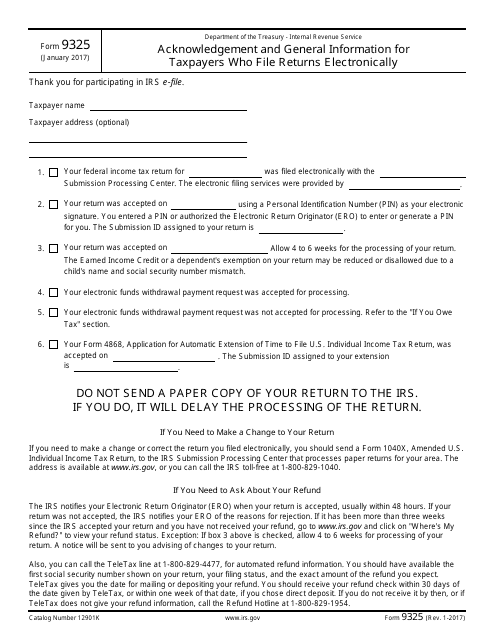

IRS Form 9325 Acknowledgement and General Information for Taxpayers Who File Returns Electronically

What Is IRS Form 9325?

IRS Form 9325, Acknowledgement and General Information for Taxpayers Who File Returns Electronically , is a formal instrument used by e-file return originators to inform taxpayers about the details of the filing process.

Alternate Name:

- Tax Form 9325.

Whether the paid preparer has to confirm the submission went smoothly or notify the taxpayer about payment issues, this is the form they should use upon receiving a request from their client.

This statement was issued by the Internal Revenue Service (IRS) on January 1, 2017 , rendering previous editions of the document obsolete. Download an IRS Form 9325 fillable version below.

Form 9325 Instructions

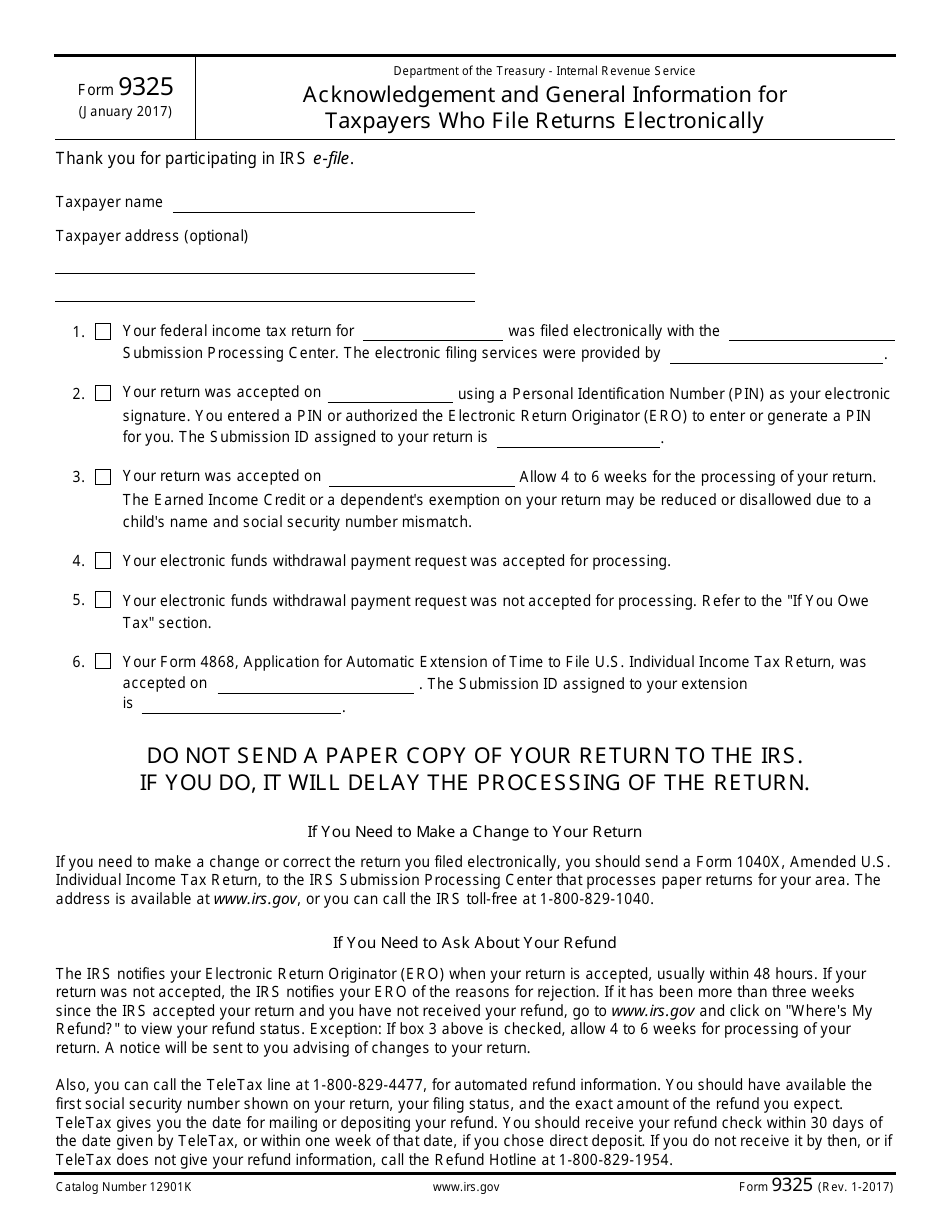

If you are a taxpayer that works with a tax professional who helps them out with their tax documentation, it is likely you will never see IRS Form 9325 unless you specifically request it from the entity that handles your tax paperwork. This instrument must be filled out by the e-file provider you have authorized to act on your behalf - IRS Form 9325 instructions are as follows:

-

Write down the name of the taxpayer and their correspondence address . The latter field is not mandatory but it lets the paid preparer differentiate between numerous clients.

