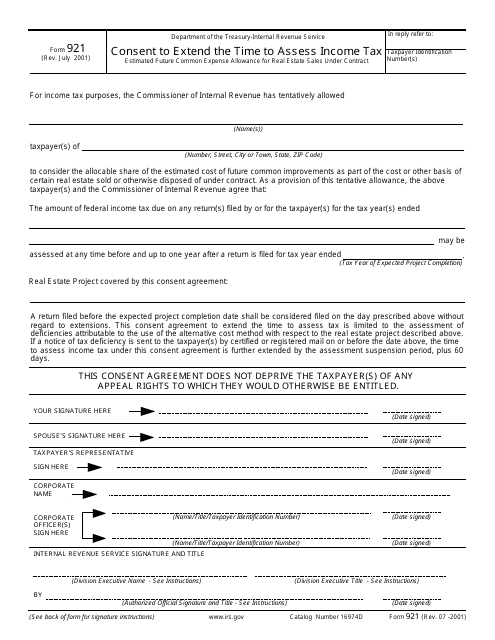

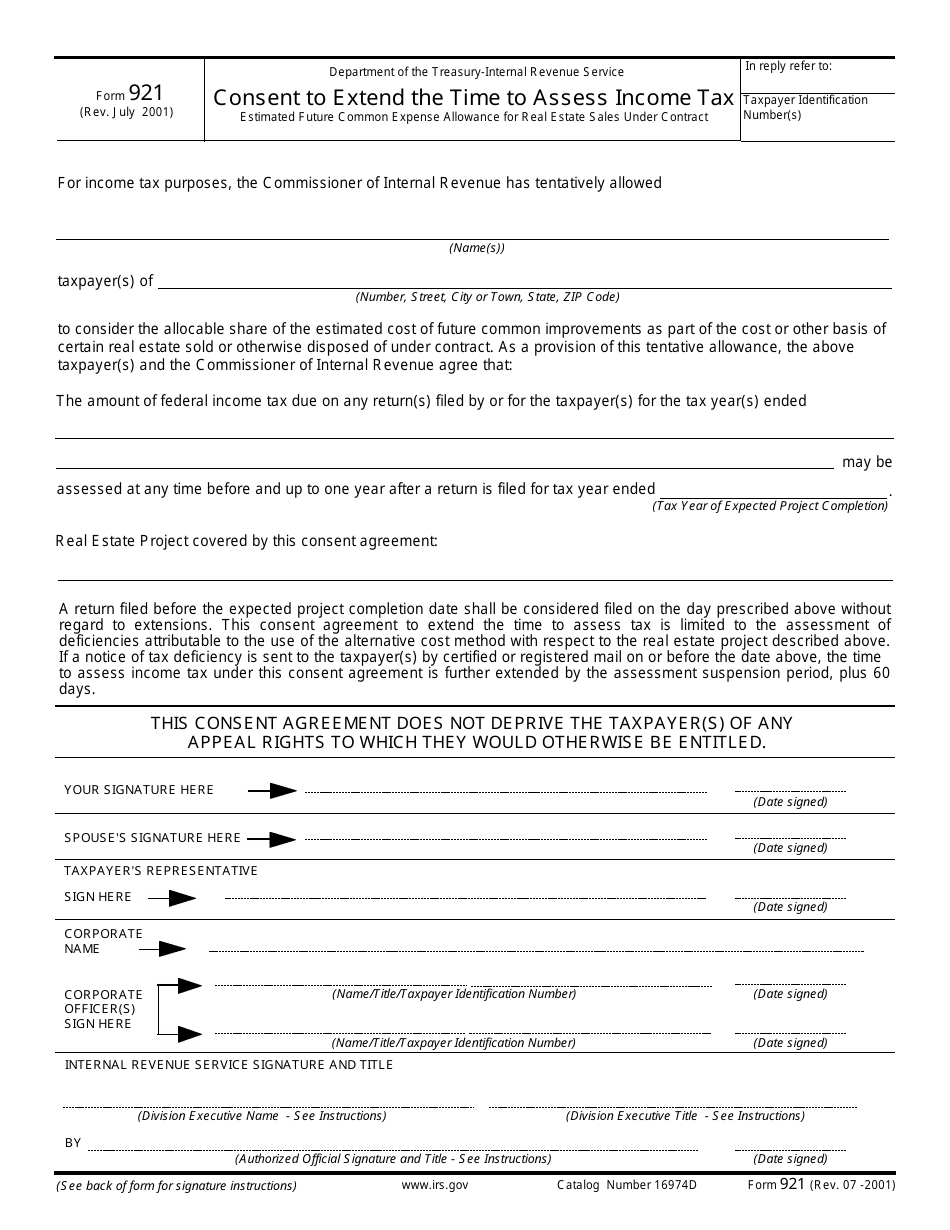

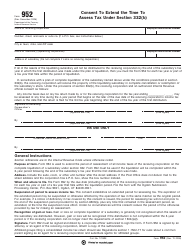

IRS Form 921 Consent to Extend the Time to Assess Income Tax

What Is Form 921?

