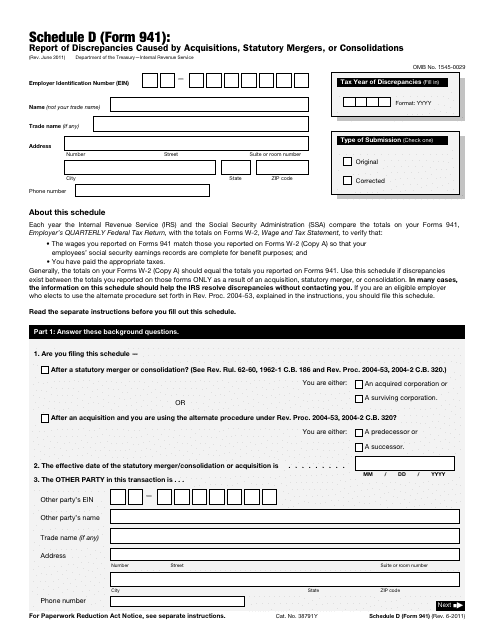

IRS Form 941 Schedule D Report of Discrepancies Caused by Acquisitions, Statutory Mergers, or Consolidations

What Is IRS Form 941 Schedule D?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury on June 1, 2011. Check the official IRS-issued instructions before completing and submitting the form.

FAQ

Q: What is IRS Form 941 Schedule D?

A: IRS Form 941 Schedule D is a report used to report discrepancies caused by acquisitions, statutory mergers, or consolidations.

Q: Who needs to file IRS Form 941 Schedule D?

A: Employers who have experienced discrepancies due to acquisitions, statutory mergers, or consolidations need to file IRS Form 941 Schedule D.

Q: When is IRS Form 941 Schedule D due?

A: IRS Form 941 Schedule D is due on the same date as Form 941, which is generally filed quarterly.

