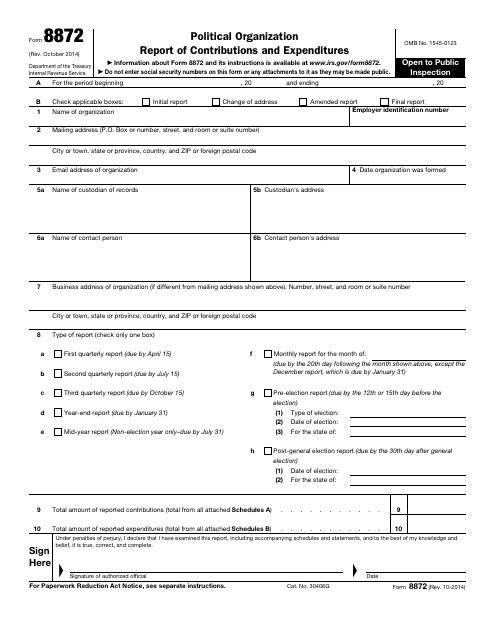

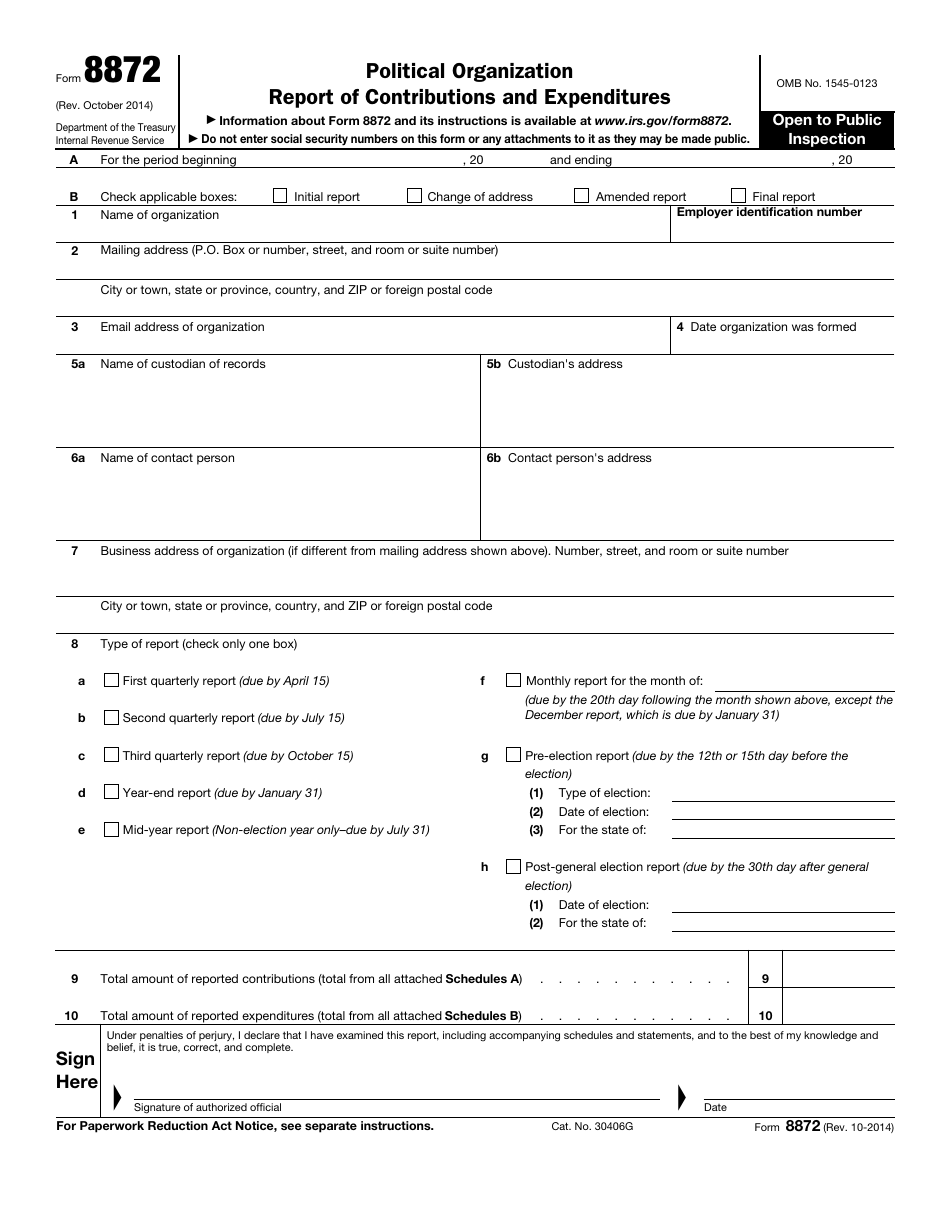

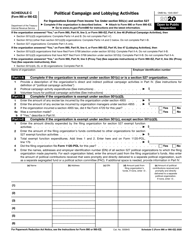

IRS Form 8872 Political Organization Report of Contributions and Expenditures

What Is IRS Form 8872?

