This version of the form is not currently in use and is provided for reference only. Download this version of

IRS Form 2106

for the current year.

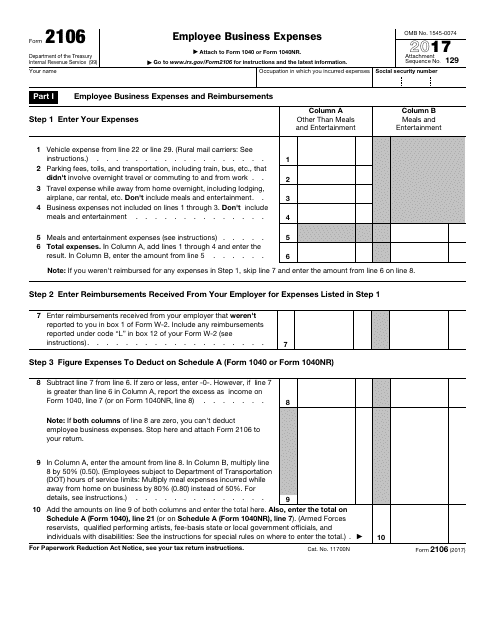

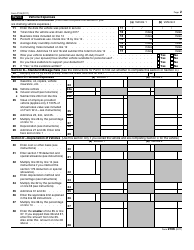

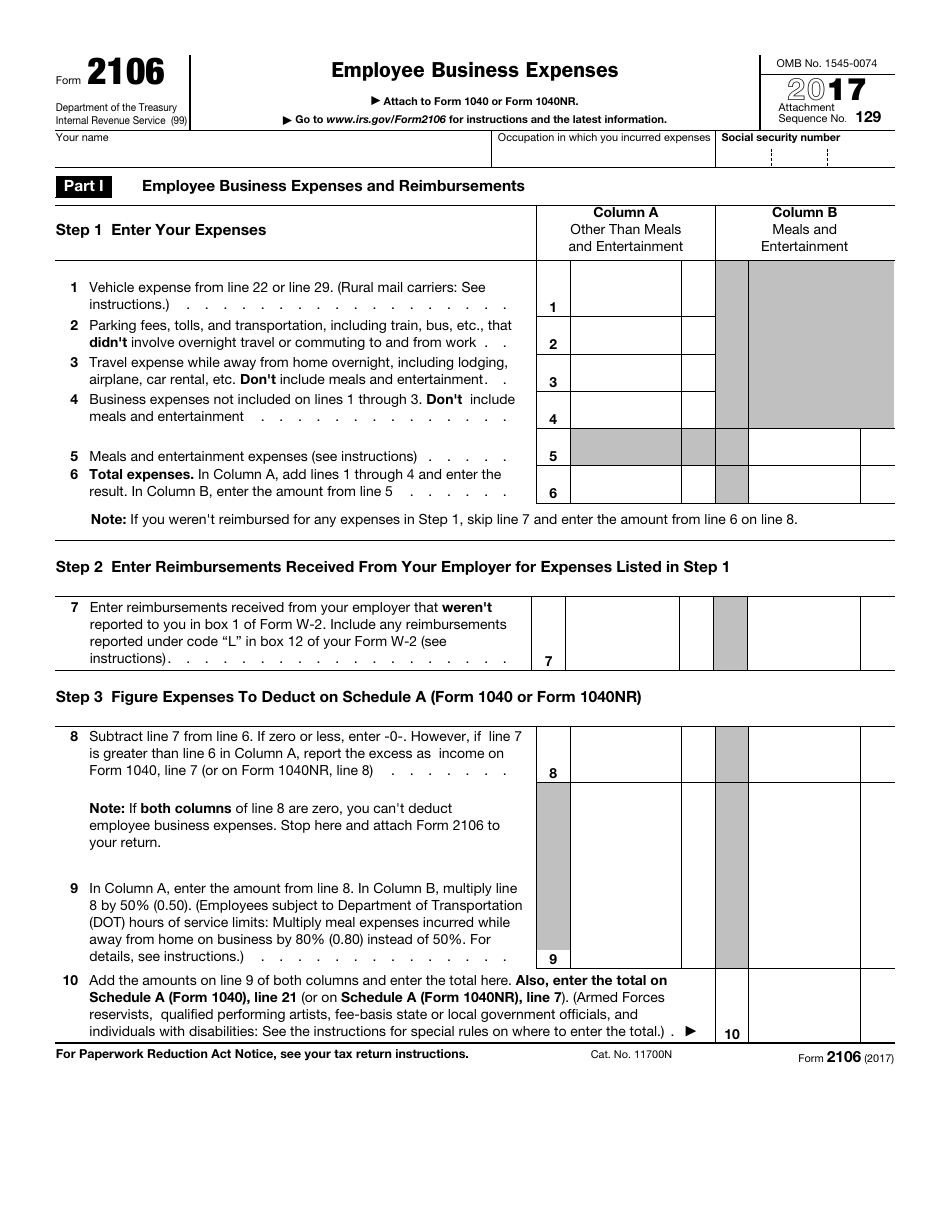

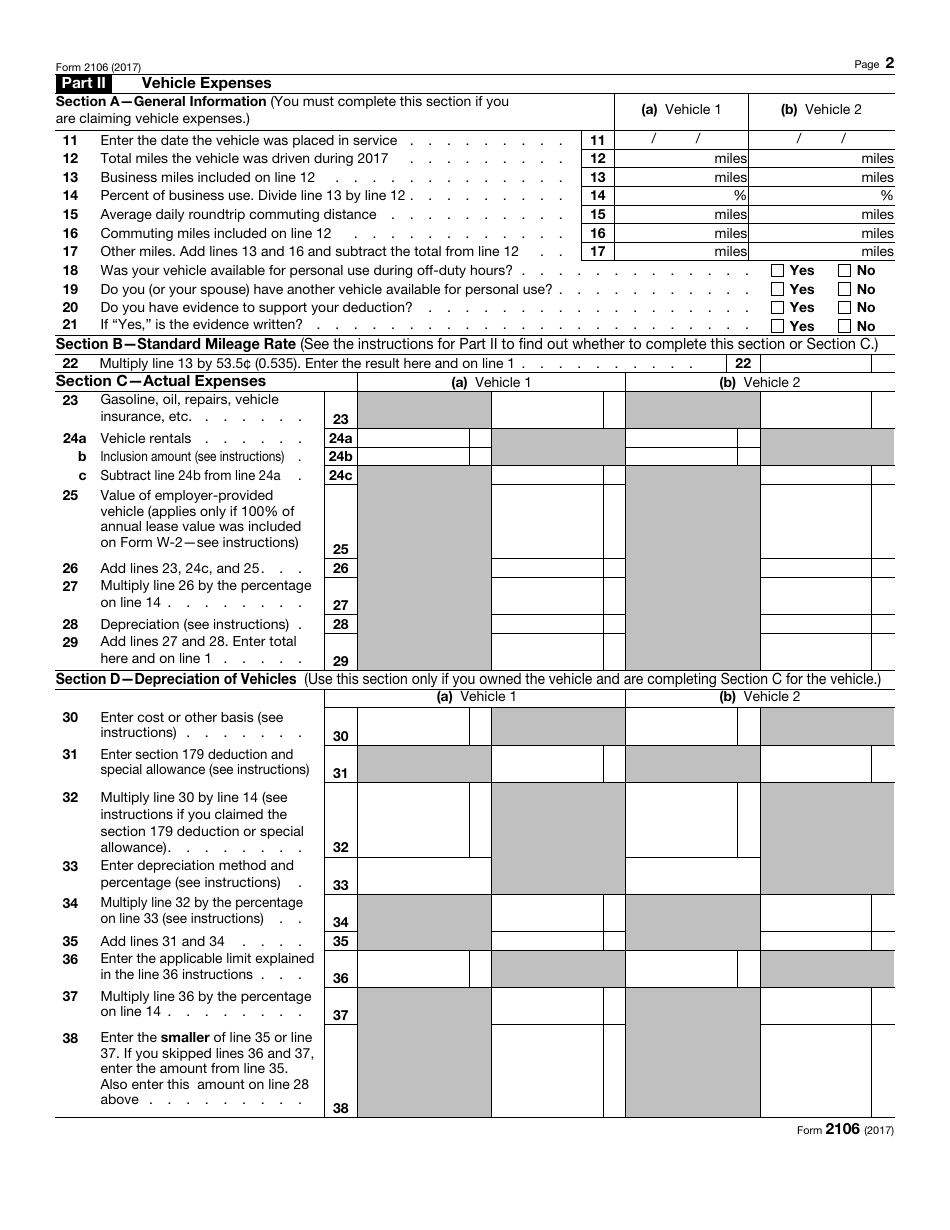

IRS Form 2106 Employee Business Expenses

What Is IRS Form 2106?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury on January 1, 2017. As of today, no separate filing guidelines for the form are provided by the IRS.

FAQ

Q: What is IRS Form 2106?

A: IRS Form 2106 is a form used to report employee business expenses.

Q: Who needs to file IRS Form 2106?

A: Employees who have unreimbursed business expenses may need to file IRS Form 2106.

Q: What expenses can be reported on IRS Form 2106?

A: Expenses such as travel, meals, entertainment, and job-related education can be reported on IRS Form 2106.

Q: Is there a limit to the amount of expenses that can be claimed on IRS Form 2106?

A: Yes, there are limits to the amount of expenses that can be claimed on IRS Form 2106. These limits vary depending on the type of expense.

Q: Is IRS Form 2106 used for self-employed individuals?

A: No, self-employed individuals should use a different form, such as Schedule C, to report business expenses.

Q: When is the deadline to file IRS Form 2106?

A: IRS Form 2106 should be filed with your annual tax return by the April tax filing deadline.

Q: Can I claim employee business expenses if I am reimbursed by my employer?

A: No, if you are reimbursed by your employer for your business expenses, you cannot claim those expenses on IRS Form 2106.

Form Details:

- A 2-page form available for download in PDF;

- This form cannot be used to file taxes for the current year. Choose a more recent version to file for the current tax year;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 2106 through the link below or browse more documents in our library of IRS Forms.