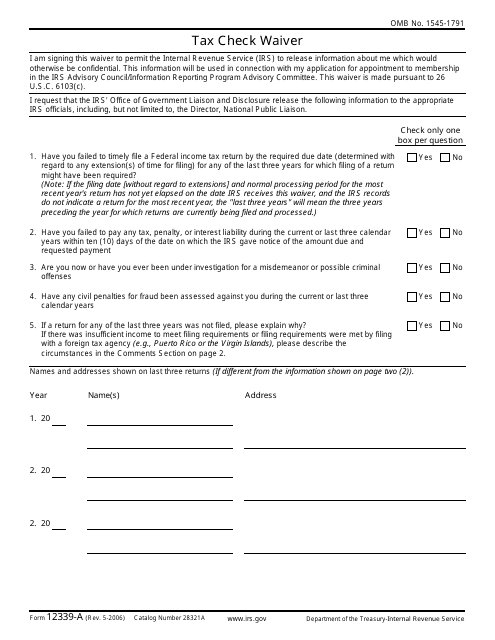

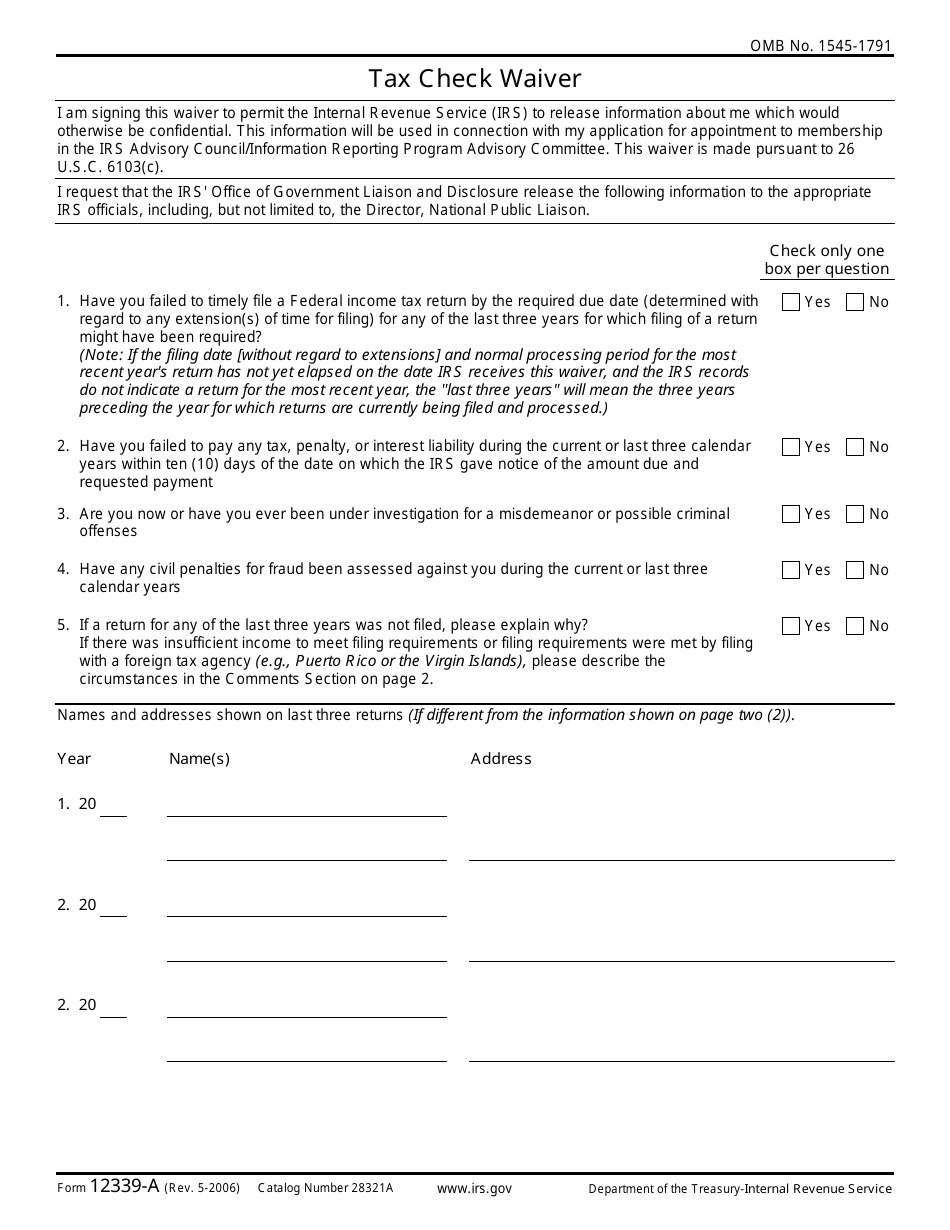

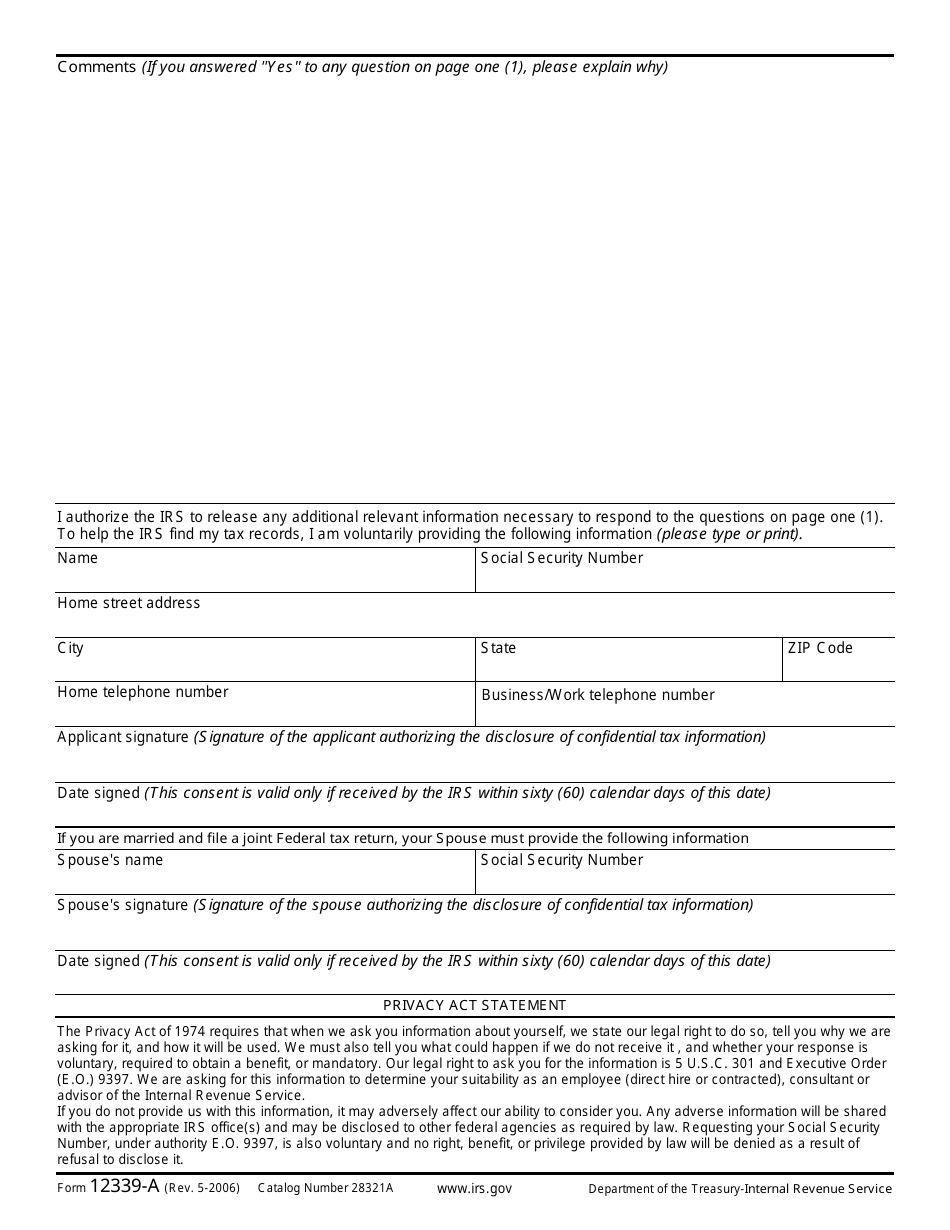

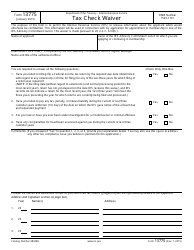

IRS Form 12339-A Tax Check Waiver

What Is IRS Form 12339-A?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury on May 1, 2006. As of today, no separate filing guidelines for the form are provided by the IRS.

FAQ

Q: What is IRS Form 12339-A?

A: IRS Form 12339-A is a Tax Check Waiver form.

Q: What is the purpose of IRS Form 12339-A?

A: The purpose of IRS Form 12339-A is to request a waiver of a tax check requirement.

Q: Who needs to fill out IRS Form 12339-A?

A: Individuals or entities who want to request a waiver of a tax check requirement need to fill out IRS Form 12339-A.

Q: What information is required on IRS Form 12339-A?

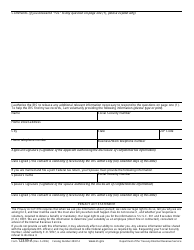

A: IRS Form 12339-A requires information such as the taxpayer's name, Social Security number or employer identification number, contact information, and reason for the waiver request.

Form Details:

- A 2-page form available for download in PDF;

- Actual and valid for filing 2023 taxes;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 12339-A through the link below or browse more documents in our library of IRS Forms.