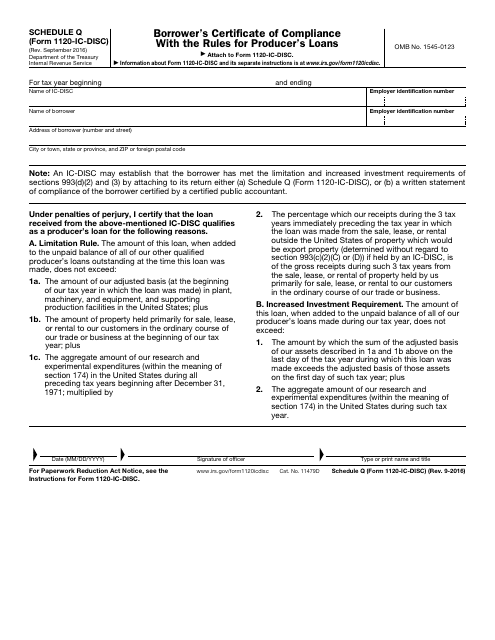

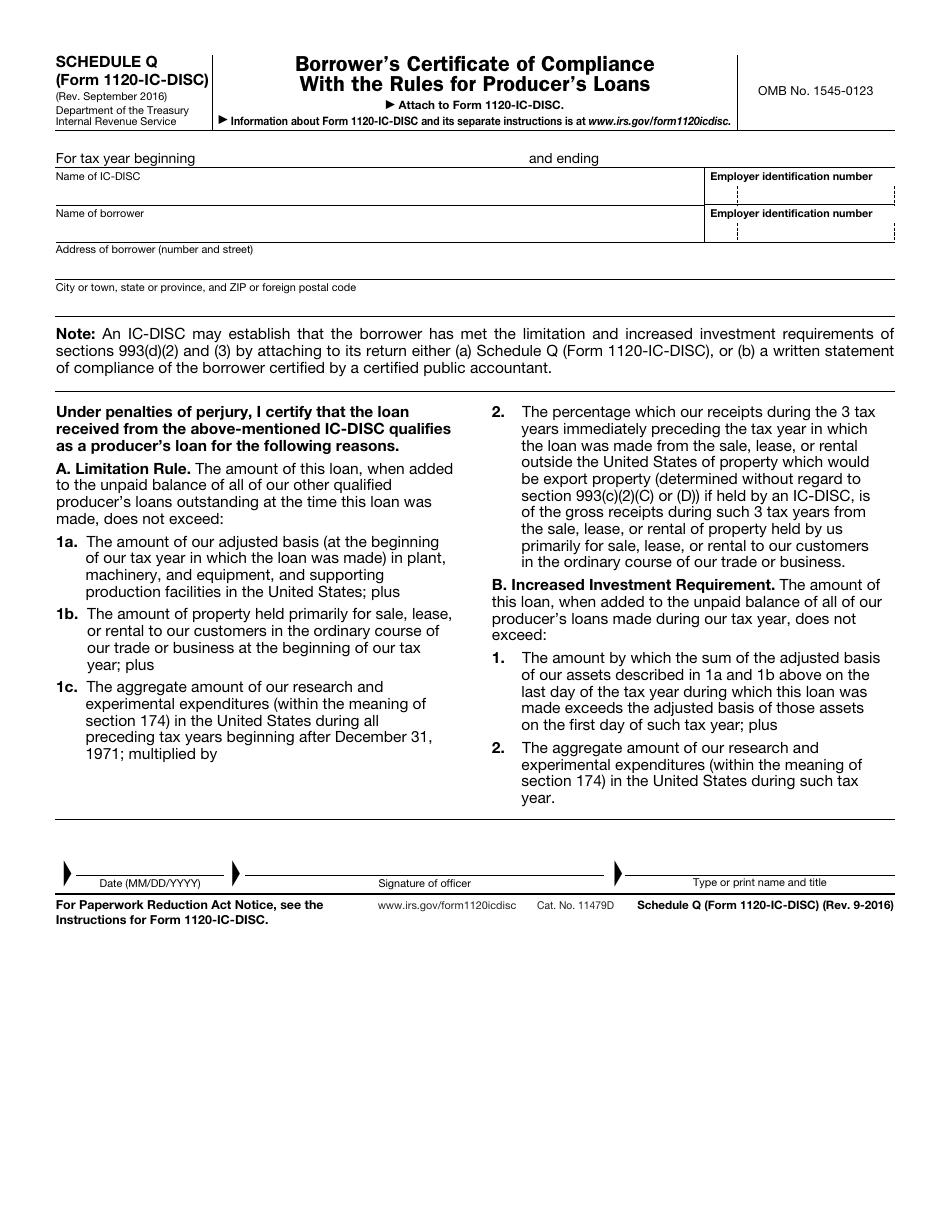

IRS Form 1120-IC-DISC Schedule Q Borrower's Certificate of Compliance With the Rules for Producer's Loan

What Is IRS Form 1120-IC-DISC Schedule Q?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury on September 1, 2016. The document is a supplement to IRS Form 1120-IC-DISC, Interest Charge Domestic International Sales Corporation Return. As of today, no separate filing guidelines for the form are provided by the IRS.

FAQ

Q: What is IRS Form 1120-IC-DISC?

A: IRS Form 1120-IC-DISC is a tax form specifically designed for Interest Charge Domestic International Sales Corporations (IC-DISCs).

Q: What is Schedule Q?

A: Schedule Q is a part of IRS Form 1120-IC-DISC, specifically the Borrower's Certificate of Compliance With the Rules for Producer's Loan.

Q: What is an IC-DISC?

A: An IC-DISC is a special type of corporation that allows certain exporters to reduce their tax liabilities.

Q: What is a Producer's Loan?

A: A Producer's Loan is a loan made by the IC-DISC to its shareholders in order to finance qualifying export transactions.

Q: What information does Schedule Q require?

A: Schedule Q requires the borrower's name, tax identification number, and a detailed description of the producer's loans.

Form Details:

- A 1-page form available for download in PDF;

- Actual and valid for filing 2023 taxes;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 1120-IC-DISC Schedule Q through the link below or browse more documents in our library of IRS Forms.