This version of the form is not currently in use and is provided for reference only. Download this version of

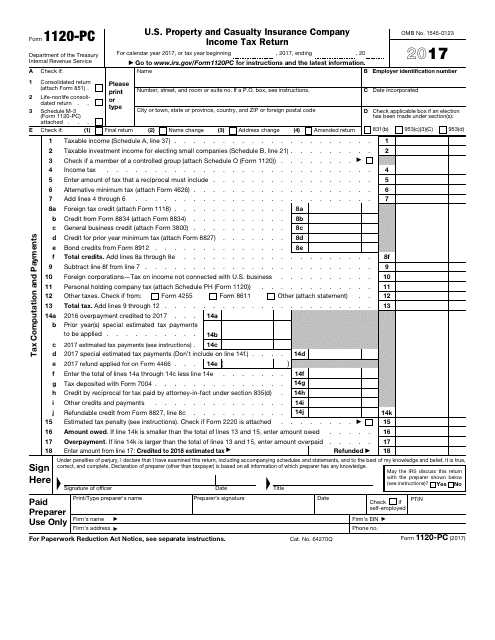

IRS Form 1120-PC

for the current year.

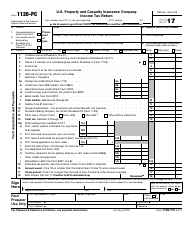

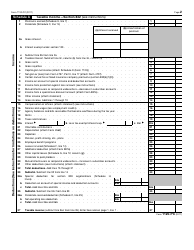

