This version of the form is not currently in use and is provided for reference only. Download this version of

IRS Form W-2C

for the current year.

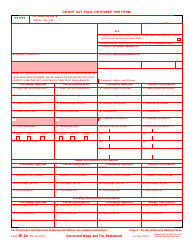

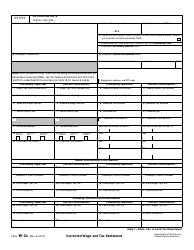

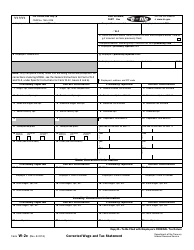

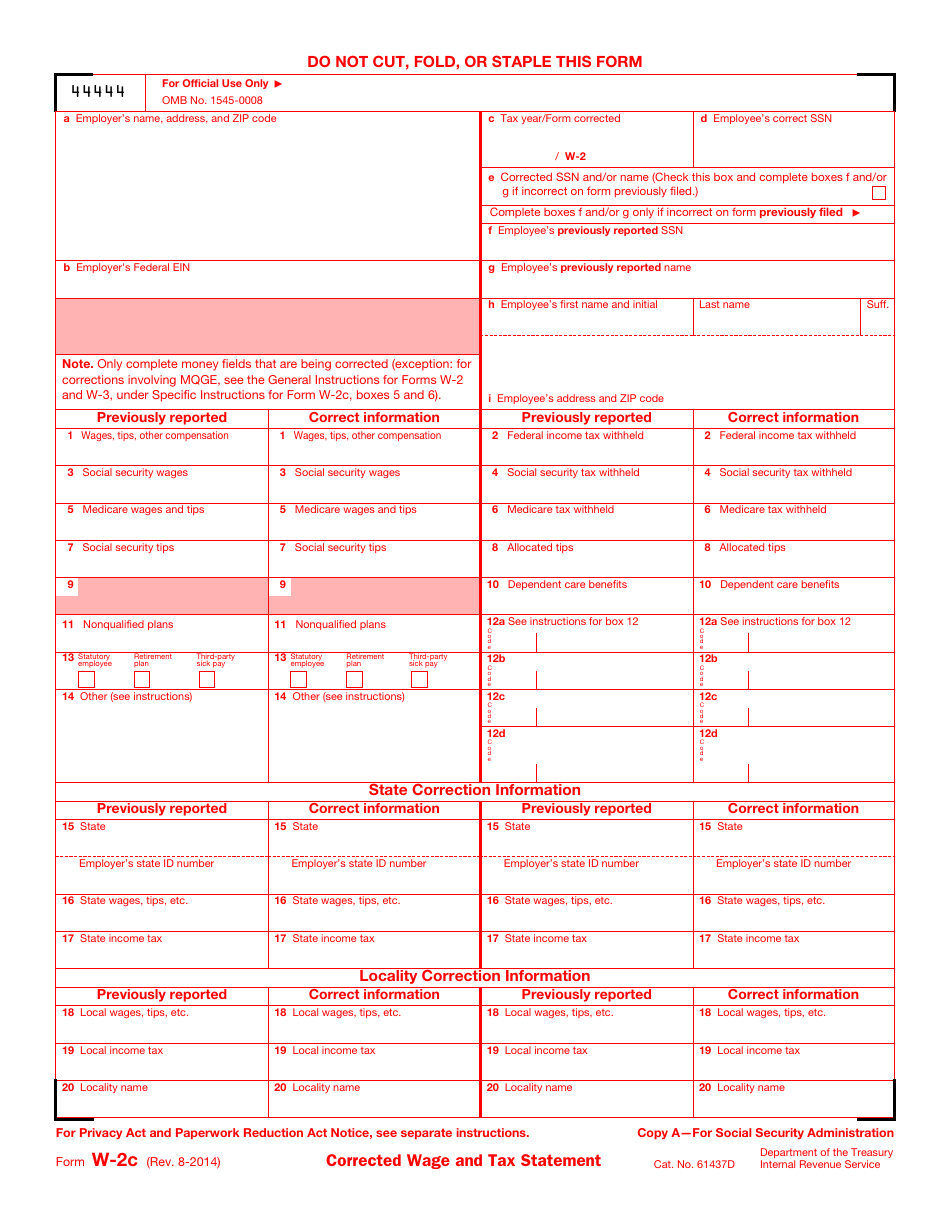

