This version of the form is not currently in use and is provided for reference only. Download this version of

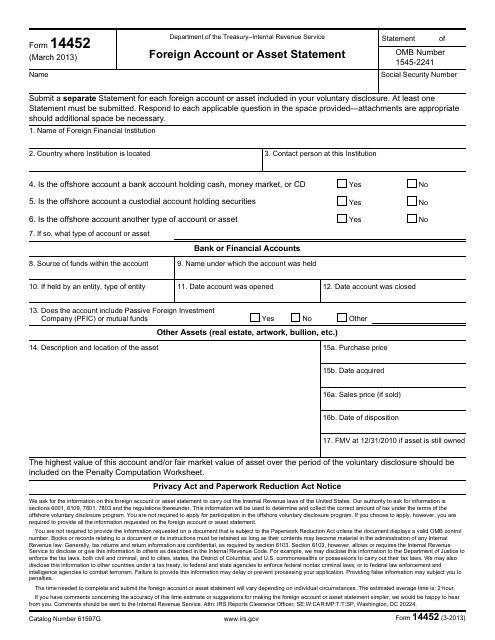

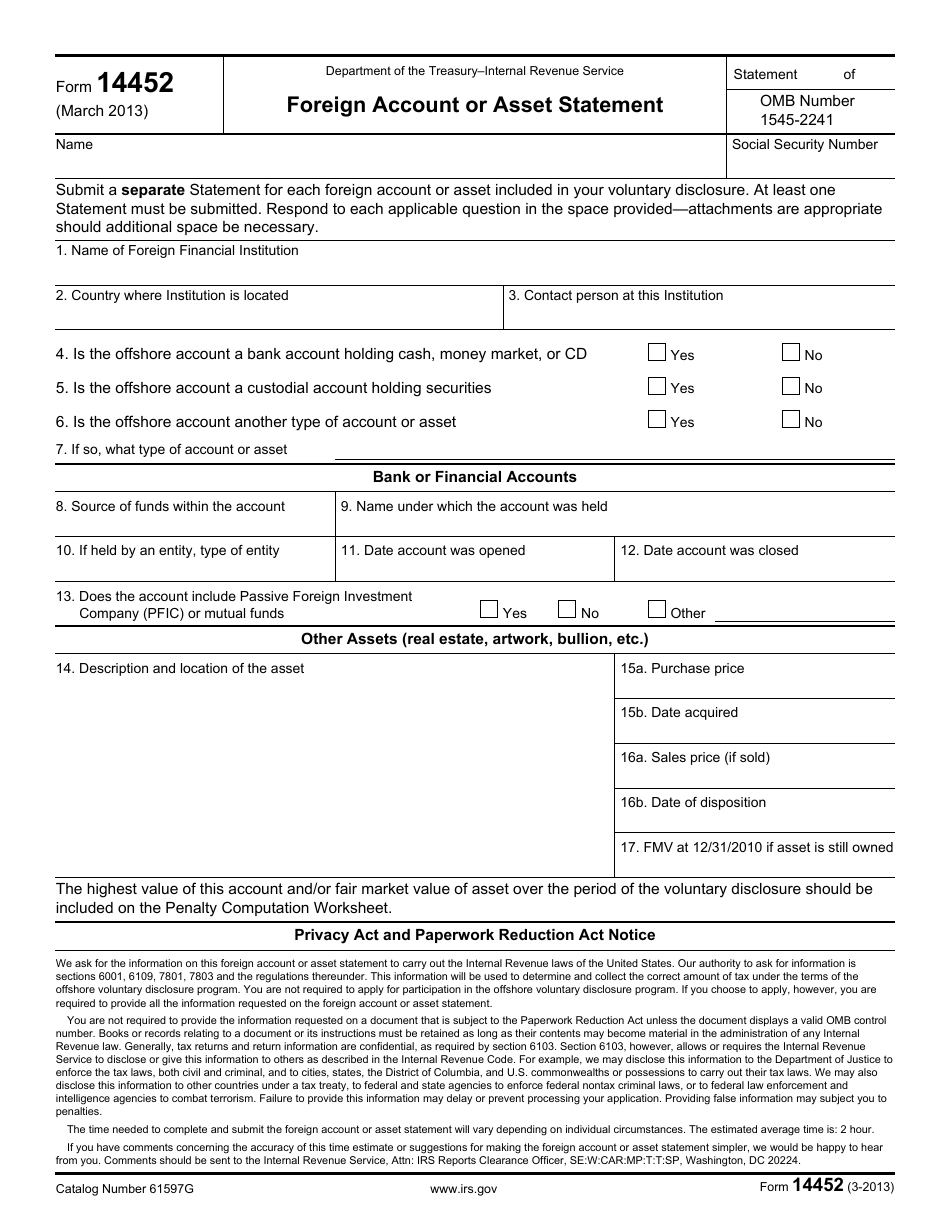

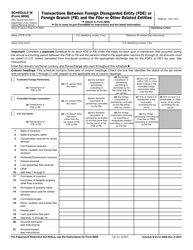

IRS Form 14452

for the current year.

IRS Form 14452 Foreign Account or Asset Statement

What Is IRS Form 14452?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury on March 1, 2013. As of today, no separate filing guidelines for the form are provided by the IRS.

FAQ

Q: What is IRS Form 14452?

A: IRS Form 14452 is the Foreign Account or Asset Statement.

Q: Who needs to file IRS Form 14452?

A: Individuals who have foreign financial accounts or assets that exceed certain thresholds need to file IRS Form 14452.

Q: What is the purpose of filing IRS Form 14452?

A: The purpose of filing IRS Form 14452 is to report foreign financial accounts or assets and to comply with the requirements of the Foreign Account Tax Compliance Act (FATCA).

Q: What information is required on IRS Form 14452?

A: IRS Form 14452 requires information about the foreign financial accounts or assets, including the account balance, income earned, and any distributions or withdrawals.

Q: When is the deadline for filing IRS Form 14452?

A: The deadline for filing IRS Form 14452 is typically April 15th, but it may be extended to October 15th under certain circumstances.

Q: Are there any penalties for not filing IRS Form 14452?

A: Yes, there are penalties for not filing IRS Form 14452, including monetary fines and potential criminal charges.

Form Details:

- A 1-page form available for download in PDF;

- Actual and valid for filing 2023 taxes;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 14452 through the link below or browse more documents in our library of IRS Forms.