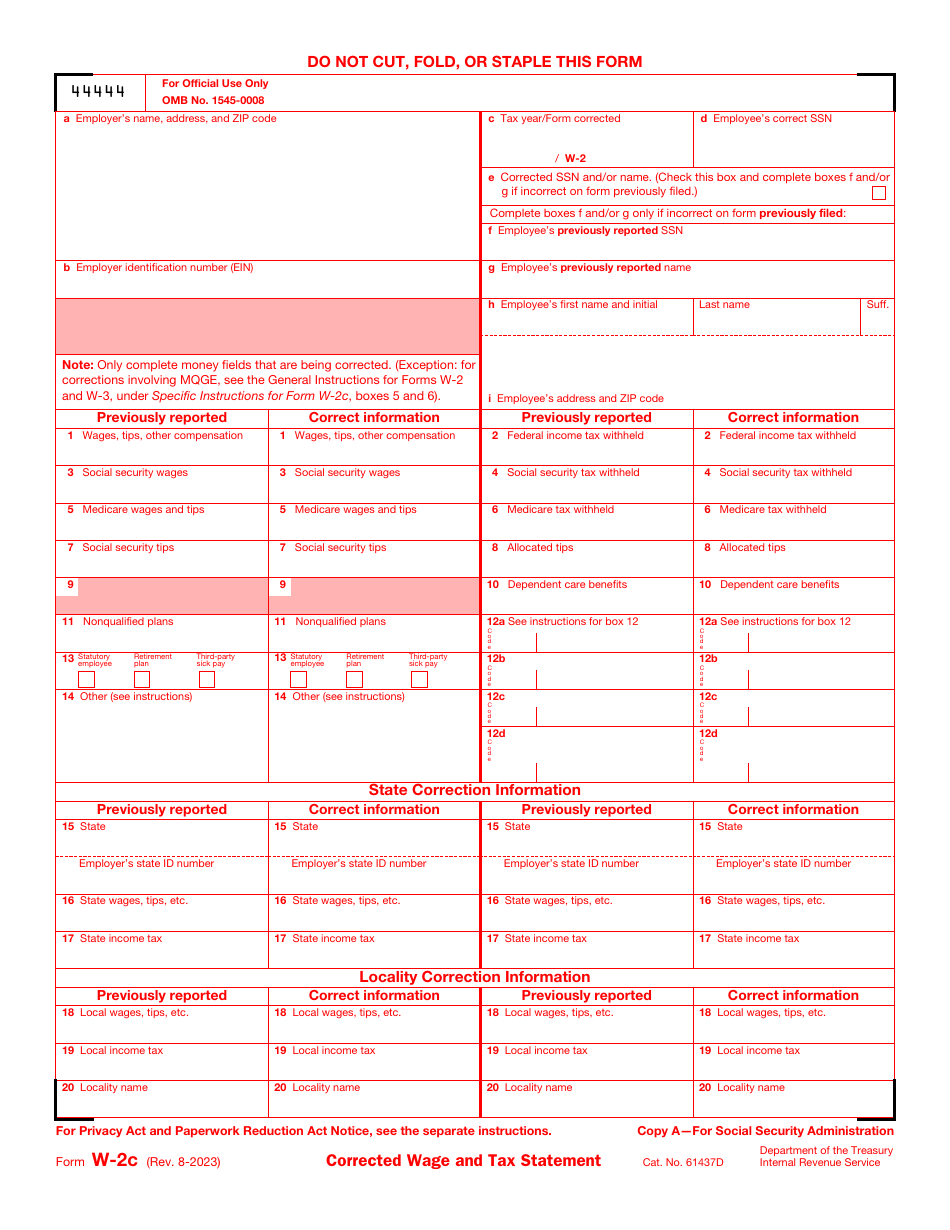

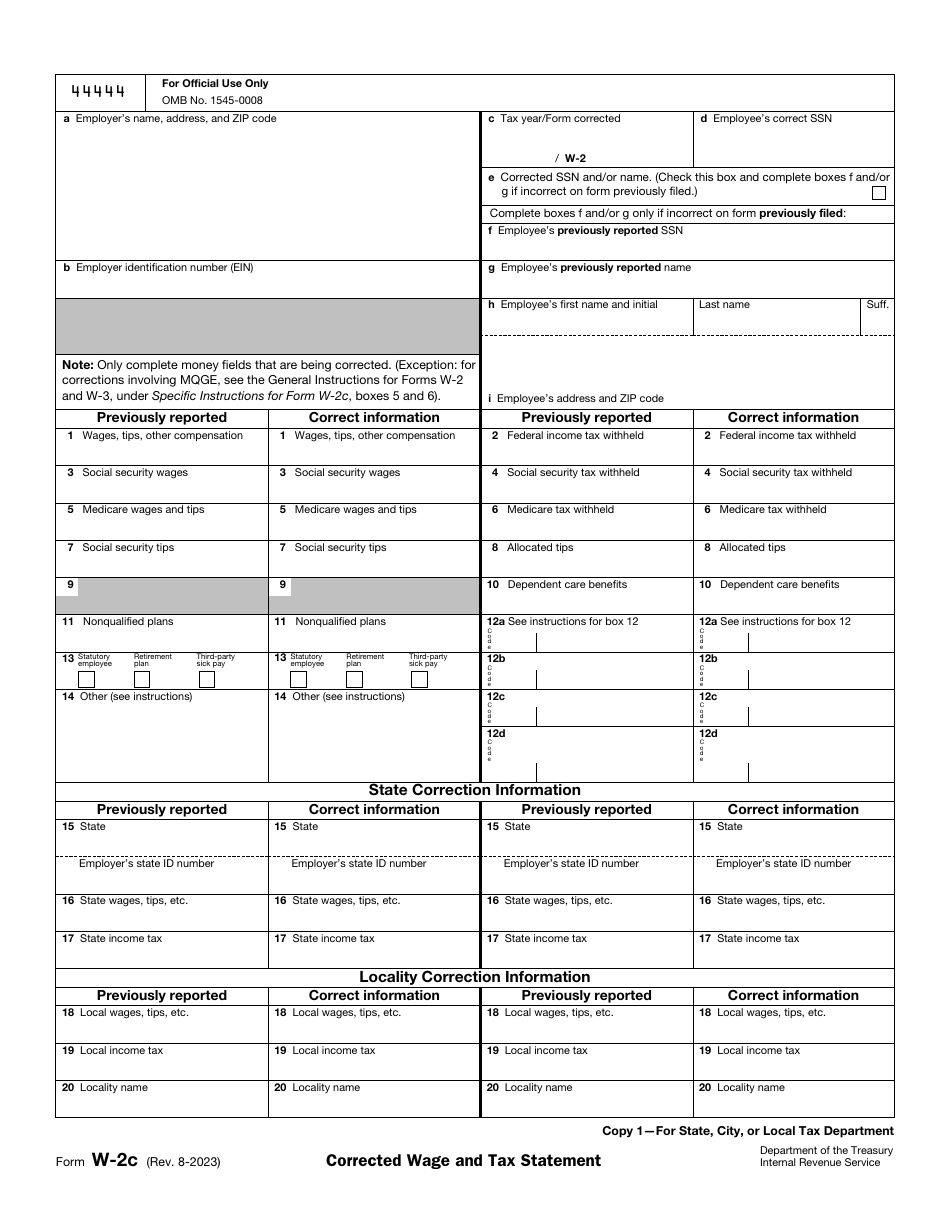

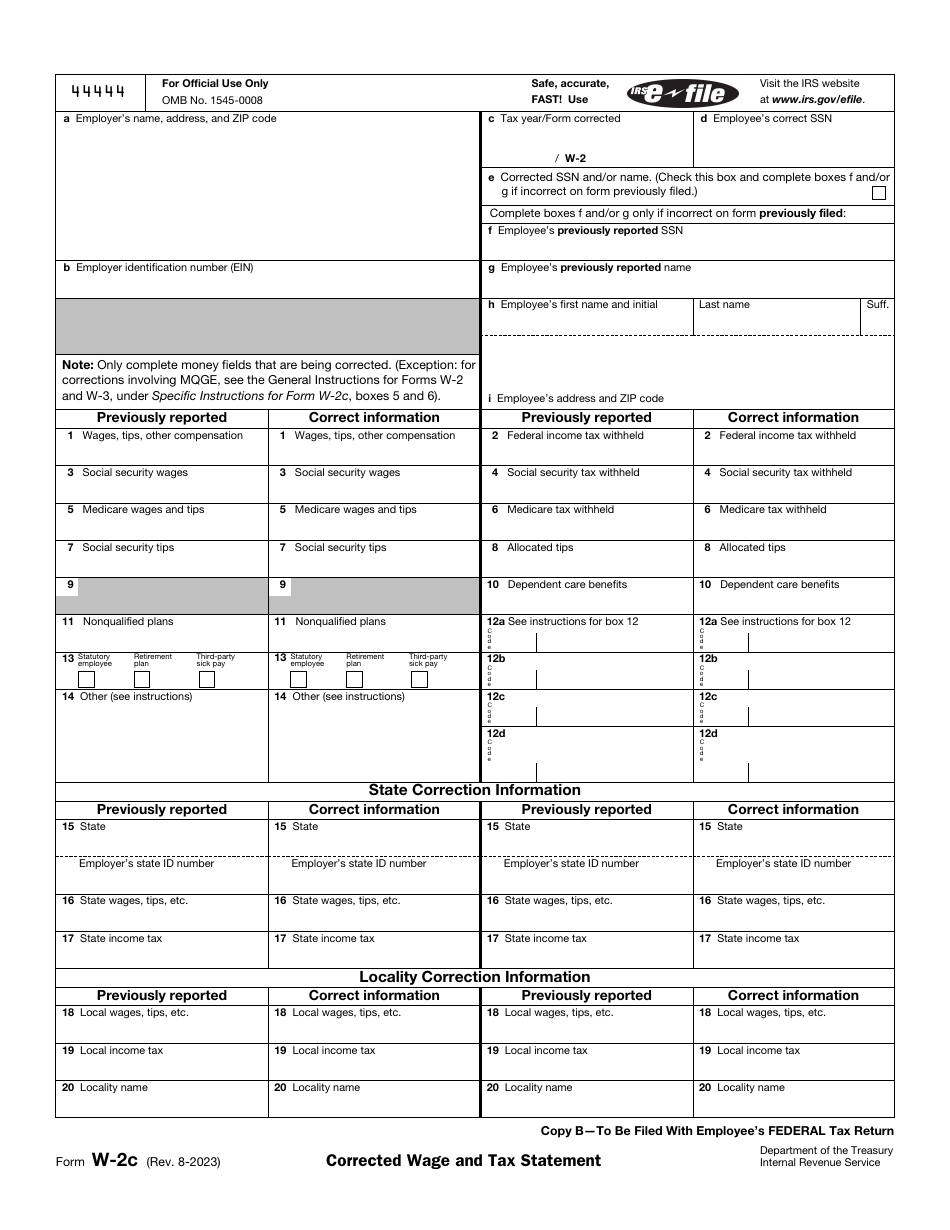

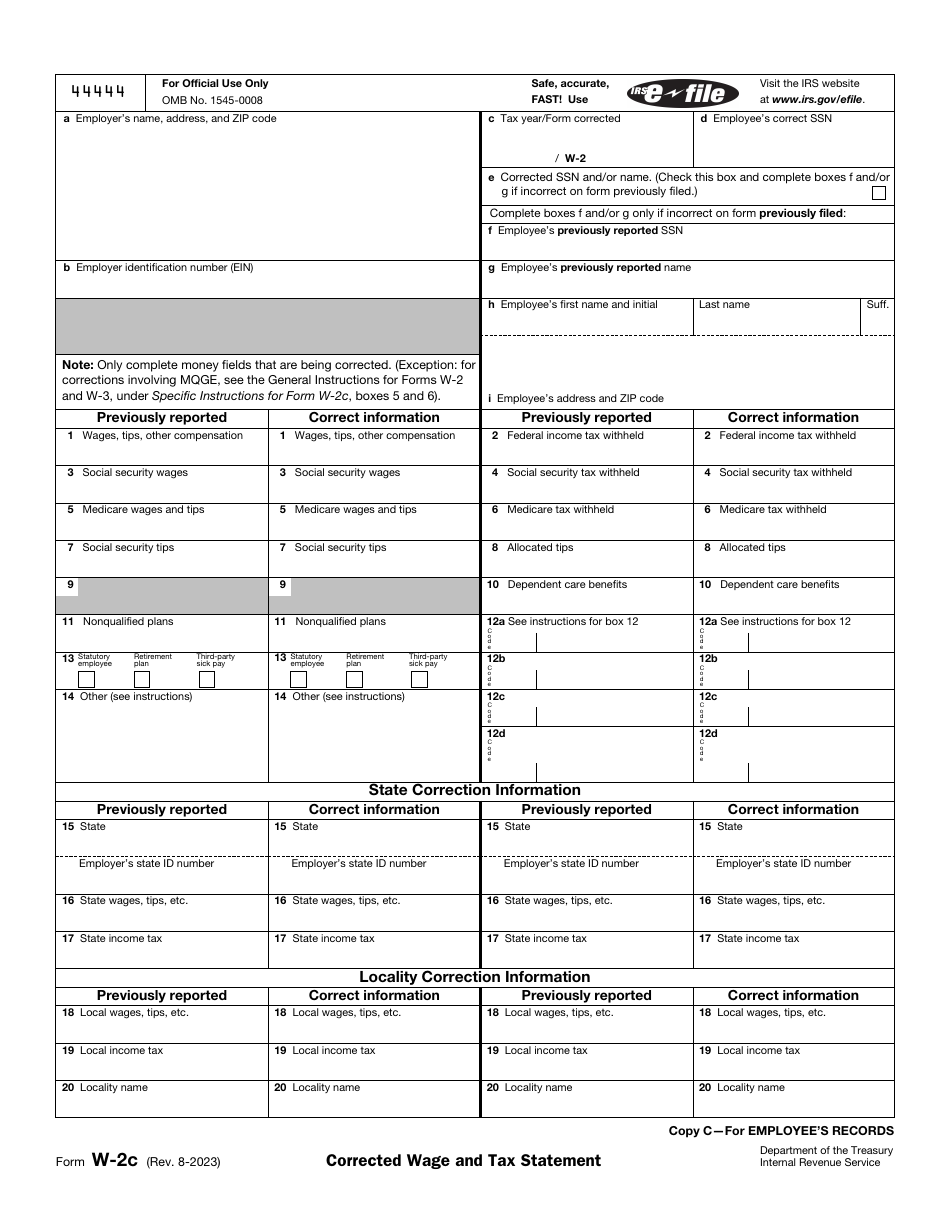

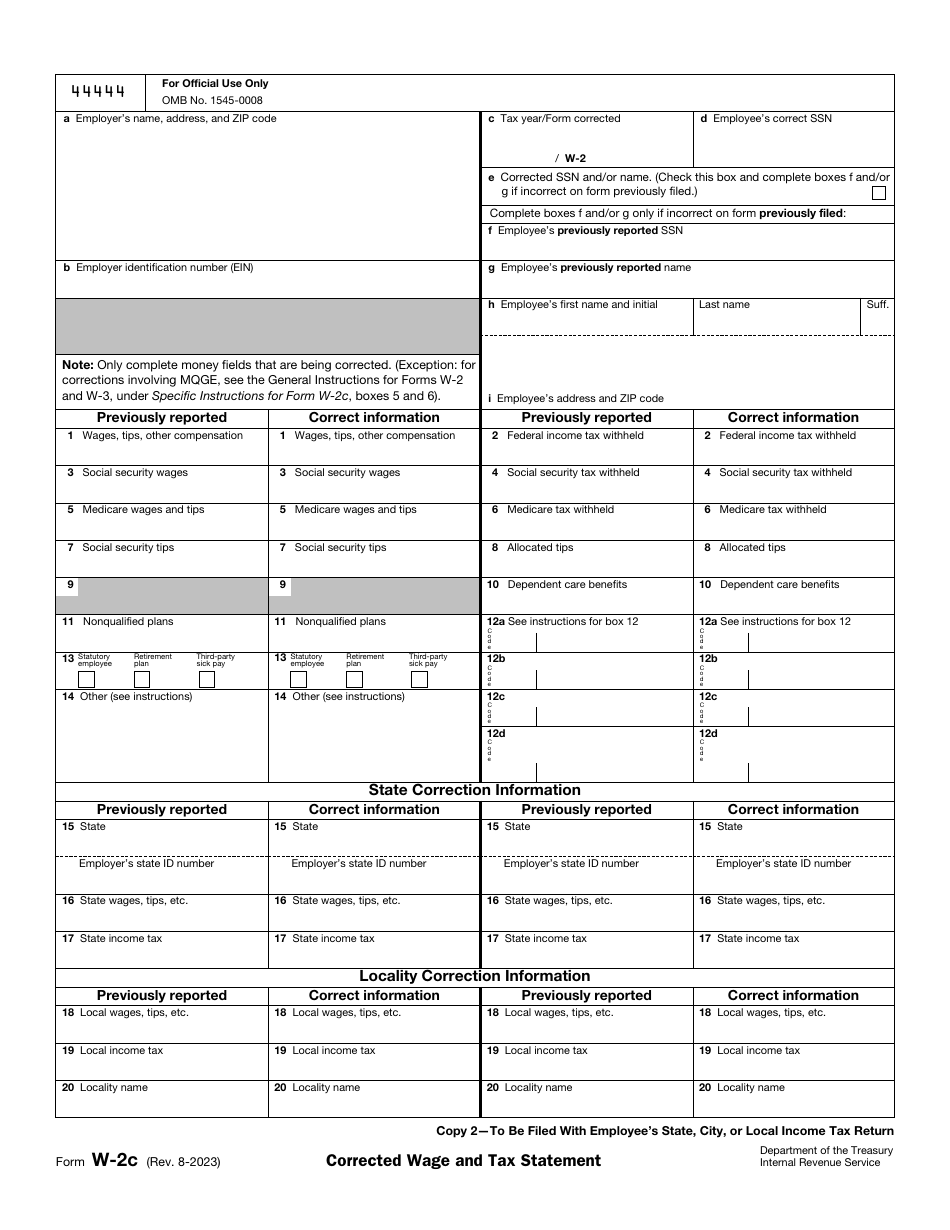

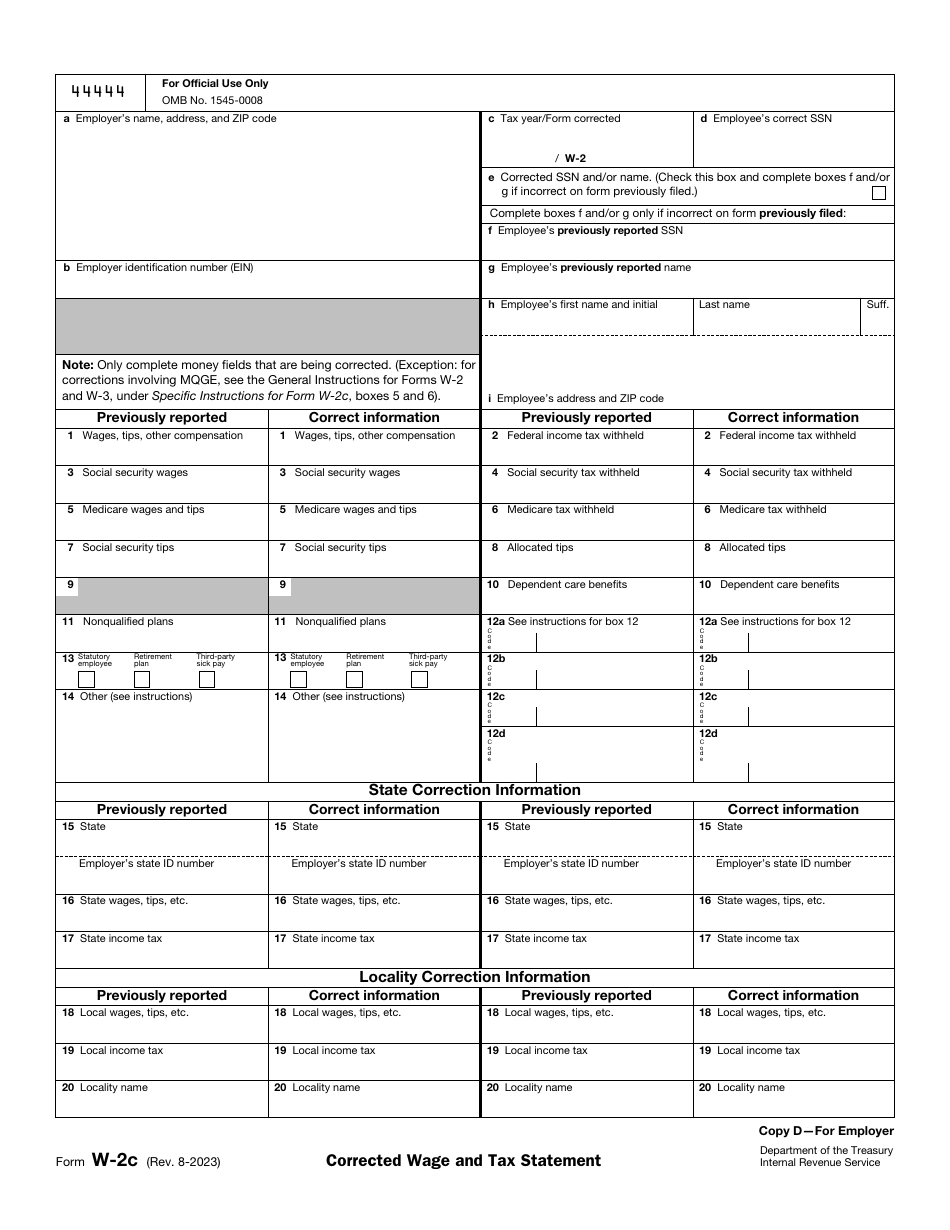

IRS Form W-2C Corrected Wage and Tax Statements

What Is IRS Form W-2C?

IRS Form W-2C, Corrected Wage and Tax Statements , is a supplementary instrument used by employers to handle