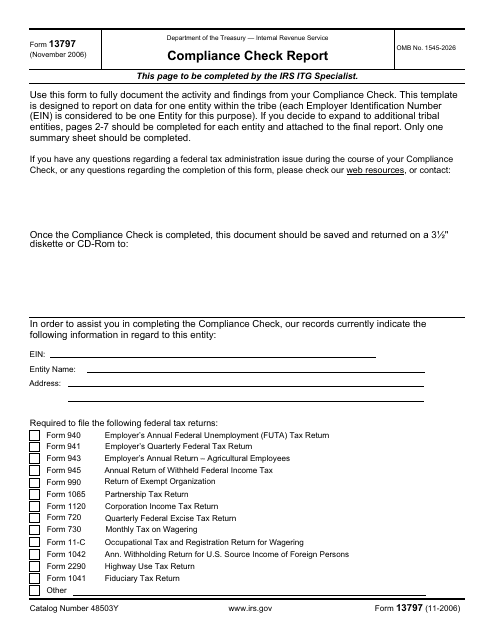

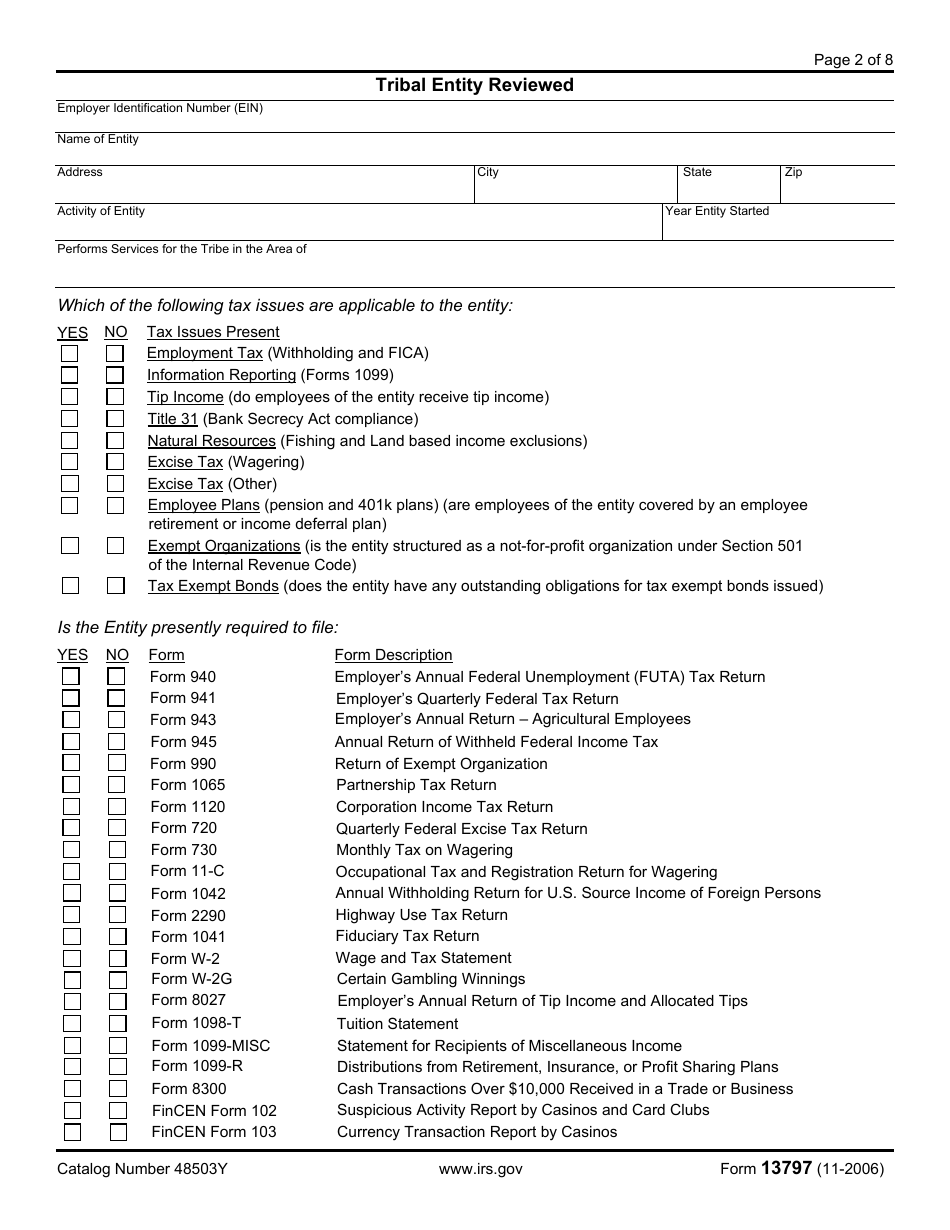

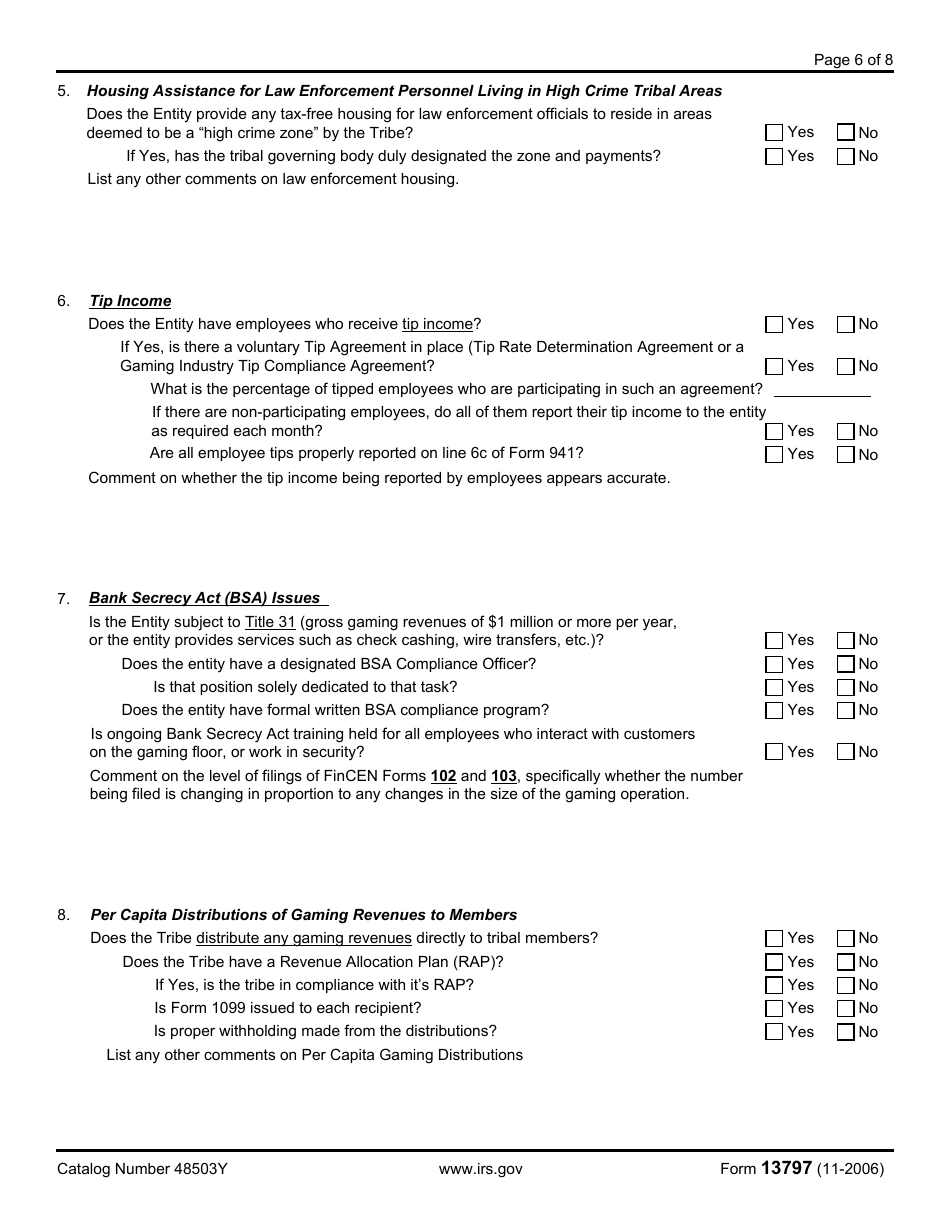

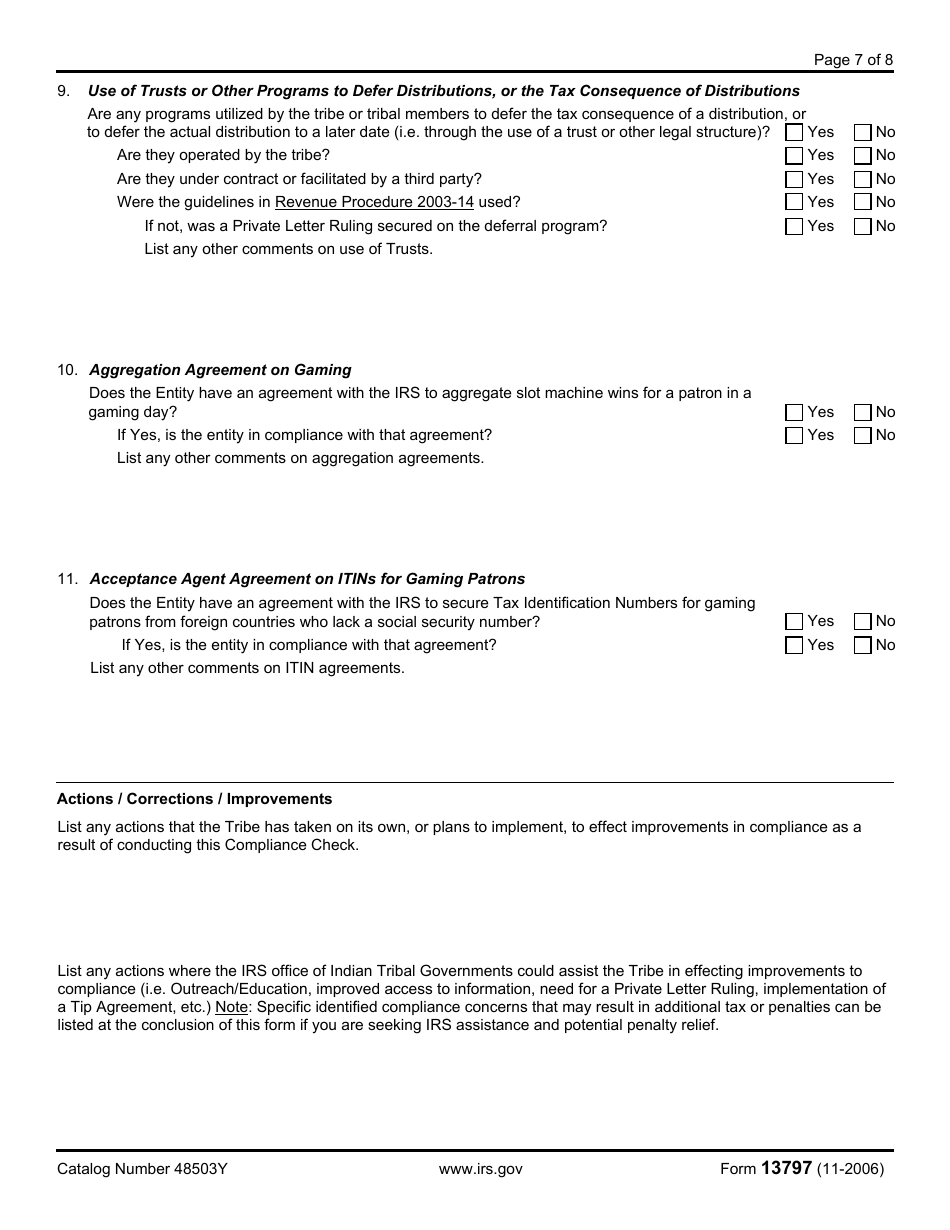

