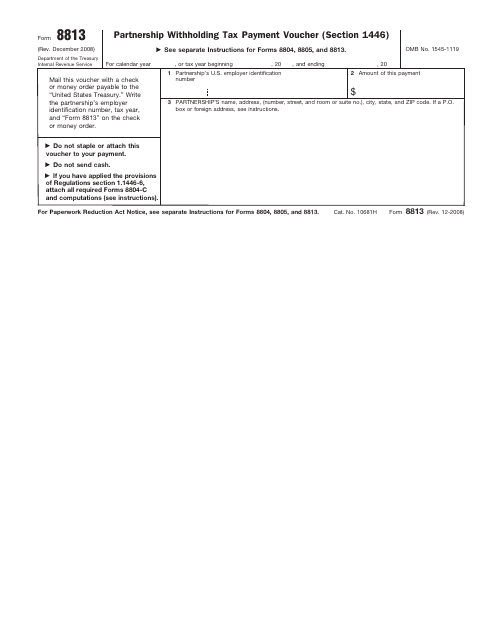

IRS Form 8813 Partnership Withholding Tax Payment Voucher (Section 1446)

What Is IRS Form 8813?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury on December 1, 2008. Check the official IRS-issued instructions before completing and submitting the form.

FAQ

Q: What is IRS Form 8813?

A: IRS Form 8813 is Partnership Withholding Tax Payment Voucher (Section 1446).

Q: What is the purpose of IRS Form 8813?

A: The purpose of IRS Form 8813 is to report and remit withholding tax on effectively connected income allocated to foreign partners in a partnership.

Q: Who should use IRS Form 8813?

A: If you are a partnership making payments of effectively connected income to foreign partners, you should use IRS Form 8813.

Q: When should IRS Form 8813 be filed?

A: IRS Form 8813 should be filed with each payment of withholding tax to the IRS.

Q: Are there any penalties for not filing IRS Form 8813?

A: Yes, failure to file IRS Form 8813 or pay the withholding tax on time can result in penalties and interest charges.

Q: Are there any exceptions to filing IRS Form 8813?

A: There are certain exceptions to filing IRS Form 8813. Consult the instructions provided with the form or seek professional advice for more information.

Form Details:

- A 1-page form available for download in PDF;

- Actual and valid for filing 2023 taxes;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 8813 through the link below or browse more documents in our library of IRS Forms.