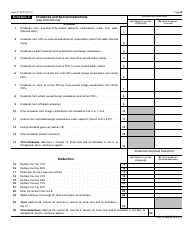

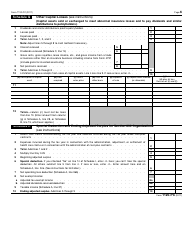

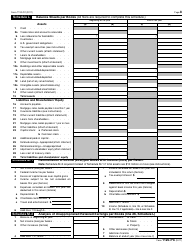

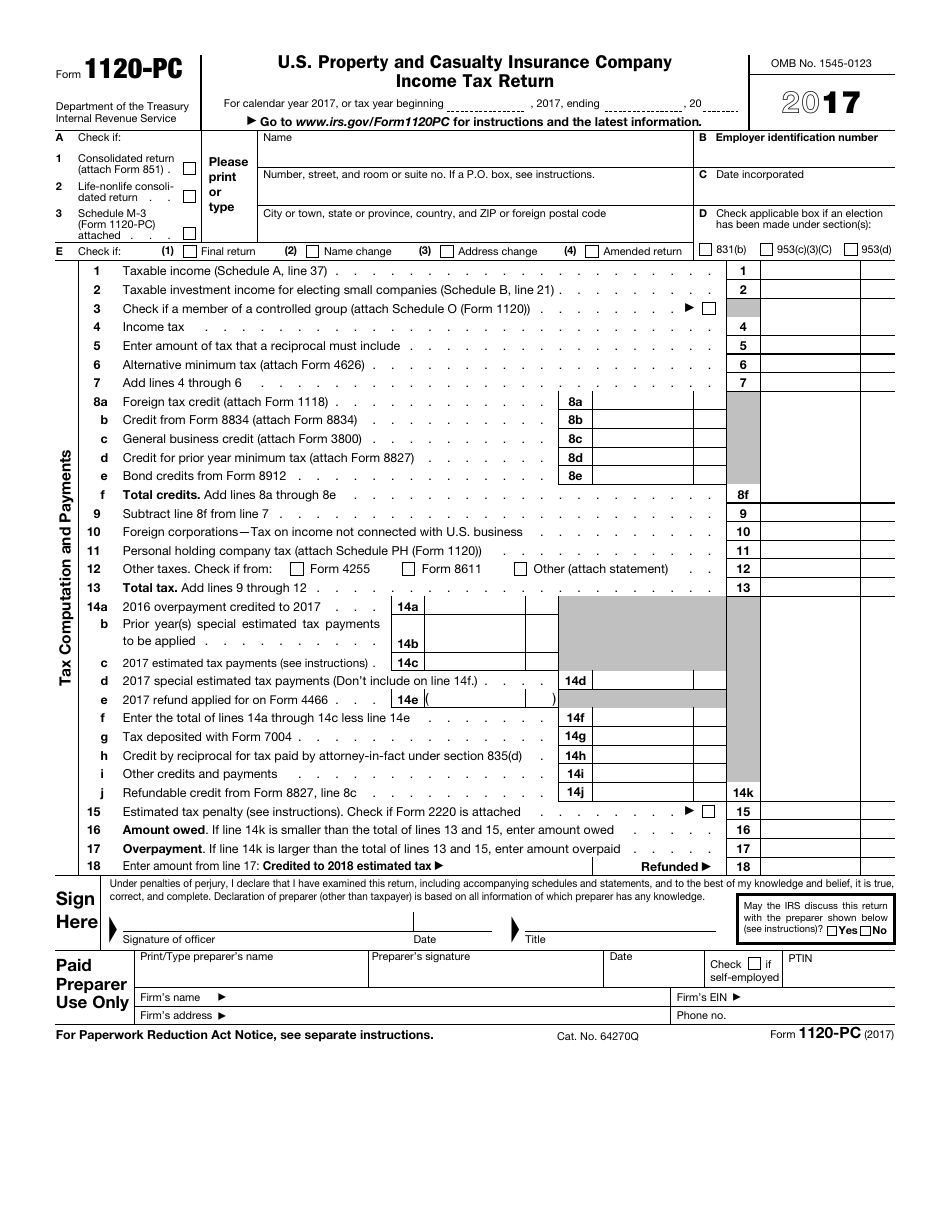

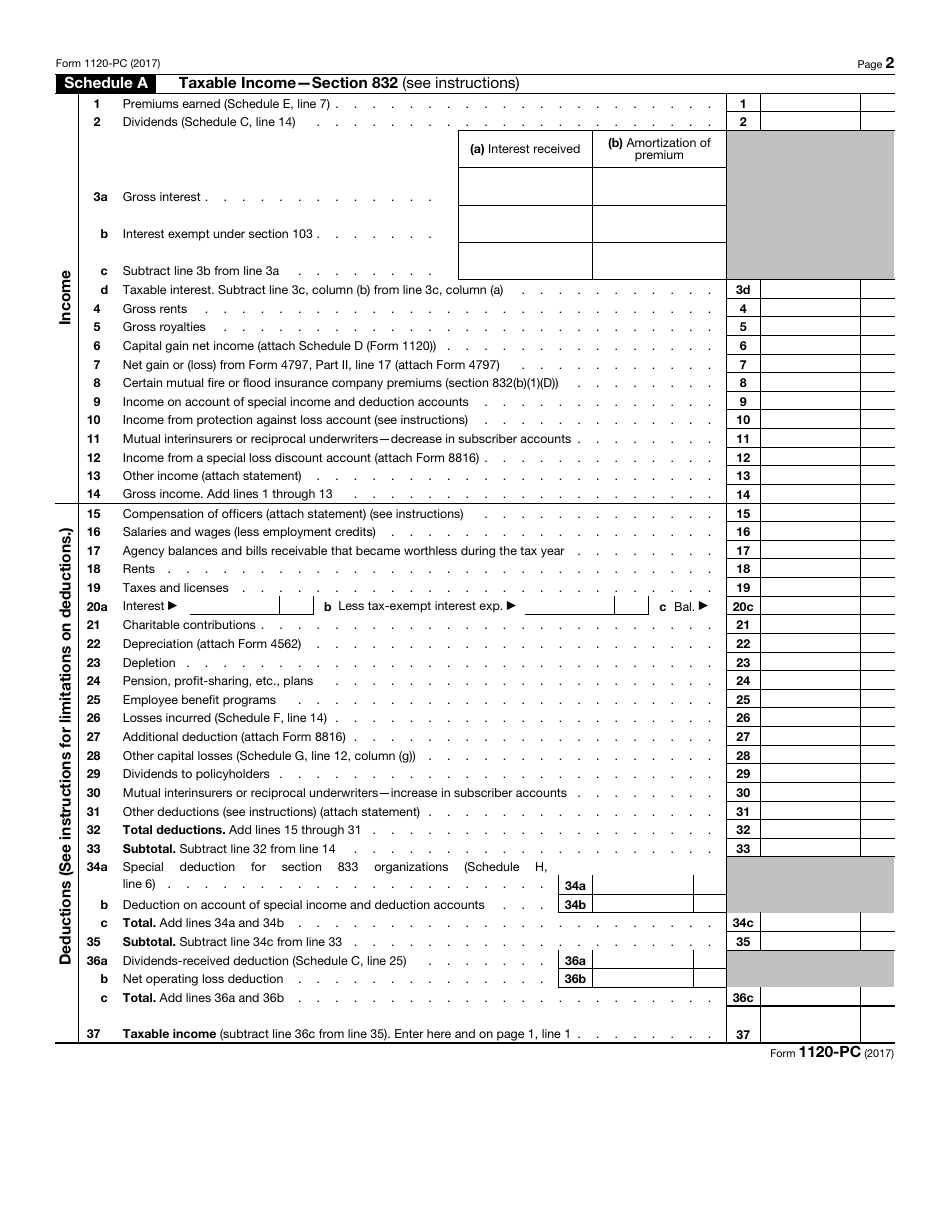

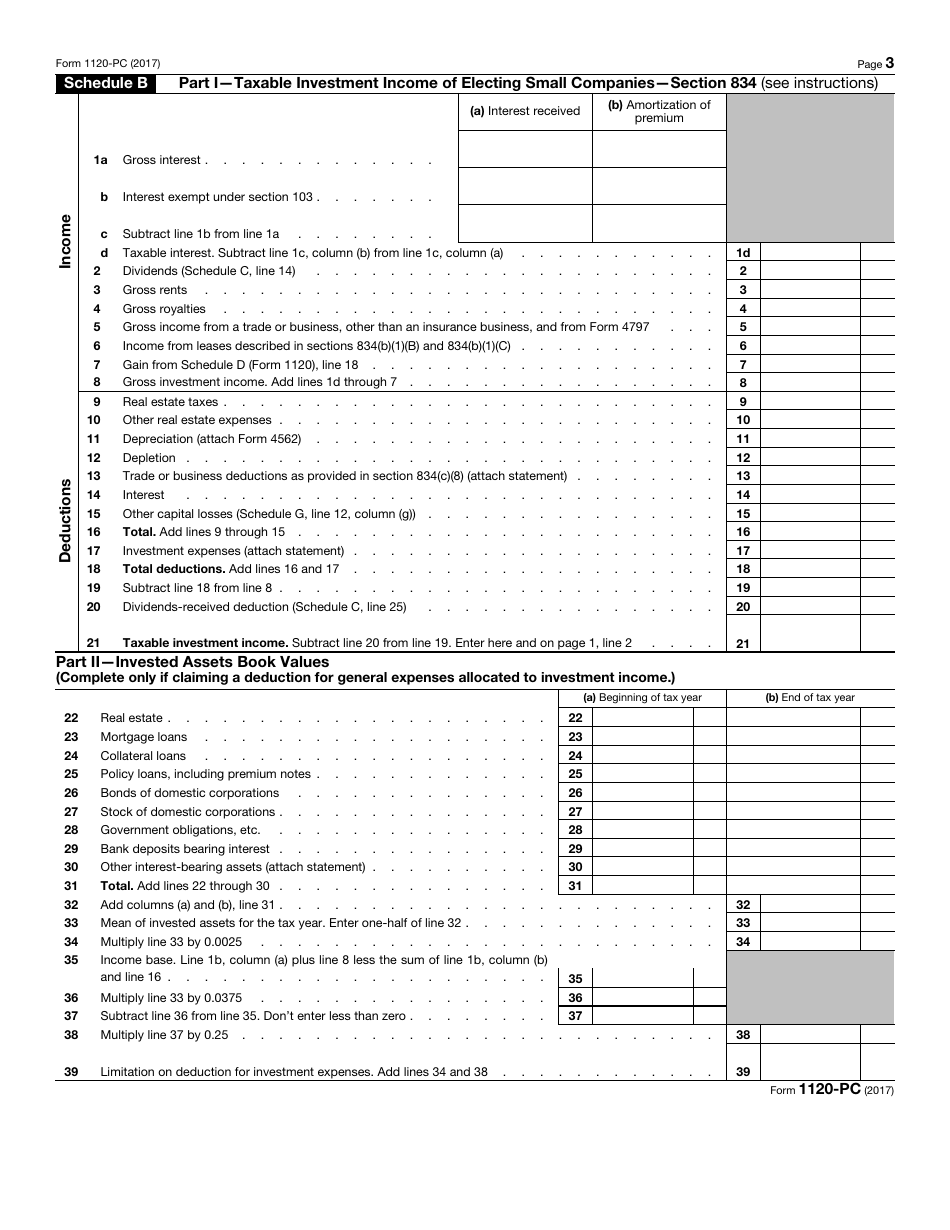

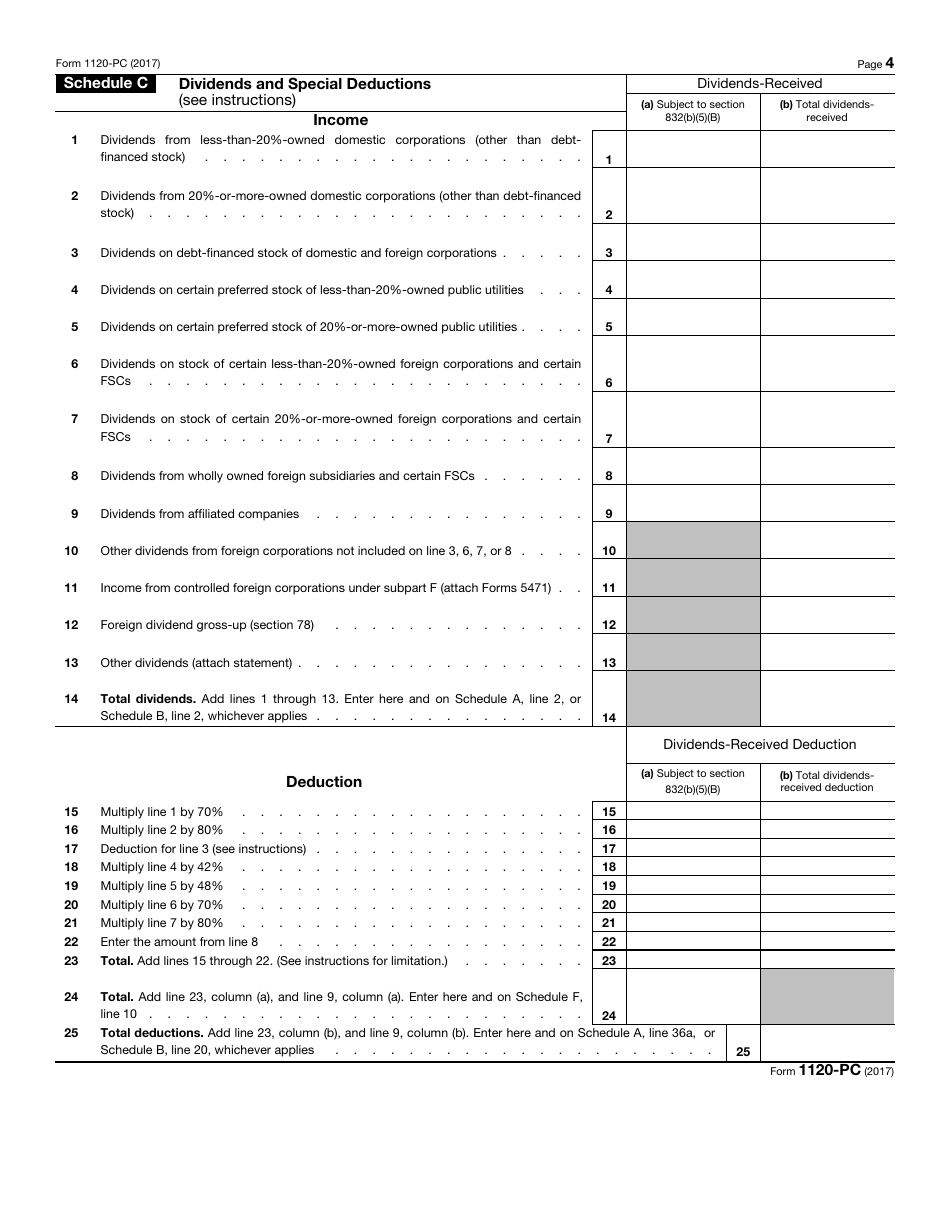

