This version of the form is not currently in use and is provided for reference only. Download this version of

IRS Form 14498

for the current year.

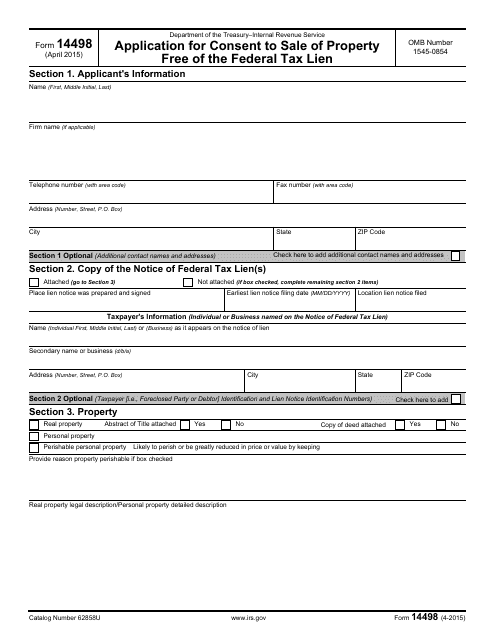

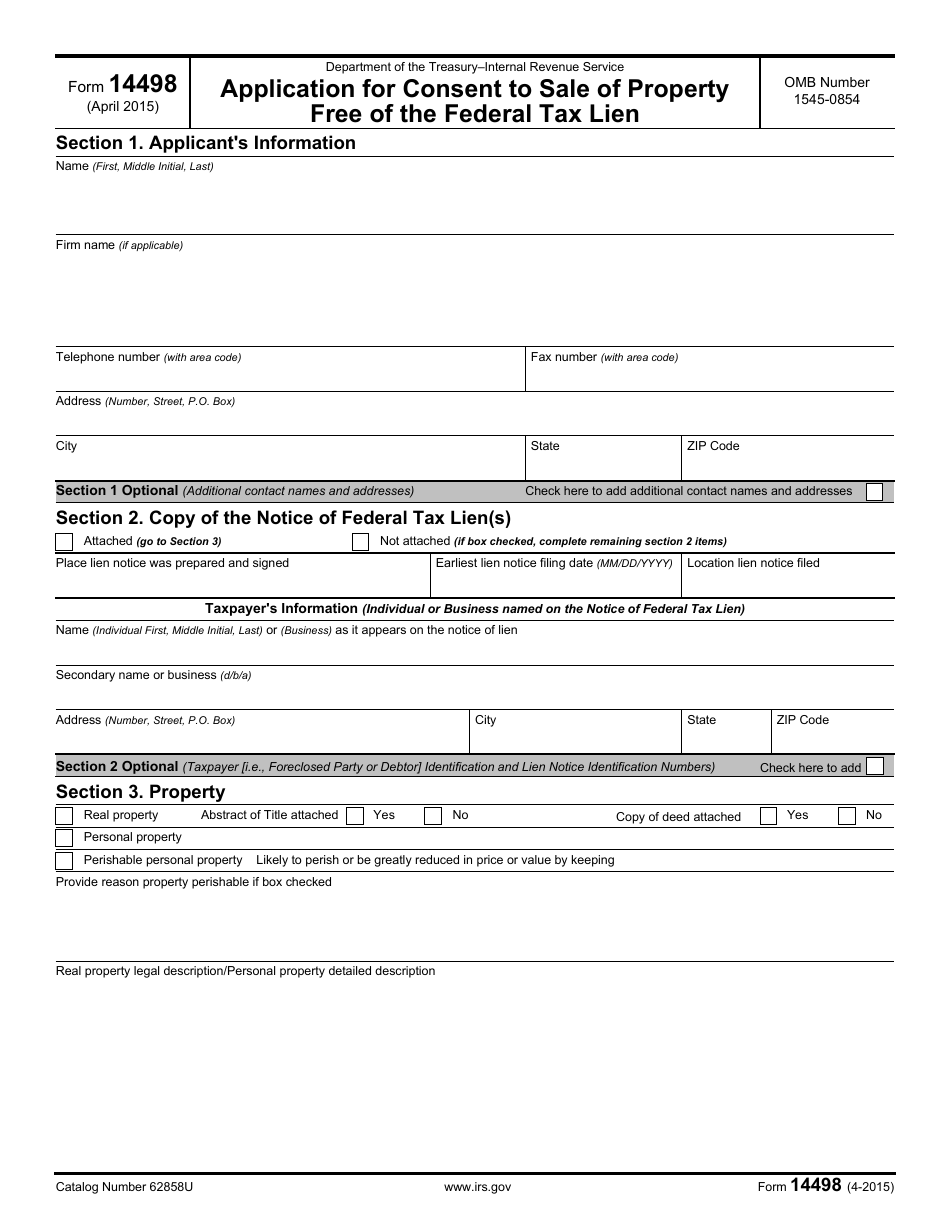

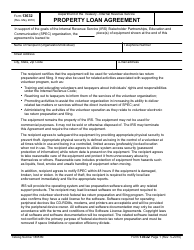

IRS Form 14498 Application for Consent to Sale of Property Free of the Federal Tax Lien

What Is IRS Form 14498?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury on April 1, 2015. As of today, no separate filing guidelines for the form are provided by the IRS.

