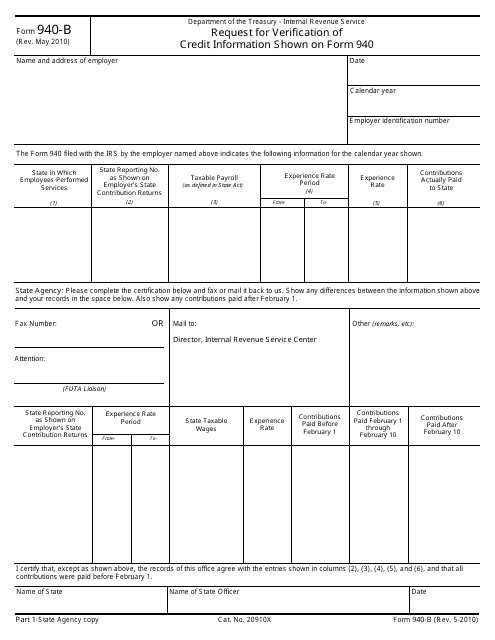

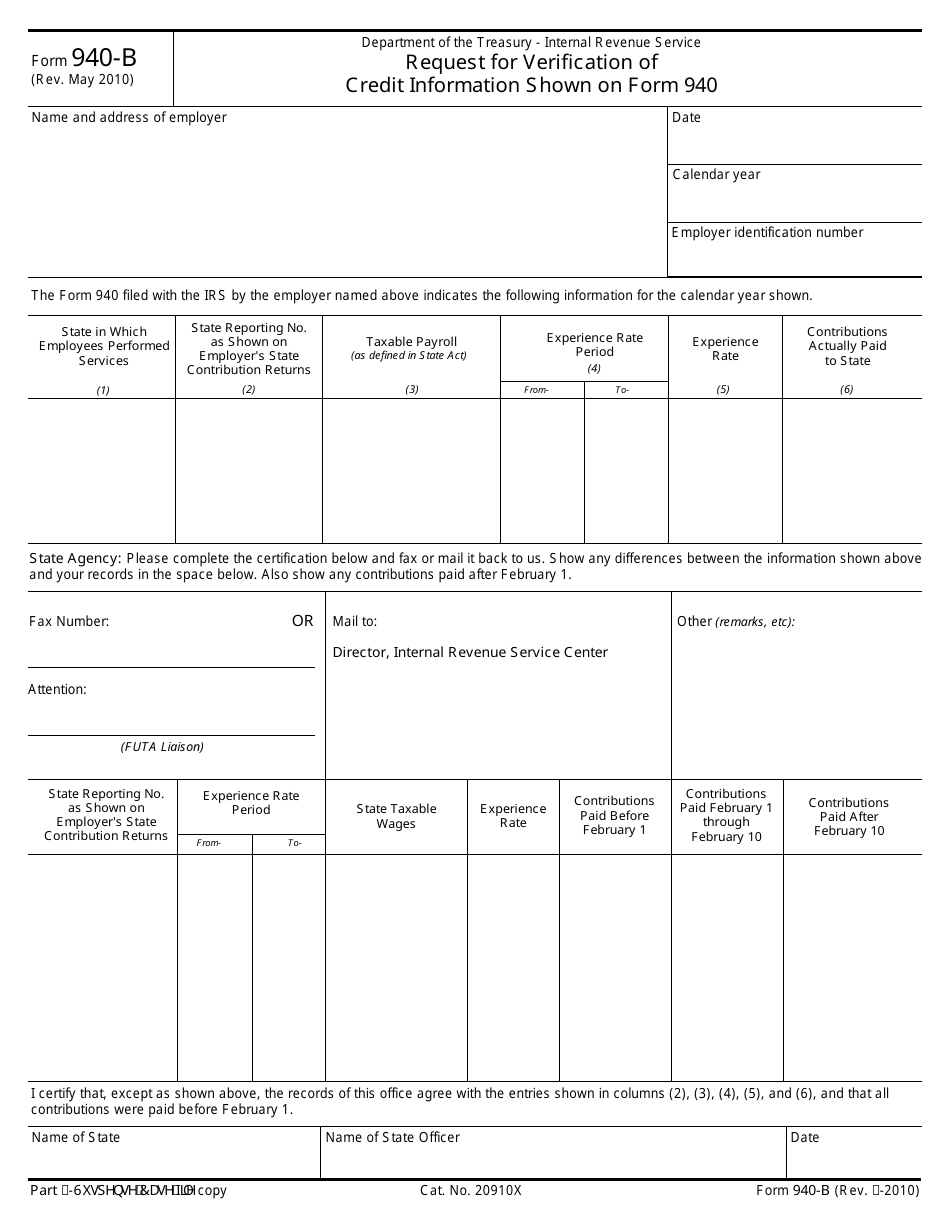

IRS Form 940-B Request for Verification of Credit Information Shown on Form 940

What Is IRS Form 940-B?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury on May 1, 2010. As of today, no separate filing guidelines for the form are provided by the IRS.

