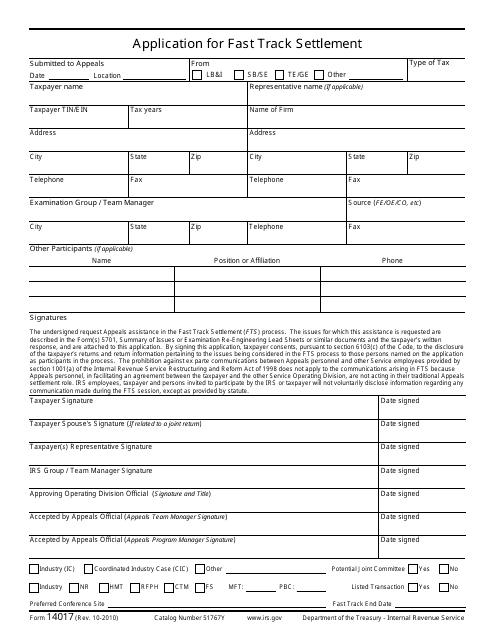

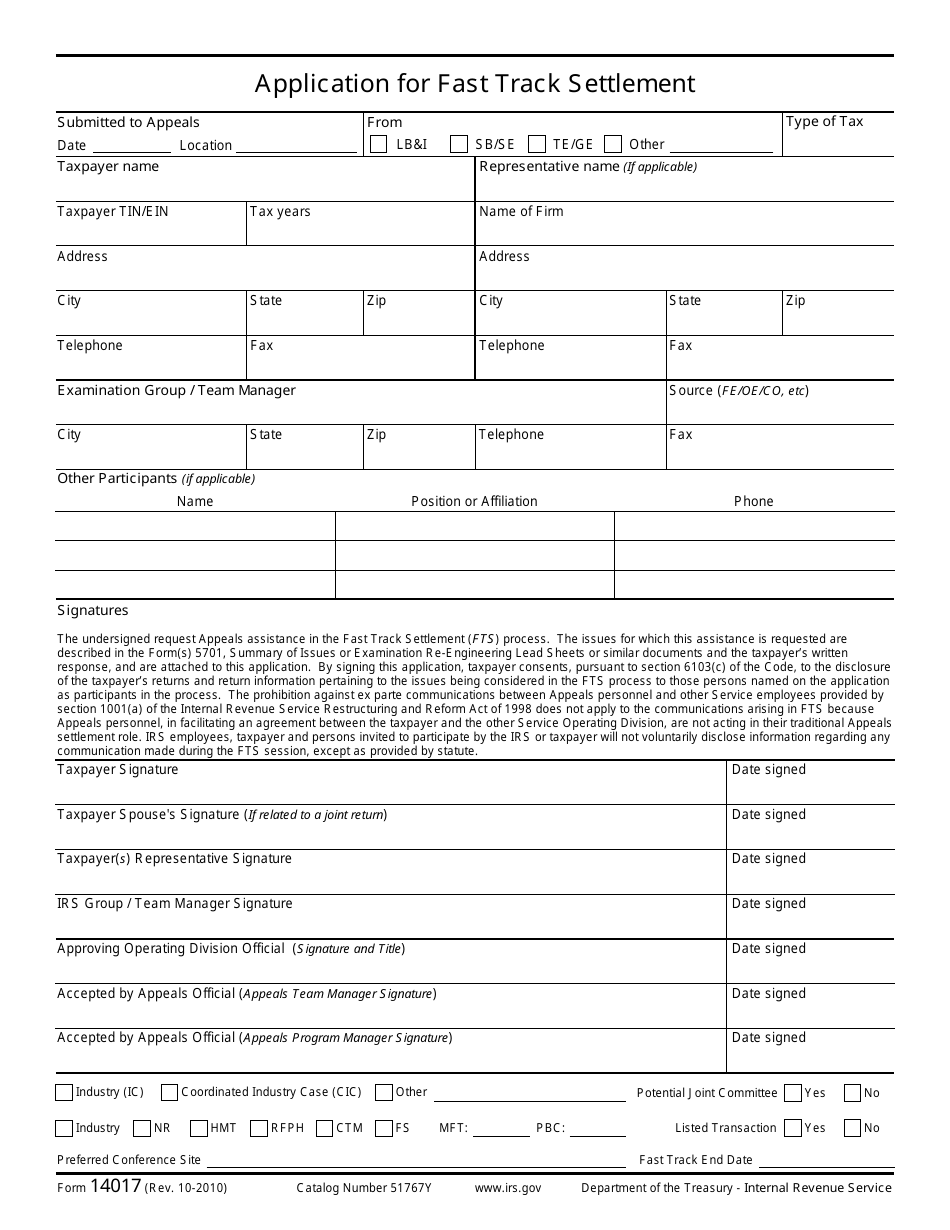

This version of the form is not currently in use and is provided for reference only. Download this version of

IRS Form 14017

for the current year.

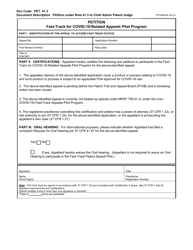

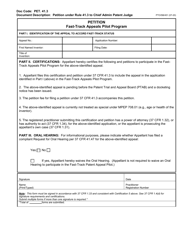

IRS Form 14017 Application for Fast Track Settlement

What Is IRS Form 14017?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury on October 1, 2010. As of today, no separate filing guidelines for the form are provided by the IRS.

FAQ

Q: What is IRS Form 14017?

A: IRS Form 14017 is the Application for Fast Track Settlement.

Q: What is Fast Track Settlement?

A: Fast Track Settlement is an alternative dispute resolution program offered by the IRS.

Q: Who can use IRS Form 14017?

A: Taxpayers who are eligible for the Fast Track Settlement program can use IRS Form 14017.

Q: What is the purpose of IRS Form 14017?

A: The purpose of IRS Form 14017 is to initiate the Fast Track Settlement process for resolving tax disputes.

Q: Is there a fee to submit IRS Form 14017?

A: No, there is no fee to submit IRS Form 14017.

Q: What are the benefits of using Fast Track Settlement?

A: The benefits of using Fast Track Settlement include quicker resolution of tax disputes and a more informal and flexible process.

Q: Can I appeal the decision made through Fast Track Settlement?

A: No, the decision made through Fast Track Settlement is final and cannot be further appealed.

Q: Can I use IRS Form 14017 for all types of tax disputes?

A: No, IRS Form 14017 is only used for certain types of tax disputes that are eligible for the Fast Track Settlement program.

Form Details:

- A 1-page form available for download in PDF;

- Actual and valid for filing 2023 taxes;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 14017 through the link below or browse more documents in our library of IRS Forms.