FAQ

Q: What is IRS Form 14498?

A: IRS Form 14498 is the Application for Consent to Sale of Property Free of the Federal Tax Lien.

Q: When is IRS Form 14498 used?

A: IRS Form 14498 is used when someone wants to sell property that has a federal tax lien attached to it.

Q: What is a federal tax lien?

A: A federal tax lien is a claim by the IRS on someone's property due to unpaid taxes.

Q: Why do I need consent to sell property with a federal tax lien?

A: You need consent to sell property with a federal tax lien because the lien gives the IRS the right to the proceeds from the sale.

Q: How do I apply for consent to sell property free of the federal tax lien?

A: You can apply for consent to sell property free of the federal tax lien by filling out IRS Form 14498 and submitting it to the IRS.

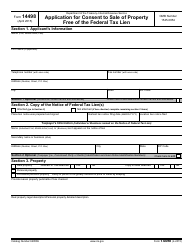

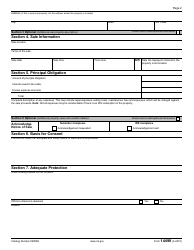

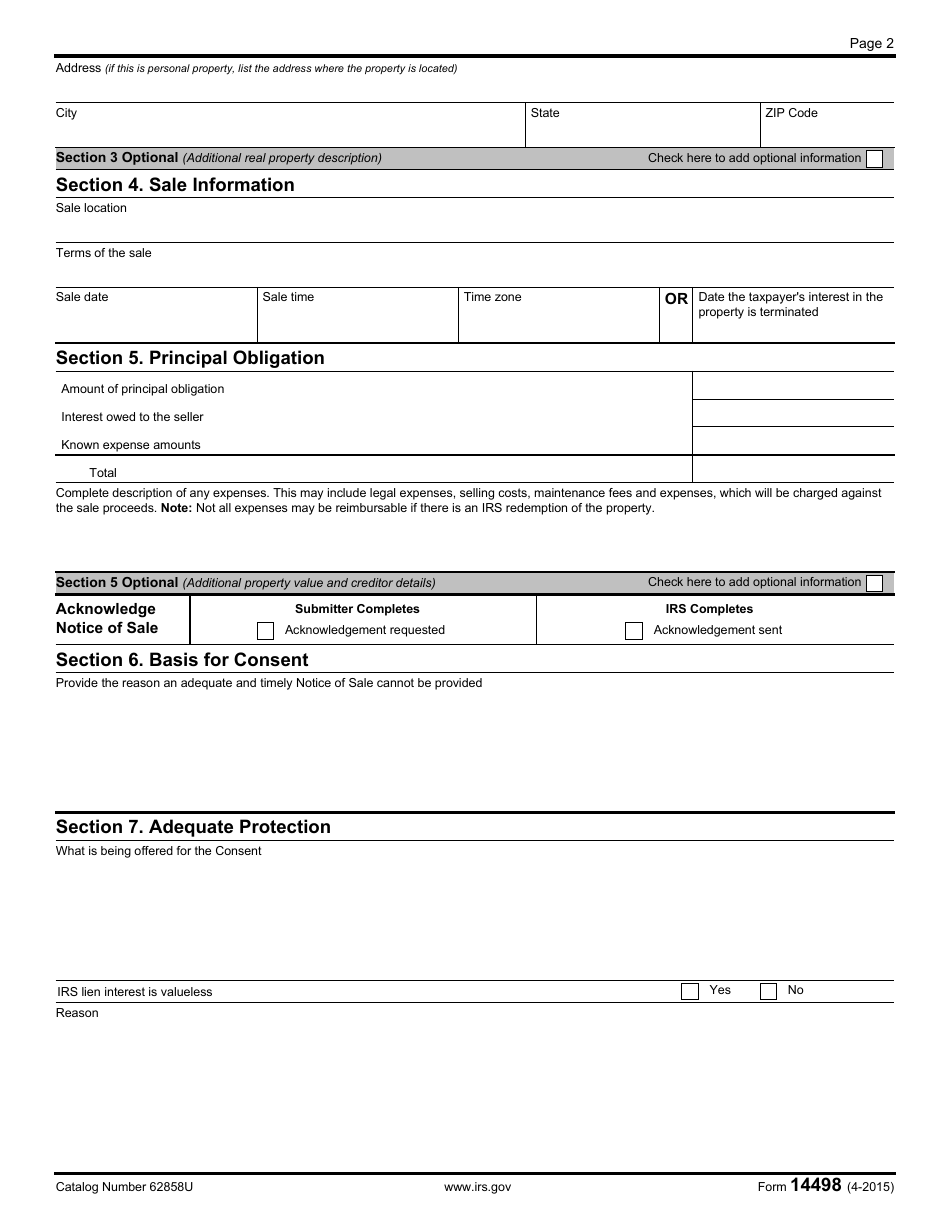