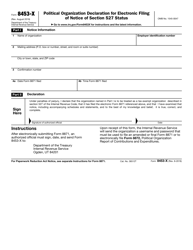

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury on October 1, 2014. Check the official IRS-issued instructions before completing and submitting the form.

FAQ

Q: What is IRS Form 8872?

A: IRS Form 8872 is a Political Organization Report of Contributions and Expenditures.

Q: Who needs to file IRS Form 8872?

A: Political organizations that engage in certain political activities must file IRS Form 8872.

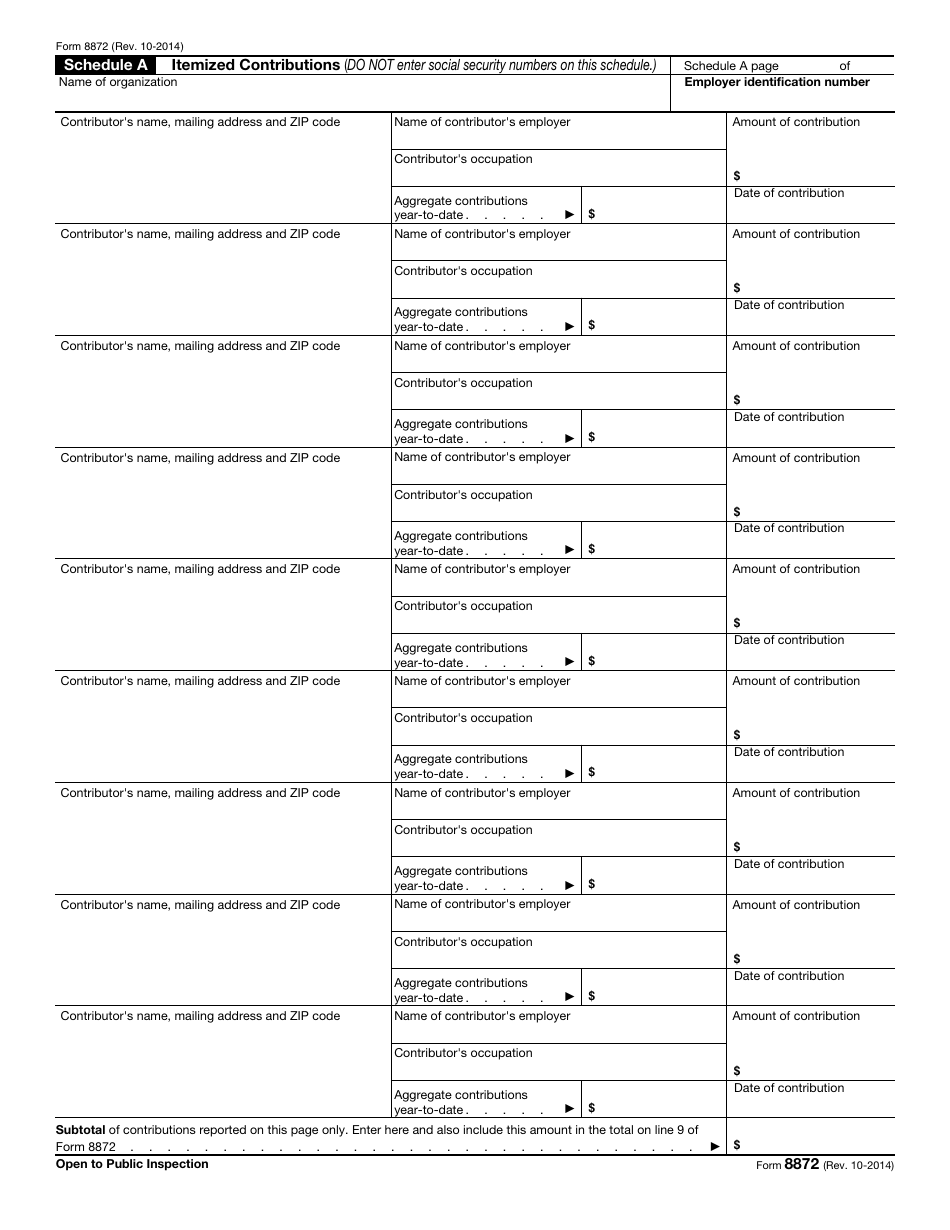

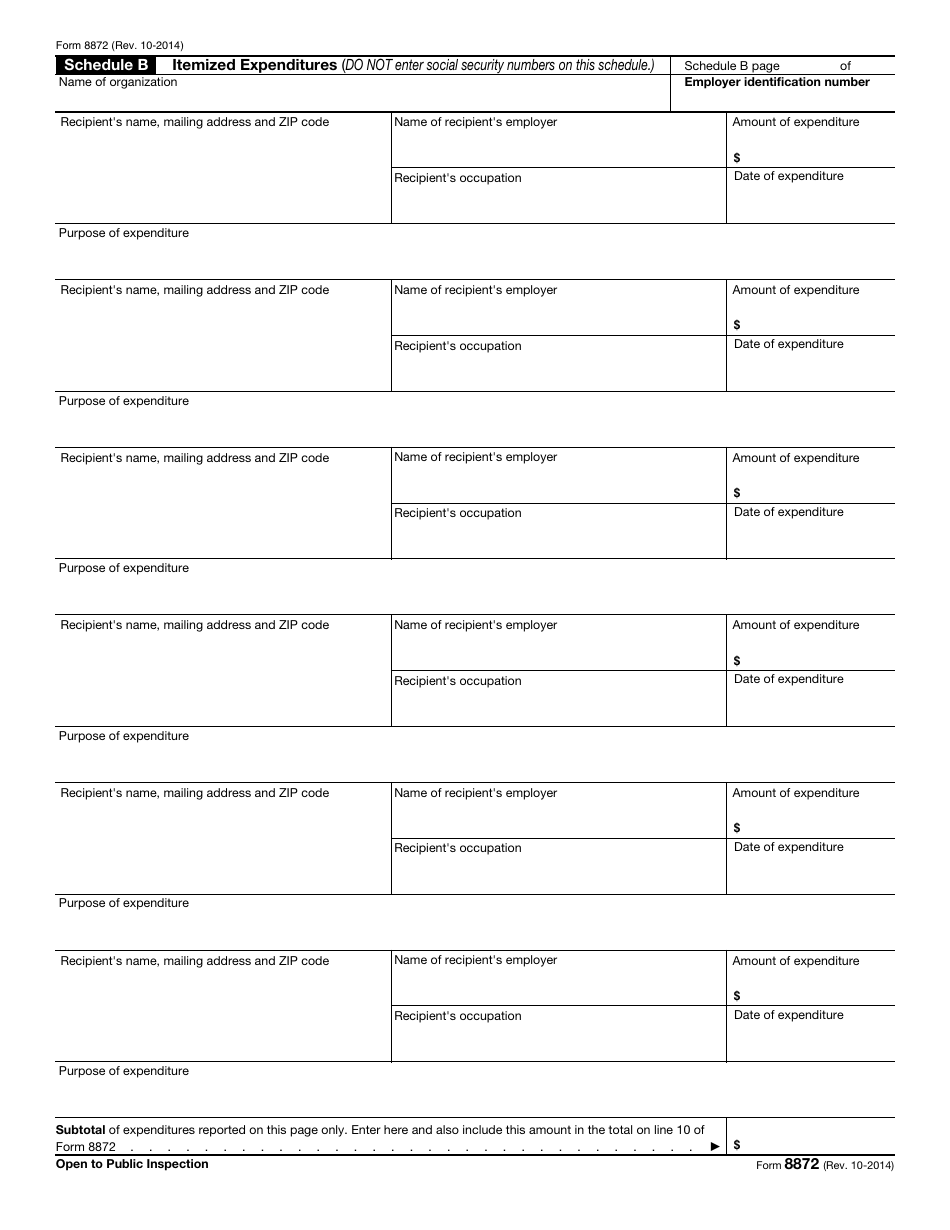

Q: What information is reported on IRS Form 8872?

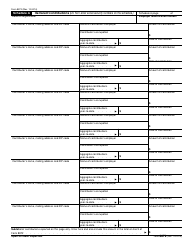

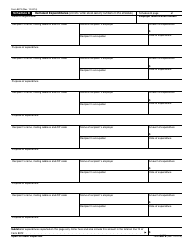

A: IRS Form 8872 requires reporting of contributions, expenses, and other financial information of the political organization.

Q: When is IRS Form 8872 due?

A: IRS Form 8872 is due on or before the 15th day of the 5th calendar month after the end of the organization's tax year.

Q: Are there any penalties for not filing IRS Form 8872?

A: Yes, there can be penalties for not filing IRS Form 8872, including monetary penalties and loss of tax-exempt status.

Form Details:

- A 3-page form available for download in PDF;

- Actual and valid for filing 2023 taxes;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 8872 through the link below or browse more documents in our library of IRS Forms.