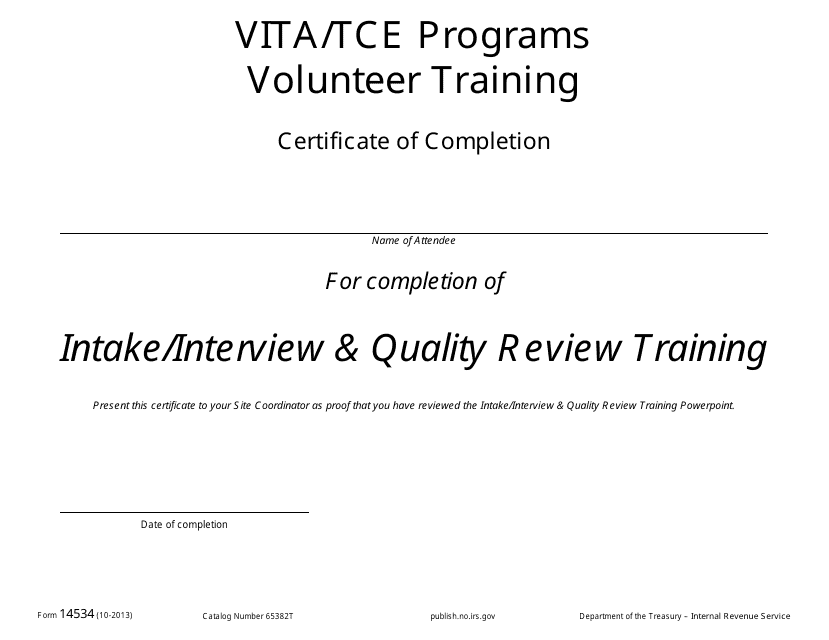

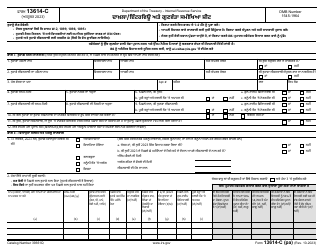

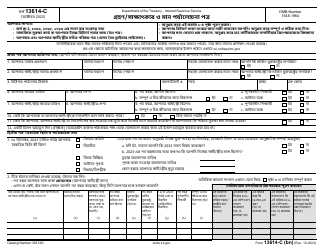

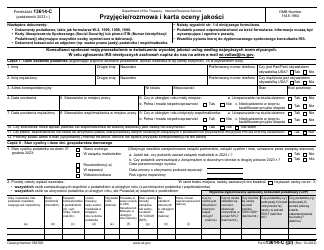

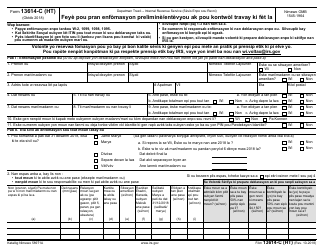

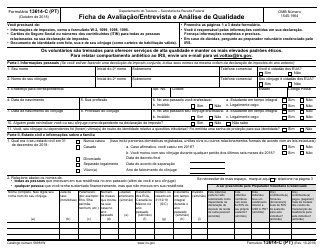

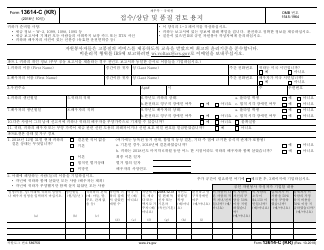

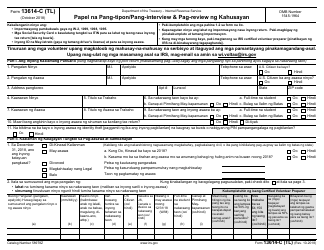

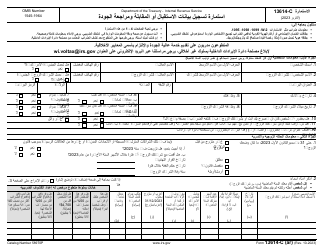

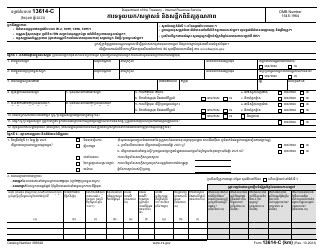

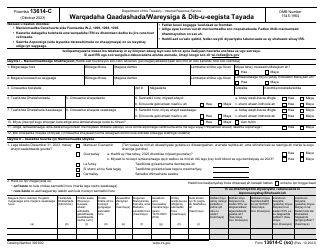

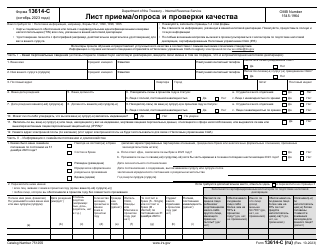

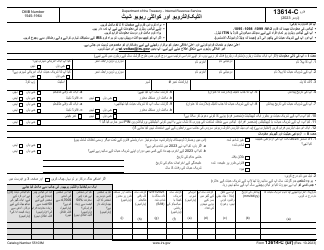

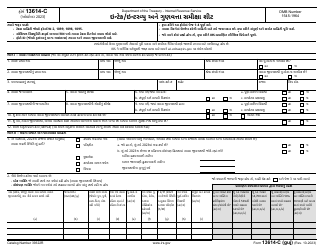

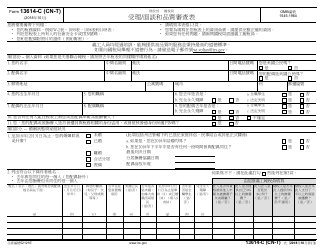

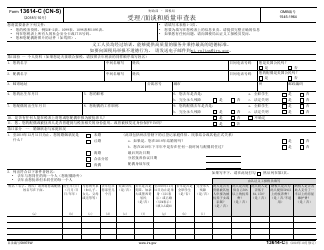

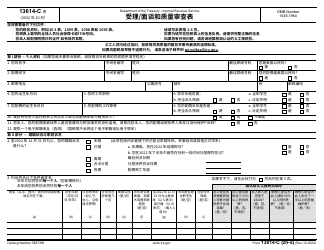

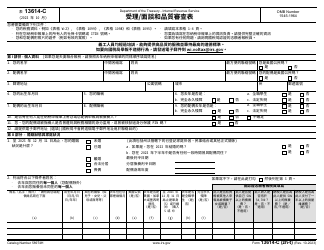

IRS Form 14534 Intake / Interview and Quality Review Certificate

What Is IRS Form 14534?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury on October 1, 2013. As of today, no separate filing guidelines for the form are provided by the IRS.

FAQ

Q: What is IRS Form 14534?

A: IRS Form 14534 is the Intake/Interview and Quality Review Certificate.

Q: What is the purpose of IRS Form 14534?

A: The purpose of IRS Form 14534 is to certify that the taxpayer's return was accurately prepared and reviewed.

Q: Who needs to fill out IRS Form 14534?

A: Tax professionals who prepare and review tax returns on behalf of individuals or businesses need to fill out IRS Form 14534.

