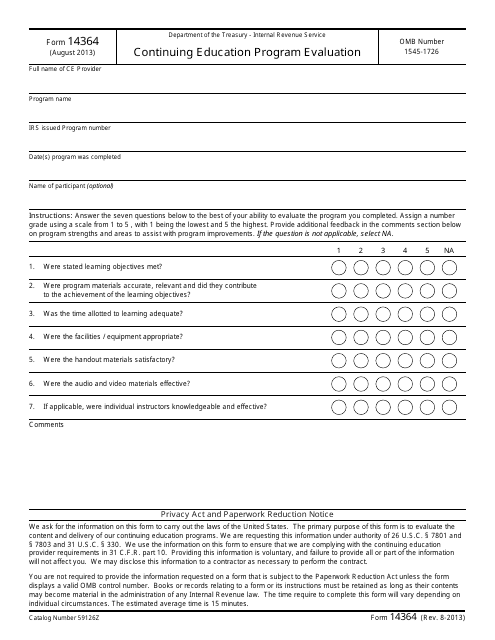

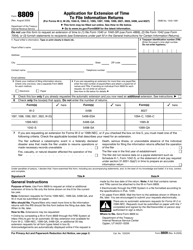

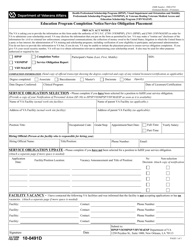

IRS Form 14364 Continuing Education Program Evaluation

What Is IRS Form 14364?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury on August 1, 2013. As of today, no separate filing guidelines for the form are provided by the IRS.

FAQ

Q: What is IRS Form 14364?

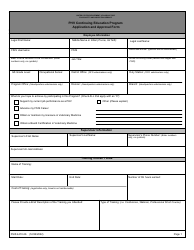

A: IRS Form 14364 is a Continuing Education Program Evaluation form.

Q: What is the purpose of IRS Form 14364?

A: The purpose of IRS Form 14364 is to evaluate a continuing education program.

Q: Who is required to fill out IRS Form 14364?

A: Individuals who have participated in a continuing education program are required to fill out IRS Form 14364.

Q: Is IRS Form 14364 mandatory?

A: No, IRS Form 14364 is not mandatory. It is optional.

Q: What information is required on IRS Form 14364?

A: IRS Form 14364 requires information about the continuing education program and the participant's evaluation of the program.

Q: When should I submit IRS Form 14364?

A: IRS Form 14364 should be submitted within a reasonable time after completing the continuing education program.

Q: Can I submit IRS Form 14364 multiple times?

A: Yes, you can submit IRS Form 14364 multiple times if you have participated in multiple continuing education programs.

Q: Can I save a copy of IRS Form 14364 for my records?

A: Yes, you can save a copy of IRS Form 14364 for your records.

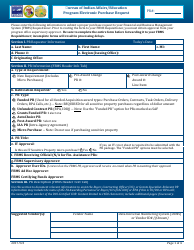

Form Details:

- A 1-page form available for download in PDF;

- Actual and valid for filing 2023 taxes;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 14364 through the link below or browse more documents in our library of IRS Forms.