This version of the form is not currently in use and is provided for reference only. Download this version of

IRS Form 1127

for the current year.

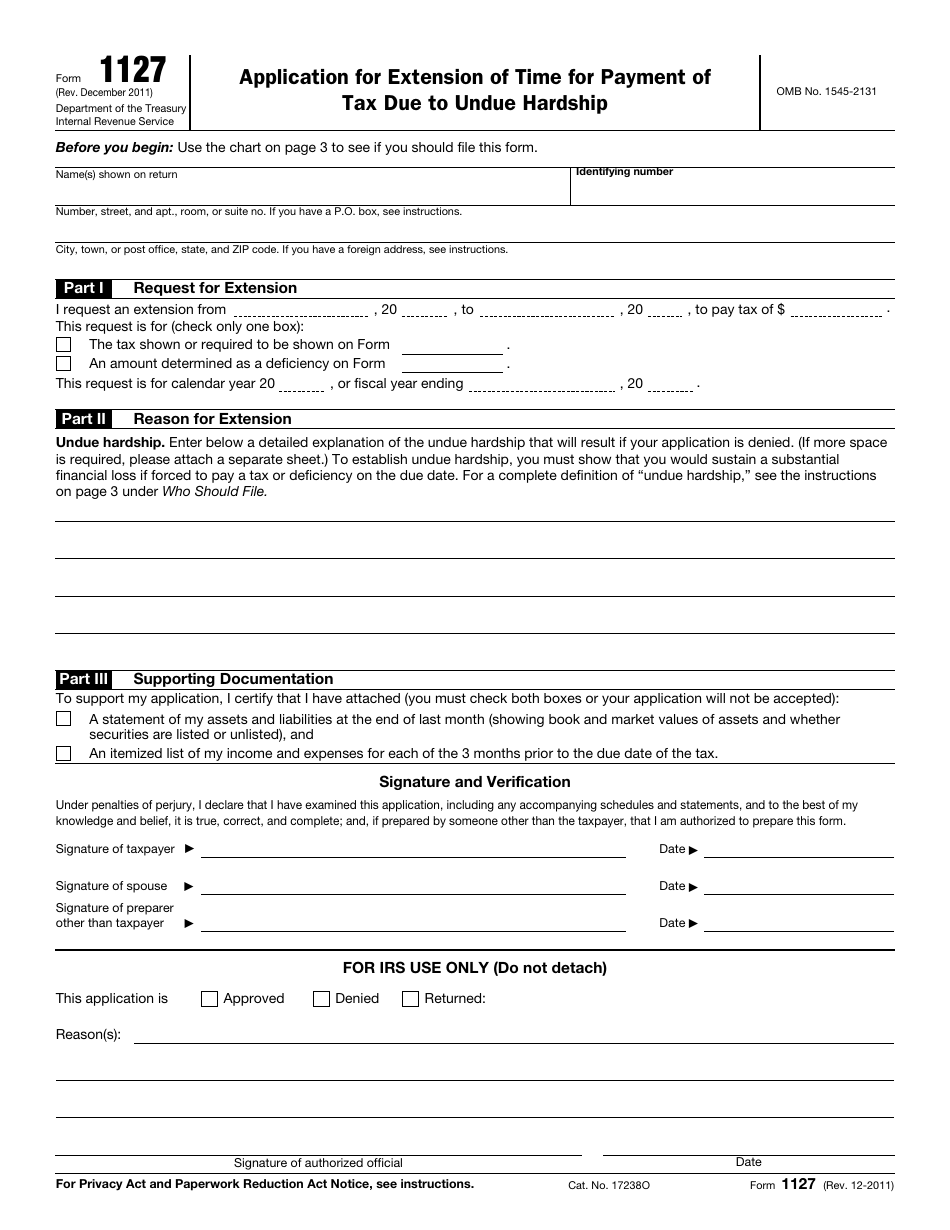

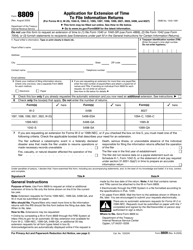

IRS Form 1127 Application for Extension of Time for Payment of Tax Due to Undue Hardship

What Is Form 1127?