errors they have made upon filing IRS Form W-2, Wage and Tax Statement.

Alternate Name:

- Tax Form W-2C.

Instead of preparing the same document once again or trying to contact the Social Security Administration to tell them about a single typing error you have made when completing the papers for the first time, you need to fill out a specific statement designed to make amends to previous versions of the form. Additionally, the employee who was affected by a mistake must be warned about it - they will need to enclose a copy of the form with the amended income statement and submit the documentation without delay.

This document was issued by the Internal Revenue Service (IRS) on August 1, 2023 - older editions are now obsolete. An IRS Form W-2C fillable version is available for download below.

Check the IRS W-2 Series Forms to see more IRS documents in this series.

Form W-2C Instructions

Follow these Form W-2C instructions to correct the mistakes on the Form W-2 you filed already:

-

Identify the employer by their name, address, and taxpayer identification number . Specify the tax year covered in the Form W-2 that is supposed to be corrected and list the social security number of the individual for whom you filed the form previously. If it is necessary to amend any of the employee's details, check the appropriate box and fix your errors in the fields below.

-

Proceed to the main part of the form that describes the wages the employee received, the tax that was deducted from that income, and their benefits and tips . You can skip all the fields that do not require correction - fill out the information that is different from the previous instrument. Do the same for state and local income tax.

-

Make sure you submit the W-2C Form right after you find a mistake in the statement you already sent to the Social Security Administration . The employer is also obliged to furnish several copies of the document to the employee as soon as they can - one copy will be sent alongside the federal income statement, the other must remain in the records of the individual, and the last will be attached to the local, city, or state income statement of the employee.

