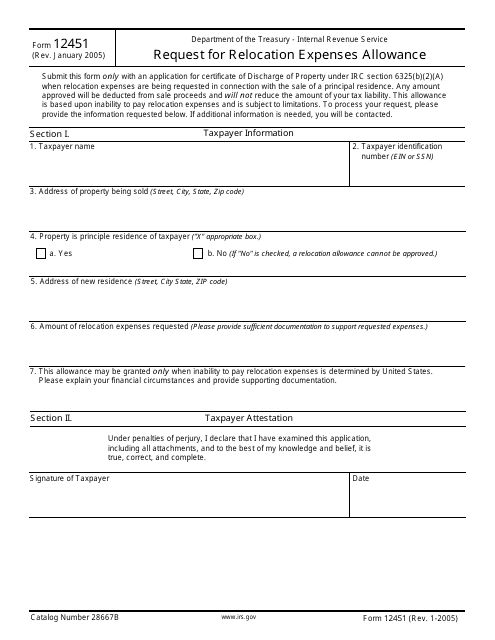

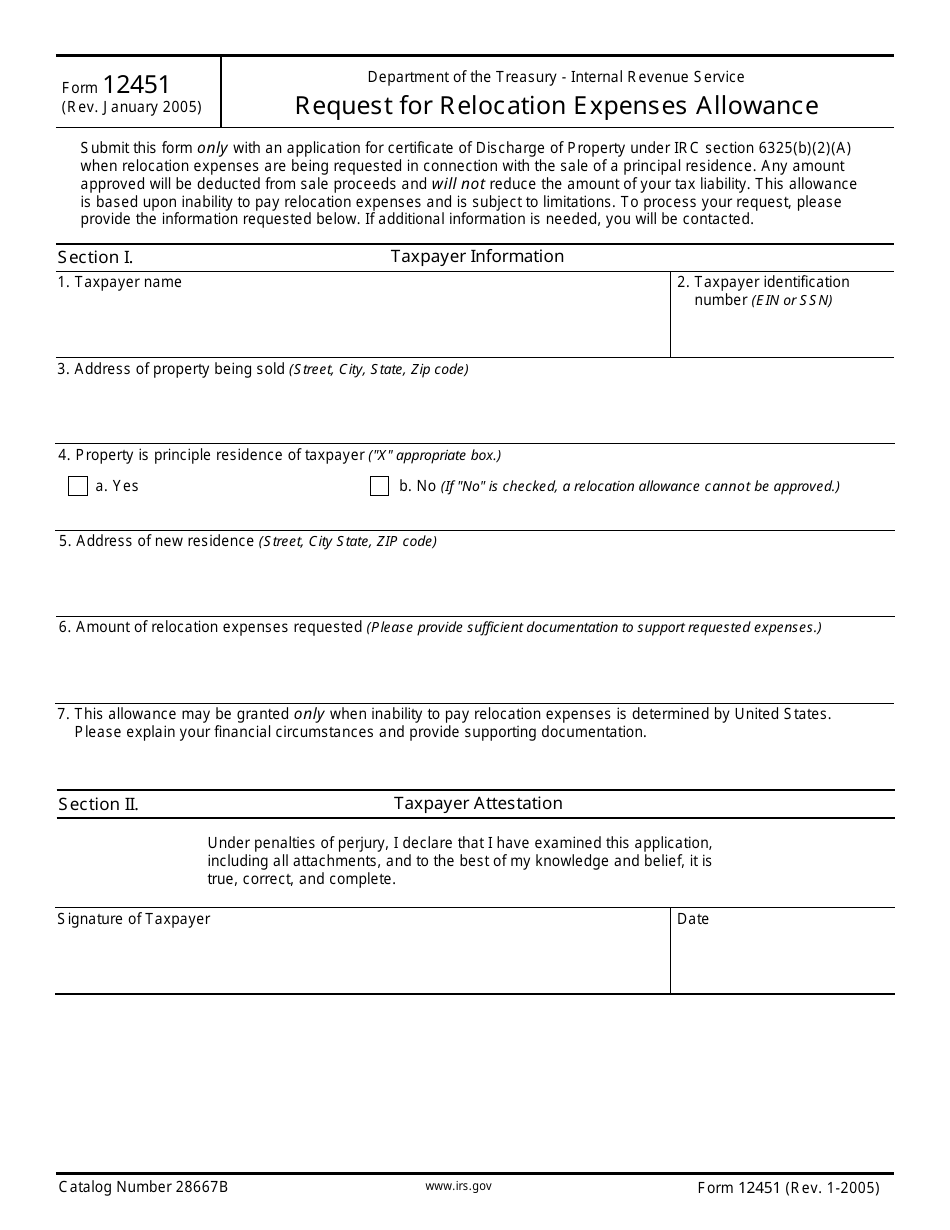

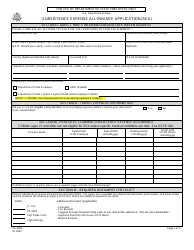

IRS Form 12451 Request for Relocation Expenses Allowance

What Is IRS Form 12451?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury on January 1, 2005. As of today, no separate filing guidelines for the form are provided by the IRS.

FAQ

Q: What is IRS Form 12451?

A: IRS Form 12451 is a form used to request a relocation expenses allowance.

Q: What is the purpose of IRS Form 12451?

A: The purpose of IRS Form 12451 is to request reimbursement for expenses incurred during a relocation.

Q: Who can use IRS Form 12451?

A: IRS Form 12451 can be used by individuals who have incurred relocation expenses due to a job-related move.

Q: What expenses can be claimed on IRS Form 12451?

A: Expenses such as moving supplies, transportation costs, and lodging expenses can be claimed on IRS Form 12451.

Q: Is there a deadline for submitting IRS Form 12451?

A: Yes, IRS Form 12451 must be submitted within three years from the date the expense was paid or incurred.

Q: Are relocation expenses taxable?

A: Relocation expenses may be taxable. It is recommended to consult a tax professional for specific advice on your situation.

Q: Can I claim expenses for moving my personal belongings?

A: Yes, expenses for moving personal belongings can be claimed on IRS Form 12451.

Q: What supporting documents should be included with IRS Form 12451?

A: Supporting documents such as receipts, invoices, and contracts should be included with IRS Form 12451 to substantiate the claimed expenses.

Q: Can I claim relocation expenses for a non-job-related move?

A: No, IRS Form 12451 is specifically for claiming relocation expenses related to a job-related move.

Form Details:

- A 1-page form available for download in PDF;

- Actual and valid for filing 2023 taxes;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 12451 through the link below or browse more documents in our library of IRS Forms.