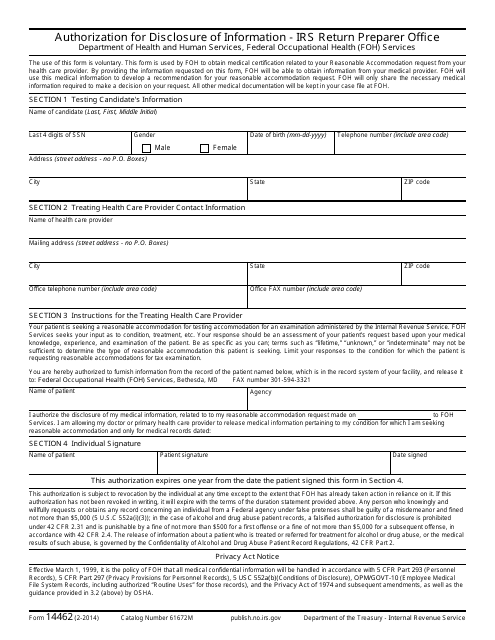

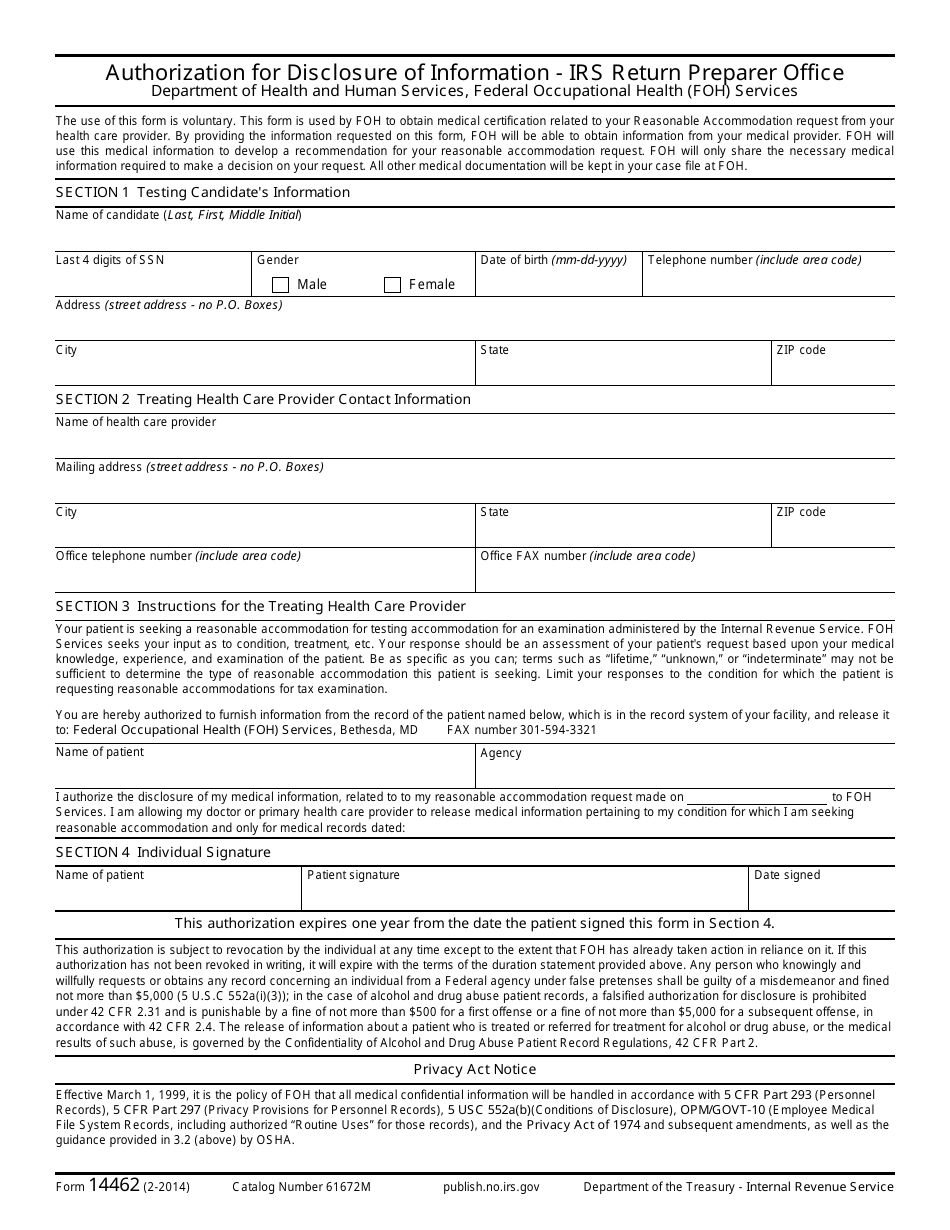

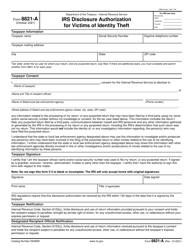

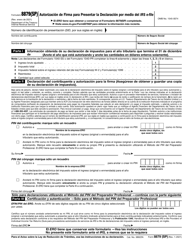

IRS Form 14462 Authorization for Disclosure of Information - IRS Return Preparer Office

What Is IRS Form 14462?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury on February 1, 2014. As of today, no separate filing guidelines for the form are provided by the IRS.

FAQ

Q: What is IRS Form 14462?

A: IRS Form 14462 is the Authorization for Disclosure of Information - IRS Return Preparer Office.

Q: What is the purpose of IRS Form 14462?

A: The purpose of IRS Form 14462 is to authorize the disclosure of taxpayer information to the IRS Return Preparer Office.

Q: Who needs to fill out IRS Form 14462?

A: Taxpayers or their authorized representatives who want to authorize the disclosure of their information to the IRS Return Preparer Office need to fill out IRS Form 14462.

Q: Is IRS Form 14462 mandatory?

A: No, IRS Form 14462 is not mandatory. It is only necessary if you want to authorize the disclosure of your information to the IRS Return Preparer Office.

Q: What information is required on IRS Form 14462?

A: On IRS Form 14462, you need to provide your personal information, the tax period(s) you are authorizing the disclosure for, and the specific information you want to disclose.

Q: Can I revoke the authorization on IRS Form 14462?

A: Yes, you can revoke the authorization by sending a written statement to the IRS Return Preparer Office.

Form Details:

- A 1-page form available for download in PDF;

- Actual and valid for filing 2023 taxes;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 14462 through the link below or browse more documents in our library of IRS Forms.