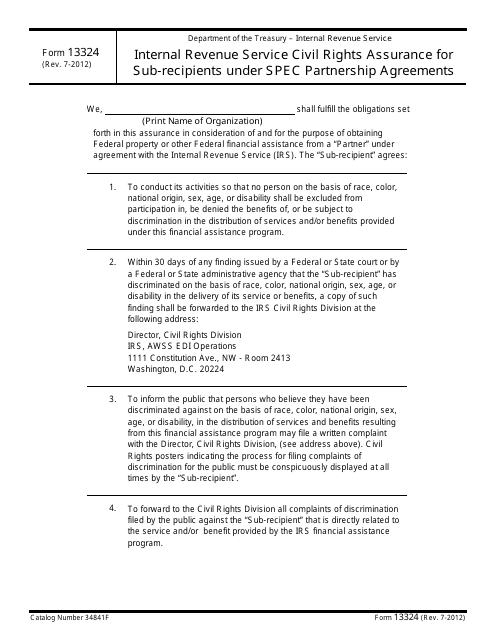

IRS Form 13324 Internal Revenue Service Civil Rights Assurance for Subrecipients Under Spec Partnership Agreements

What Is IRS Form 13324?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury on July 1, 2012. As of today, no separate filing guidelines for the form are provided by the IRS.

FAQ

Q: What is IRS Form 13324?

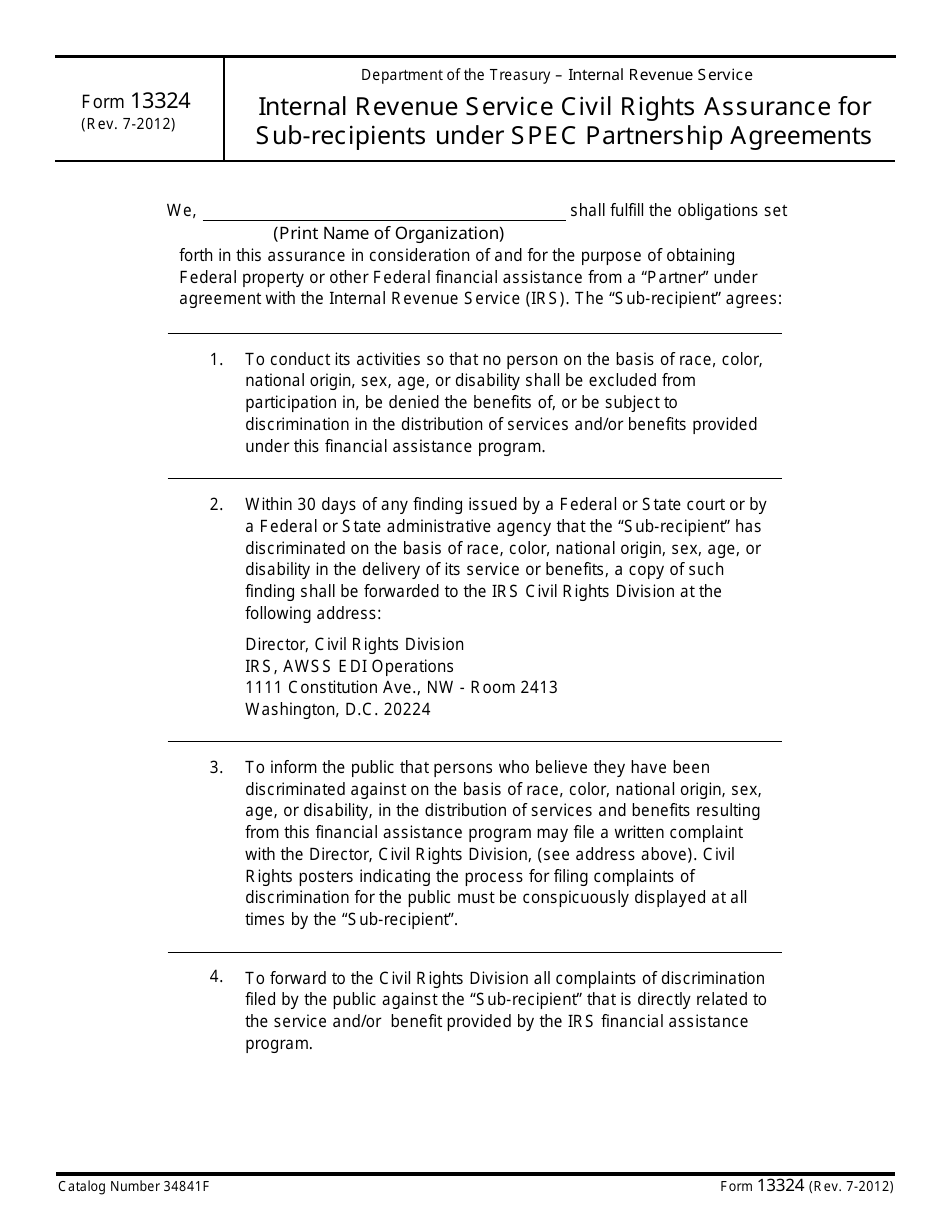

A: IRS Form 13324 is a form used by the Internal Revenue Service (IRS) to ensure that subrecipients under Special Partnership Agreements comply with civil rights regulations.

