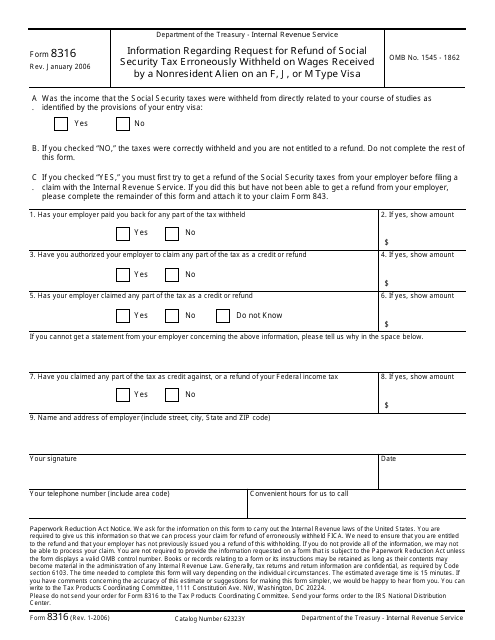

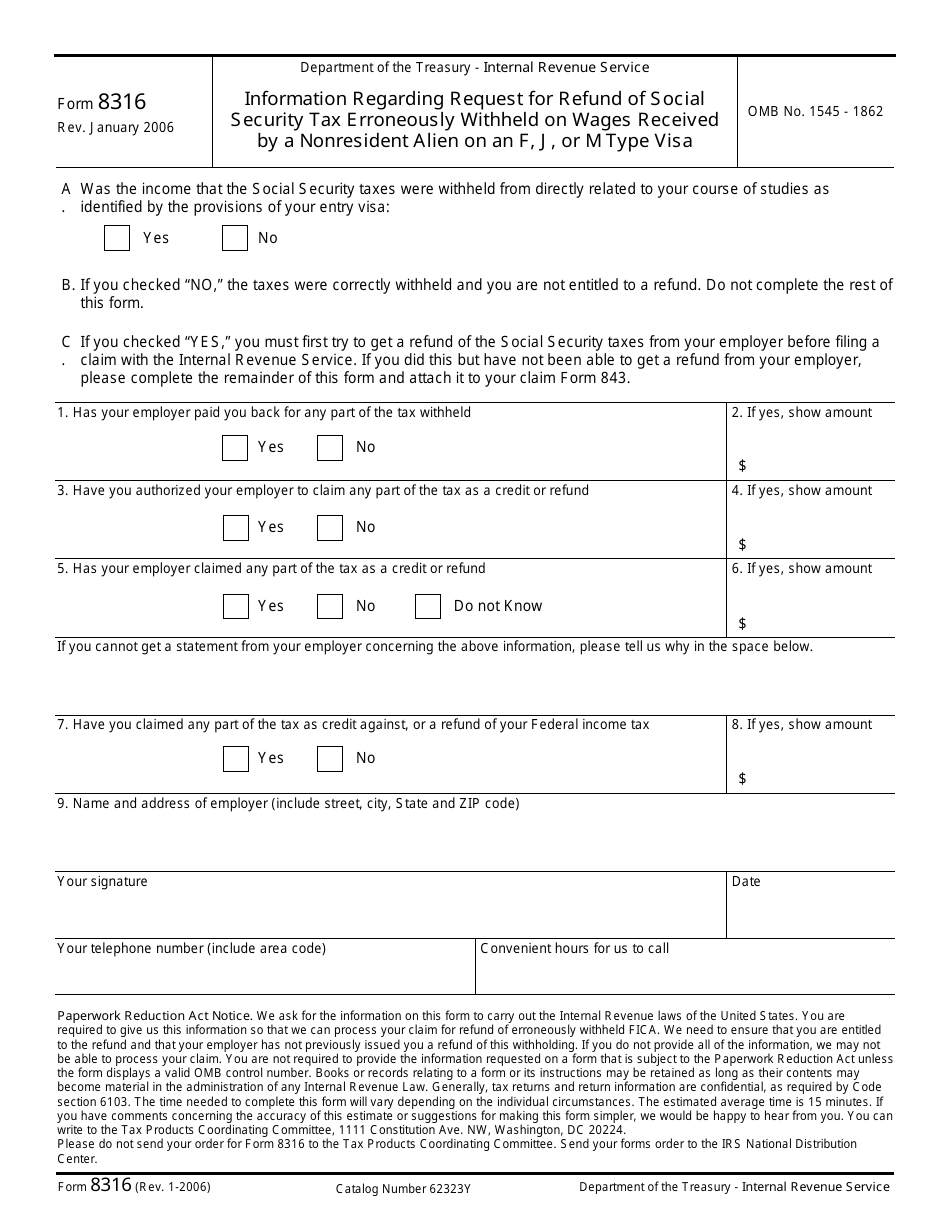

IRS Form 8316 Information Regarding Request for Refund of Social Security Tax Erroneously Withheld on Wages Received by a Nonresident Alien on an F, J, or M Type Visa

What Is IRS Form 8316?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury on January 1, 2006. As of today, no separate filing guidelines for the form are provided by the IRS.

FAQ

Q: What is IRS Form 8316?

A: IRS Form 8316 is a form used to request a refund of Social Security tax erroneously withheld on wages received by a nonresident alien on an F, J, or M type visa.

Q: Who can use IRS Form 8316?

A: Nonresident aliens who were on an F, J, or M type visa and had Social Security tax erroneously withheld on their wages can use IRS Form 8316 to request a refund.

Q: What is the purpose of IRS Form 8316?

A: The purpose of IRS Form 8316 is to allow nonresident aliens to request a refund of Social Security tax that was incorrectly withheld from their wages.

Q: Is there a deadline to submit IRS Form 8316?

A: Yes, IRS Form 8316 must be submitted within a specific time period. It is recommended to consult the form instructions or contact the IRS for the deadline.

Form Details:

- A 1-page form available for download in PDF;

- Actual and valid for filing 2023 taxes;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 8316 through the link below or browse more documents in our library of IRS Forms.