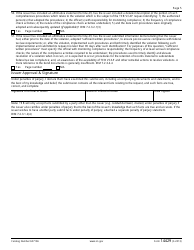

This version of the form is not currently in use and is provided for reference only. Download this version of

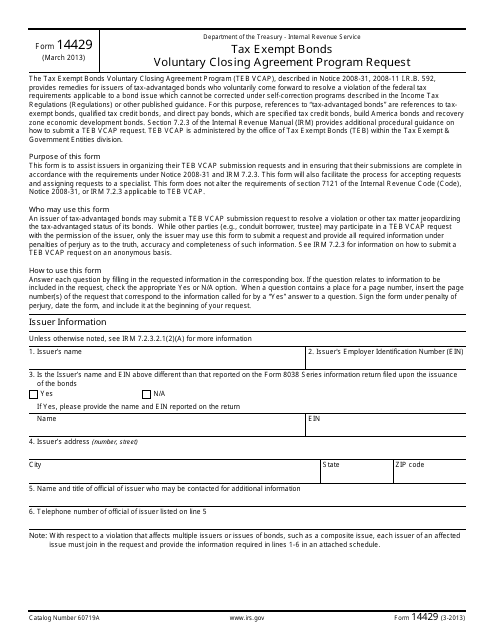

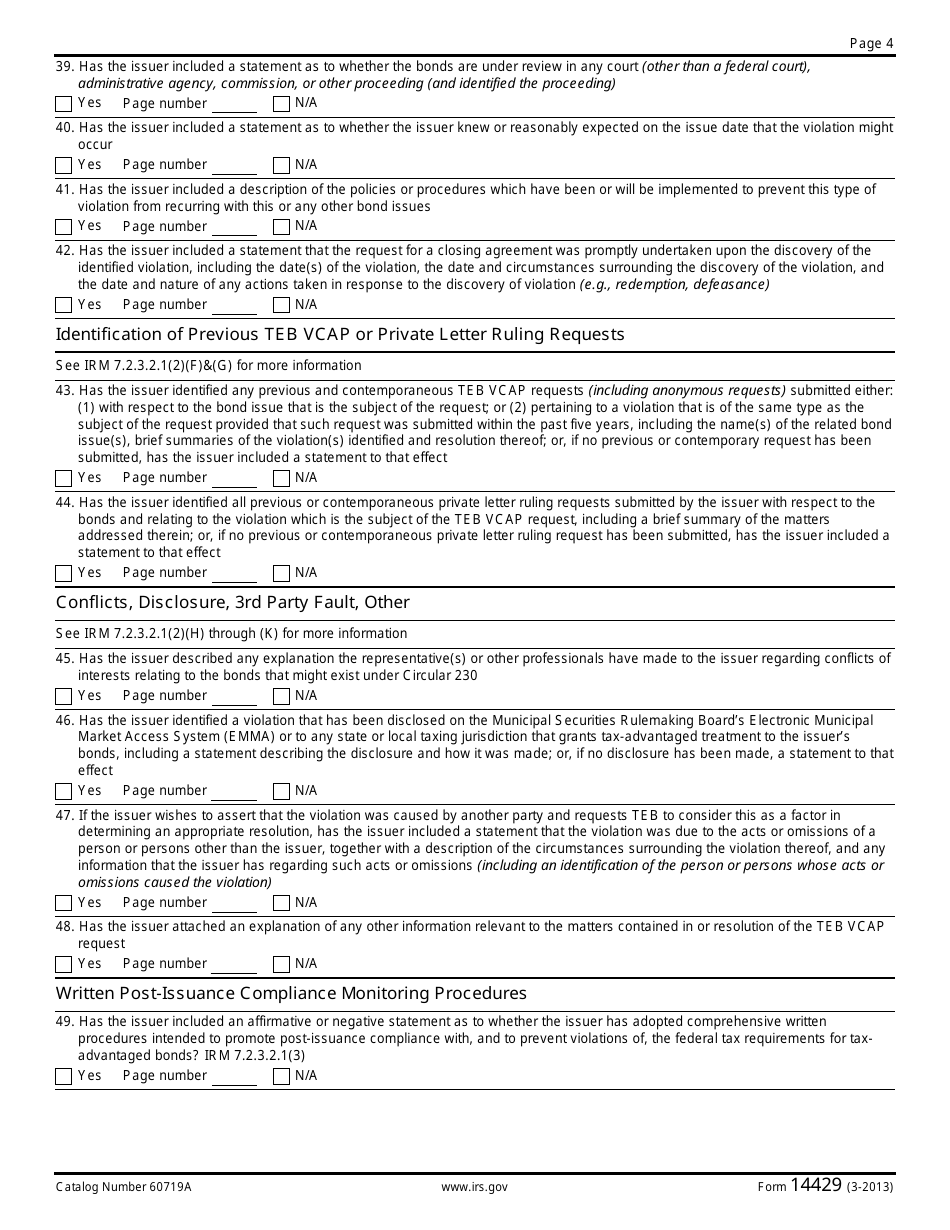

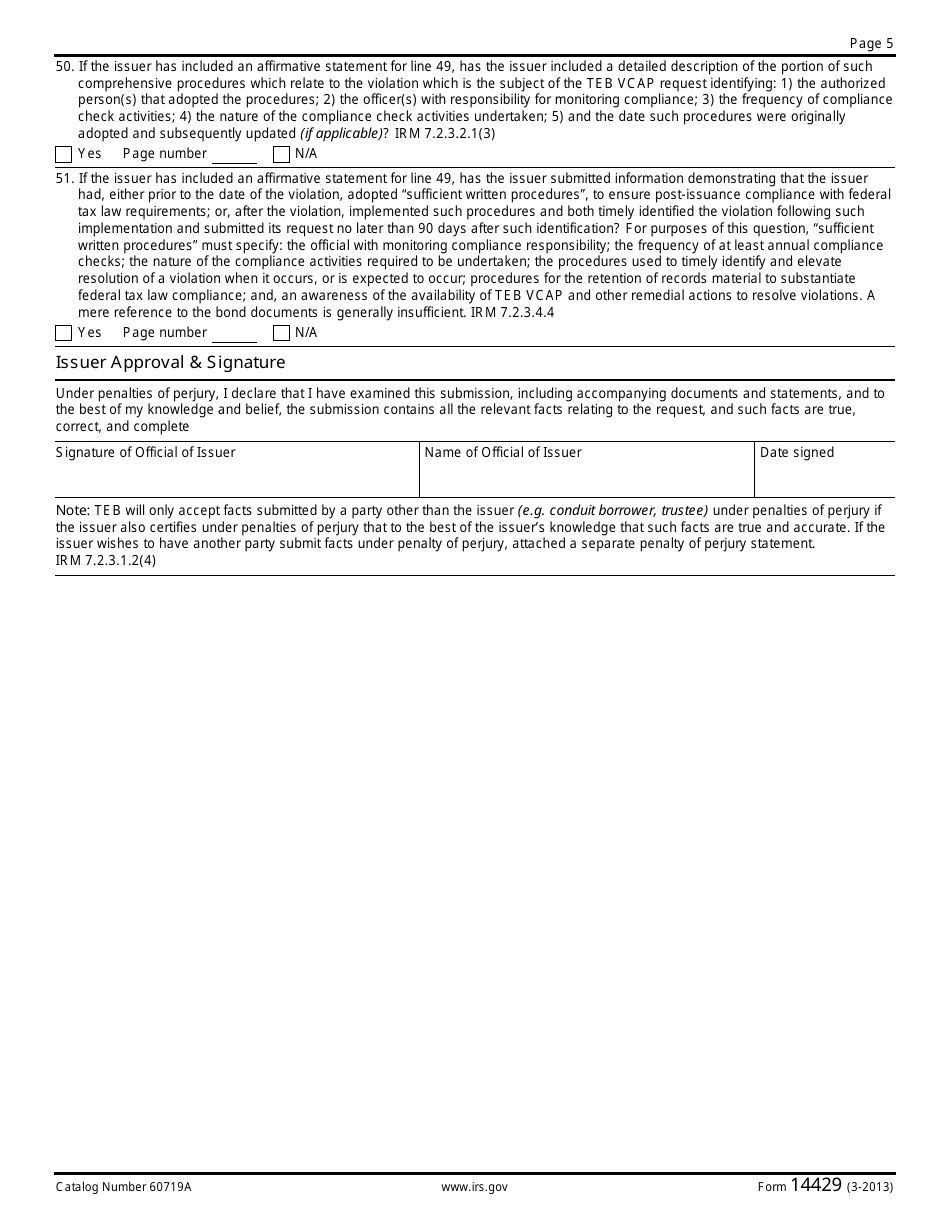

IRS Form 14429

for the current year.