Q: Who uses IRS Form 13324?

A: Subrecipients under Special Partnership Agreements use IRS Form 13324.

Q: What is the purpose of IRS Form 13324?

A: The purpose of IRS Form 13324 is to ensure that subrecipients comply with civil rights regulations.

Q: What are Special Partnership Agreements?

A: Special Partnership Agreements are agreements between organizations and the IRS for the delivery of taxpayer services.

Q: What does IRS Form 13324 verify?

A: IRS Form 13324 verifies that subrecipients have policies and procedures in place to comply with civil rights regulations.

Form Details:

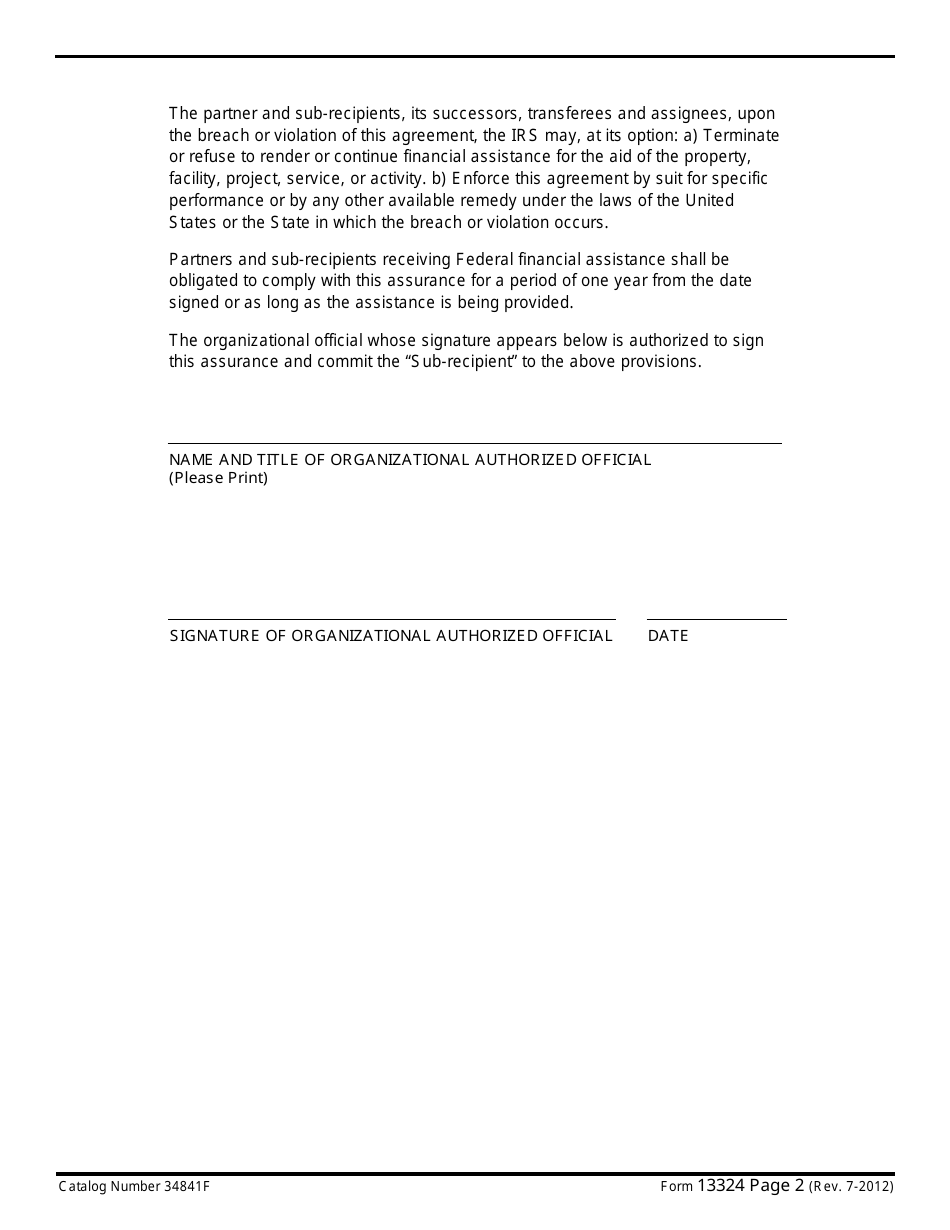

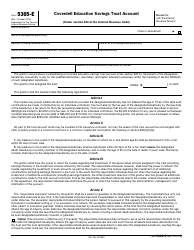

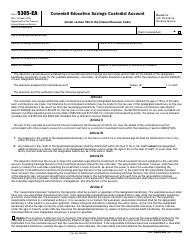

- A 2-page form available for download in PDF;

- Actual and valid for filing 2023 taxes;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 13324 through the link below or browse more documents in our library of IRS Forms.