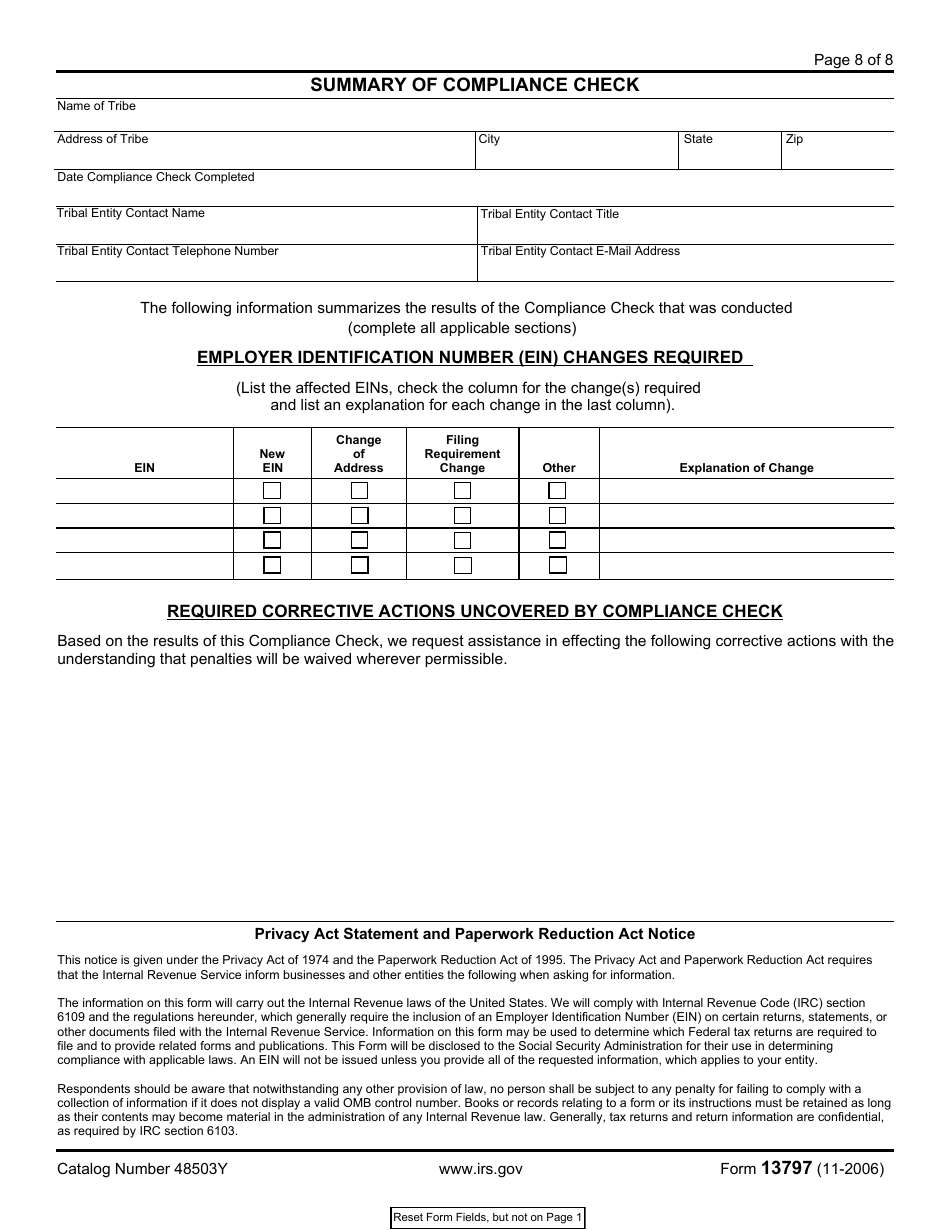

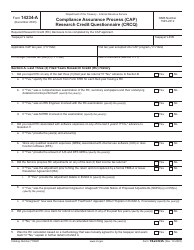

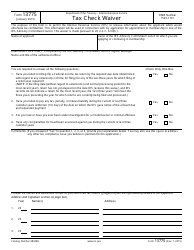

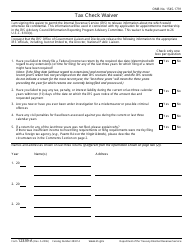

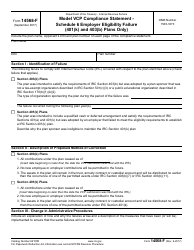

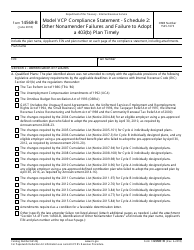

IRS Form 13797 Compliance Check Report

What Is IRS Form 13797?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury on November 1, 2006. As of today, no separate filing guidelines for the form are provided by the IRS.