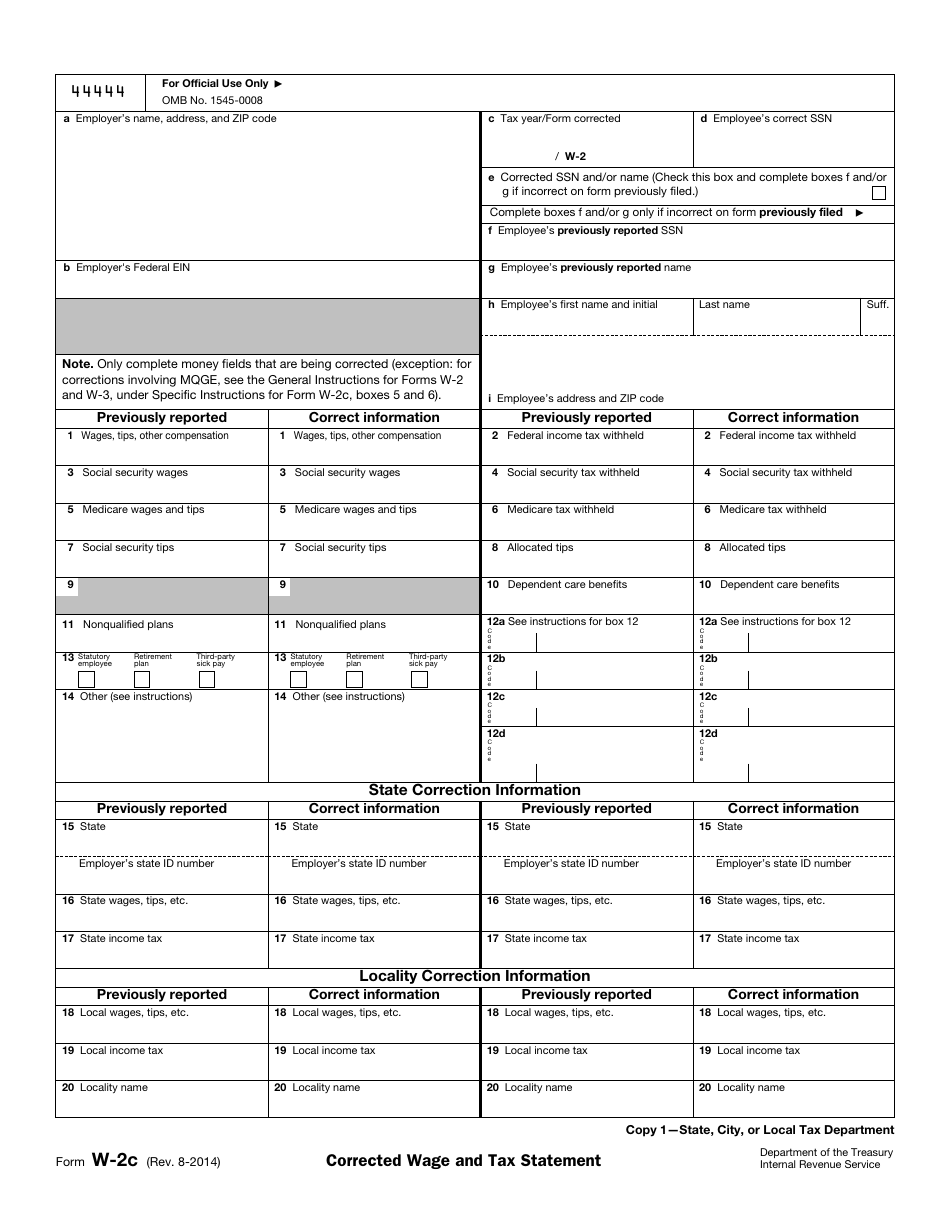

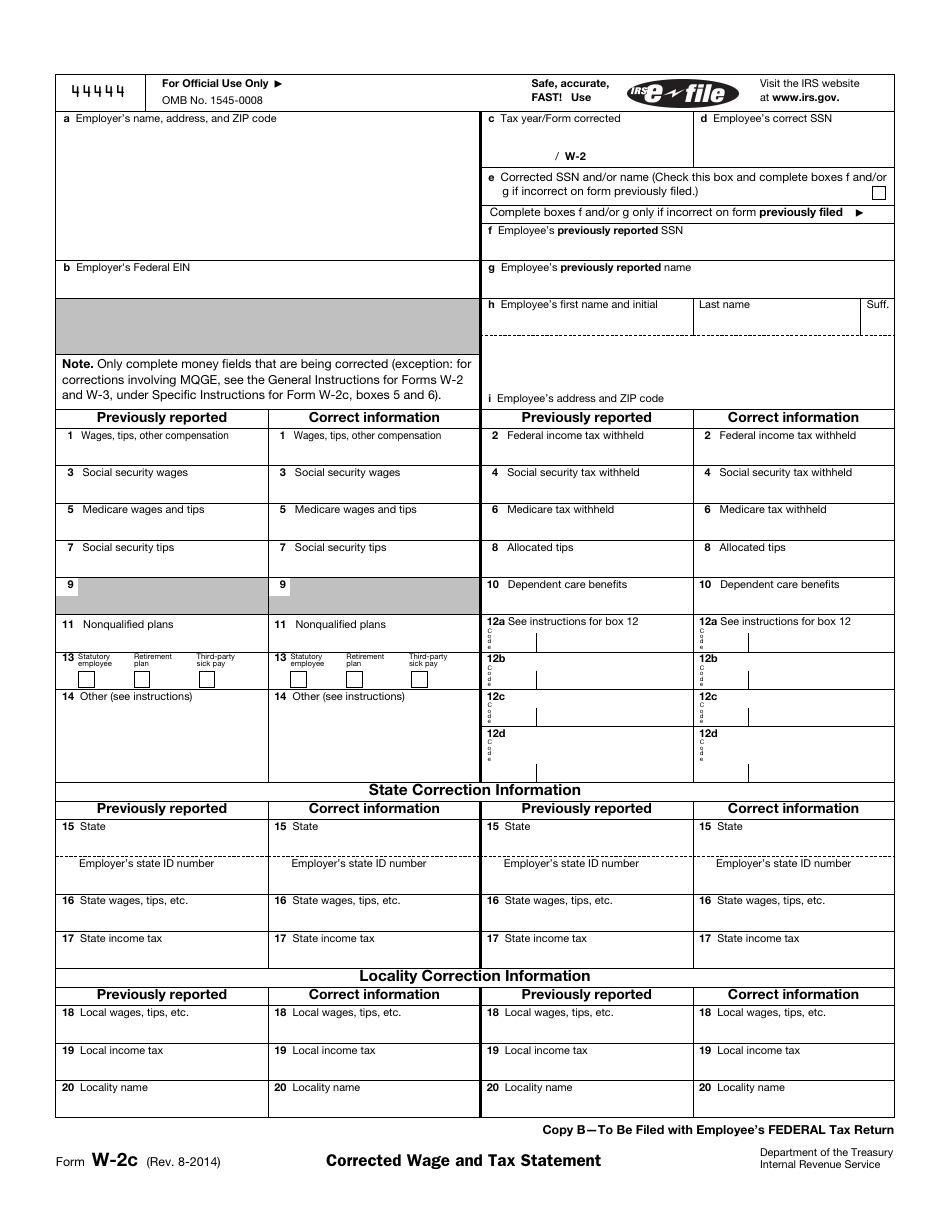

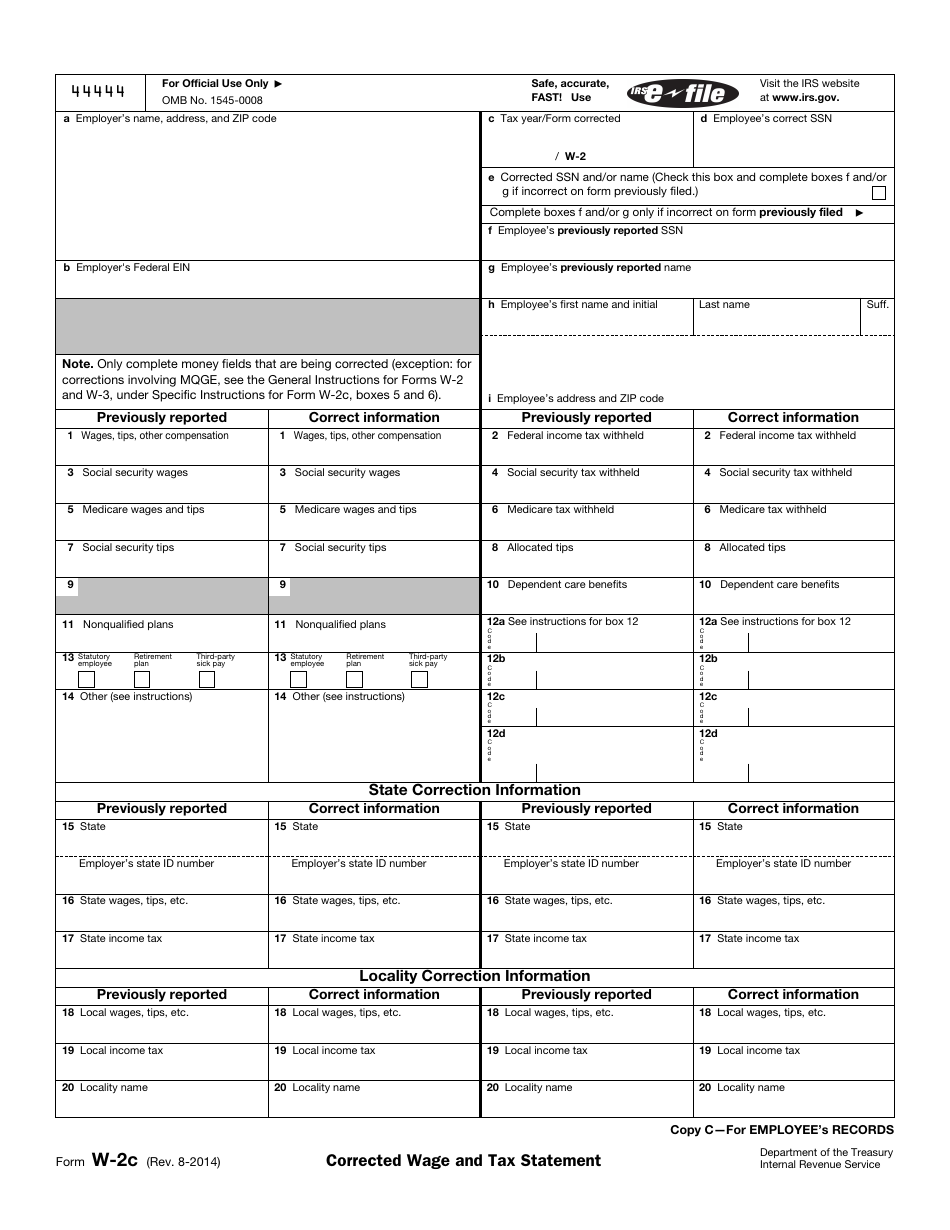

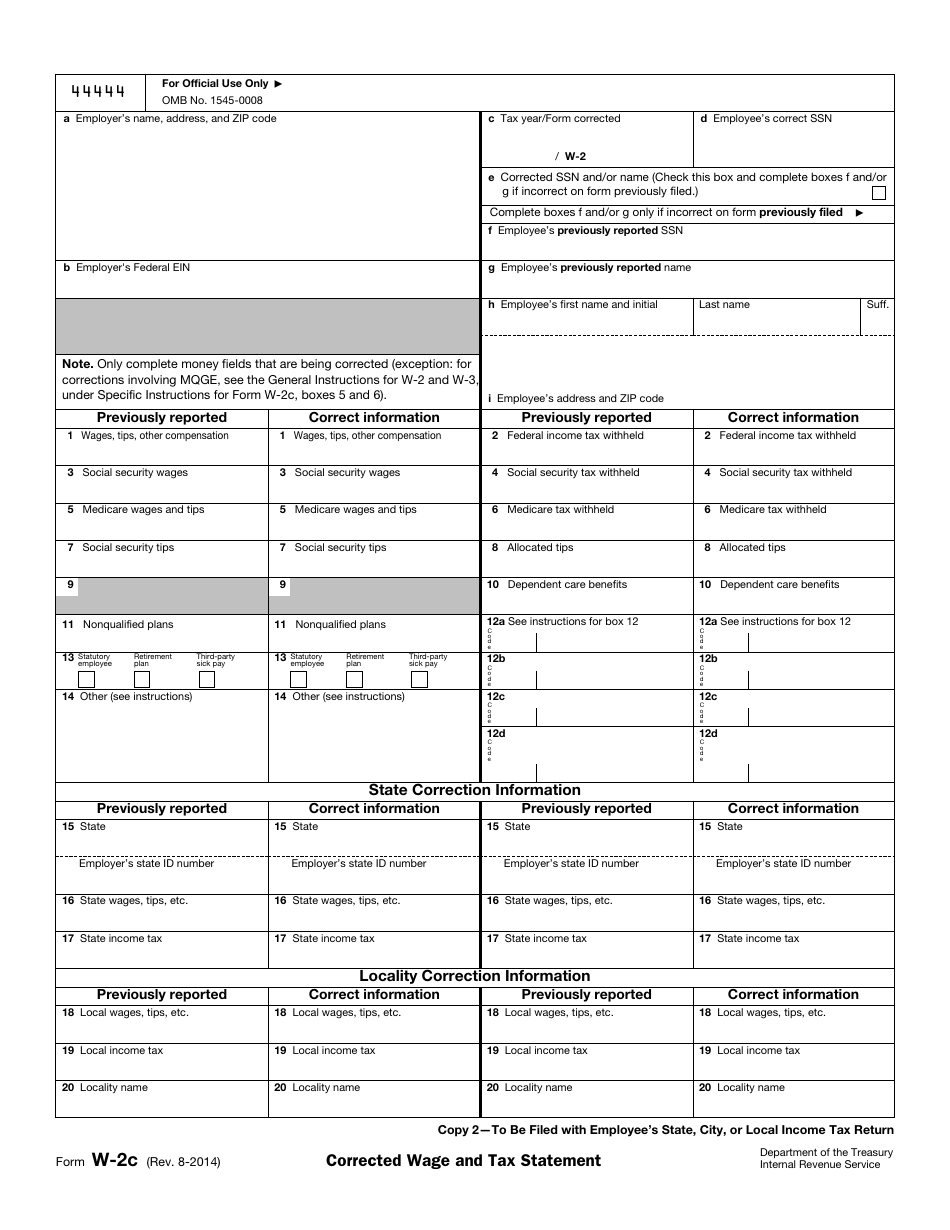

