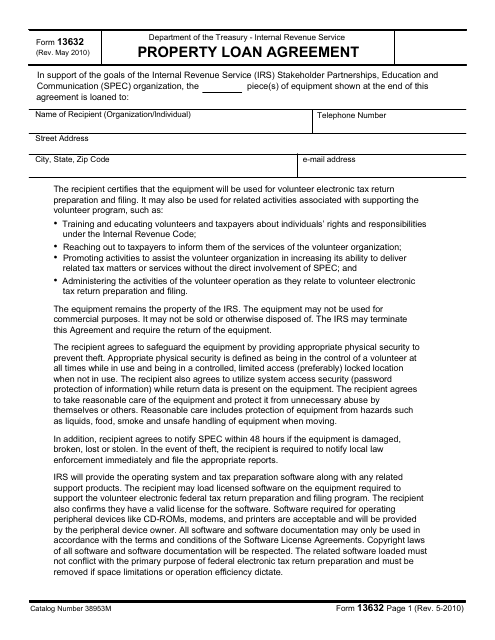

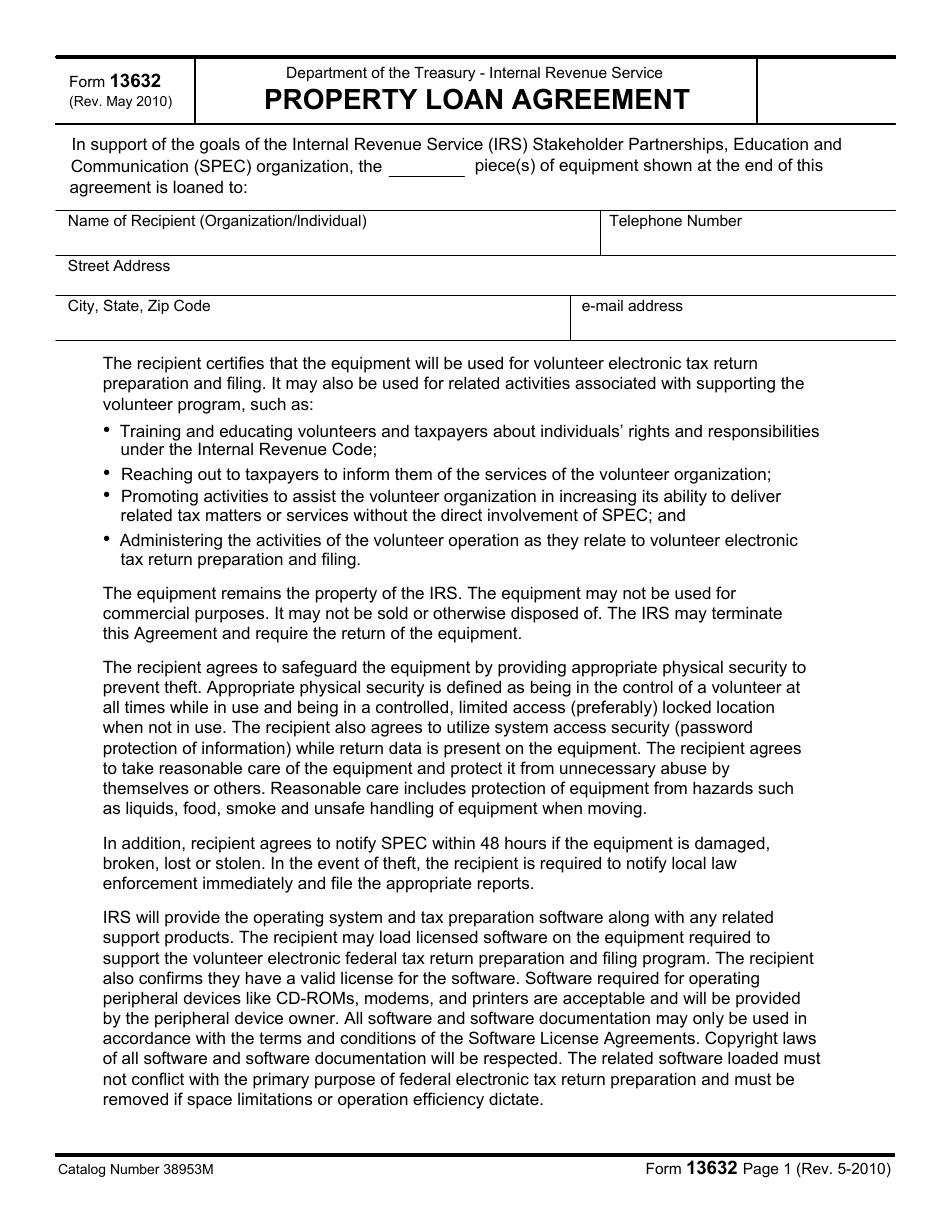

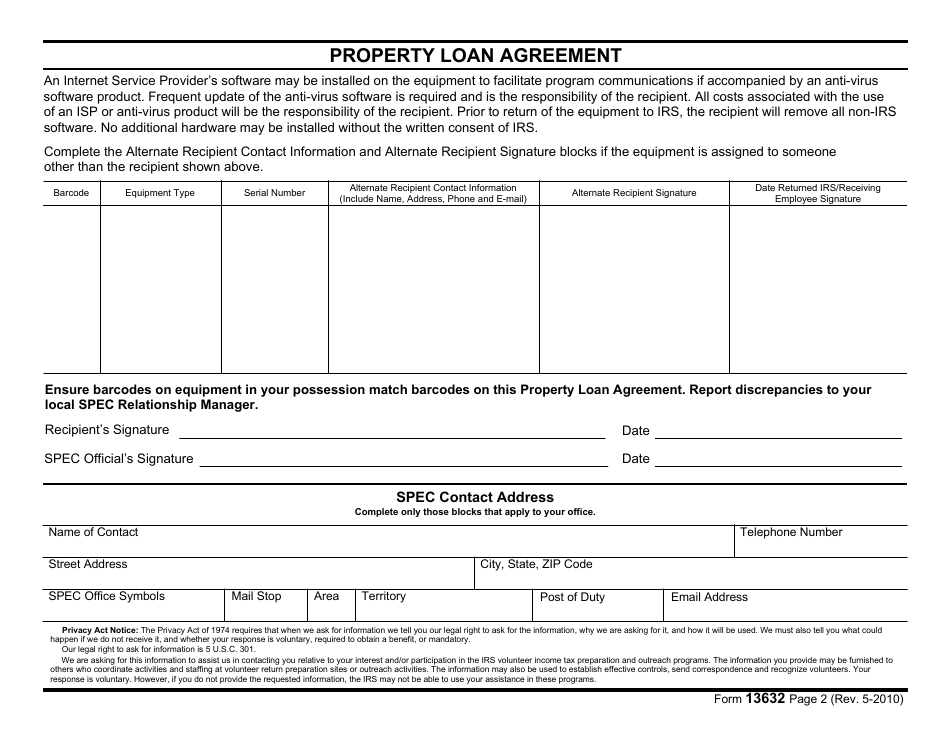

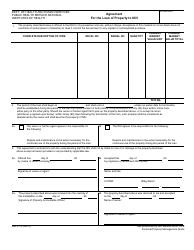

IRS Form 13632 Property Loan Agreement

What Is IRS Form 13632?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury on May 1, 2010. As of today, no separate filing guidelines for the form are provided by the IRS.

FAQ

Q: What is IRS Form 13632?

A: IRS Form 13632 is the Property Loan Agreement form used by the Internal Revenue Service.

Q: What is the purpose of IRS Form 13632?

A: The purpose of IRS Form 13632 is to document the agreement between the borrower and the lender for the loan of property.

Q: Who needs to fill out IRS Form 13632?

A: Both the borrower and the lender need to fill out IRS Form 13632.

Q: Is IRS Form 13632 mandatory?

A: No, IRS Form 13632 is not mandatory. It is optional and used when there is a loan of property between two parties.

Q: What information is required on IRS Form 13632?

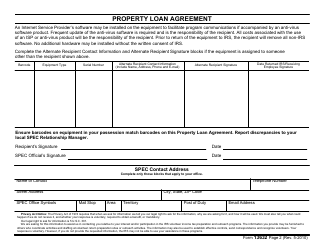

A: IRS Form 13632 requires information such as the names and addresses of both the borrower and the lender, description of the loaned property, and terms of the loan agreement.

Q: Is IRS Form 13632 specific to the United States?

A: Yes, IRS Form 13632 is specific to the United States and is used for loan agreements involving US property.

Q: Are there any fees associated with filing IRS Form 13632?

A: There are no fees associated with filing IRS Form 13632. It is a free form provided by the Internal Revenue Service.

Form Details:

- A 2-page form available for download in PDF;

- Actual and valid for filing 2023 taxes;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 13632 through the link below or browse more documents in our library of IRS Forms.