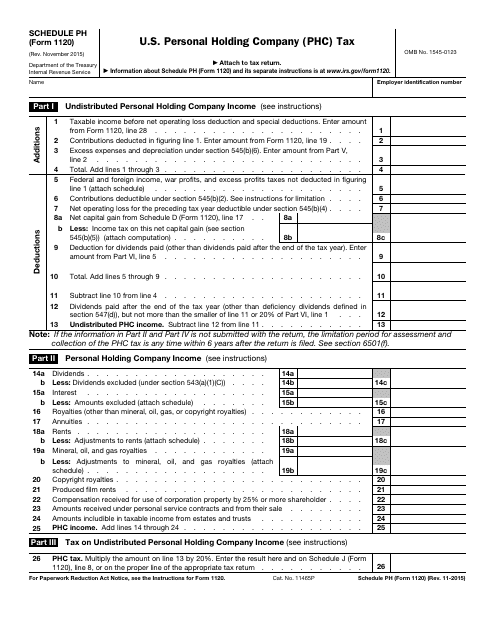

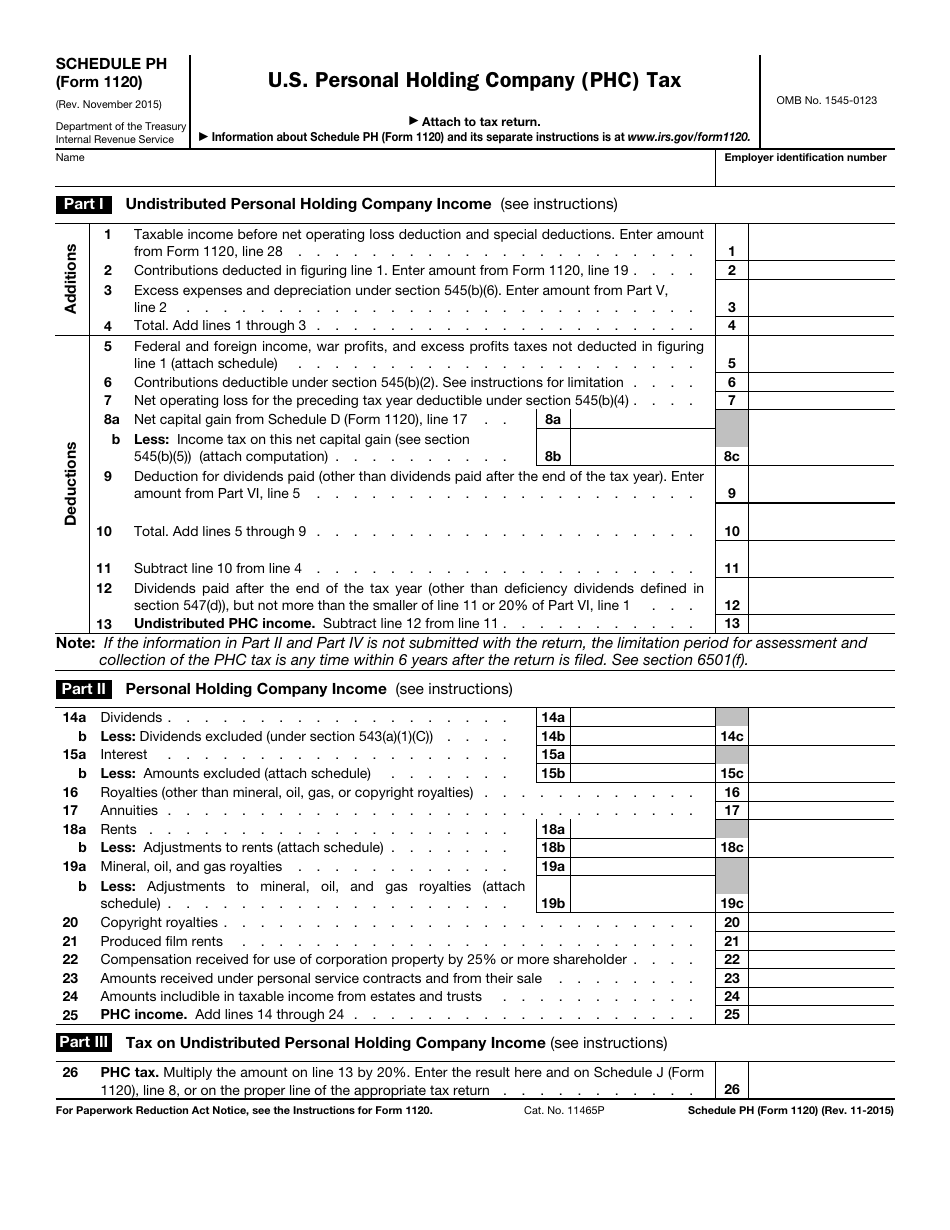

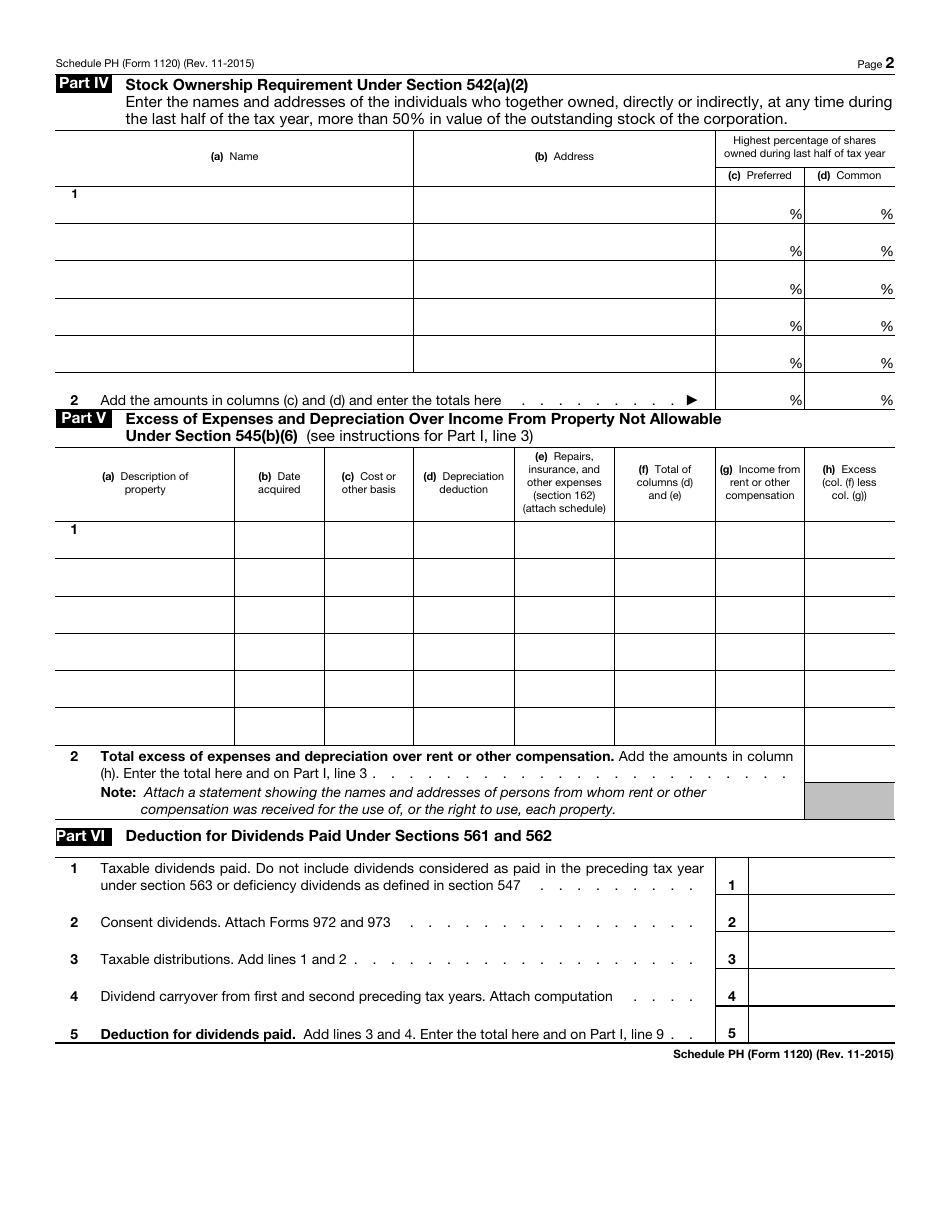

IRS Form 1120 Schedule PH U.S. Personal Holding Company (Phc) Tax

What Is IRS Form 1120 Schedule PH?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury on November 1, 2015. As of today, no separate filing guidelines for the form are provided by the IRS.

FAQ

Q: What is IRS Form 1120 Schedule PH?

A: IRS Form 1120 Schedule PH is a tax form used by U.S. Personal Holding Companies (PHCs) to calculate and report their tax liability.

Q: What is a U.S. Personal Holding Company (PHC)?

A: A U.S. Personal Holding Company (PHC) is a corporation that primarily engages in passive income activities, such as receiving dividends, interest, and royalties.

Q: Who needs to file IRS Form 1120 Schedule PH?

A: U.S. Personal Holding Companies (PHCs) are required to file IRS Form 1120 Schedule PH along with their annual tax return.

Q: What information is required on IRS Form 1120 Schedule PH?

A: IRS Form 1120 Schedule PH requires information related to the company's passive income, deductions, and calculations of the Personal Holding Company Tax.

Q: What is the Personal Holding Company Tax?

A: The Personal Holding Company Tax is a tax imposed on U.S. Personal Holding Companies (PHCs) to prevent them from avoiding tax by accumulating passive income inside the corporation.

Form Details:

- A 2-page form available for download in PDF;

- Actual and valid for filing 2023 taxes;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 1120 Schedule PH through the link below or browse more documents in our library of IRS Forms.