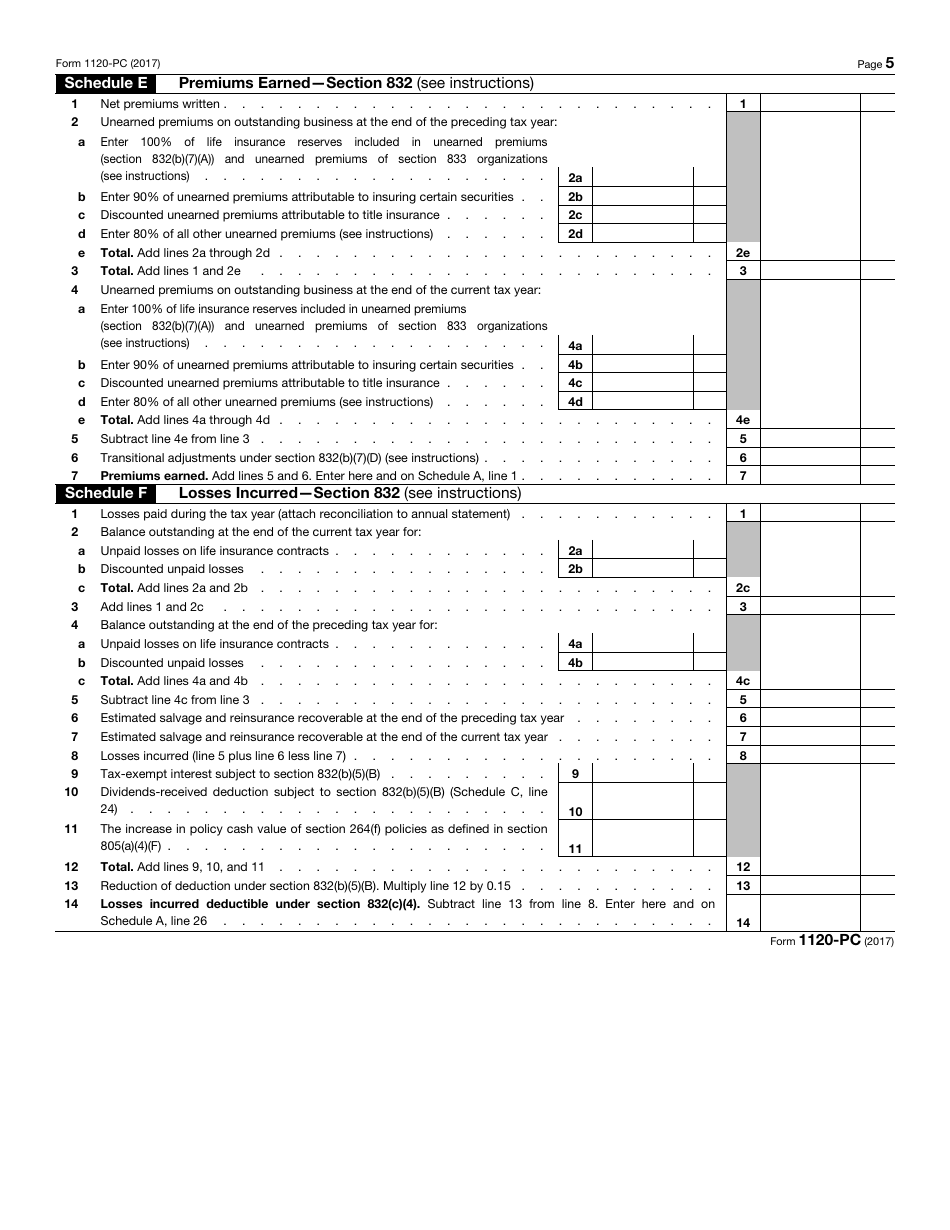

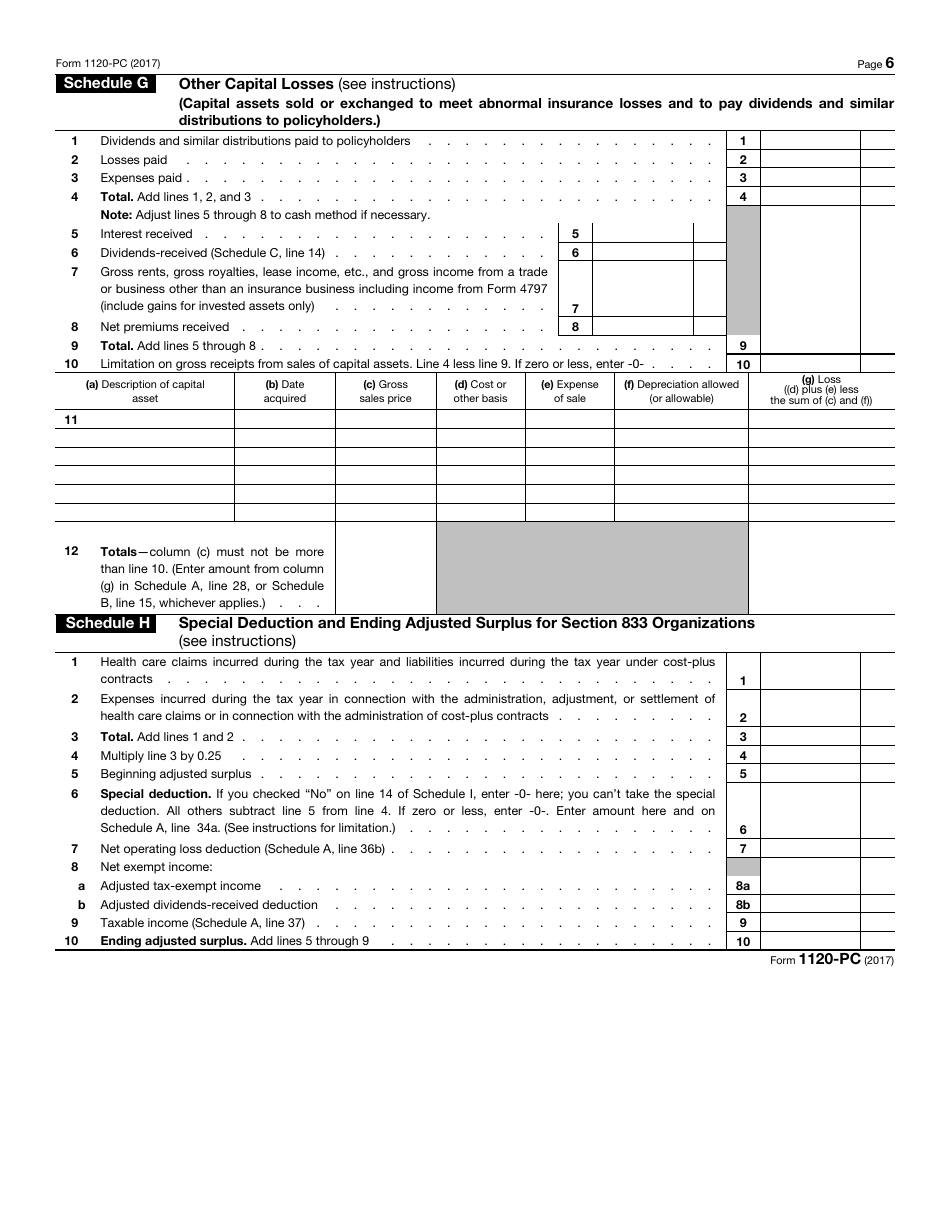

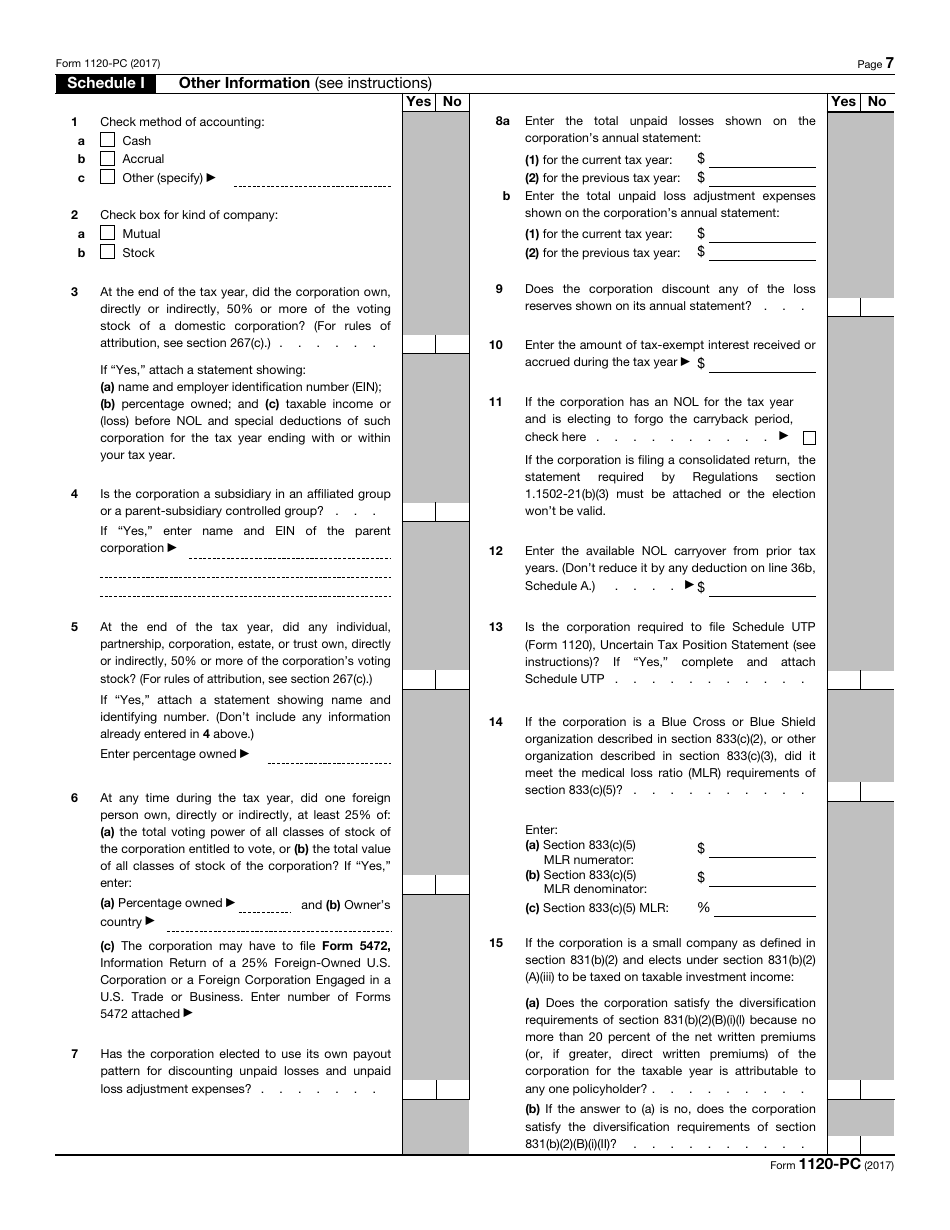

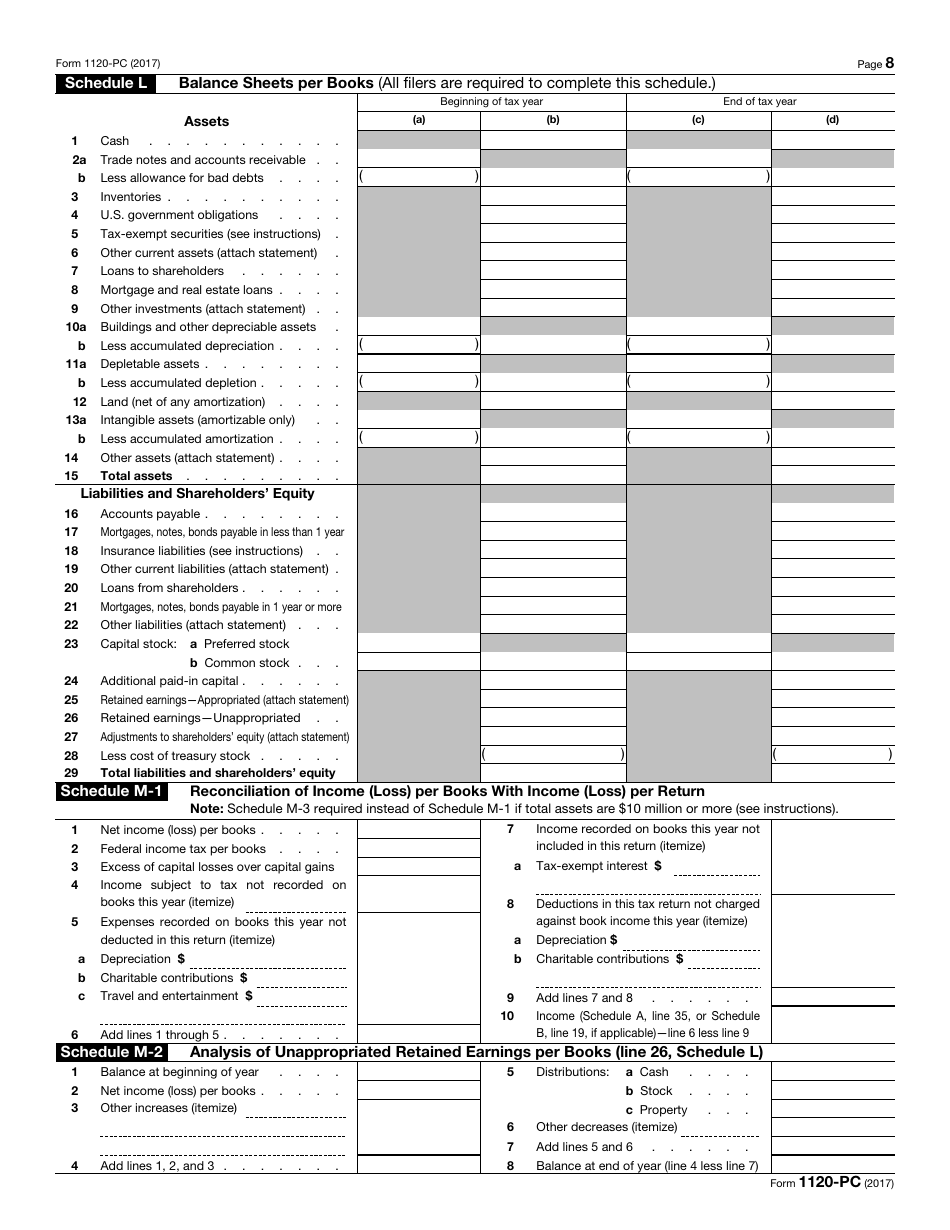

IRS Form 1120-PC U.S. Property and Casualty Insurance Company Income Tax Return