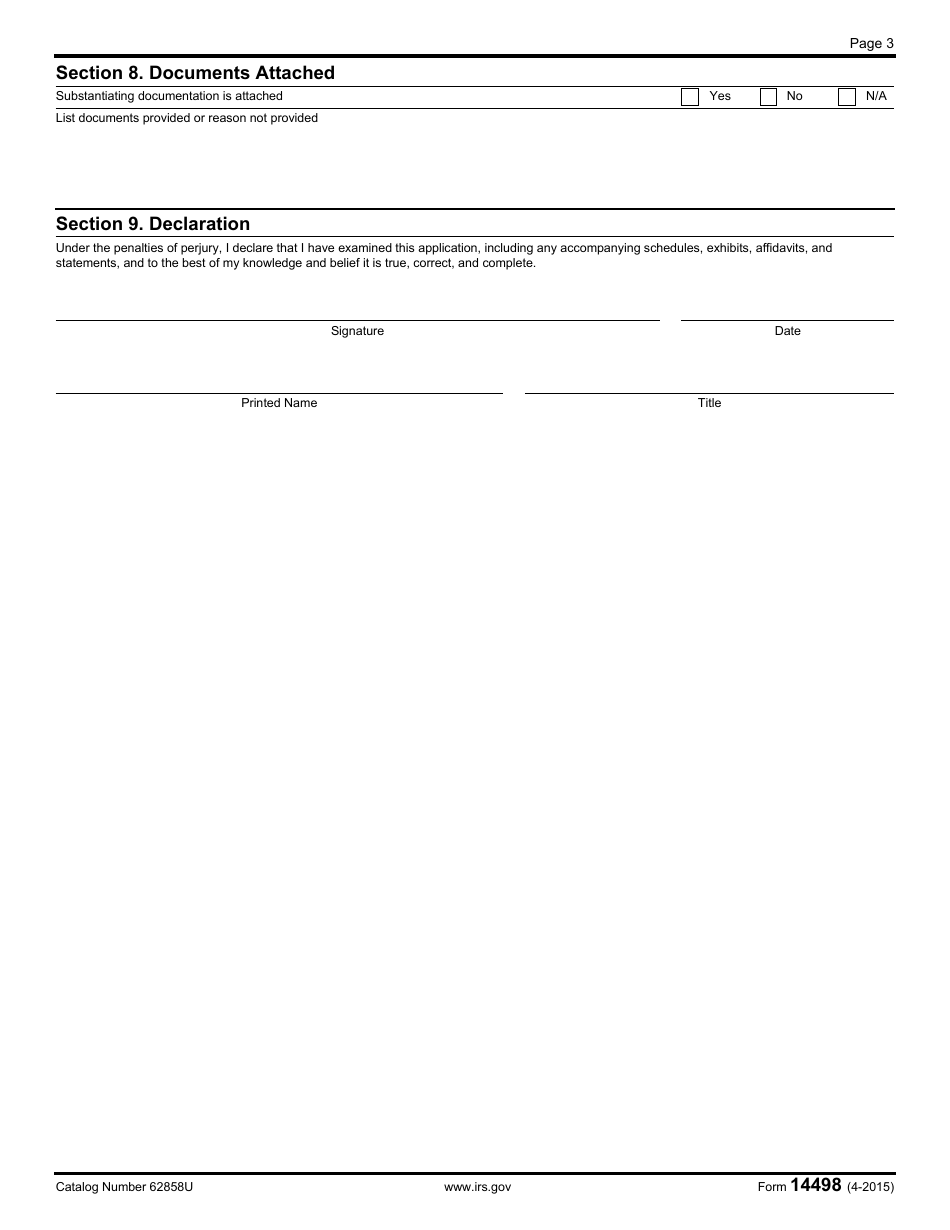

Q: What information is required on IRS Form 14498?

A: IRS Form 14498 requires information about the property, the taxpayer, and the proposed sale, as well as details about the federal tax lien.

Q: Is there a fee to file IRS Form 14498?

A: No, there is no fee to file IRS Form 14498.

Q: How long does it take to get consent to sell property free of the federal tax lien?

A: The processing time for IRS Form 14498 can vary, but it is typically several weeks to a few months.

Q: What happens if my application for consent is denied?

A: If your application for consent is denied, you will need to work with the IRS to resolve the outstanding tax debt before you can sell the property.

Form Details:

- A 3-page form available for download in PDF;

- Actual and valid for filing 2023 taxes;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 14498 through the link below or browse more documents in our library of IRS Forms.