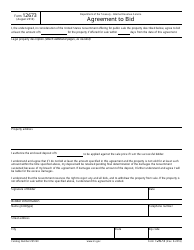

This version of the form is not currently in use and is provided for reference only. Download this version of

IRS Form 13369

for the current year.

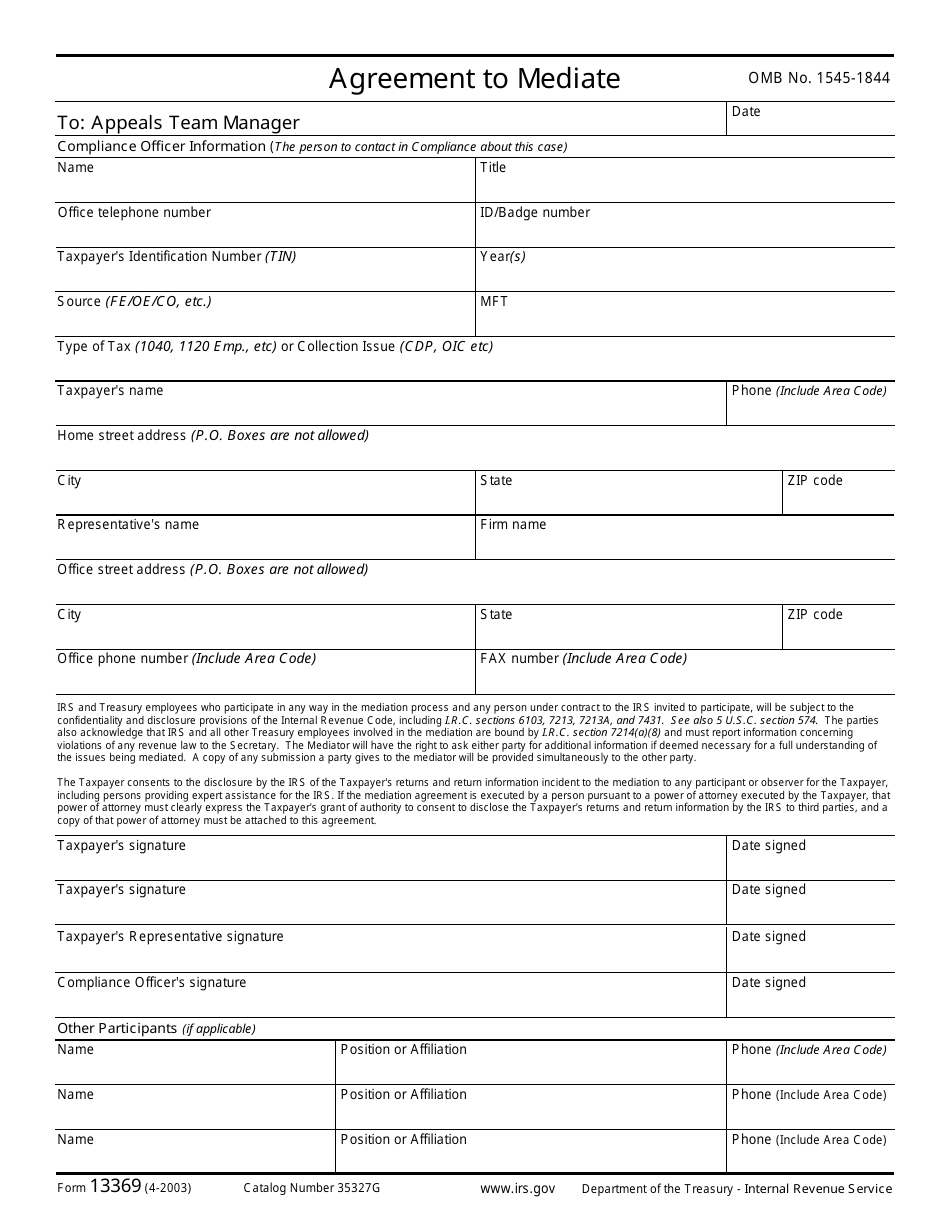

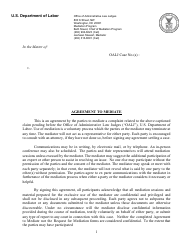

IRS Form 13369 Agreement to Mediate

What Is IRS Form 13369?