Q: When should IRS Form 14534 be completed?

A: IRS Form 14534 should be completed at the end of the tax return preparation process, before submitting the return to the IRS.

Q: Is IRS Form 14534 mandatory?

A: IRS Form 14534 is not mandatory for individual taxpayers, but it is required for tax professionals who prepare and review returns for others.

Q: Can I use IRS Form 14534 for multiple tax returns?

A: No, IRS Form 14534 should be completed for each tax return separately.

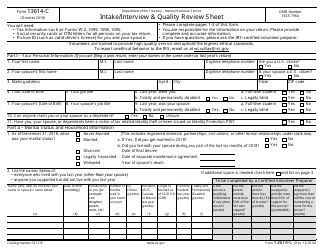

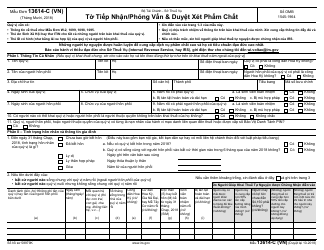

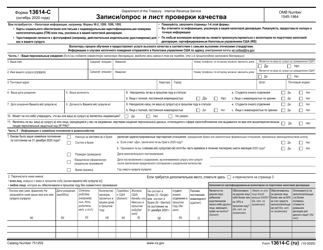

Q: What information is required on IRS Form 14534?

A: IRS Form 14534 requires information about the taxpayer, tax professional, and a certification of accuracy.

Q: Can I get a copy of IRS Form 14534?

A: Yes, you can request a copy of IRS Form 14534 from the tax professional who prepared your return or from the IRS.

Q: What should I do with IRS Form 14534 after completing it?

A: Keep a copy of IRS Form 14534 for your records and provide the original signed form to the taxpayer for their records.

Form Details:

- A 1-page form available for download in PDF;

- Actual and valid for filing 2023 taxes;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 14534 through the link below or browse more documents in our library of IRS Forms.