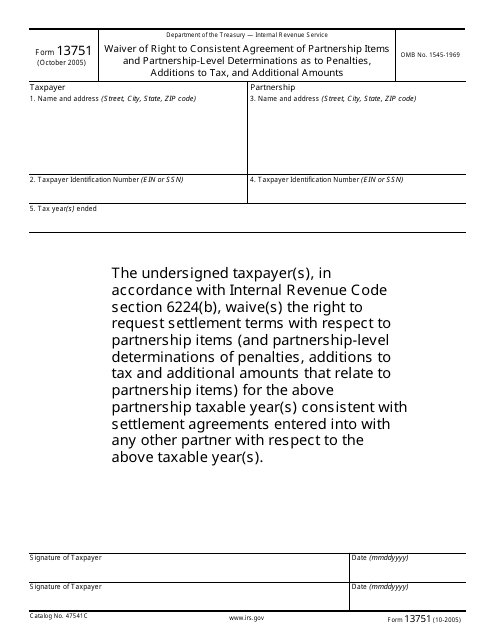

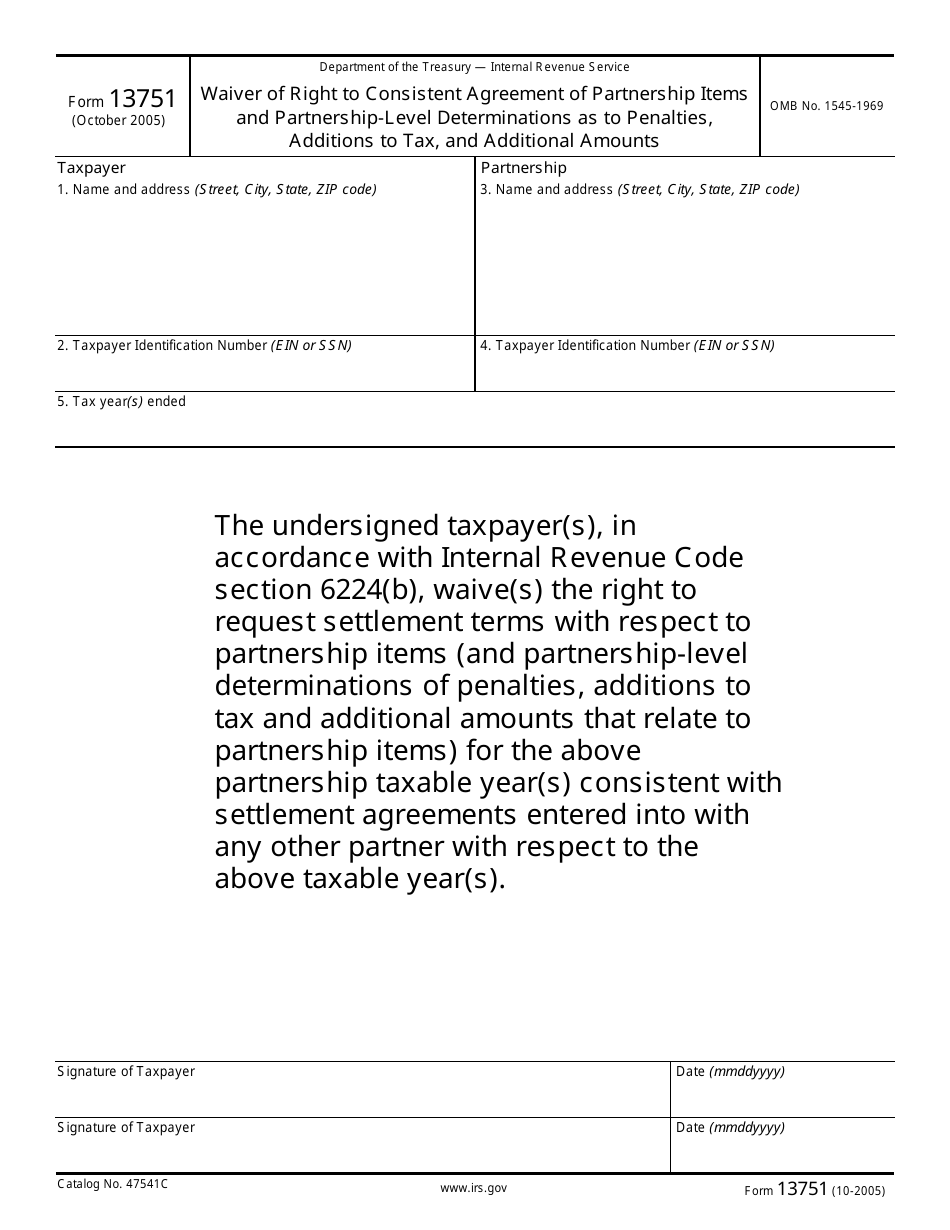

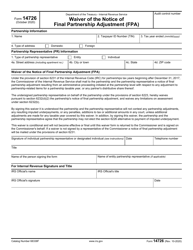

IRS Form 13751 Waiver of Right to Consistent Agreement of Partnership Items and Partnership-Level Determinations as to Penalties, Additions to Tax, and Additional Amounts

What Is IRS Form 13751?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury on October 1, 2005. As of today, no separate filing guidelines for the form are provided by the IRS.

FAQ

Q: What is IRS Form 13751?

A: IRS Form 13751 is a form used to waive the right to consistent agreement on partnership items and penalties.

Q: What does the form waive?

A: The form waives the right to consistent agreement on partnership items as well as penalties, additions to tax, and additional amounts.

Q: Who should use IRS Form 13751?

A: Partnerships and their partners should use this form.

Q: Why would someone use this form?

A: Partnerships may use this form to waive the right to consistent agreement in order to resolve certain tax issues more quickly.

Form Details:

- A 1-page form available for download in PDF;

- Actual and valid for filing 2023 taxes;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 13751 through the link below or browse more documents in our library of IRS Forms.