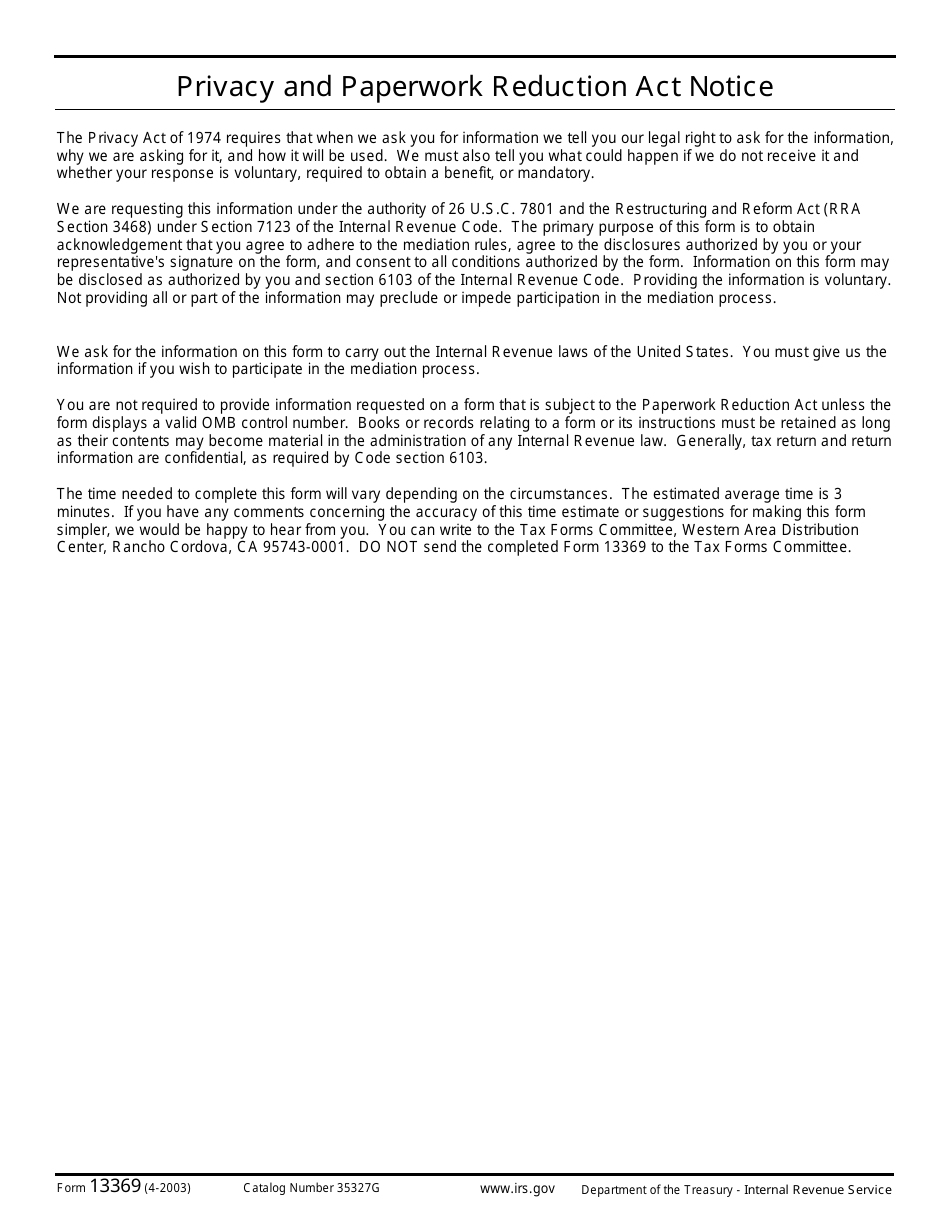

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury on April 1, 2003. As of today, no separate filing guidelines for the form are provided by the IRS.

FAQ

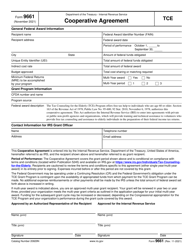

Q: What is IRS Form 13369?

A: IRS Form 13369 is an Agreement to Mediate form.

Q: What is the purpose of IRS Form 13369?

A: The purpose of IRS Form 13369 is to initiate the process of mediation between the taxpayer and the IRS.

Q: Who can use IRS Form 13369?

A: Taxpayers who are in a dispute or disagreement with the IRS can use IRS Form 13369 to request mediation.

Q: How do I complete IRS Form 13369?

A: The taxpayer needs to provide their information, describe the issues in dispute, and explain their desired resolution on IRS Form 13369.

Q: Is there a deadline to submit IRS Form 13369?

A: There is no specific deadline to submit IRS Form 13369, but it is recommended to initiate the mediation process as soon as possible.

Q: What happens after I submit IRS Form 13369?

A: Once IRS Form 13369 is submitted, the IRS will review the request and schedule a mediation session, if appropriate.

Q: Is mediation binding?

A: No, mediation is not binding. It is a voluntary process for both parties to reach a mutually acceptable agreement.

Q: Can I have legal representation during mediation?

A: Yes, taxpayers can choose to have legal representation during the mediation process.

Q: Is there a cost for using mediation?

A: The IRS offers free mediation services to taxpayers who meet the eligibility requirements.

Form Details:

- A 2-page form available for download in PDF;

- Actual and valid for filing 2023 taxes;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 13369 through the link below or browse more documents in our library of IRS Forms.