS Form 14345?

A: Qualified Intermediaries, Withholding Foreign Partnerships, or Withholding Foreign Trusts need to file IRS Form 14345.

Q: What is the purpose of IRS Form 14345?

A: The purpose of IRS Form 14345 is to apply for qualified intermediary, withholding foreign partnership, or withholding foreign trust status.

Q: Are there any fees associated with filing IRS Form 14345?

A: Yes, there are fees associated with filing IRS Form 14345. The exact amount depends on the type of entity applying for status and the services requested.

Q: What are the requirements for filing IRS Form 14345?

A: The requirements for filing IRS Form 14345 include providing detailed information about the entity, its ownership, and its activities. Additionally, supporting documentation and certifications may be required.

Q: What are the consequences of not filing IRS Form 14345?

A: Failing to file IRS Form 14345 when required can result in penalties, including potential withholding of payments made to the entity.

Q: How long does it take to process IRS Form 14345?

A: The processing time for IRS Form 14345 can vary. It is recommended to submit the form well in advance of the desired effective date to allow for processing.

Form Details:

- A 5-page form available for download in PDF;

- Actual and valid for filing 2023 taxes;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 14345 through the link below or browse more documents in our library of IRS Forms.