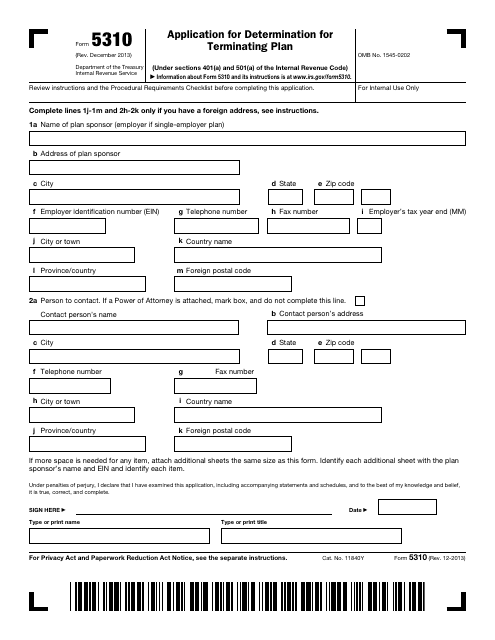

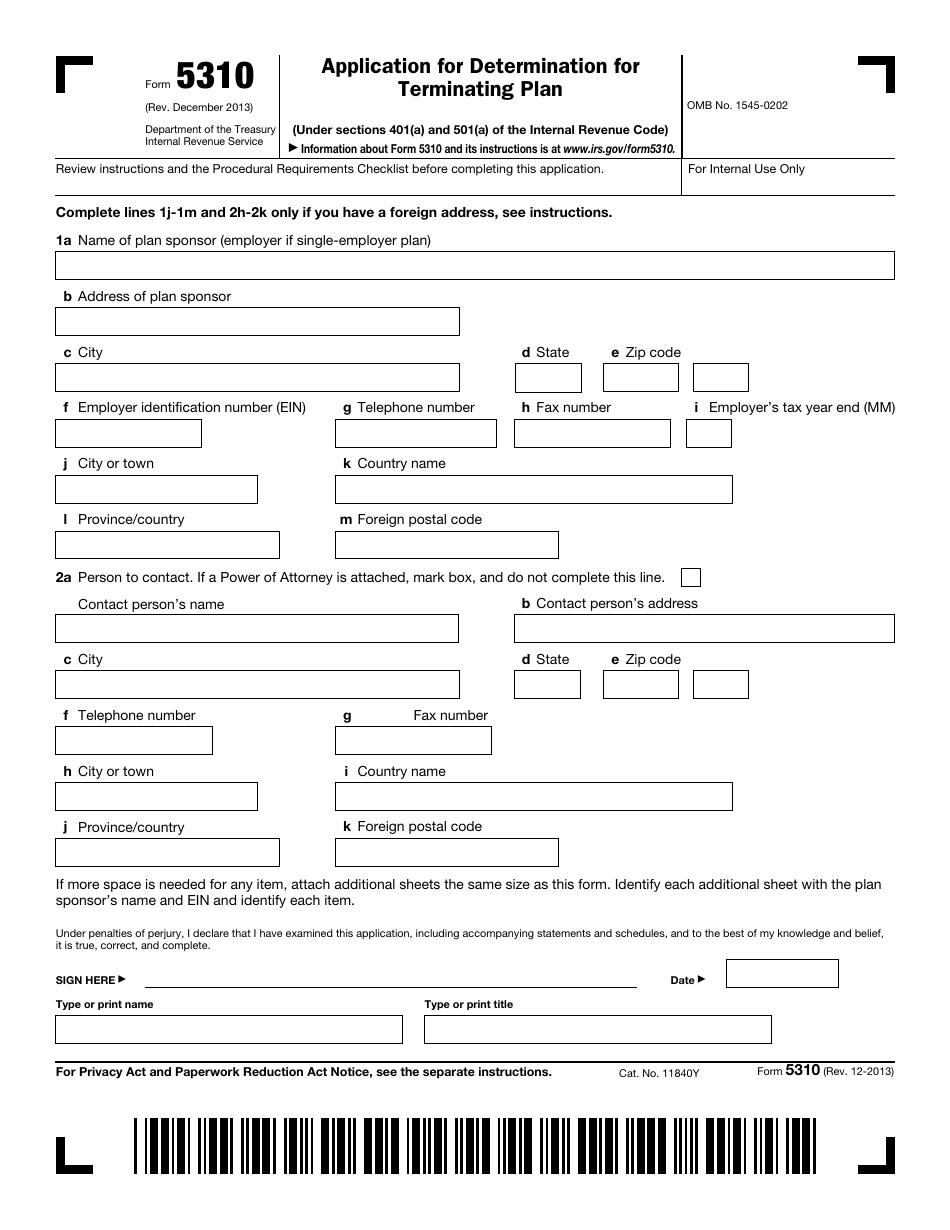

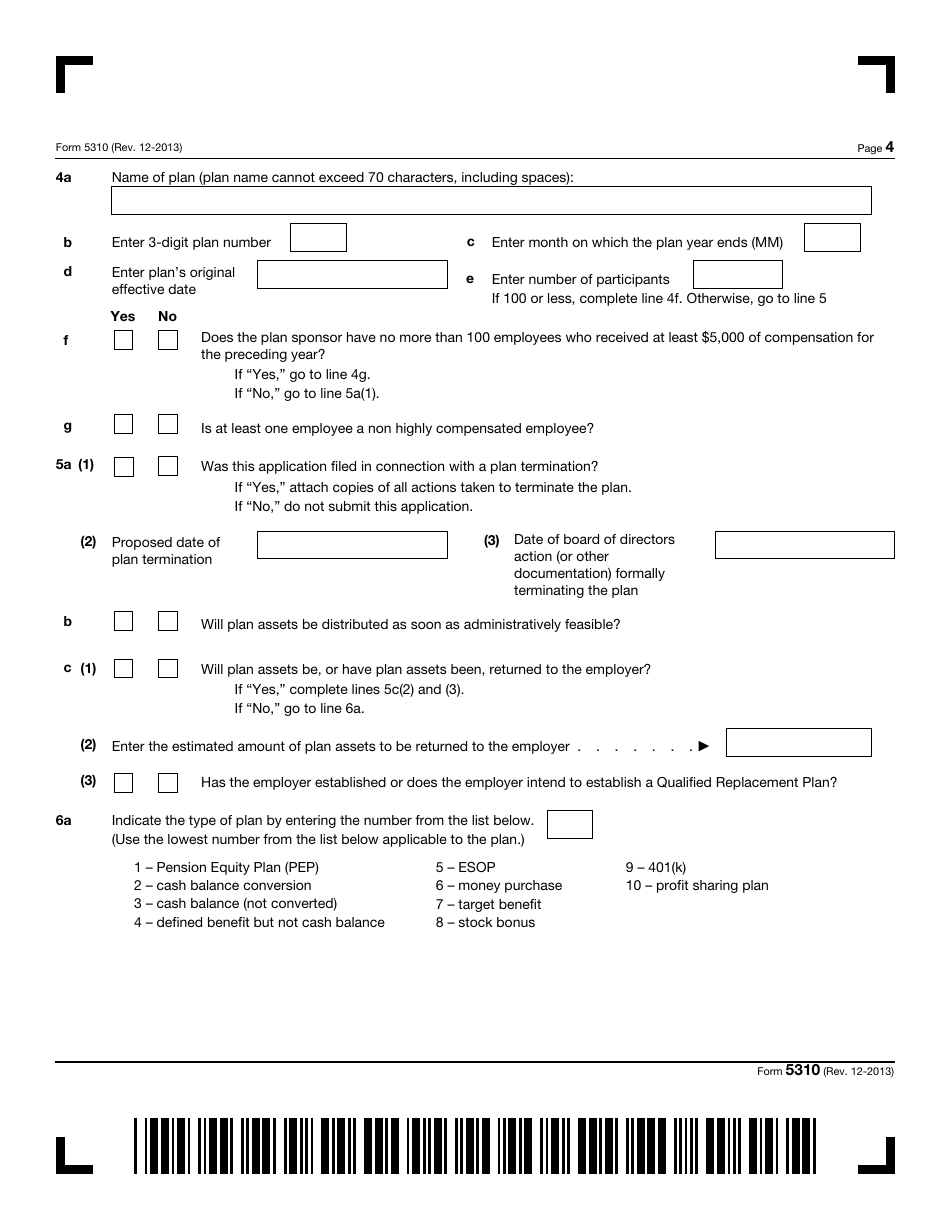

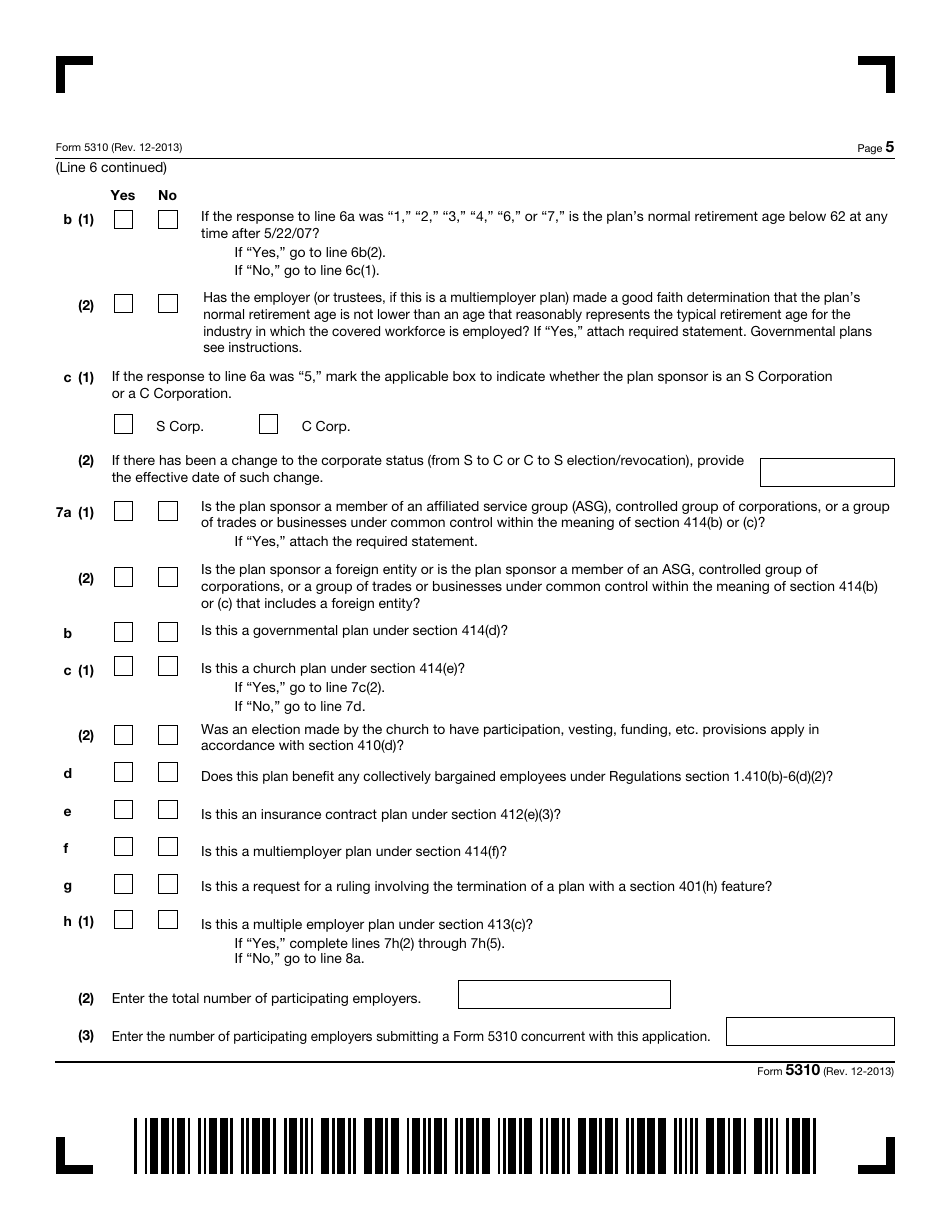

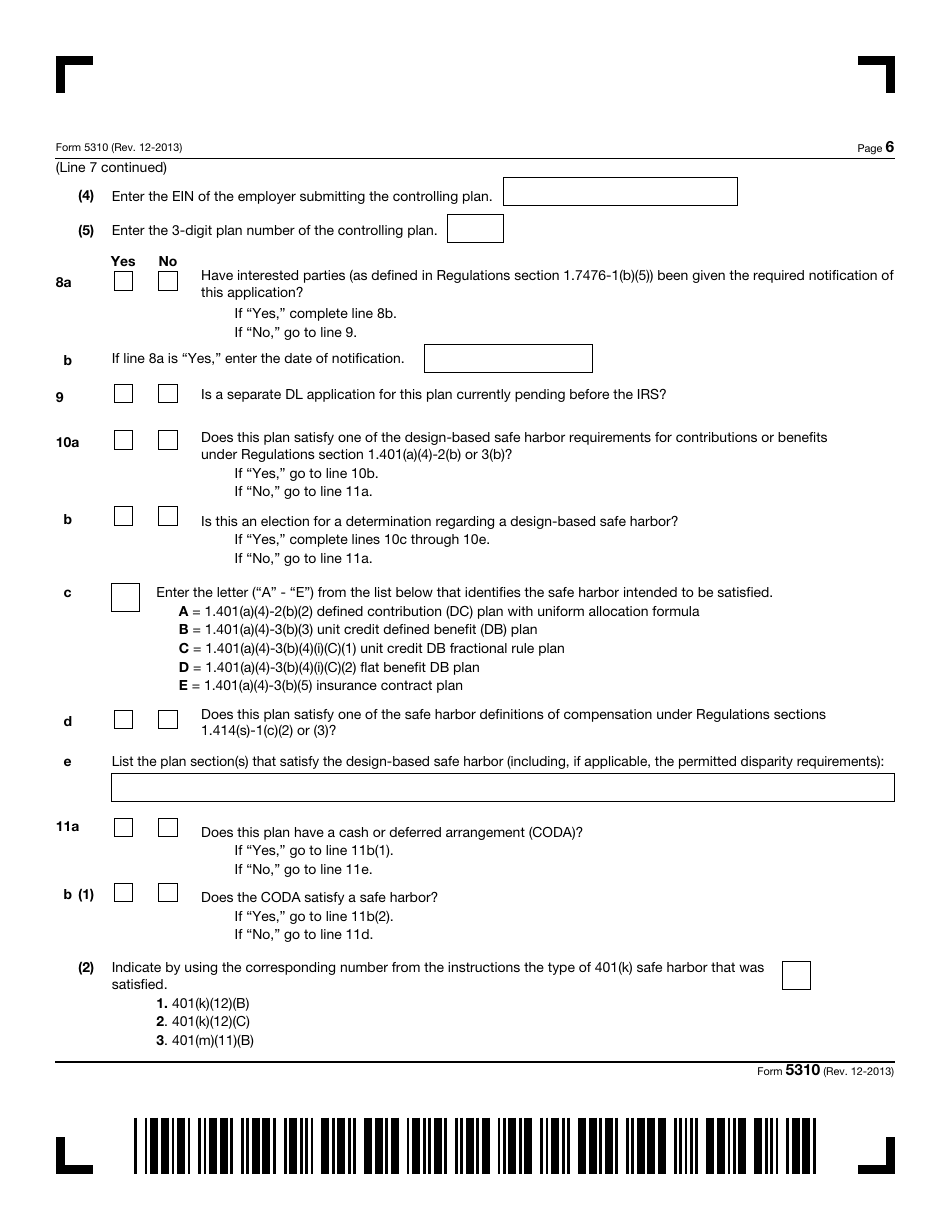

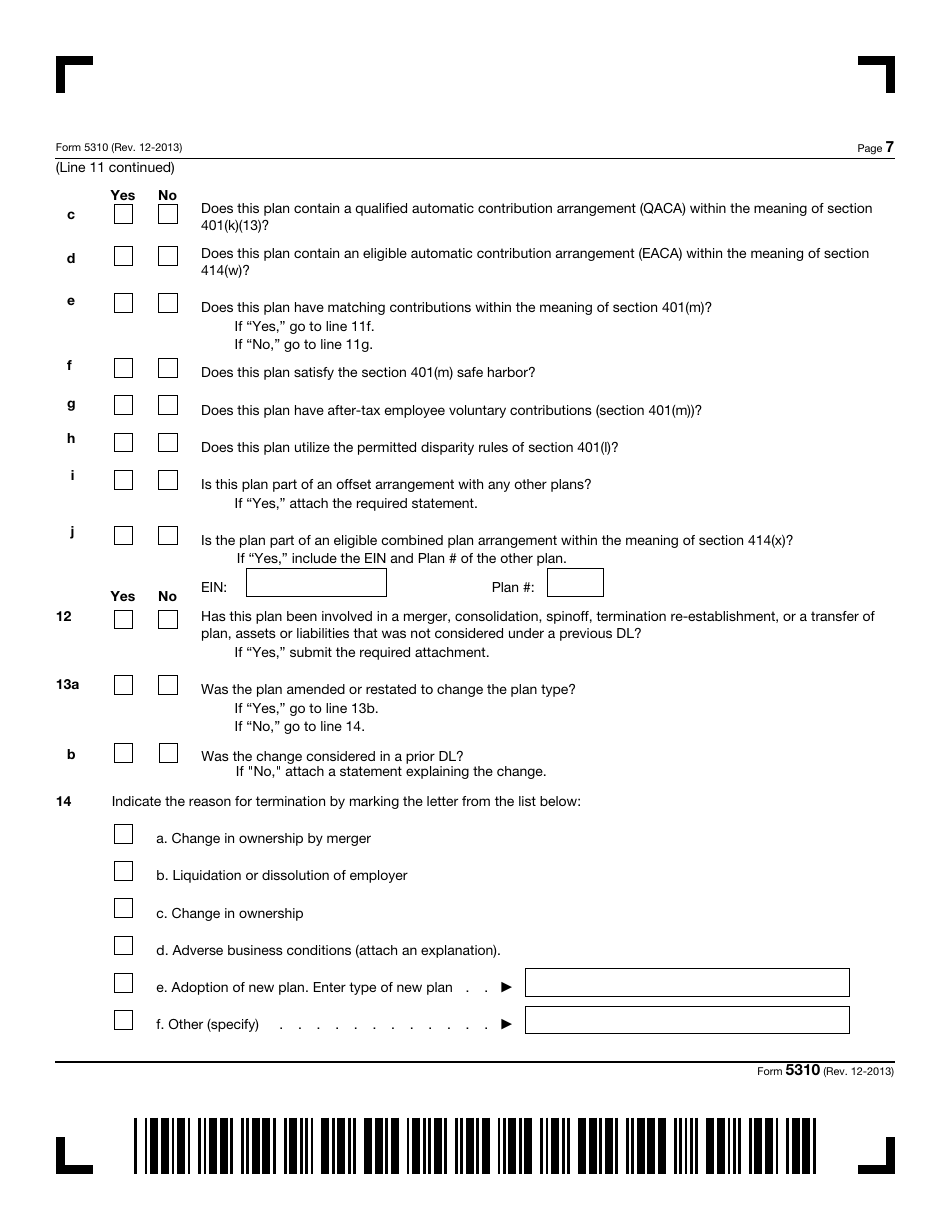

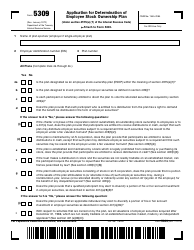

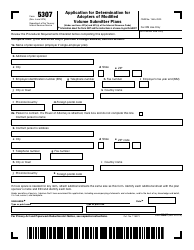

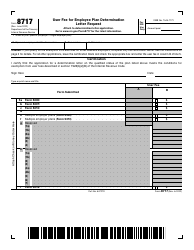

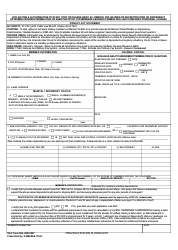

IRS Form 5310 Application for Determination for Terminating Plan

What Is IRS Form 5310?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury on December 1, 2013. Check the official IRS-issued instructions before completing and submitting the form.

FAQ

Q: What is Form 5310?

A: Form 5310 is an IRS application used to request a determination for terminating a retirement plan.

Q: Who can file Form 5310?

A: The plan sponsor or plan administrator can file Form 5310 to request a determination for terminating a retirement plan.

Q: What is the purpose of Form 5310?

A: The purpose of Form 5310 is to provide information to the IRS regarding the termination of a retirement plan and to request a determination of the plan's tax status.