FAQ

Q: What is IRS Form 13797?

A: IRS Form 13797 is a Compliance Check Report.

Q: What is the purpose of IRS Form 13797?

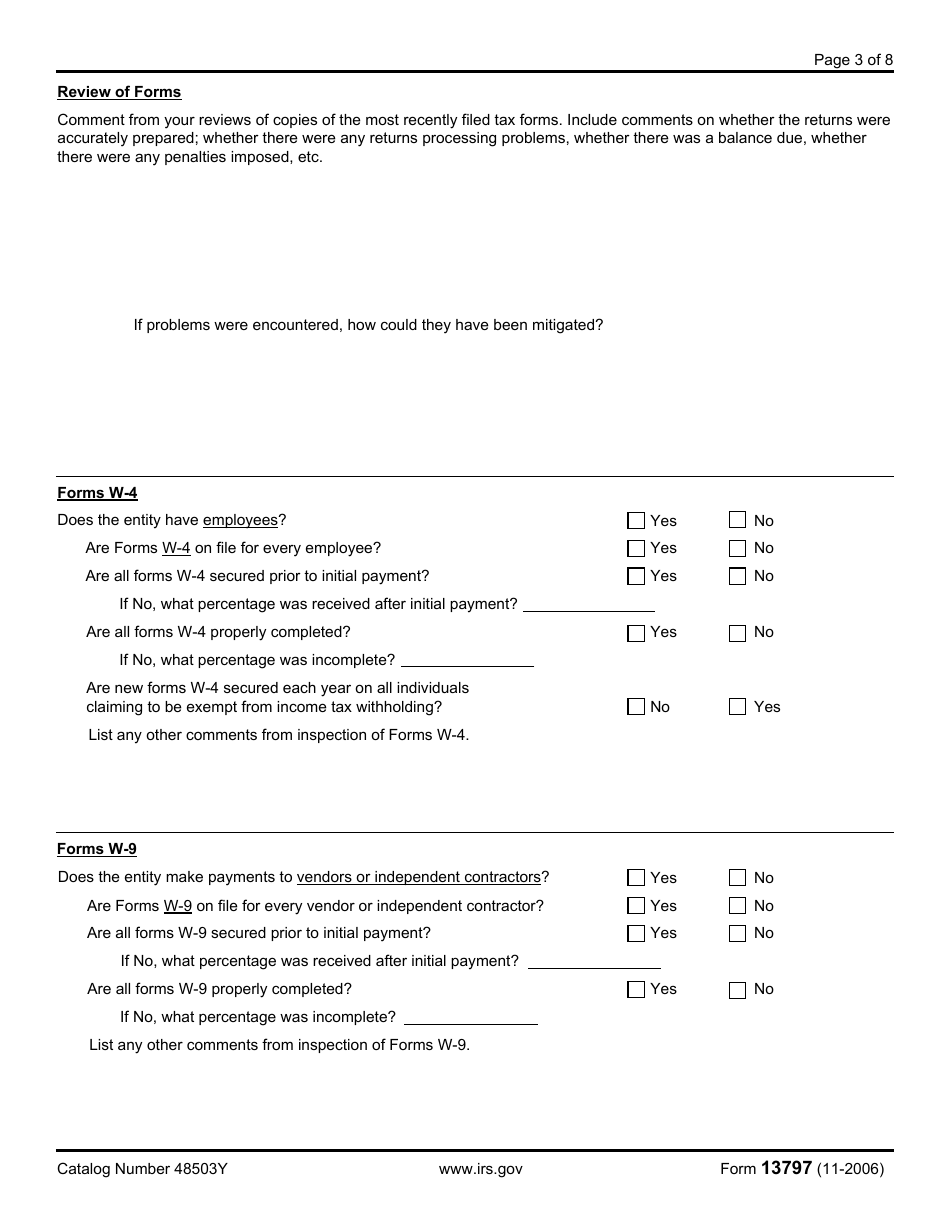

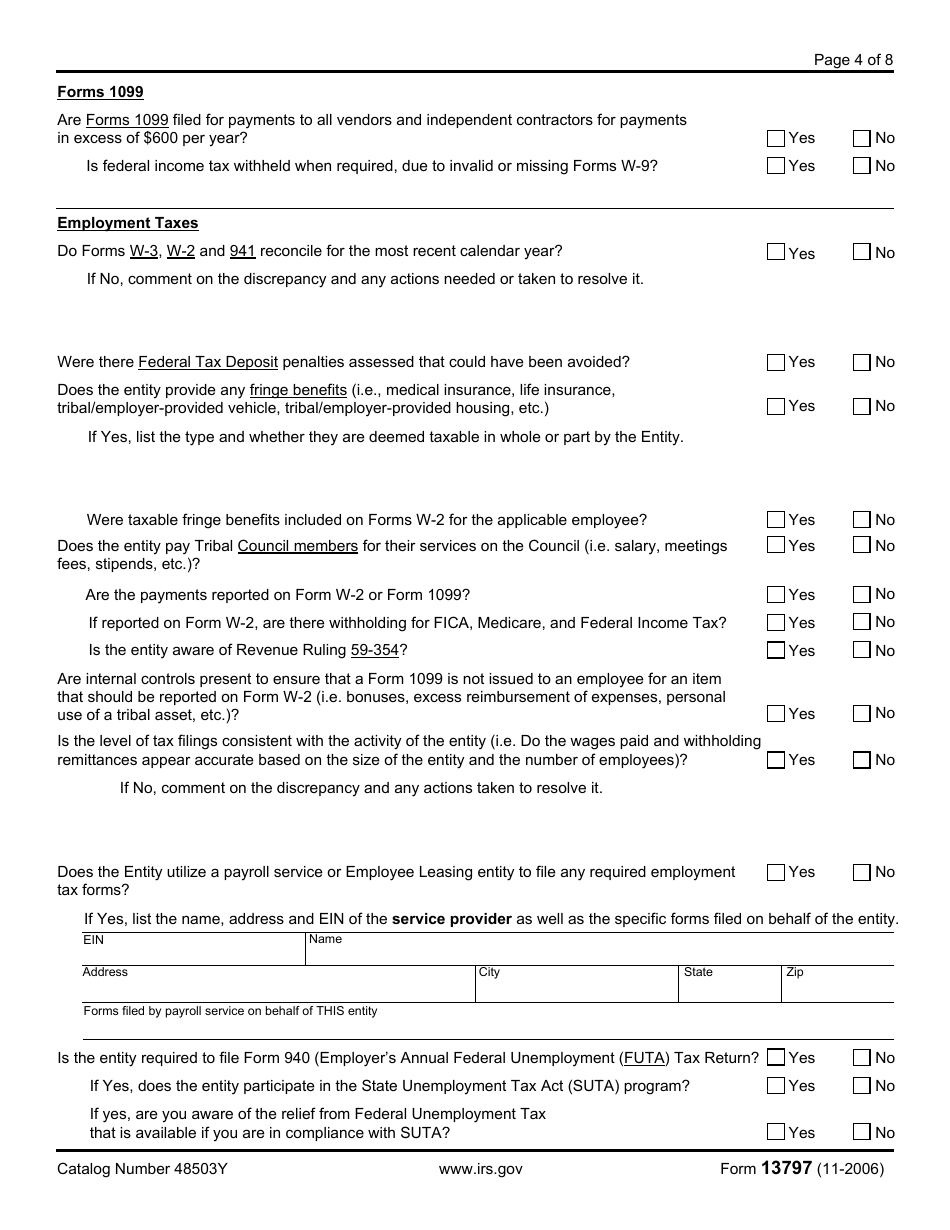

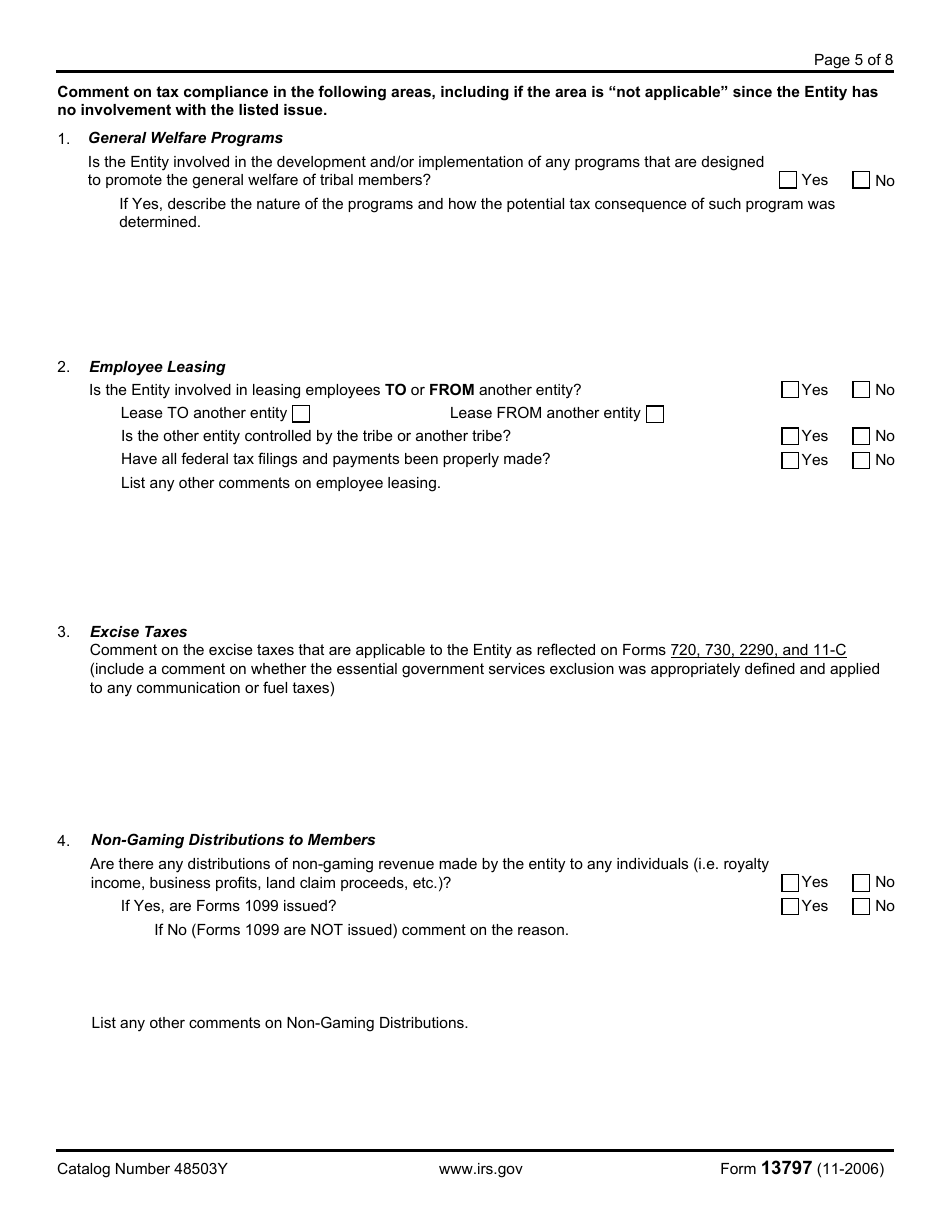

A: The purpose of IRS Form 13797 is to assess compliance with tax laws and regulations.

Q: Who needs to fill out IRS Form 13797?

A: IRS Form 13797 is typically completed by the IRS to conduct compliance checks on taxpayers or tax-exempt organizations.

Q: Is IRS Form 13797 mandatory?

A: IRS Form 13797 is not mandatory for individual taxpayers, but it may be required for certain organizations or businesses selected for a compliance check.

Q: What information is required on IRS Form 13797?