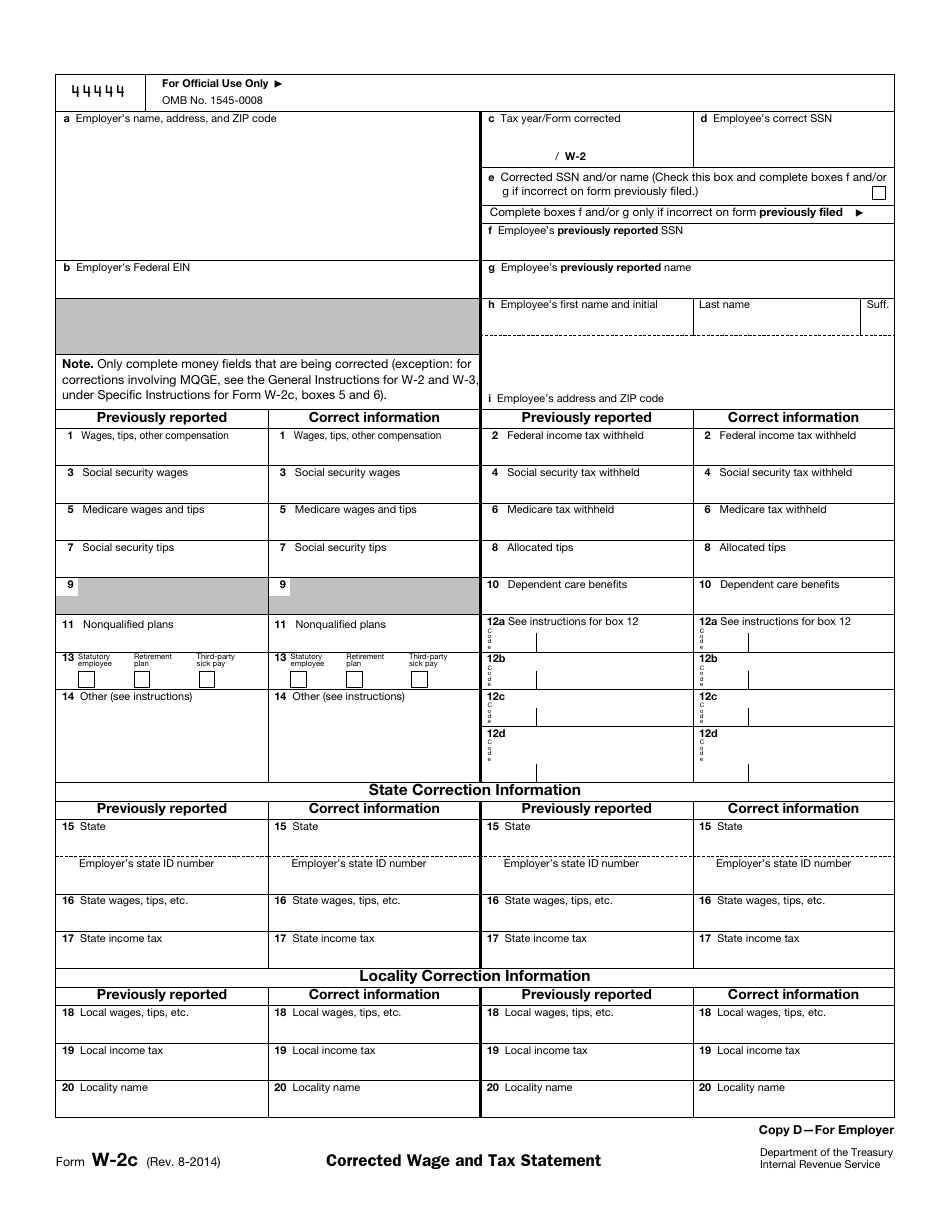

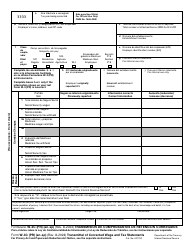

IRS Form W-2C Corrected Wage and Tax Statement

What Is W-2C Tax Form?

IRS Form W-2C, Corrected Wage and Tax Statements is a document used to correct errors on the forms of the IRS W-2 Series. It was issued by the Internal Revenue Service (IRS) . The document was last revised on August 1, 2014 . Download the latest version of the fillable W-2C Form through the link below. If you prefer a paper version, you can order it from the IRS.