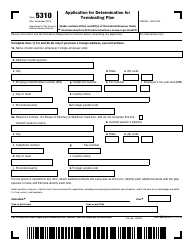

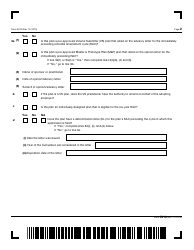

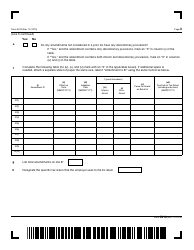

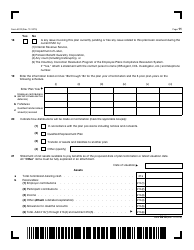

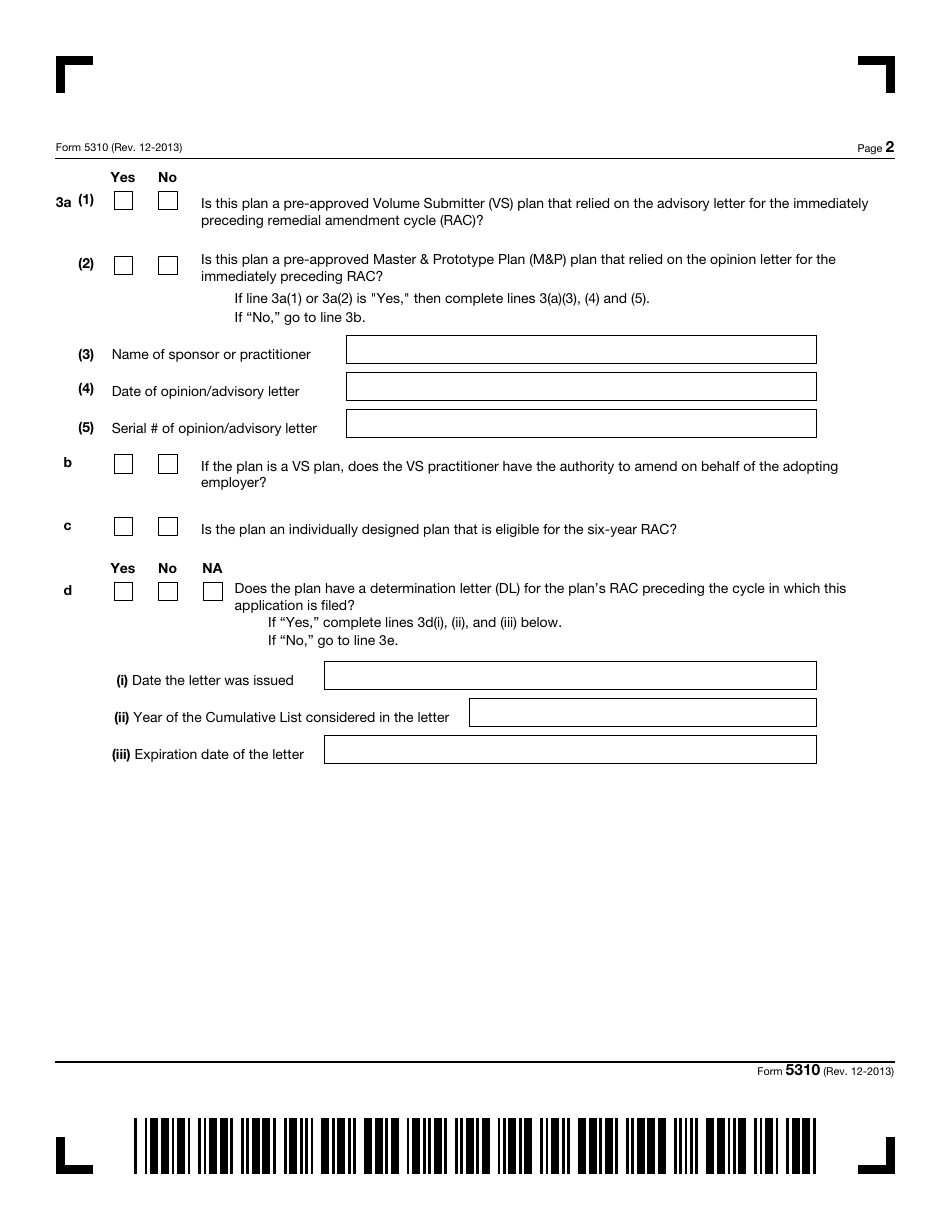

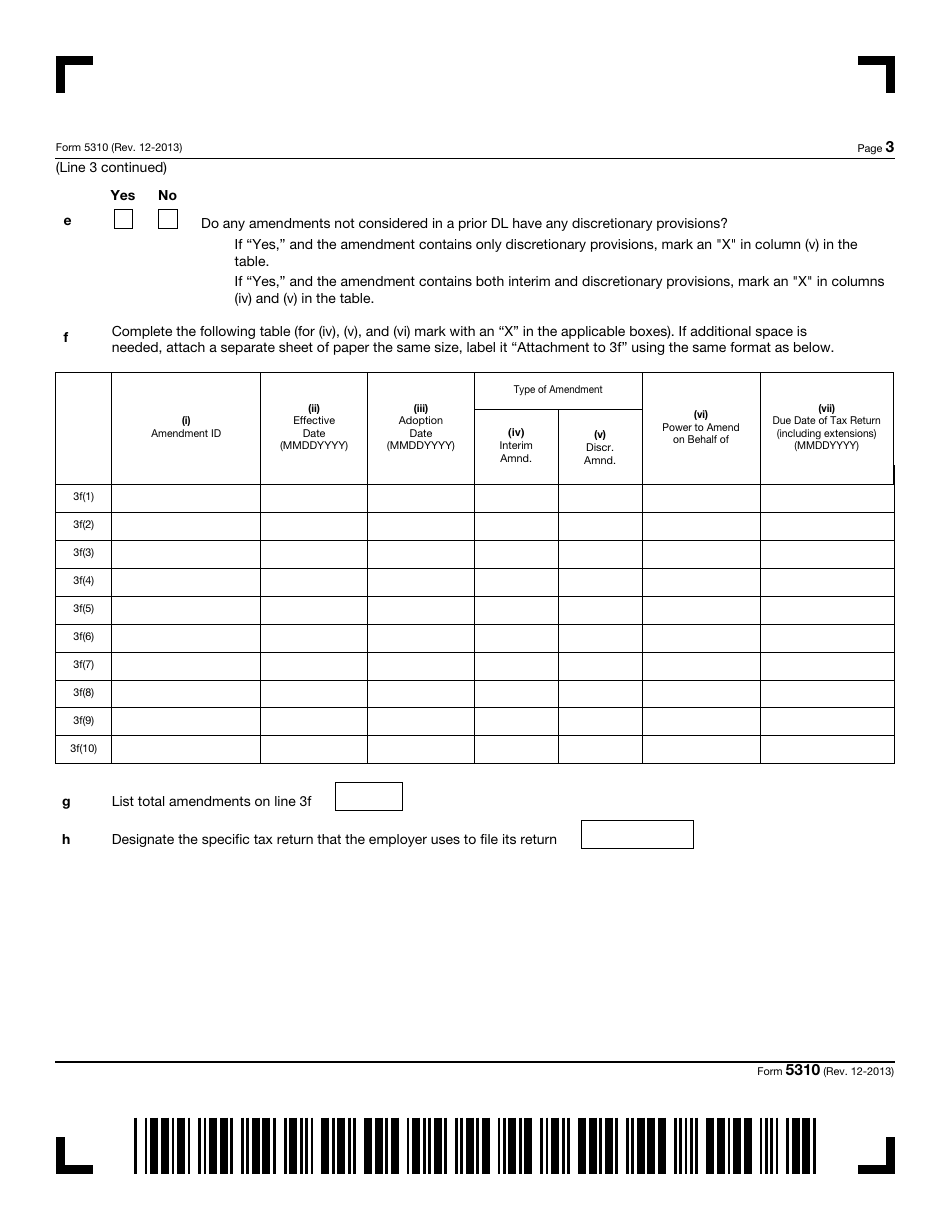

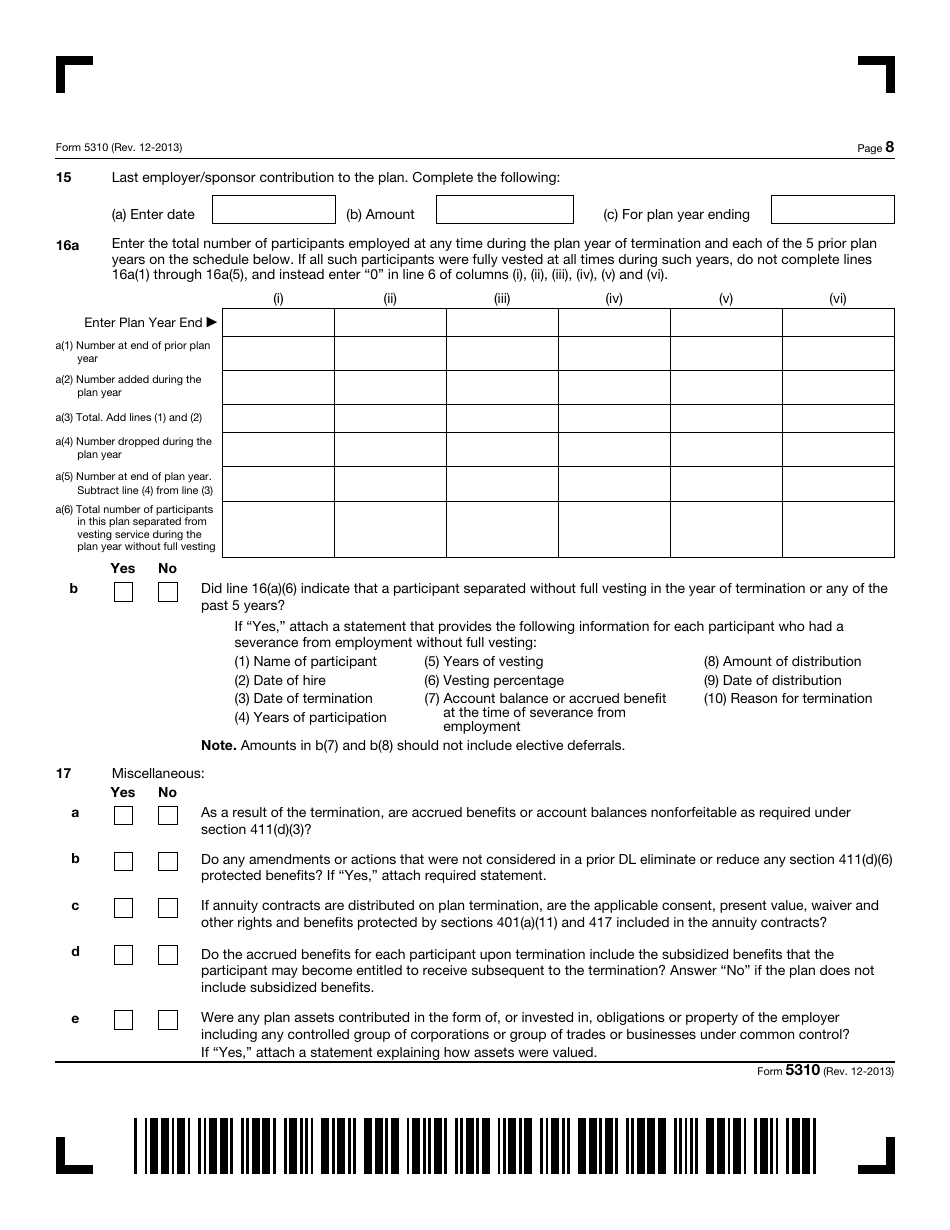

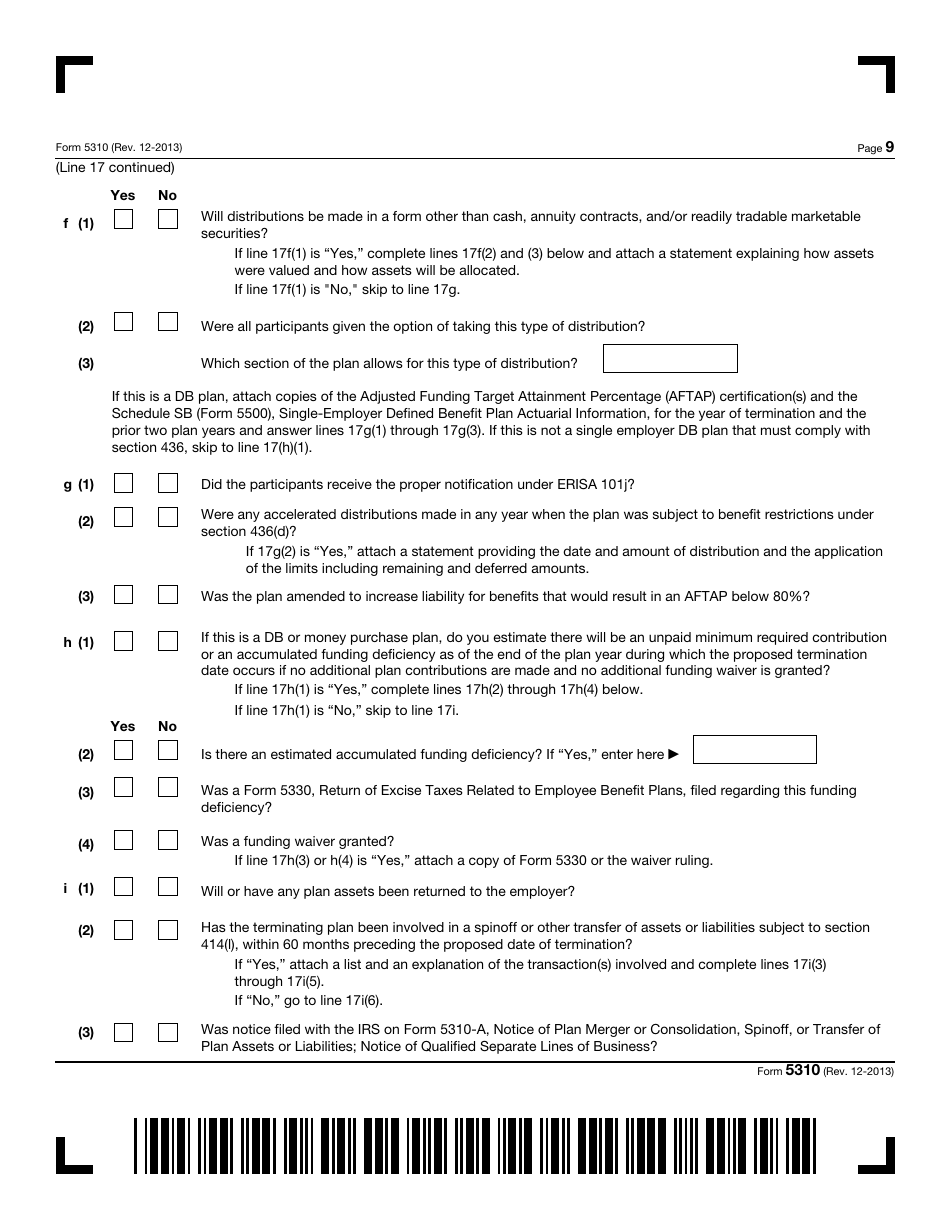

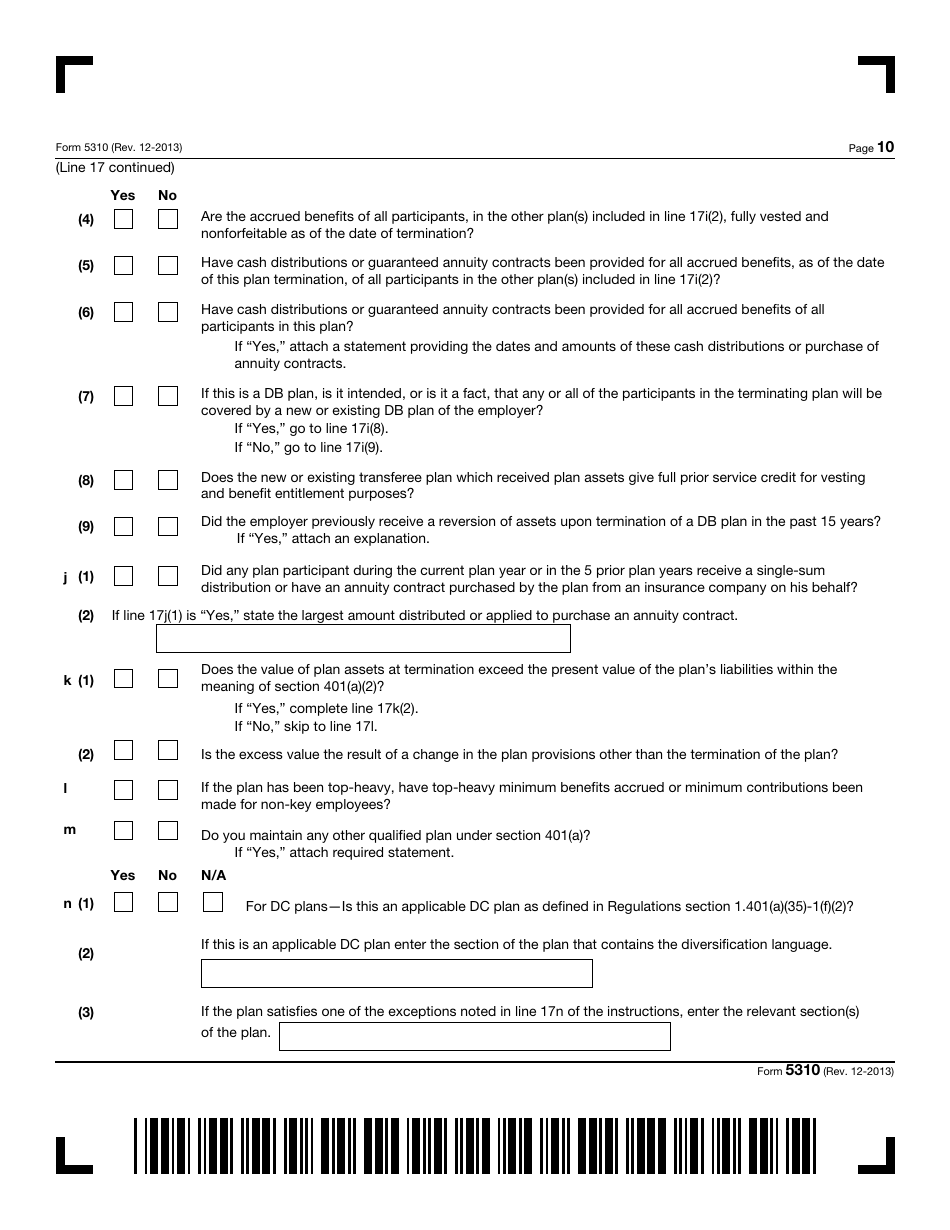