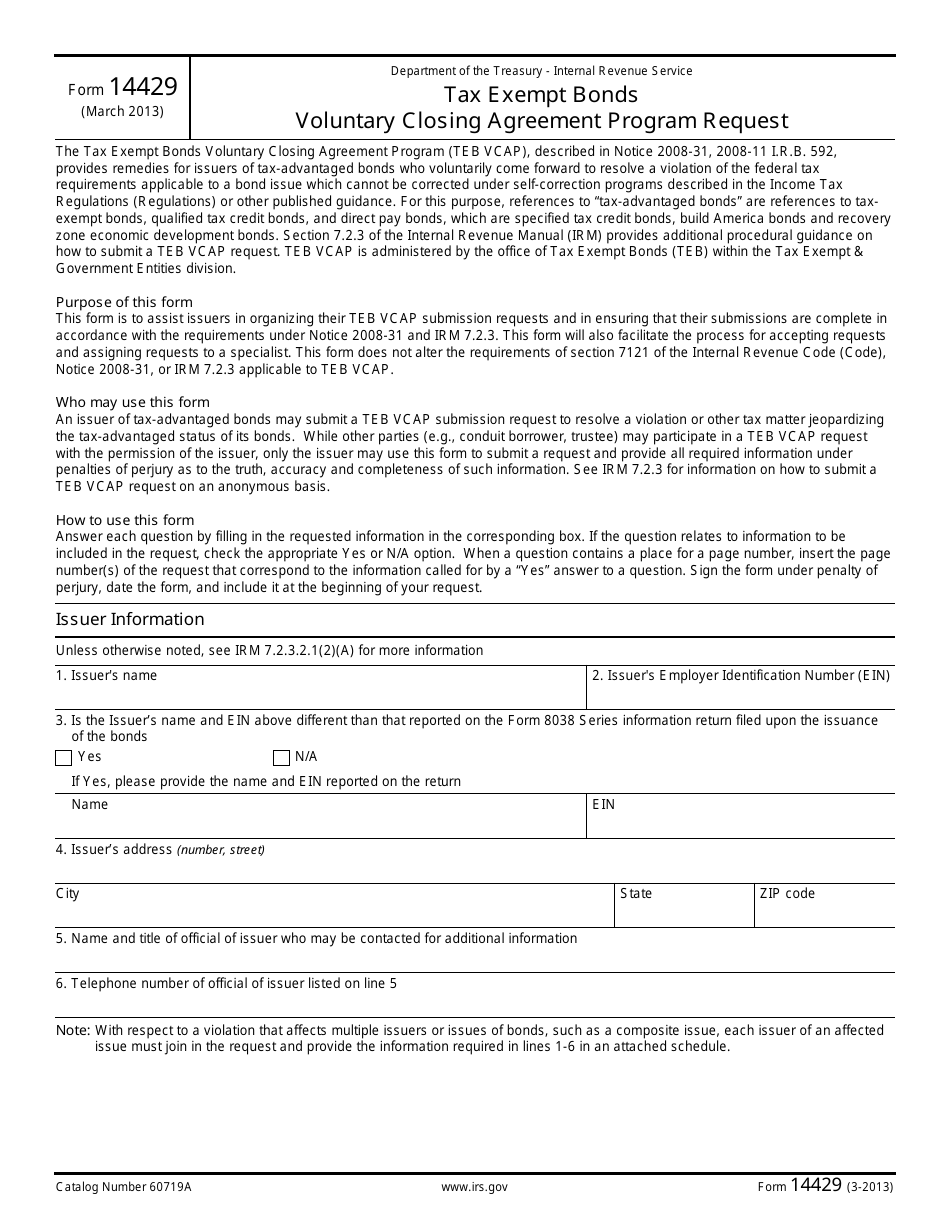

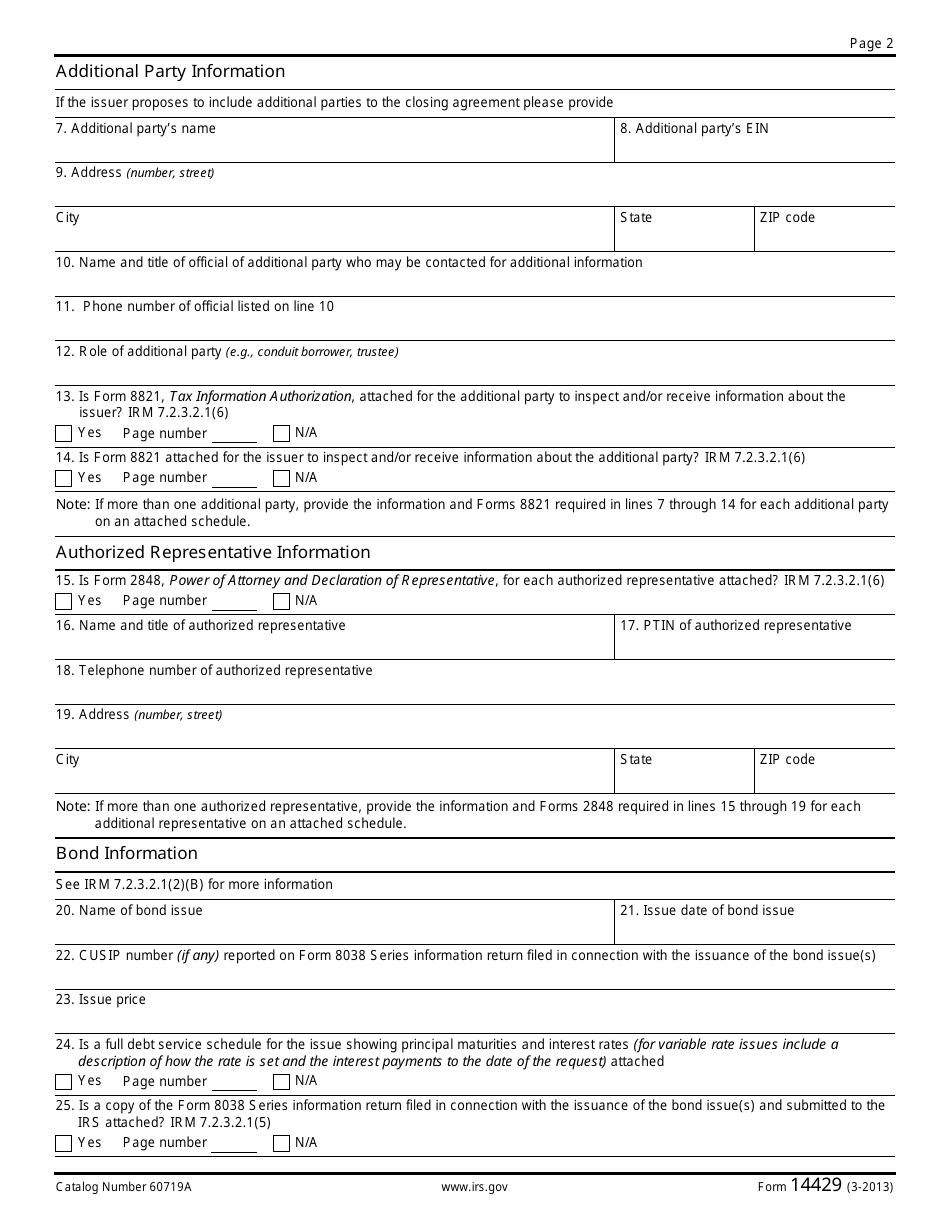

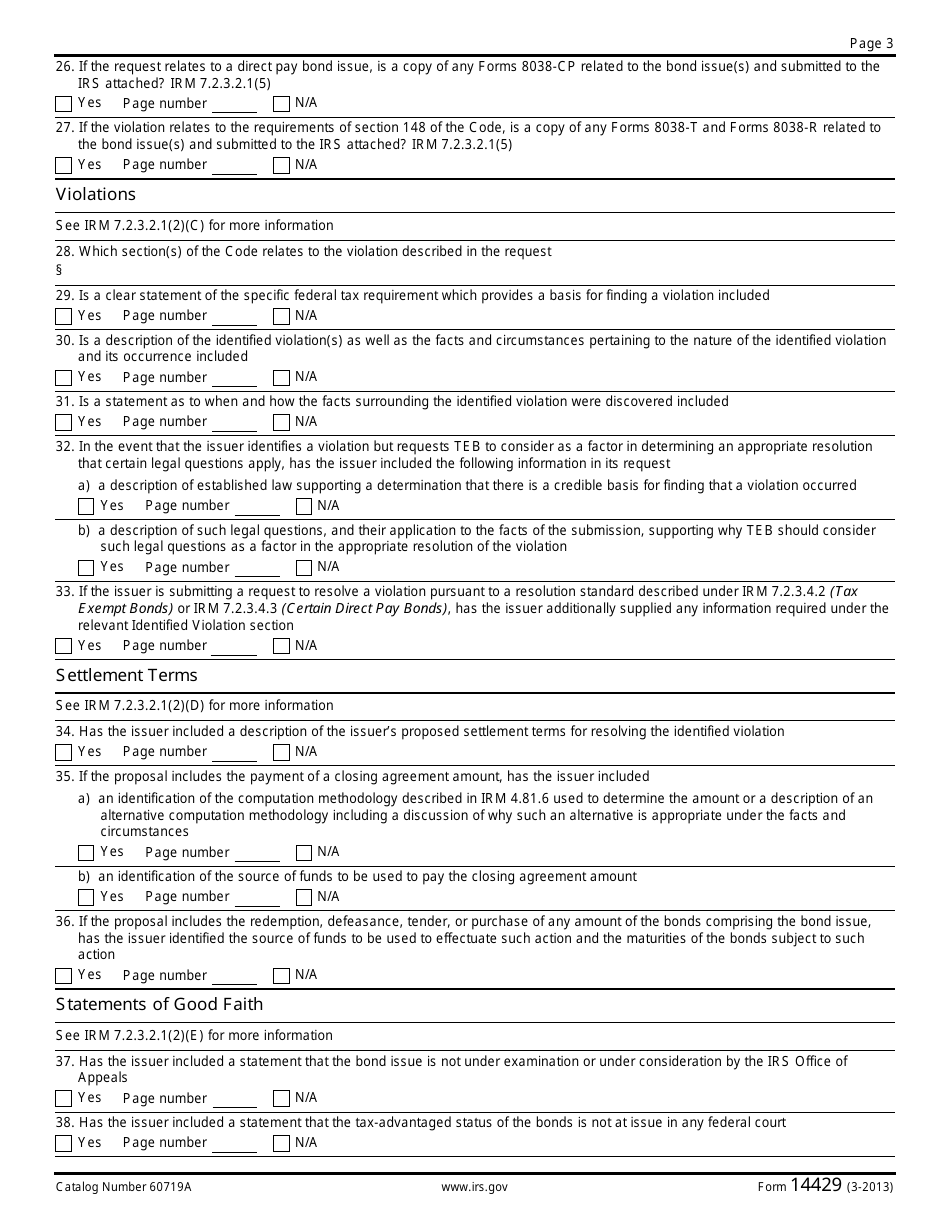

IRS Form 14429 Tax Exempt Bonds Voluntary Closing Agreement Program Request

What Is IRS Form 14429?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury on March 1, 2013. As of today, no separate filing guidelines for the form are provided by the IRS.

FAQ

Q: What is IRS Form 14429?

A: IRS Form 14429 is a form used for requesting participation in the Tax Exempt Bonds Voluntary Closing Agreement Program.

Q: What is the Tax Exempt Bonds Voluntary Closing Agreement Program?

A: The Tax Exempt Bonds Voluntary Closing Agreement Program is a program offered by the IRS that allows issuers of tax-exempt bonds to resolve certain compliance issues.

Q: Who can use IRS Form 14429?

A: IRS Form 14429 can be used by issuers of tax-exempt bonds who wish to participate in the Voluntary Closing Agreement Program.