The report is mainly used to correct errors on the Form W-2, Wage and Tax Statement. Form W-2 is filled out by the employers to report wages and taxes withheld from these wages. Besides, the corrected wage and tax statement is used to correct errors on the IRS FormsW-2AS, W-2G, or W-2VI. However, do not use this form to make any amendments to the IRS Form W-2G, Certain Gambling Winning.

When Are W-2C Due to Employees?

Form W-2C due date is not fixed. Fill it out, provide to your employee, and file with the appropriate government agency (the Social Security Administration (SSA) and state, city, or local tax department) as soon as possible after discovering of an error. Furnish the report to the employee only if the Copy A of the form is already filed with the SSA. Otherwise, complete a new Form W-2 containing the correct information, file Copy A with the SSA, and write "Corrected" on the copies you furnish to your employee (Copies B, C, and 2).

IRS Form W-2C Instructions

IRS Form W-2C consists of the six copies that are distributed in the same way as copies of Form W-2. Use the following tips to prepare and submit the form properly:

- If you need to correct a name or a Social Security number of an employee, fill our boxes D through I only;

- Use a separate Form W-3C for each type of the Form W-2 you correct;

- Do not file the Form W-2C with the SSA to correct the wrong address. Just issue a corrected Form W-2 with the proper address to the affected employee. The new copies must include the phrase "Reissued Statement". As an alternative, furnish the IRS W-2C Form containing the correct address in Block I and all other correct information to the employee but do not send the Copy A to the SSA;

- Box C. If you are submitting this document to correct Form W-2, provide all 4 digits of the year you correcting the form. If you wish to amend the information provided on the Forms Form W-2VI, W-2AS, W-2GU, W-2CM, or W-2C, indicate 4 digits to specify the year and the letters "AS," "CM," "GU," "VI," or "C" to specify the form you want to correct;

- Box D. Enter the correct SSN of the employee in this box even if it was shown correctly on the form you want to amend;

- Box H. Always provide the correct name of the employee as shown on the social security card in this box. If the name does not fit in the box space, indicate the first and middle name initials and enter the full last name;

- Box I. Always report the correct address of your employee;

- Boxes 1-20. These boxes are optional. Do not make any entries unless you want to change previously provided information. In this case, indicate the amount reported on the form you amend in the "Previously Reported" column and the correct amount in the "Correct Information" column;

- Boxes 15-20. If you change only state and local information, do not submit Copy A to the SSA. Send the copies of the IRS W-2C Form to the appropriate state or local agency and to your employee;

- Do not cut, fold, staple, or tape the forms you send.

The IRS has issued the General Instructions for Forms W-2 and W-3 that contain the separate section with the specific detailed instructions for Forms W-2C and W-3C.

How to File a Corrected W-2 Form?

Always use the IRS Form W-3C, Transmittal of Corrected Wage and Tax Statements when submitting Copy A of the Form W-2C to the SSA. The Form W-2C mailing address is: Social Security Administration, Direct Operations Center, P.O. Box 3333, Wilkes-Barre, PA 18767-3333

If you use any other carrier, send the forms to: Social Security Administration, Direct Operations Center, Attn: W-2C Process, 1150 E. Mountain Drive, Wilkes-Barre, PA 18702-7997.

File the transmittal of corrected wage and tax statements form, even if you submit the form to correct your employee's name or SSN. You can e-file forms to save your efforts and ensure accuracy. Besides, if you submit 250 or more forms during the calendar year, you must file them electronically.

IRS W-2 Related Forms

- IRS Form W-2AS, American Samoa Wage and Tax Statement. Complete this version of the Form W-2 to report the American Samoa earnings;

- IRS Form W-2GU, Guam Wage and Tax Statement. Fill out this document to provide information about the Guam salaries;

- IRS Form W-2VI, U.S. Virgin Islands Wage and Tax Statement. File this version of the document to report the required information about the U.S. Virgin Islands wages;

- IRS Form W-2G, Certain Gambling Winnings. Use this document to provide information about gambling winnings and taxes withheld on these winnings.