IRS Form 921, Consent to Extend the Time to Assess Income Tax , is a legal document filed by real estate developers to extend the period for tax assessment and request the use of the estimated costs of common modifications and improvements on a project-by-project basis. An amended period of assessment ends one year after the date an income tax return is submitted for the tax year in which the real estate project is expected to be finished. Taxpayers can be granted an extension of up to 45 days to use an alternative cost method in accordance with Revenue Procedure 92-29.

This form was issued by the Internal Revenue Service (IRS) . The latest version of the form was released in July 2001 with all previous editions obsolete. A Form 921 fillable version is available for download through the link below.

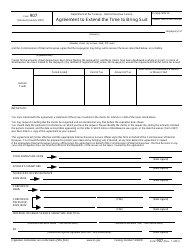

Provide the following information in the IRS 921 Form:

- Add your full name or name of your business, physical address, and taxpayer identification number;

- Indicate when the taxable years have ended and the report year when the project is expected to be completed;

- Describe the consent agreement that covers the real estate development. An annual statement, including a full description of the project, is required for each development for which the taxpayer wants to use the alternative cost method;

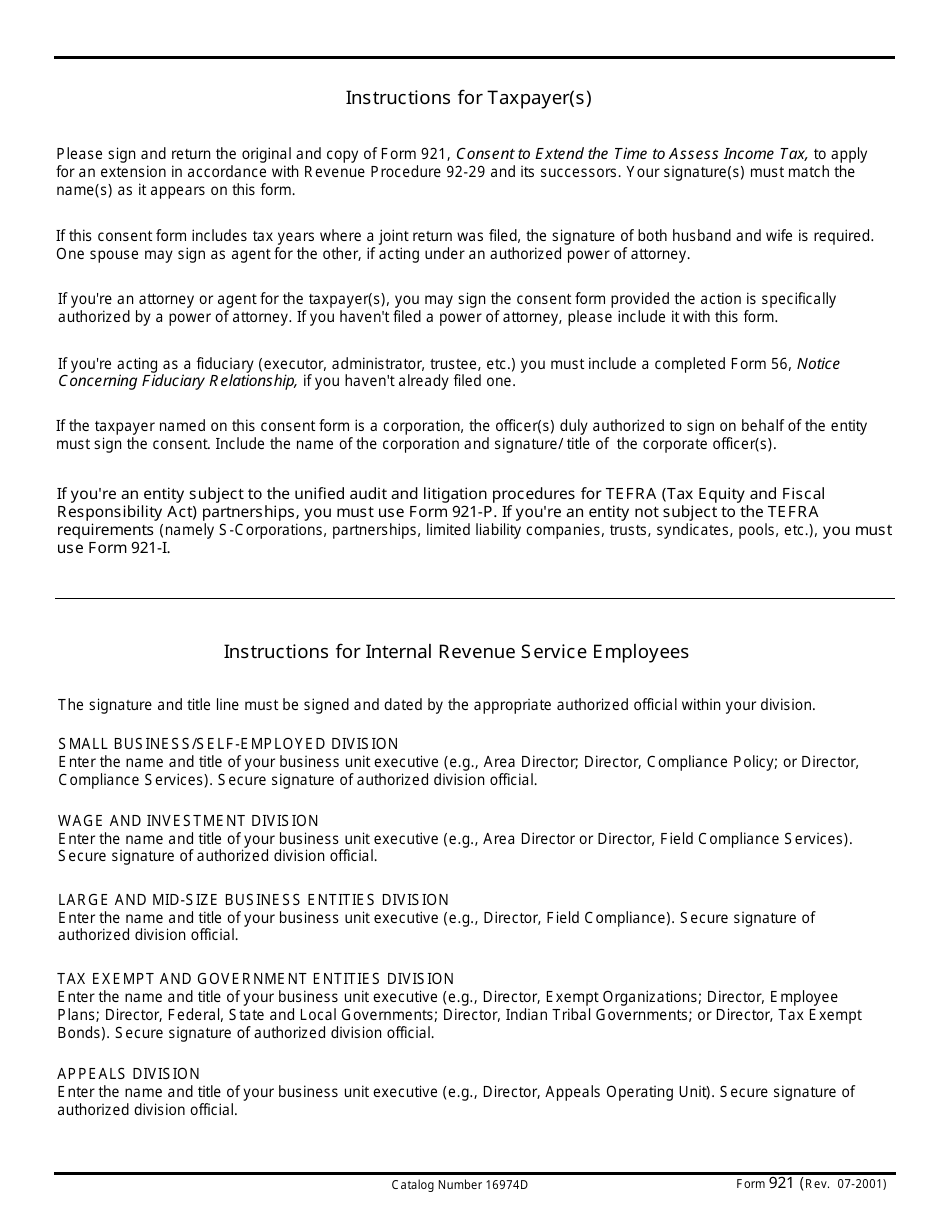

- Sign the form. If the consent covers years where you submitted a joint return, obtain the signature of your spouse. It is also possible to sign the form using a power of attorney.

The rest of the document must be filled out by the IRS - state the name and title of the unit executive and obtain the signature of the division official who is authorized to sign the consent.