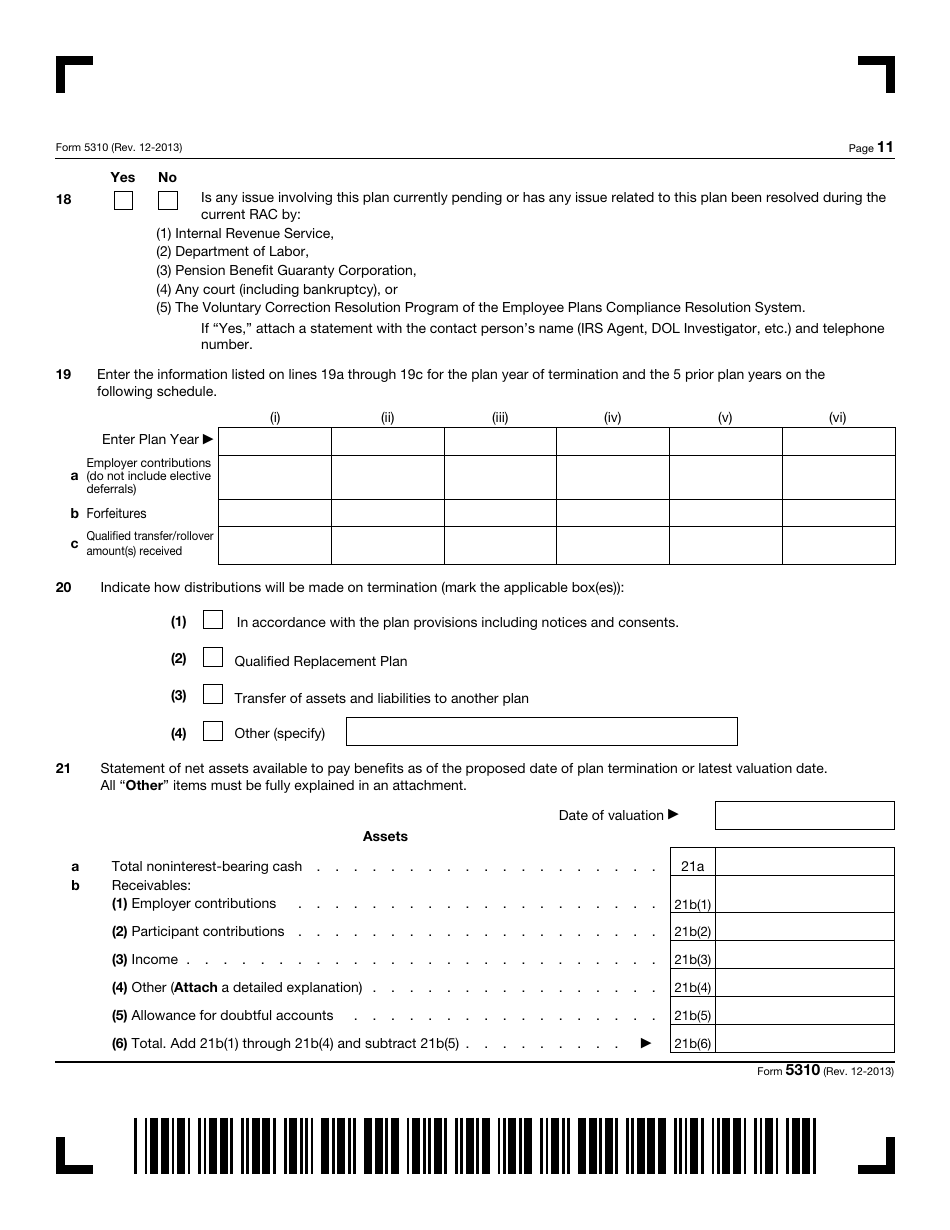

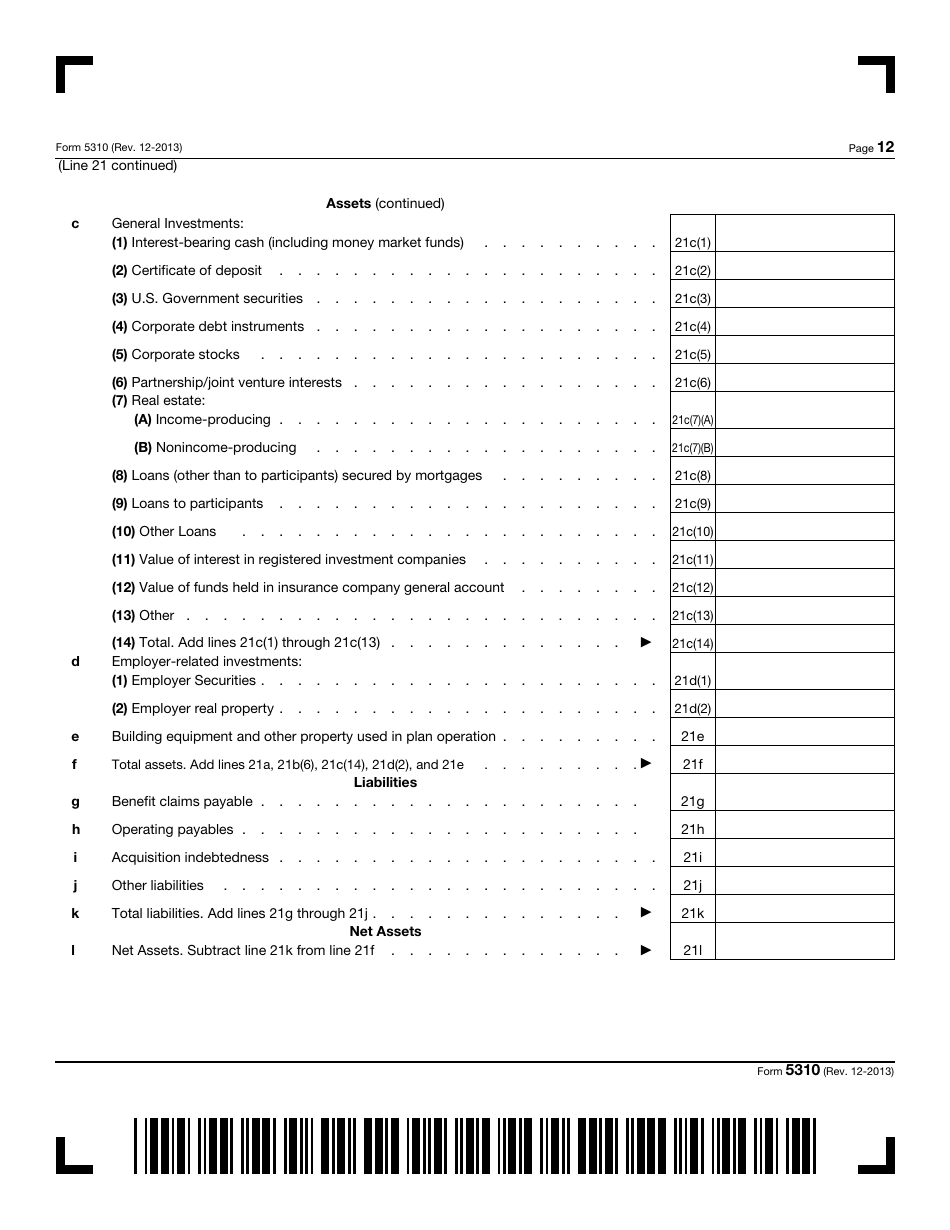

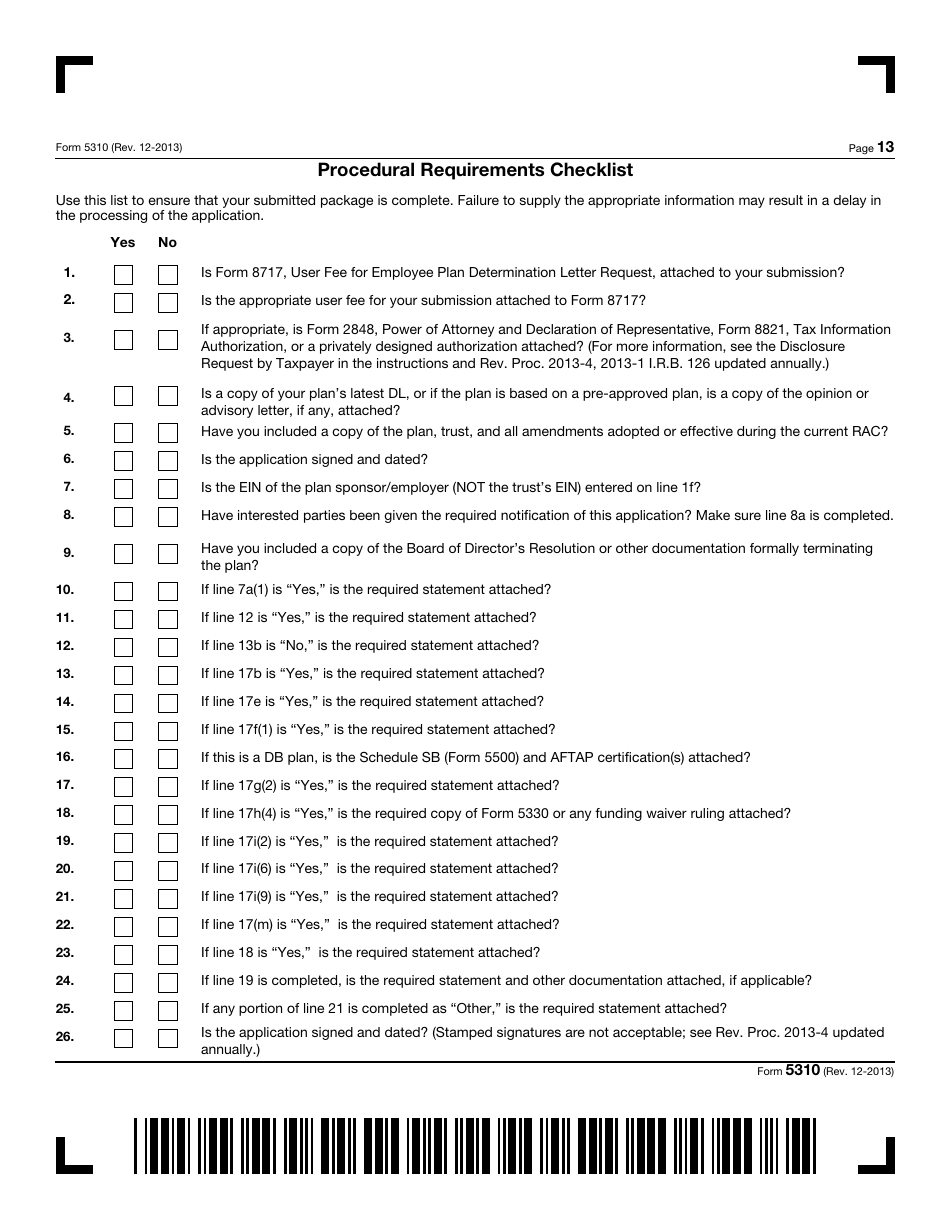

Q: What information is required on Form 5310?

A: Form 5310 requires information about the plan, the reason for termination, and details about any benefits that will be distributed to participants.

Form Details:

- A 13-page form available for download in PDF;

- Actual and valid for filing 2023 taxes;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 5310 through the link below or browse more documents in our library of IRS Forms.