-

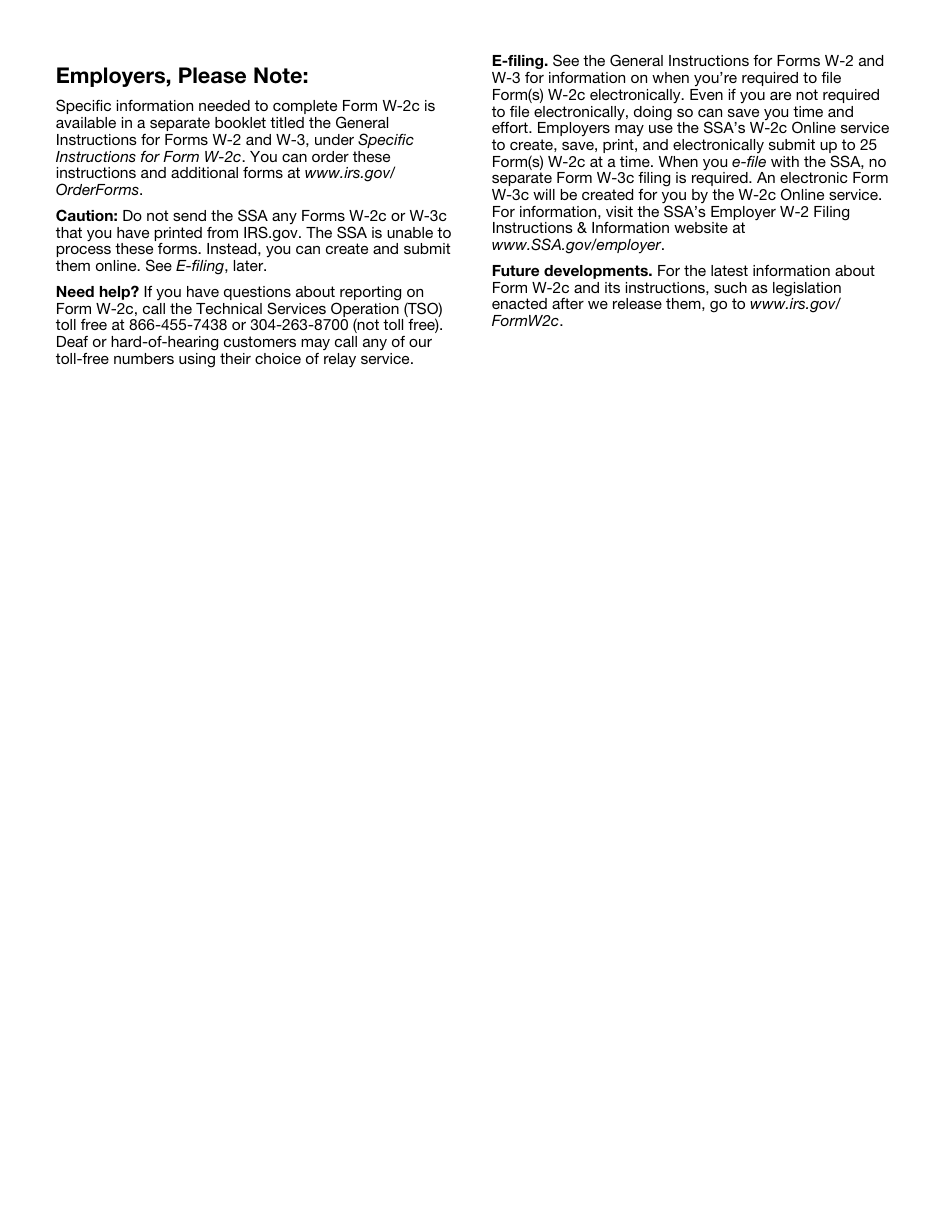

File the documentation with the Social Security Administration, Direct Operations Center, P.O. Box 3333, Wilkes-Barre, PA 18767-3333 . If it is more convenient for you to submit the form via a carrier, address the paperwork to the Social Security Administration, Direct Operations Center, Attn: W-2c Process, 1150 E. Mountain Drive, Wilkes-Barre, PA 18702-7997 . Attach IRS Form W-3C, Transmittal of Corrected Wage and Tax Statements, if you decide to send the form the traditional way.

-

Consider opting for e-filing - an electronic document remains the fastest and safest way to communicate with any authorities - even if you are not legally required to submit the statement online, it will save you both effort and time.

When Are W-2C Forms Due to Employees?

The Form W-2C due date is not fixed. Fill it out, provide to your employee, and file with the appropriate government agency (the Social Security Administration (SSA) and state, city, or local tax department) as soon as possible after discovering of an error. Furnish the report to the employee only if the Copy A of the form is already filed with the SSA. Otherwise, complete a new Form W-2 containing the correct information, file Copy A with the SSA, and write "Corrected" on the copies you furnish to your employee (Copies B, C, and 2).

IRS W-2C Related Forms

- IRS Form W-2AS, American Samoa Wage and Tax Statement. Complete this version of the Form W-2 to report the American Samoa earnings;

- IRS Form W-2GU, Guam Wage and Tax Statement. Fill out this document to provide information about the Guam salaries;

- IRS Form W-2VI, U.S. Virgin Islands Wage and Tax Statement. File this version of the document to report the required information about the U.S. Virgin Islands wages;

- IRS Form W-2G, Certain Gambling Winnings. Use this document to provide information about gambling winnings and taxes withheld on these winnings.