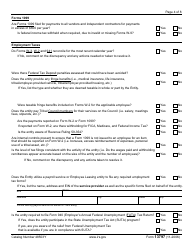

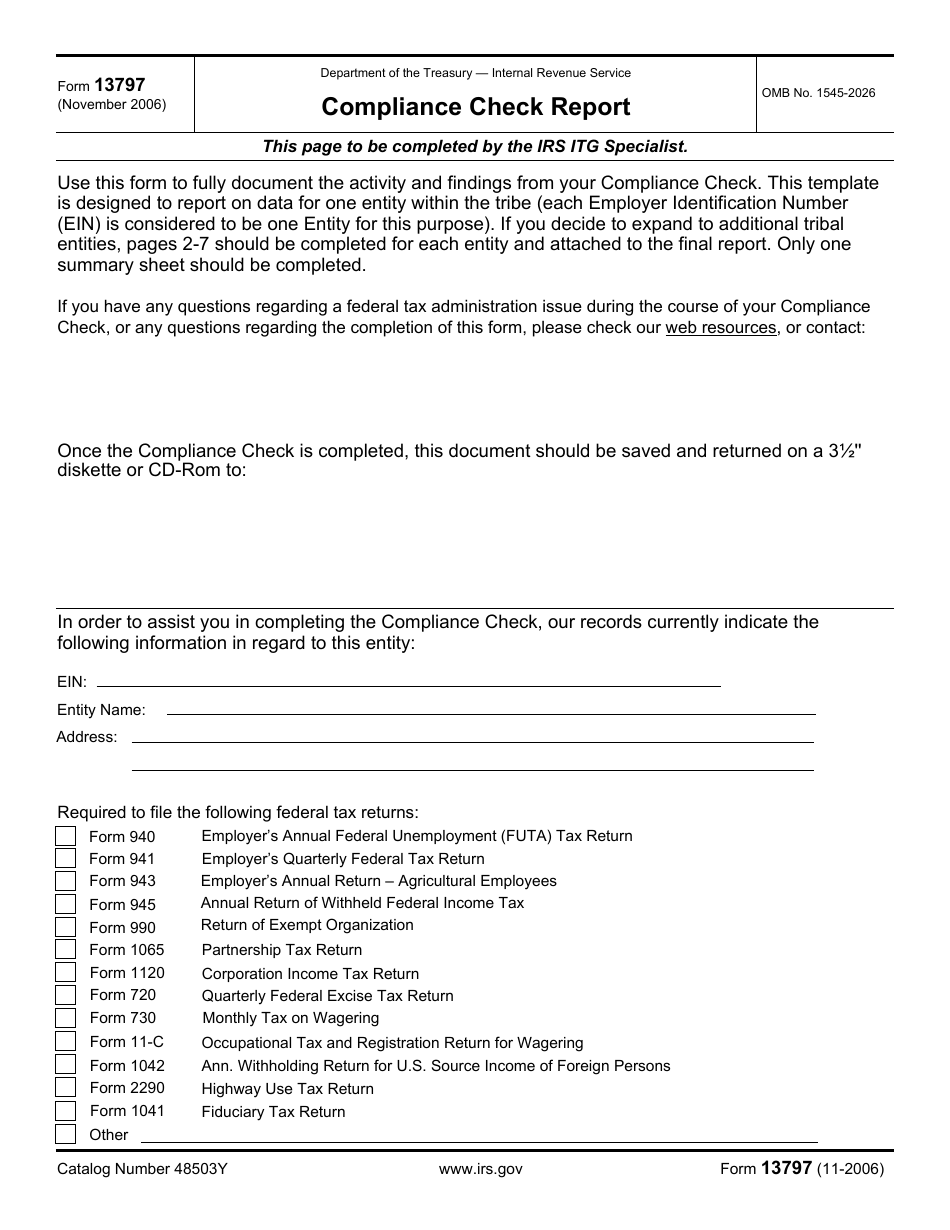

A: IRS Form 13797 may require information such as income sources, deductions, credits, and other relevant financial information.

Q: Are there any penalties for non-compliance with IRS Form 13797?

A: Penalties for non-compliance with IRS Form 13797 may vary depending on the specific circumstances and extent of non-compliance. It is advisable to consult with a tax professional or the IRS for more information.

Q: How often is IRS Form 13797 required?

A: The frequency of IRS Form 13797 requirement depends on the IRS's selection criteria for compliance checks. It is not a form that is typically required on a regular basis.

Form Details:

- A 8-page form available for download in PDF;

- Actual and valid for filing 2023 taxes;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 13797 through the link below or browse more documents in our library of IRS Forms.