What Is IRS Form 1120-PC?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury on January 1, 2017. As of today, no separate filing guidelines for the form are provided by the IRS.

FAQ

Q: What is IRS Form 1120-PC?

A: IRS Form 1120-PC is the U.S. Property and Casualty Insurance Company Income Tax Return.

Q: Who should file IRS Form 1120-PC?

A: U.S. Property and Casualty Insurance Companies should file IRS Form 1120-PC.

Q: What is the purpose of IRS Form 1120-PC?

A: The purpose of IRS Form 1120-PC is to report income, deductions, and tax liability for U.S. Property and Casualty Insurance Companies.

Q: When is the due date for filing IRS Form 1120-PC?

A: The due date for filing IRS Form 1120-PC is typically March 15th.

Q: Can IRS Form 1120-PC be filed electronically?

A: Yes, IRS Form 1120-PC can be filed electronically.

Q: Are there any special considerations for filing IRS Form 1120-PC?

A: Yes, there are various special considerations for filing IRS Form 1120-PC, such as certain deductions and tax calculations specific to property and casualty insurance companies.

Form Details:

- A 8-page form available for download in PDF;

- This form cannot be used to file taxes for the current year. Choose a more recent version to file for the current tax year;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 1120-PC through the link below or browse more documents in our library of IRS Forms.