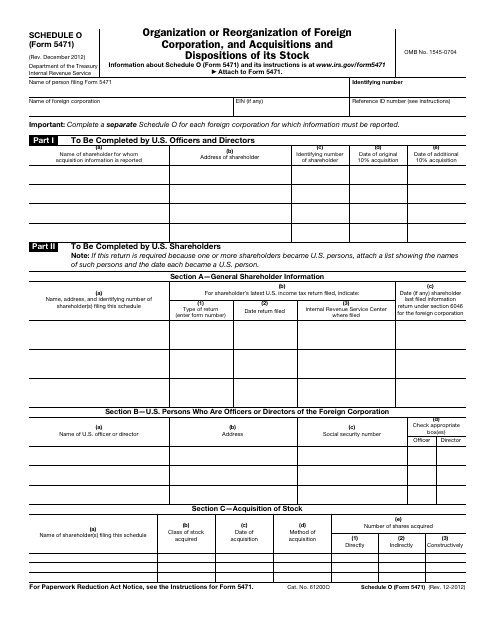

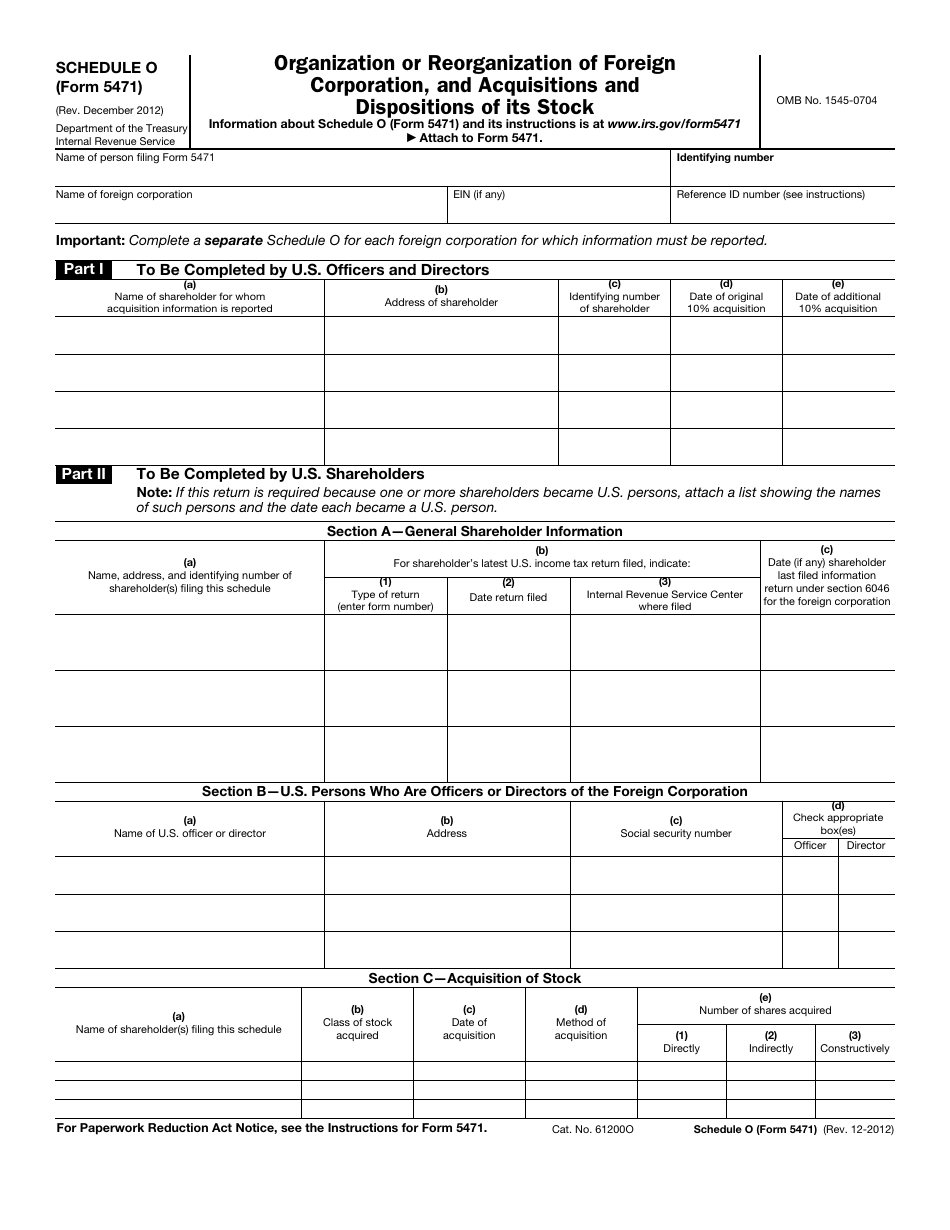

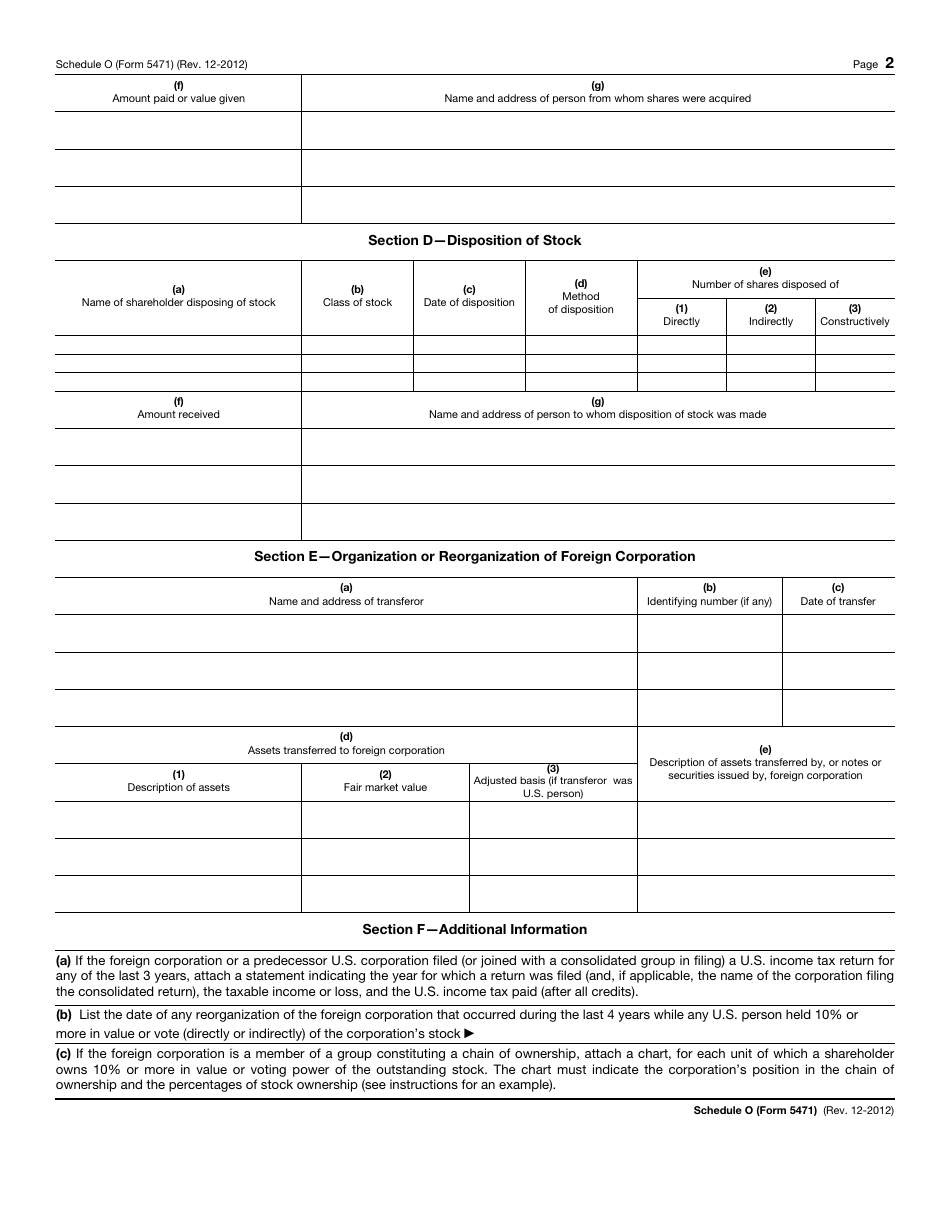

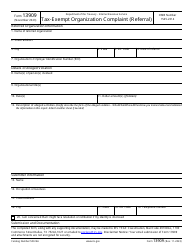

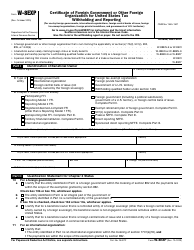

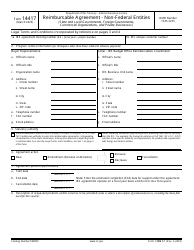

IRS Form 5471 Schedule O Organization or Reorganization of Foreign Corporation, and Acquisitions and Dispositions of Its Stock

What Is IRS Form 5471 Schedule O?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury on December 1, 2012. The document is a supplement to IRS Form 5471, Information Return of U.S. Persons With Respect to Certain Foreign Corporations. As of today, no separate filing guidelines for the form are provided by the IRS.

FAQ

Q: What is IRS Form 5471 Schedule O?

A: IRS Form 5471 Schedule O is a form used for reporting organization or reorganization of a foreign corporation, as well as acquisitions and dispositions of its stock.

Q: Who is required to file IRS Form 5471 Schedule O?

A: Any US person who owns 10% or more of a foreign corporation is required to file IRS Form 5471 Schedule O.

Q: What information needs to be reported on IRS Form 5471 Schedule O?

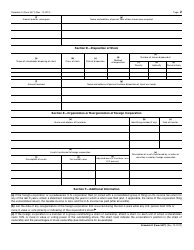

A: IRS Form 5471 Schedule O requires reporting of details regarding the organization or reorganization of a foreign corporation, as well as any acquisitions or dispositions of its stock.

Q: What is the deadline for filing IRS Form 5471 Schedule O?

A: The deadline for filing IRS Form 5471 Schedule O is the same as the taxpayer's annual income tax return, including extensions.

Q: Are there any penalties for non-compliance with filing IRS Form 5471 Schedule O?

A: Yes, there are penalties for non-compliance with filing IRS Form 5471 Schedule O. The penalties can be substantial and vary depending on the circumstances.

Form Details:

- A 2-page form available for download in PDF;

- Actual and valid for filing 2023 taxes;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 5471 Schedule O through the link below or browse more documents in our library of IRS Forms.