Q: What is the purpose of the Voluntary Closing Agreement Program?

A: The purpose of the Voluntary Closing Agreement Program is to help issuers of tax-exempt bonds correct compliance issues and avoid potential tax consequences.

Q: How do I submit IRS Form 14429?

A: IRS Form 14429 should be completed and submitted according to the instructions provided by the IRS.

Q: Are there any fees associated with participating in the Voluntary Closing Agreement Program?

A: Yes, there are fees associated with participating in the Voluntary Closing Agreement Program. The specific fees are outlined in the program's guidelines.

Q: What compliance issues can be resolved through the Voluntary Closing Agreement Program?

A: The Voluntary Closing Agreement Program can be used to resolve various compliance issues related to tax-exempt bonds, such as arbitrage, yield restriction, and issue price violations.

Q: Can the Voluntary Closing Agreement Program be used for all types of tax-exempt bonds?

A: Yes, the Voluntary Closing Agreement Program can be used for all types of tax-exempt bonds, including governmental and private activity bonds.

Q: Is participating in the Voluntary Closing Agreement Program mandatory?

A: Participating in the Voluntary Closing Agreement Program is voluntary and not mandatory for issuers of tax-exempt bonds.

Form Details:

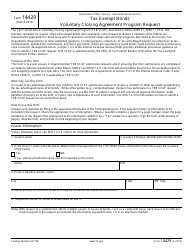

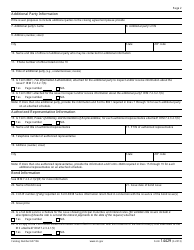

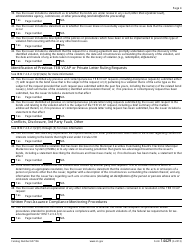

- A 5-page form available for download in PDF;

- Actual and valid for filing 2023 taxes;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 14429 through the link below or browse more documents in our library of IRS Forms.