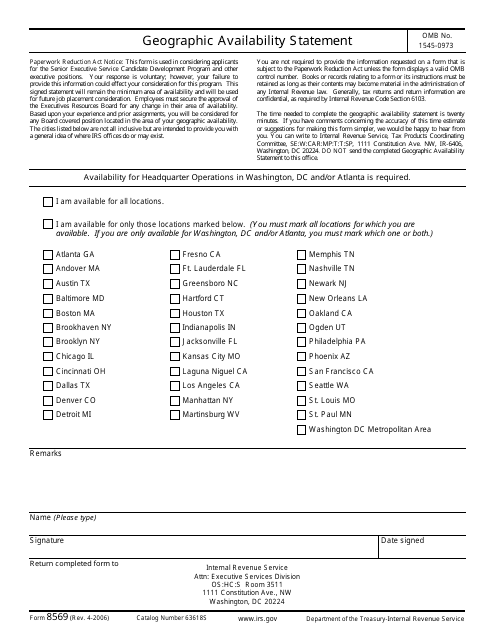

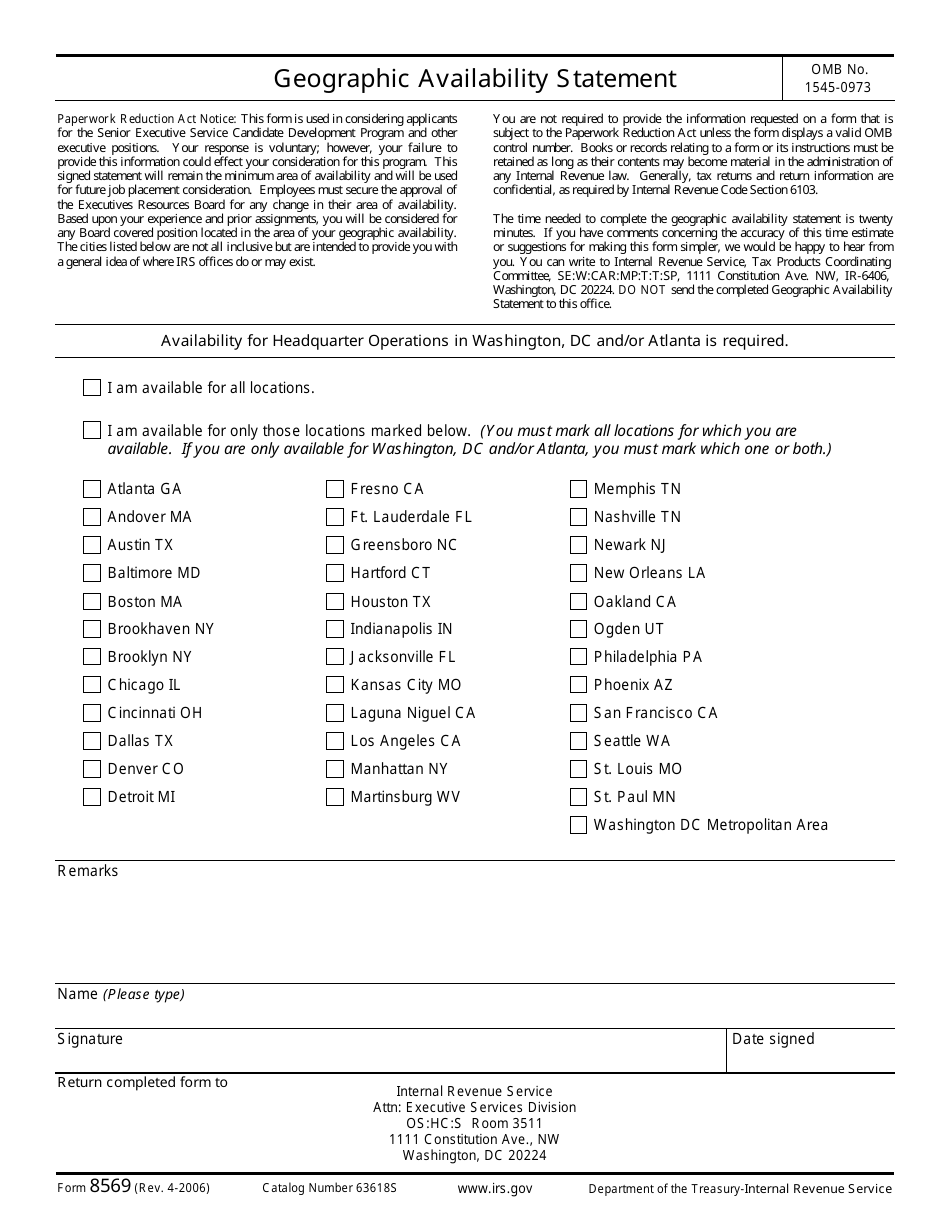

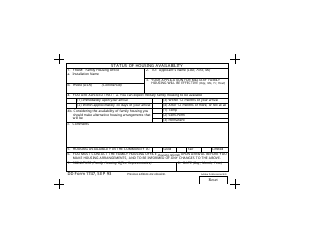

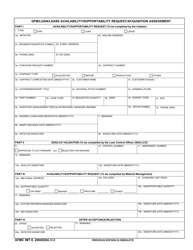

IRS Form 8569 Geographic Availability Statement

What Is IRS Form 8569?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury on April 1, 2006. As of today, no separate filing guidelines for the form are provided by the IRS.

FAQ

Q: What is IRS Form 8569?

A: IRS Form 8569 is a Geographic Availability Statement.

Q: What is the purpose of IRS Form 8569?

A: The purpose of Form 8569 is to determine if a taxpayer has the necessary geographic availability to participate in the Qualified Performing Artist Deduction.

Q: Who is required to fill out IRS Form 8569?

A: Qualified performing artists who want to claim the Qualified Performing Artist Deduction are required to fill out Form 8569.

Q: What is the Qualified Performing Artist Deduction?

A: The Qualified Performing Artist Deduction allows eligible performing artists to deduct certain business expenses.

Q: What information is needed to complete IRS Form 8569?

A: To complete Form 8569, taxpayers need to provide information about their geographic availability for work.

Q: Are there any filing fees for IRS Form 8569?

A: No, there are no filing fees for Form 8569.

Q: When is the deadline to file IRS Form 8569?

A: The deadline to file Form 8569 is the same as the deadline for filing your individual income tax return (usually April 15th).

Q: Can Form 8569 be filed electronically?

A: No, Form 8569 cannot be filed electronically. It must be filed by mail or in person.

Q: Can I claim the Qualified Performing Artist Deduction without filing Form 8569?

A: No, filing Form 8569 is required in order to claim the Qualified Performing Artist Deduction.

Form Details:

- A 1-page form available for download in PDF;

- Actual and valid for filing 2023 taxes;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 8569 through the link below or browse more documents in our library of IRS Forms.