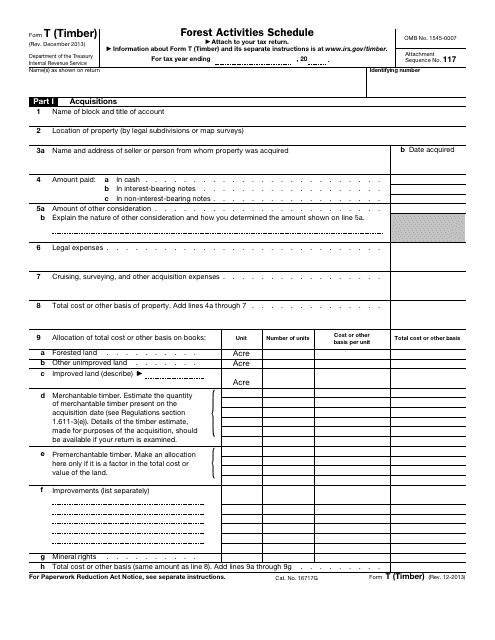

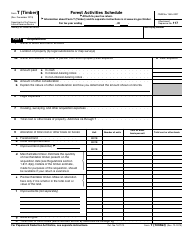

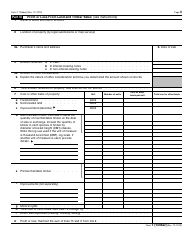

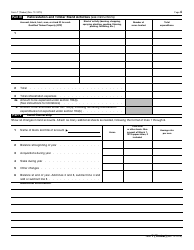

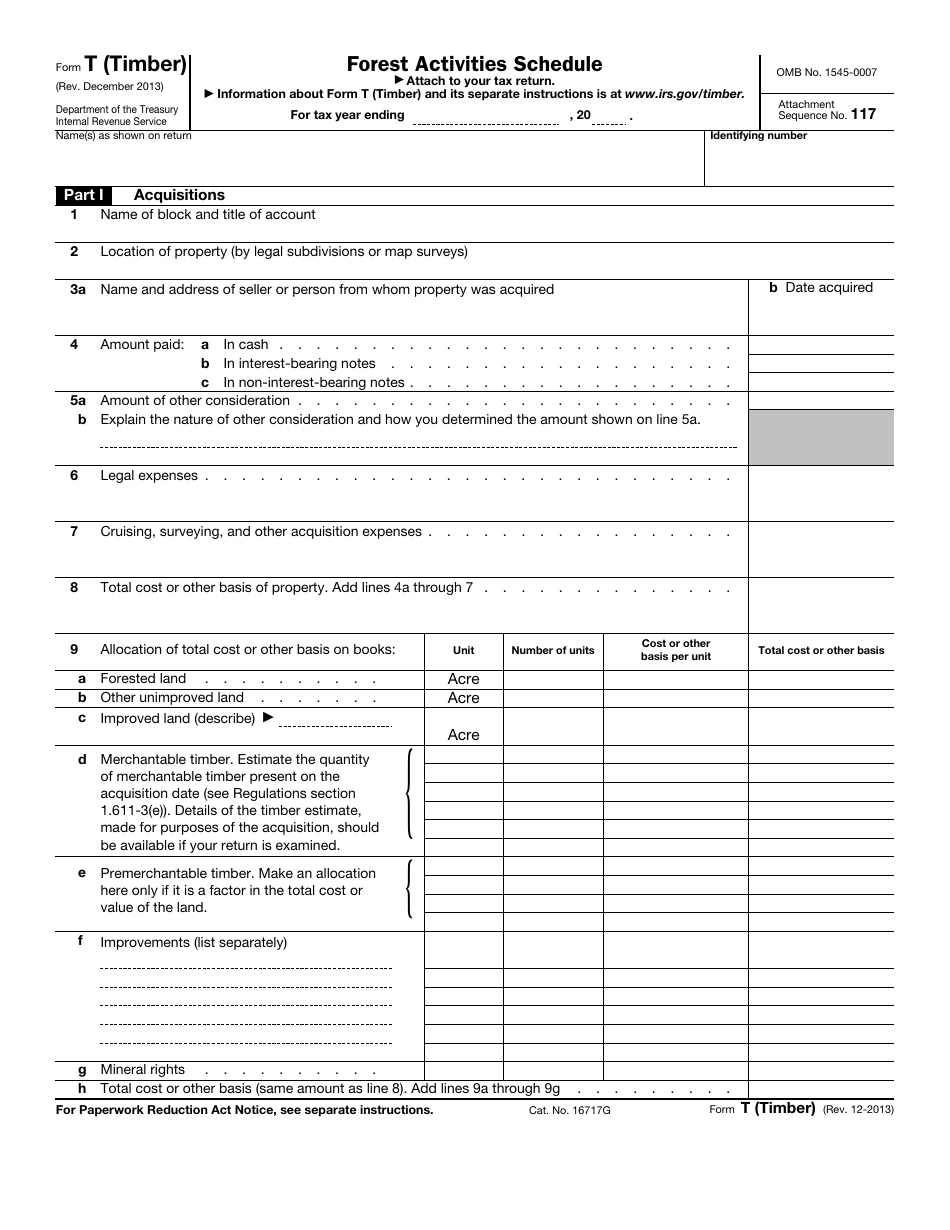

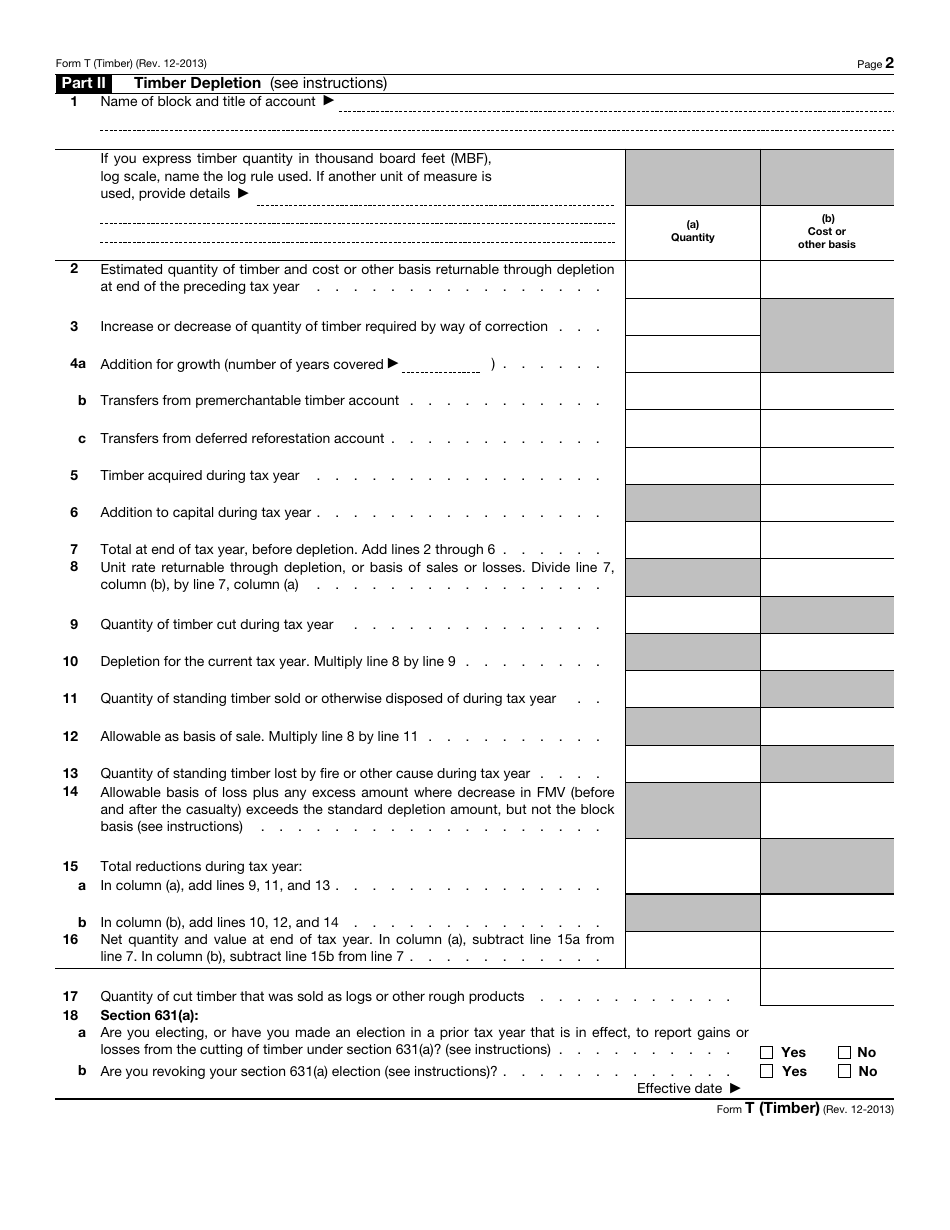

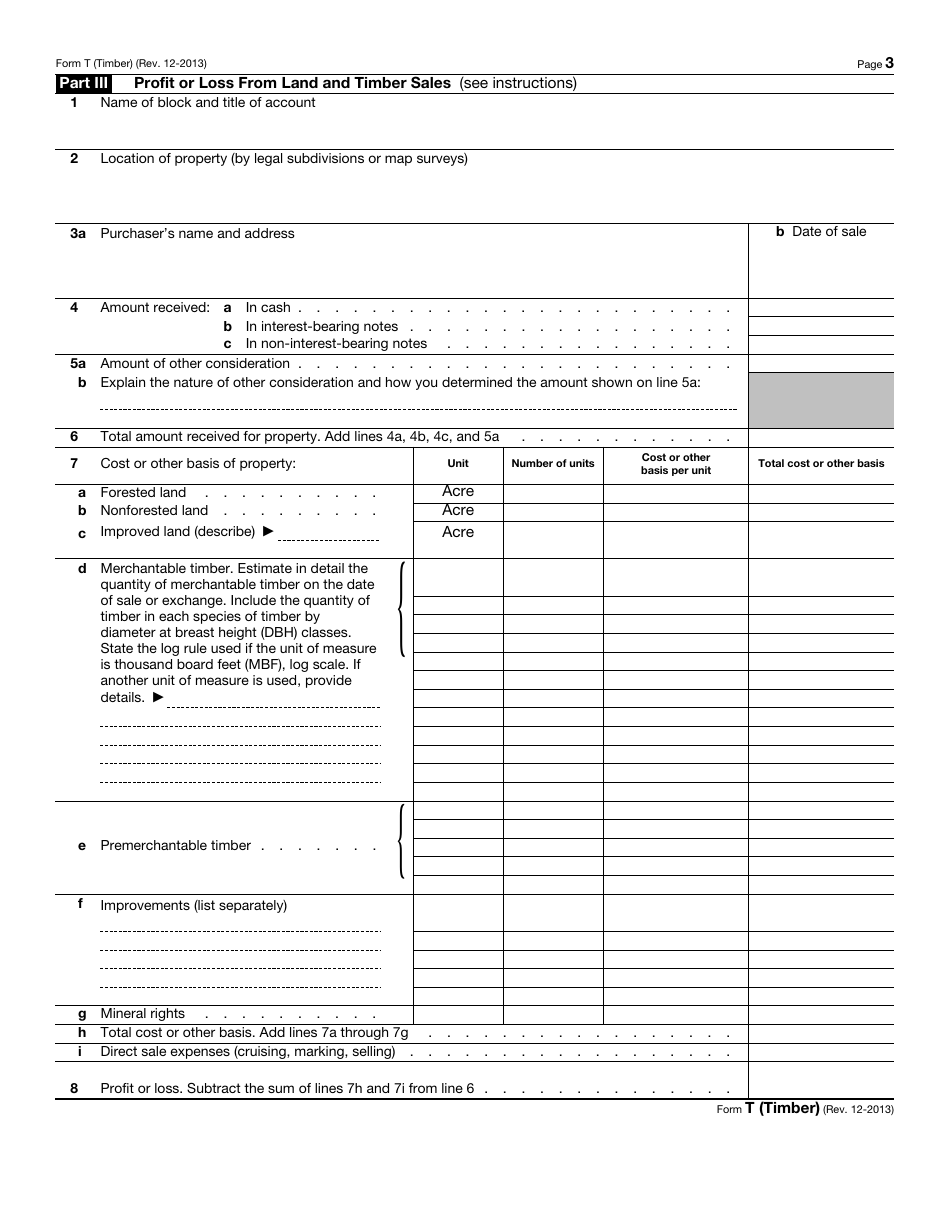

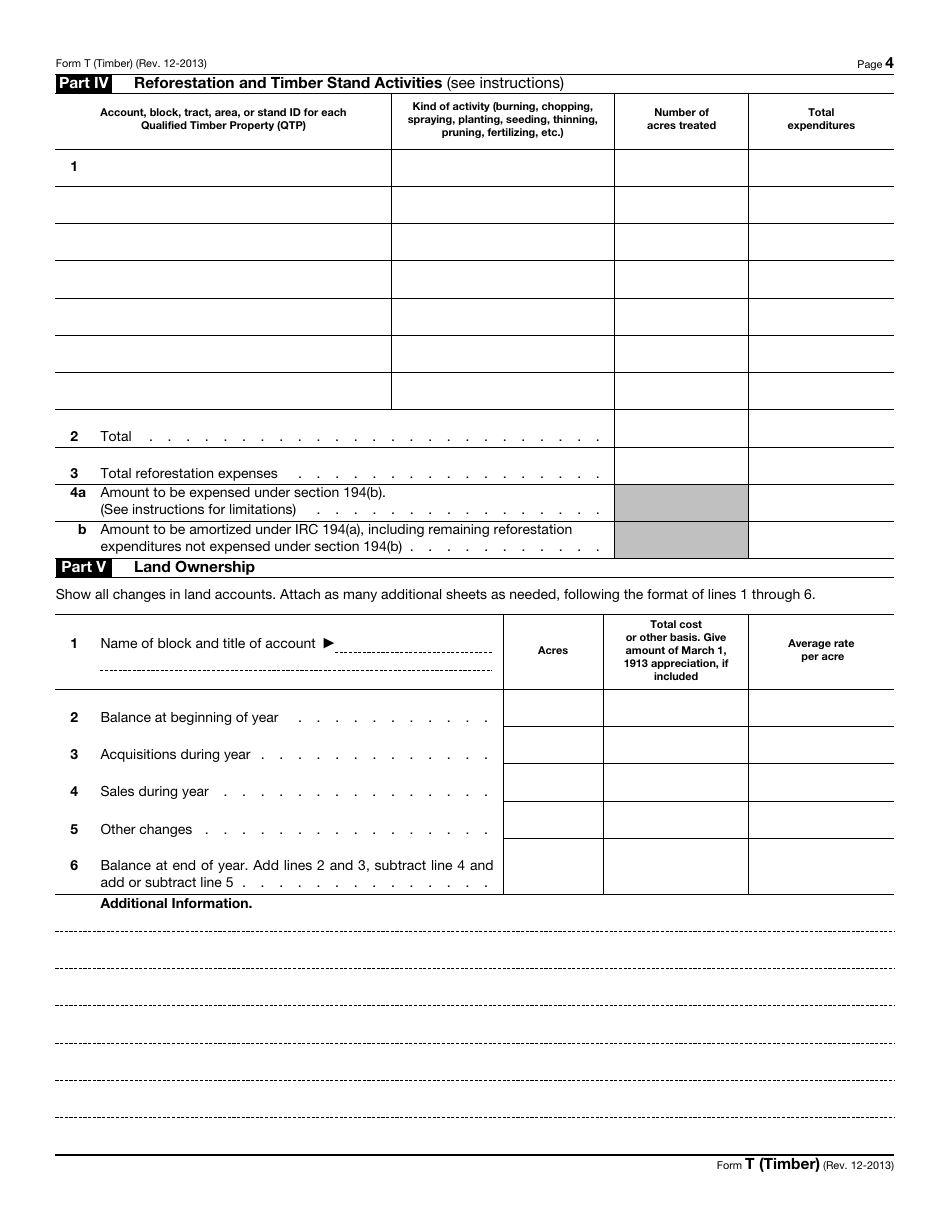

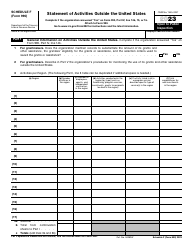

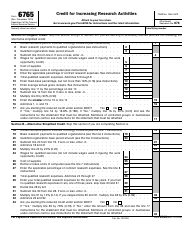

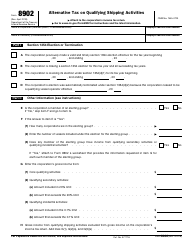

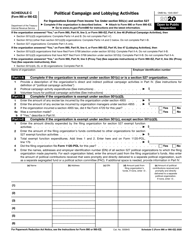

IRS Form T (TIMBER) Forest Activities Schedule

What Is IRS Form T (TIMBER)?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury on December 1, 2013. As of today, no separate filing guidelines for the form are provided by the IRS.

FAQ

Q: What is IRS Form T?

A: IRS Form T is a form used to report forest activities for tax purposes.

Q: Who should file IRS Form T?

A: Individuals or businesses engaged in qualifying forest activities should file IRS Form T.

Q: What are qualifying forest activities?

A: Qualifying forest activities include the growing and harvesting of trees for timber.

Q: What information is required on IRS Form T?

A: IRS Form T requires information such as the taxpayer's name, address, and social security number or employer identification number, as well as details about the forest activities.

Q: When is the deadline to file IRS Form T?

A: The deadline to file IRS Form T is generally April 15th of the year following the tax year in which the forest activities occurred.

Q: Are there any penalties for not filing IRS Form T?

A: Yes, failing to file IRS Form T can result in penalties and interest on any tax owed.

Q: Is professional assistance needed to fill out IRS Form T?

A: While professional assistance is not required, it may be helpful to consult a tax professional or accountant for guidance on completing IRS Form T.

Form Details:

- A 4-page form available for download in PDF;

- Actual and valid for filing 2023 taxes;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form T (TIMBER) through the link below or browse more documents in our library of IRS Forms.