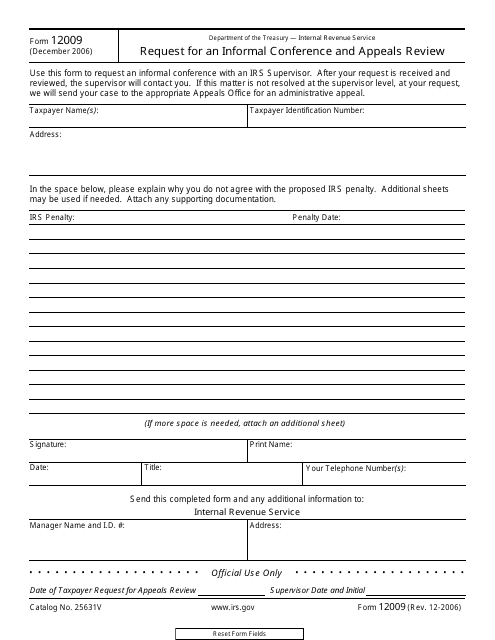

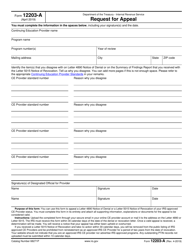

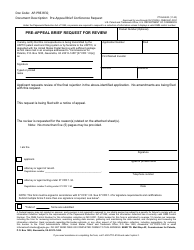

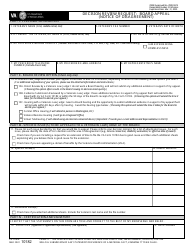

IRS Form 12009 Request for an Informal Conference and Appeals Review

What Is IRS Form 12009?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury on December 1, 2006. As of today, no separate filing guidelines for the form are provided by the IRS.

FAQ

Q: What is IRS Form 12009?

A: IRS Form 12009 is a form used to request an informal conference and appeals review with the IRS.

Q: When would I use IRS Form 12009?

A: You would use IRS Form 12009 when you want to request an informal conference and appeals review regarding a tax issue.

Q: How do I fill out IRS Form 12009?

A: You should follow the instructions provided with the form to accurately fill out IRS Form 12009.

Q: Is there a deadline for submitting IRS Form 12009?

A: The deadline for submitting IRS Form 12009 may vary depending on the specific circumstances. It is important to check the instructions or contact the IRS for more information.

Q: What can I expect during an informal conference and appeals review?

A: During an informal conference and appeals review, you will have an opportunity to discuss your tax issue with an IRS representative and present your case. The goal is to reach a resolution or settlement for the tax dispute.

Q: Can I have representation during an informal conference and appeals review?

A: Yes, you have the right to have representation, such as a tax professional or attorney, during an informal conference and appeals review.

Q: What happens after the informal conference and appeals review?

A: After the informal conference and appeals review, the IRS will provide you with their decision or proposed resolution for your tax issue. You will have the option to accept or appeal the decision, if necessary.

Form Details:

- A 1-page form available for download in PDF;

- Actual and valid for filing 2023 taxes;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 12009 through the link below or browse more documents in our library of IRS Forms.