-

Check the first box if the income statement you filed in the name of your client was submitted online . You will have to record the tax year covered in that document, specify the processing center that received the papers, and confirm your own name.

-

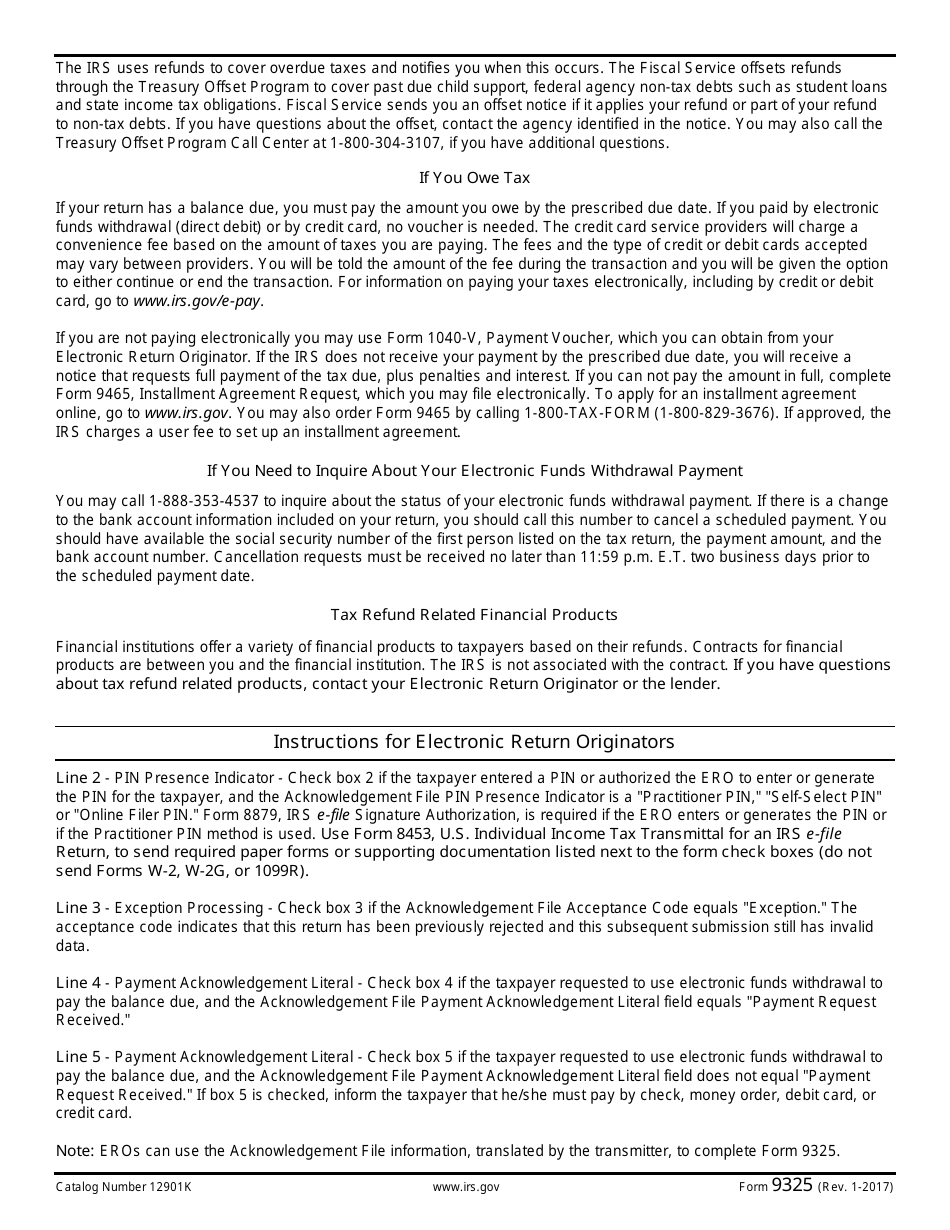

Put a tick in the second box in case you have proof the electronic return was accepted by the fiscal authorities . This option is for e-file providers that were allowed to write or create an identification number for their client - make sure you add the submission identification number to the form. Note that you may only submit the tax return if you have an electronic signature authorization from the taxpayer that hired you.

-

Check the appropriate box to verify the tax return was accepted by the IRS and record the accurate date . This field is for taxpayers whose returns were previously dismissed due to certain data missing or incorrect details added to the text of the document. The form warns the taxpayer that it may take up to six weeks for the tax organs to review the information they have submitted.

-

If the tax return was accompanied by an electronic payment, check the box that describes the situation - either the payment was accepted or the IRS has rejected the processing of the funds . In the latter case, the taxpayer will be expected to pay their taxes via a check, money order, debit card, or credit card - they are allowed to refer to specific guidelines on the second page of the form.

-

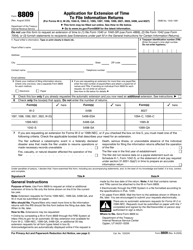

Confirm the request for additional time to complete the paperwork was accepted . If the taxpayer sent information to their e-file provider too late, it is likely a filing extension will be needed - check the box to let the client know the application was successful.