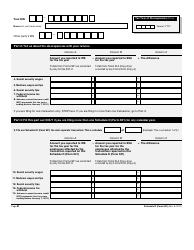

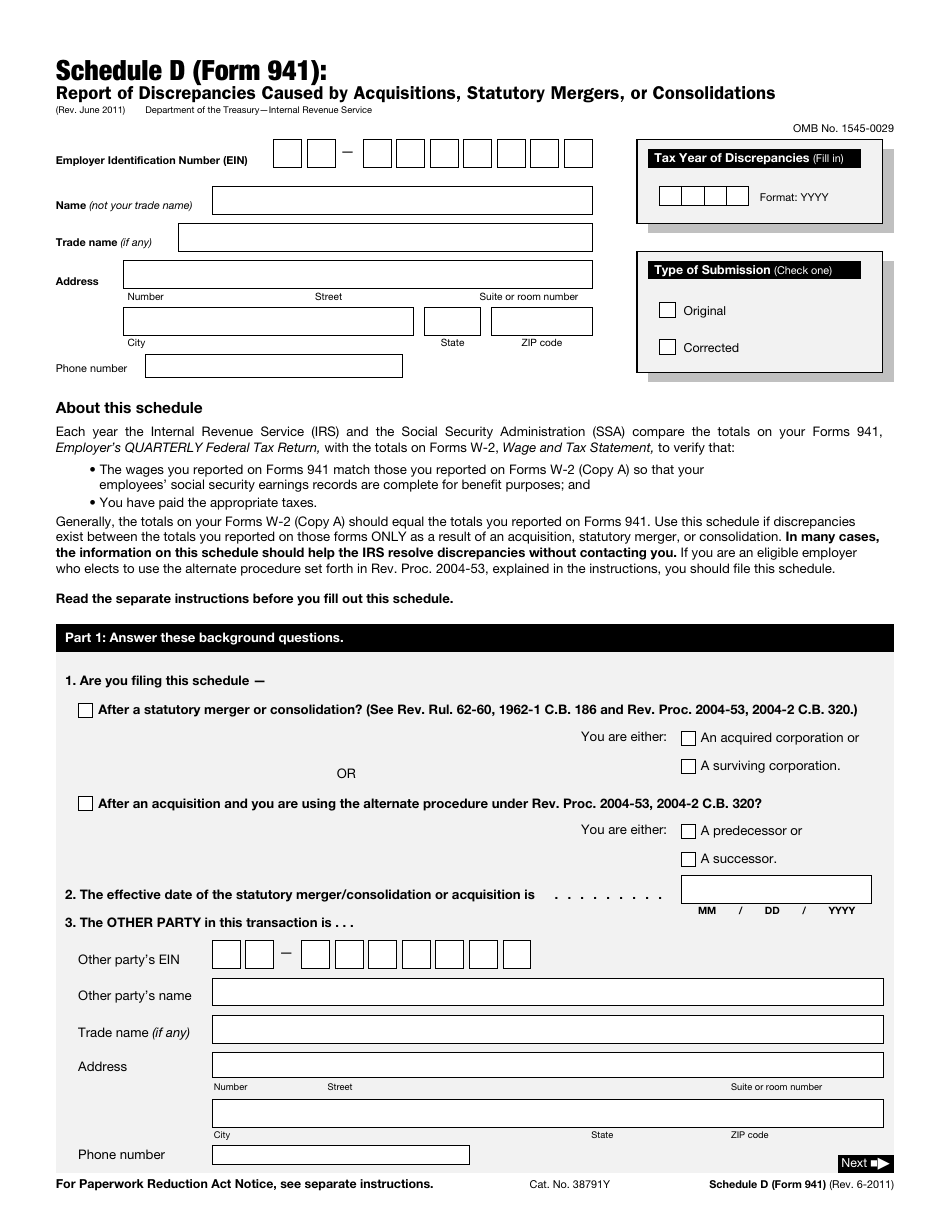

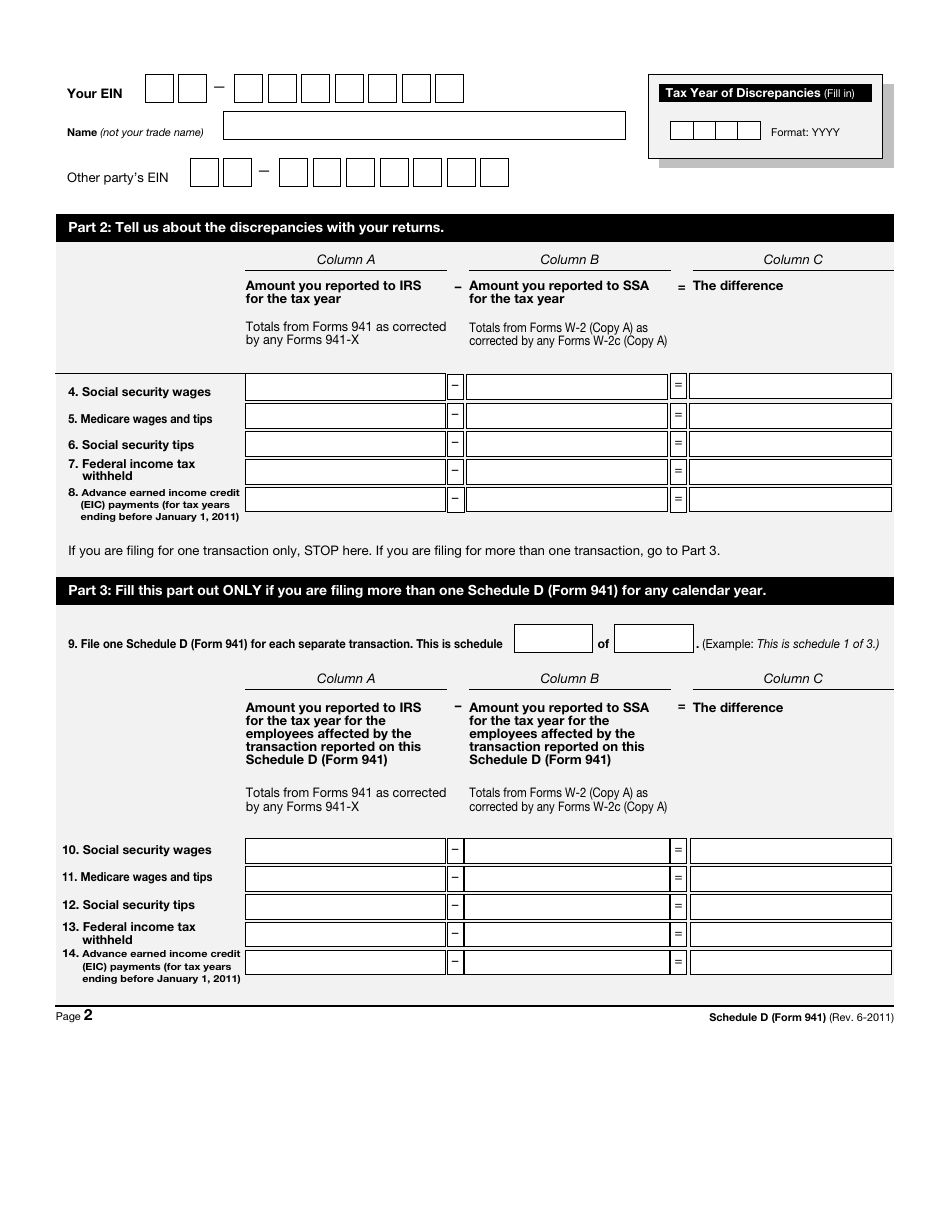

Q: What information is required on IRS Form 941 Schedule D?

A: IRS Form 941 Schedule D requires information related to the employer's business, as well as details about the acquisitions, statutory mergers, or consolidations.

Q: What should I do if I have errors or discrepancies on IRS Form 941 Schedule D?

A: If you have errors or discrepancies on IRS Form 941 Schedule D, you should correct them and file an amended form as soon as possible.

Form Details:

- A 2-page form available for download in PDF;

- Actual and valid for filing 2023 taxes;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 941 Schedule D through the link below or browse more documents in our library of IRS Forms.