FAQ

Q: What is IRS Form 940-B?

A: IRS Form 940-B is a form used to request verification of credit information shown on Form 940.

Q: What is Form 940?

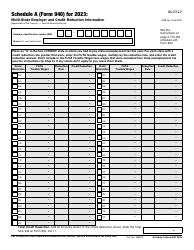

A: Form 940 is an employer's annual federal unemployment (FUTA) tax return.

Q: Why would I need to request verification of credit information on Form 940?

A: You may need to request verification of credit information if there are discrepancies or errors on Form 940 that you need resolved.

Q: How do I complete Form 940-B?

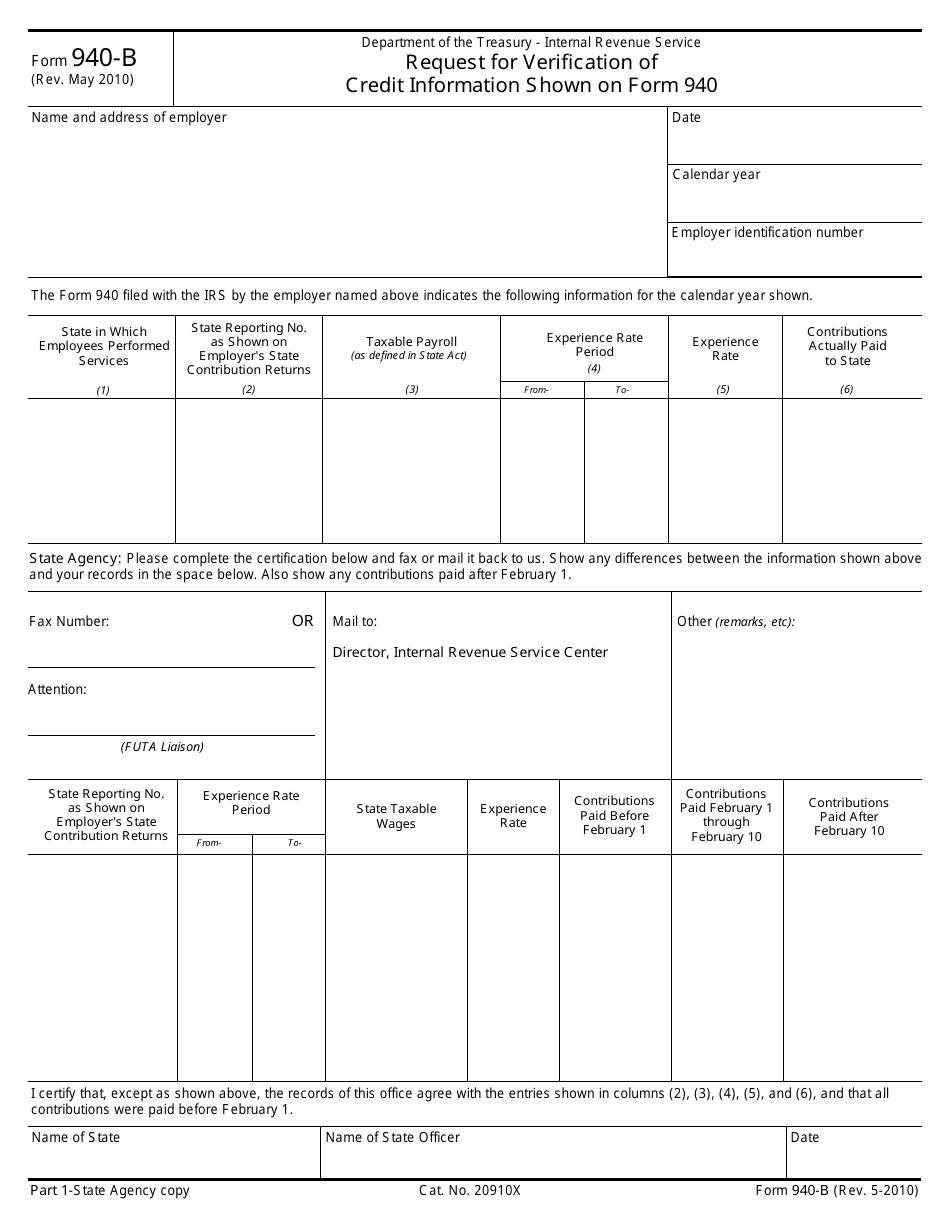

A: You must fill out Form 940-B with your business information, provide the specific details of the credit information you want verified, and sign the form.

Q: Is there a fee to submit Form 940-B?

A: No, there is no fee to submit Form 940-B.

Form Details:

- A 2-page form available for download in PDF;

- Actual and valid for filing 2023 taxes;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 940-B through the link below or browse more documents in our library of IRS Forms.