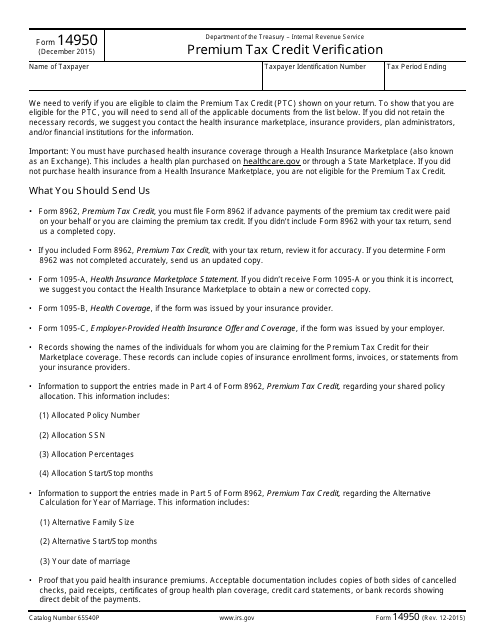

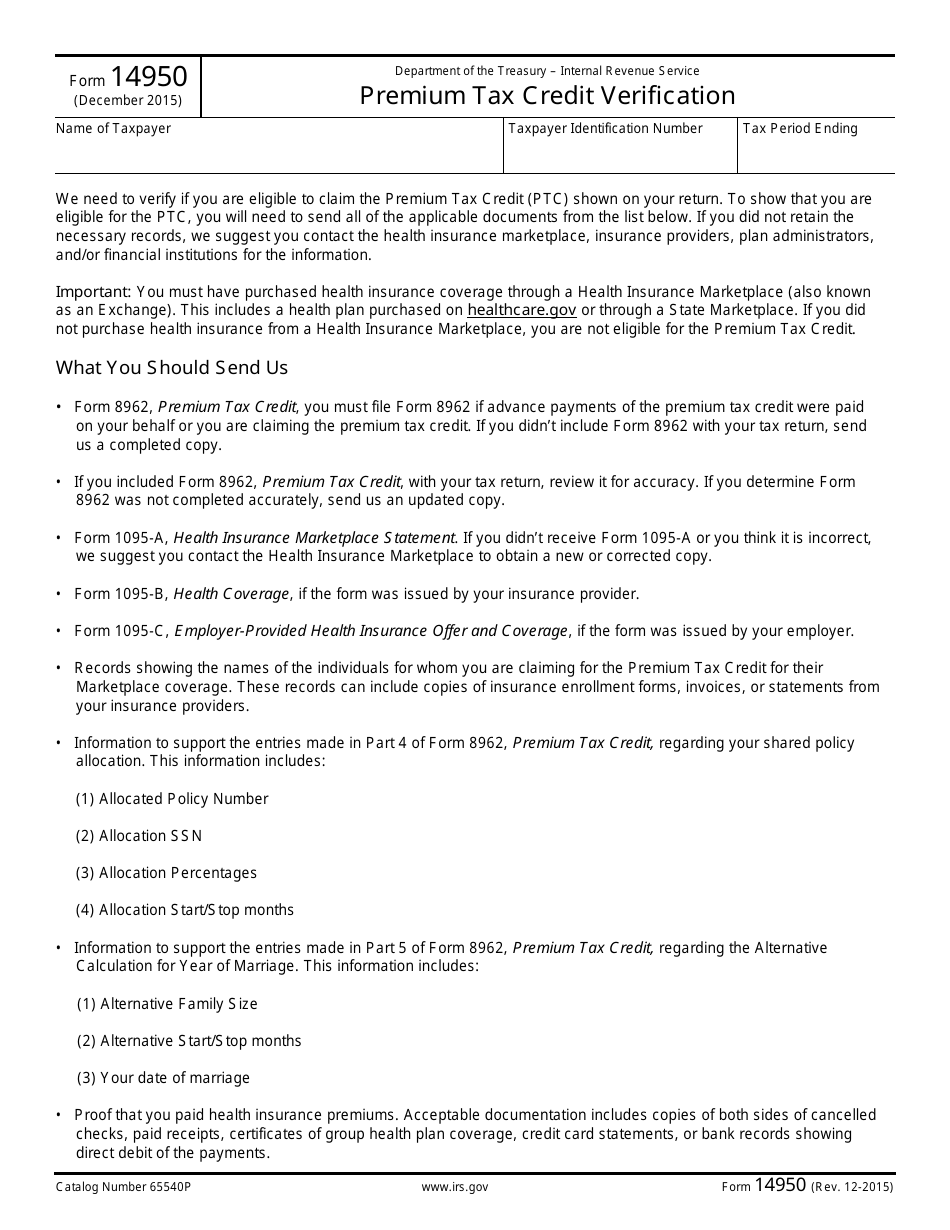

IRS Form 14950 Premium Tax Credit Verification

What Is IRS Form 14950?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury on December 1, 2015. As of today, no separate filing guidelines for the form are provided by the IRS.

FAQ

Q: What is IRS Form 14950?

A: IRS Form 14950 is the Premium Tax Credit Verification form.

Q: What is the Premium Tax Credit?

A: The Premium Tax Credit is a refundable tax credit that helps eligible individuals and families afford health insurance coverage.

Q: Who needs to use IRS Form 14950?

A: IRS Form 14950 is used by individuals who received advance payments of the Premium Tax Credit and need to reconcile those payments on their tax return.

Q: What information is required on IRS Form 14950?

A: IRS Form 14950 requires information related to the advance payments of the Premium Tax Credit, household income, and the health insurance coverage obtained through the Marketplace.

Q: When is IRS Form 14950 due?

A: IRS Form 14950 is generally due when filing the individual's federal income tax return for the corresponding tax year.

Form Details:

- A 1-page form available for download in PDF;

- Actual and valid for filing 2023 taxes;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 14950 through the link below or browse more documents in our library of IRS Forms.