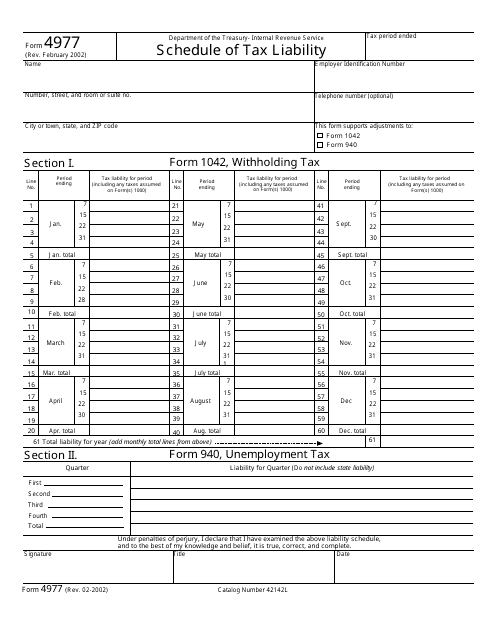

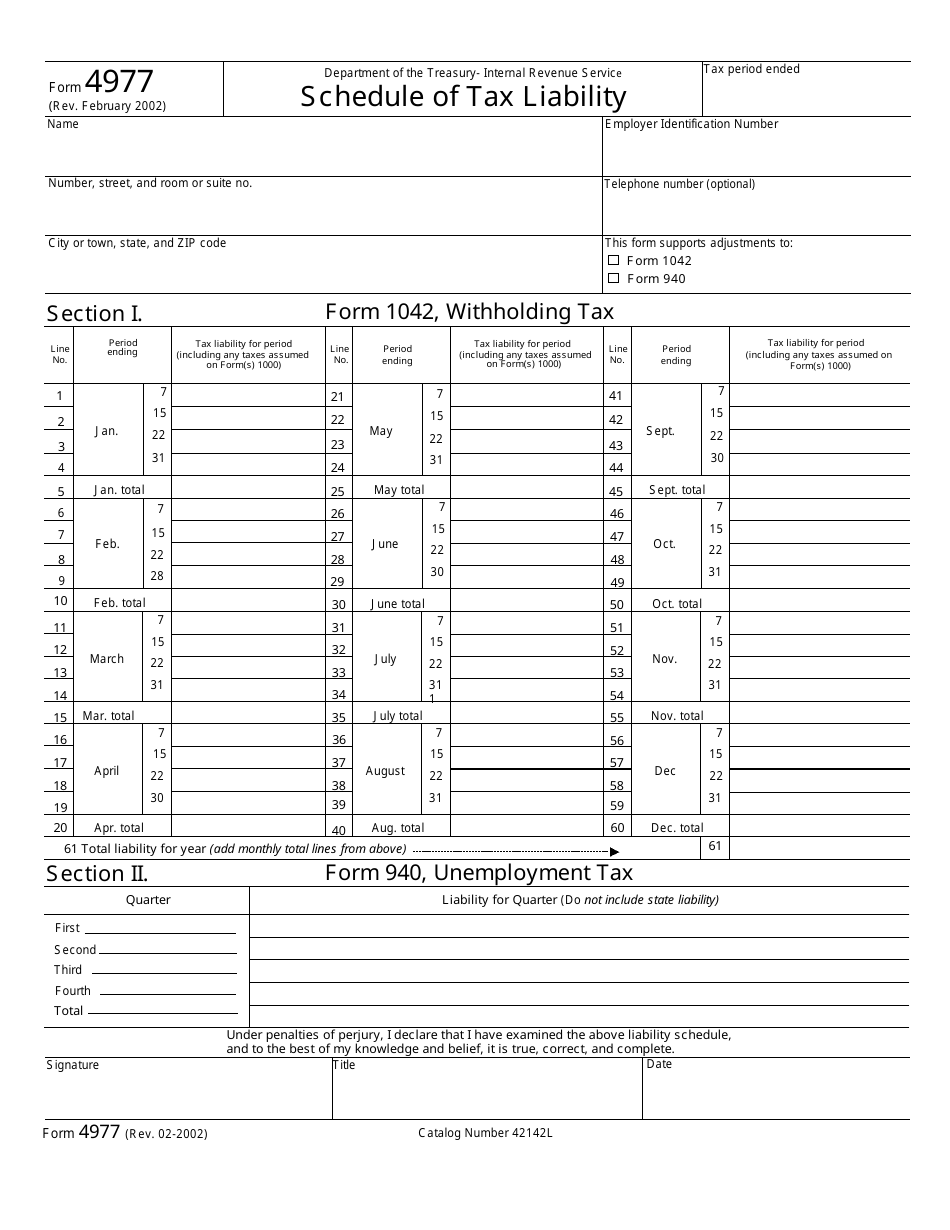

IRS Form 4977 Schedule of Tax Liability

What Is IRS Form 4977?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury on February 1, 2002. As of today, no separate filing guidelines for the form are provided by the IRS.

FAQ

Q: What is IRS Form 4977?

A: IRS Form 4977 is a schedule used to calculate tax liability.

Q: When is IRS Form 4977 used?

A: IRS Form 4977 is used when reporting tax liability associated with certain investments.

Q: Who needs to file IRS Form 4977?

A: Individuals or entities that have tax liability related to specific investments may need to file IRS Form 4977.

Q: Can I file IRS Form 4977 electronically?

A: IRS Form 4977 cannot be filed electronically; it must be filed by mail with the appropriate IRS office.

Form Details:

- A 1-page form available for download in PDF;

- Actual and valid for filing 2023 taxes;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 4977 through the link below or browse more documents in our library of IRS Forms.