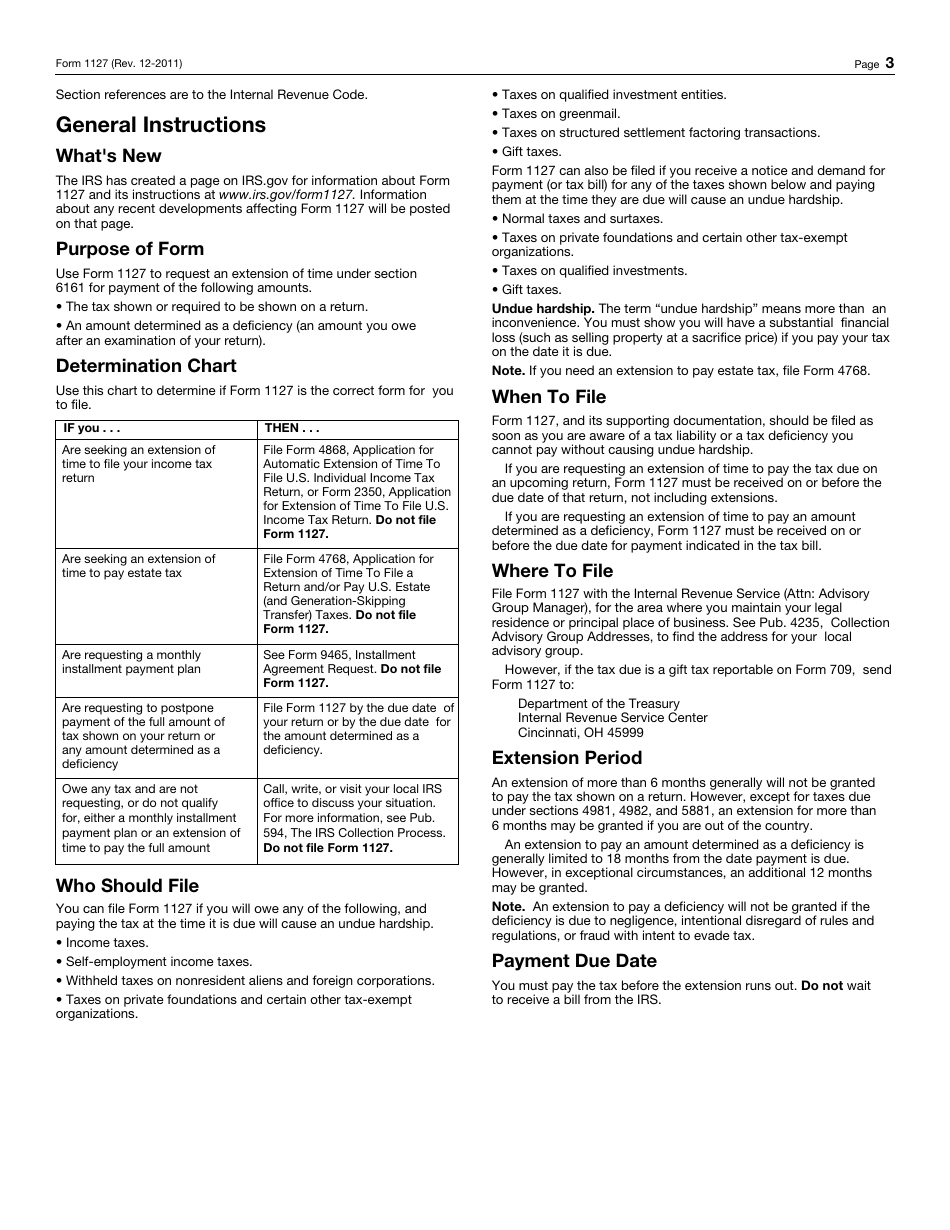

IRS Form 1127, Application for Extension of Time for Payment of Tax Due to Undue Hardship , is a legal document completed by taxpayers who cannot pay their taxes on time and have to postpone the tax filing deadline. It is only applicable if you face undue hardship and significant financial burden which you are able to prove to the Internal Revenue Service (IRS) - for instance, illness, death of a household wage-earner, jail sentence, or natural disaster. By submitting this application to delay the tax return, you will avoid the failure-to-pay penalty but will not be excused from paying interest on the amount of tax you owe.

This form was released by the IRS . The latest version of the form was issued in December 2011 with all previous editions obsolete. A Form 1127 fillable version is available for download below.

Follow these steps to complete the IRS 1127 Form:

- State your name, social security number or individual taxpayer identification number, and address;

- Request the extension by entering the due date of your tax return and the date you propose to pay the owed tax. Record the number of the form to which the tax you owe relates. You may request an extension of 6 months (18 months for the tax assessed as a deficiency);

- Explain the undue hardship that does not allow you to pay the tax on time;

- Indicate which documentation you submit to support the form. You must provide a statement of your assets and liabilities and itemize your income and expenses for the last three months;

- Sign the form. If you file a joint return or you were helped to fill out the application, the signatures of your spouse and preparer are required.