This version of the form is not currently in use and is provided for reference only. Download this version of

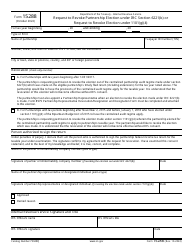

IRS Form 8023

for the current year.

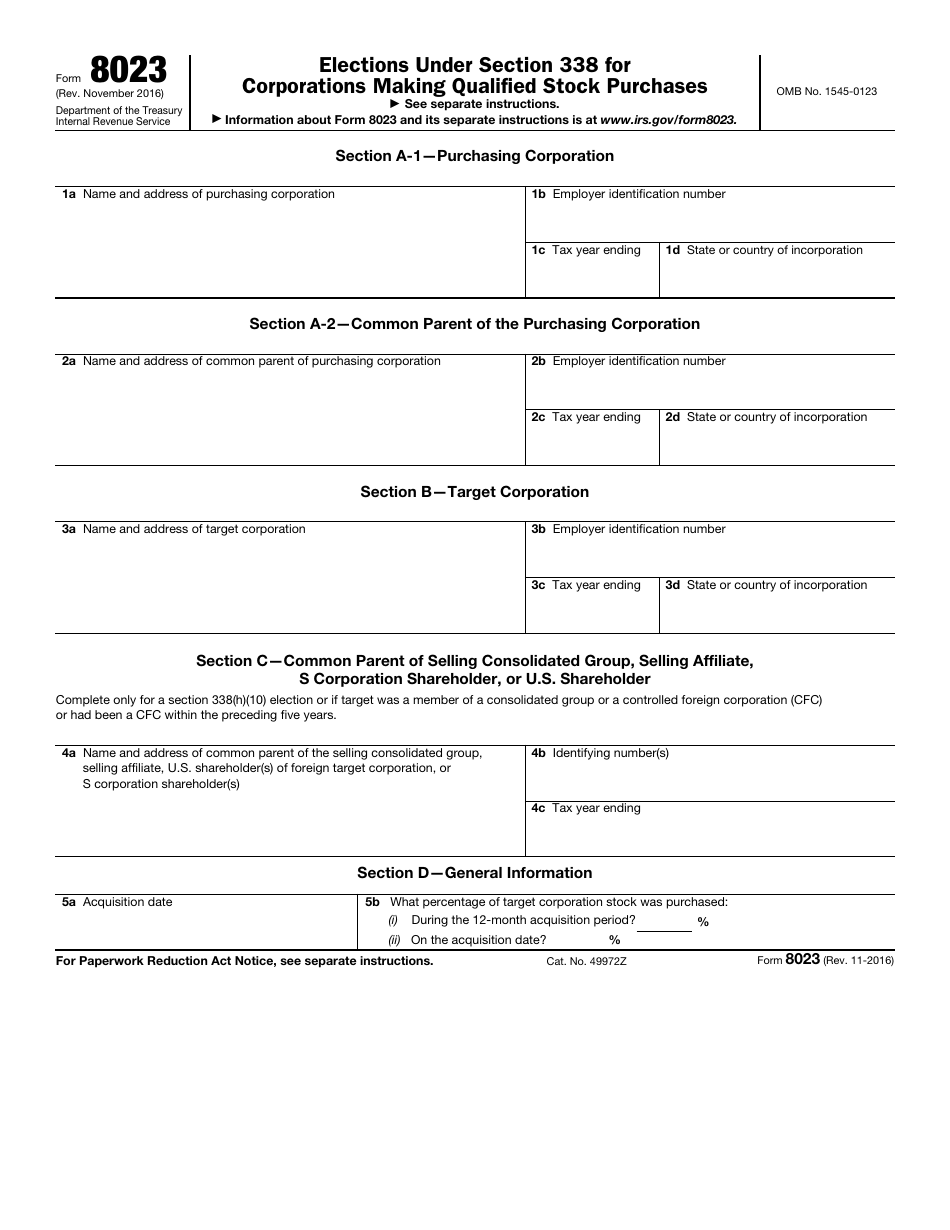

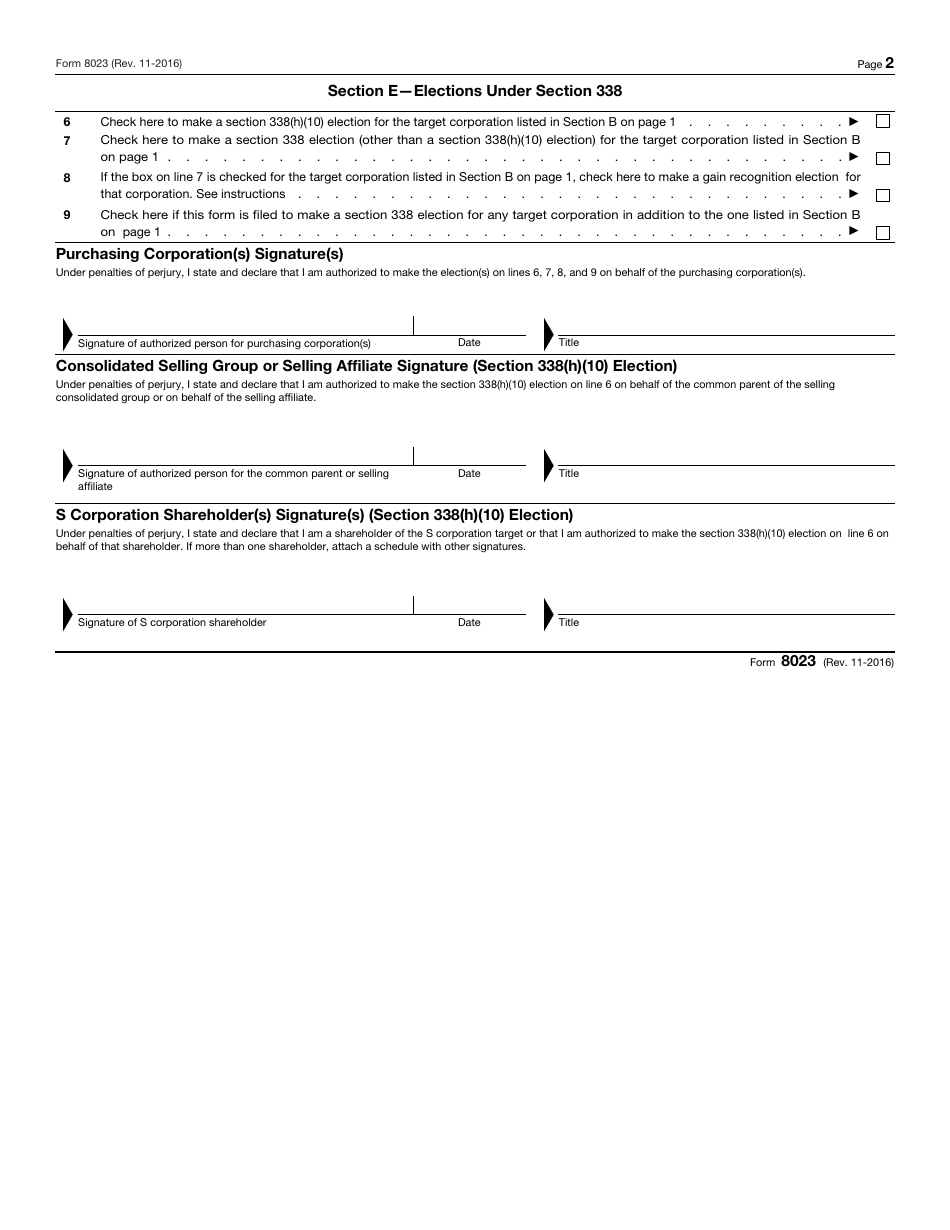

IRS Form 8023 Elections Under Section 338 for Corporations Making Qualified Stock Purchases

What Is IRS Form 8023?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury on November 1, 2016. Check the official IRS-issued instructions before completing and submitting the form.

FAQ

Q: What is IRS Form 8023?

A: IRS Form 8023 is a form used for making elections under Section 338 for corporations making qualified stock purchases.

Q: What is Section 338?

A: Section 338 refers to a provision in the Internal Revenue Code that allows corporations to elect to treat certain stock acquisitions as asset purchases for tax purposes.

Q: What is a qualified stock purchase?

A: A qualified stock purchase is when a corporation acquires at least 80% of the stock of another corporation.

Q: Why would a corporation make an election under Section 338?

A: A corporation may make an election under Section 338 to obtain certain tax benefits, such as stepped-up basis in the assets of the acquired corporation.

Q: What are some benefits of making an election under Section 338?

A: Some benefits of making an election under Section 338 include the ability to step up the basis of the acquired corporation's assets and increase the depreciable basis of those assets.

Q: When should IRS Form 8023 be filed?

A: IRS Form 8023 should be filed no later than the 15th day of the ninth month after the month in which the acquisition occurs.

Q: What happens if a corporation fails to file IRS Form 8023?

A: If a corporation fails to file IRS Form 8023, it may lose the opportunity to make an election under Section 338 and miss out on potential tax benefits.

Form Details:

- A 2-page form available for download in PDF;

- Actual and valid for filing 2023 taxes;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 8023 through the link below or browse more documents in our library of IRS Forms.