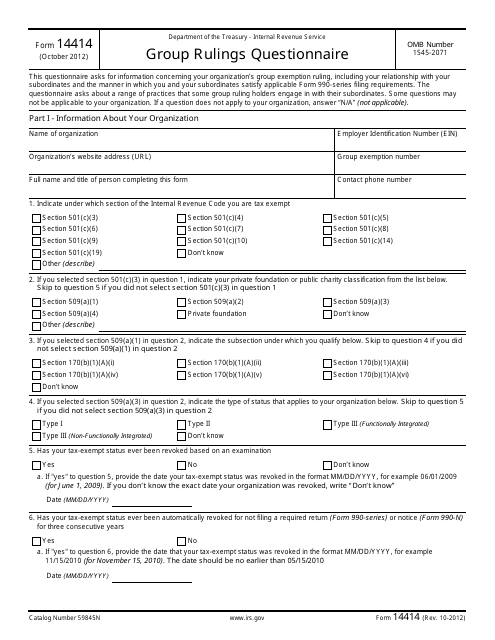

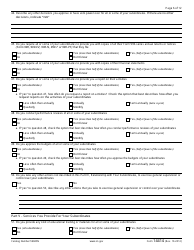

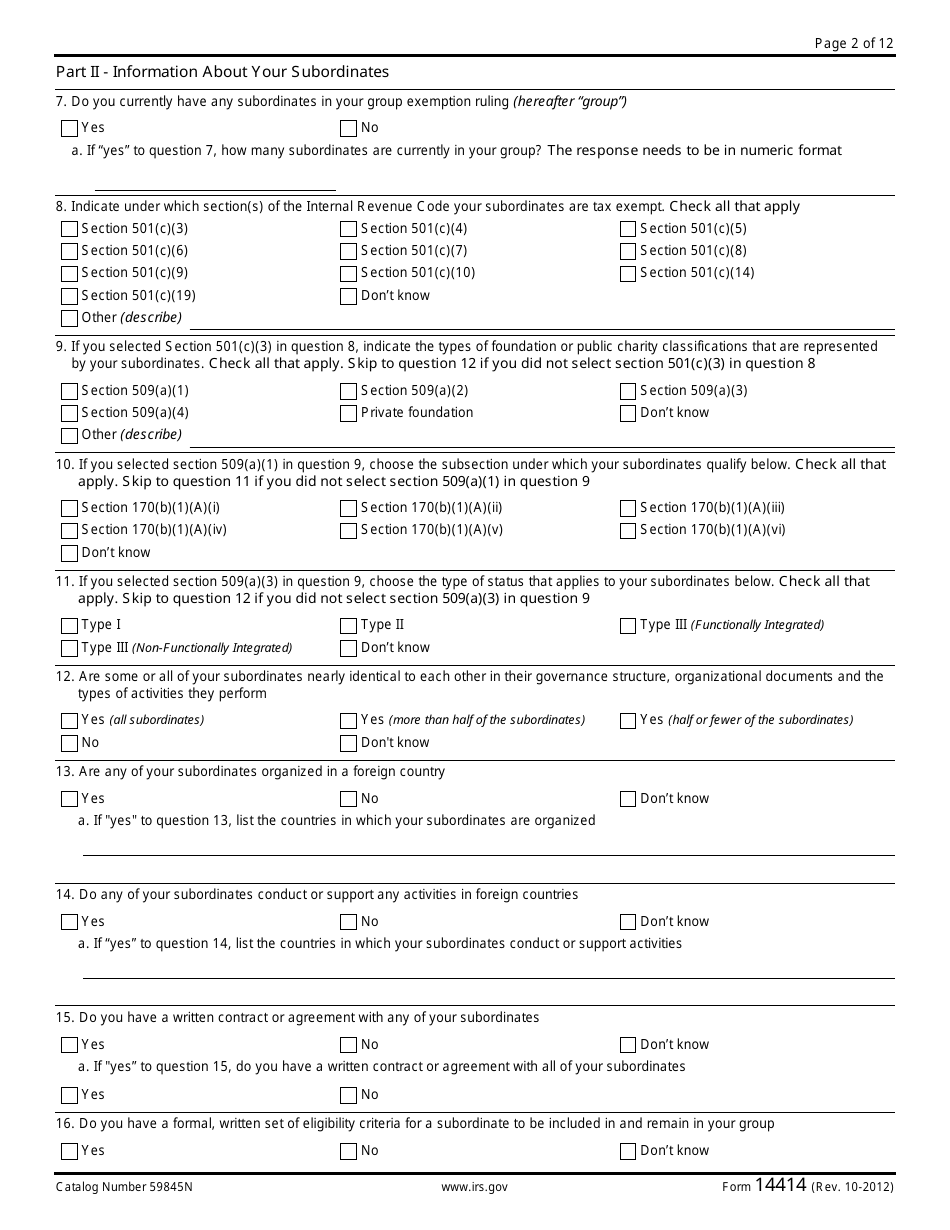

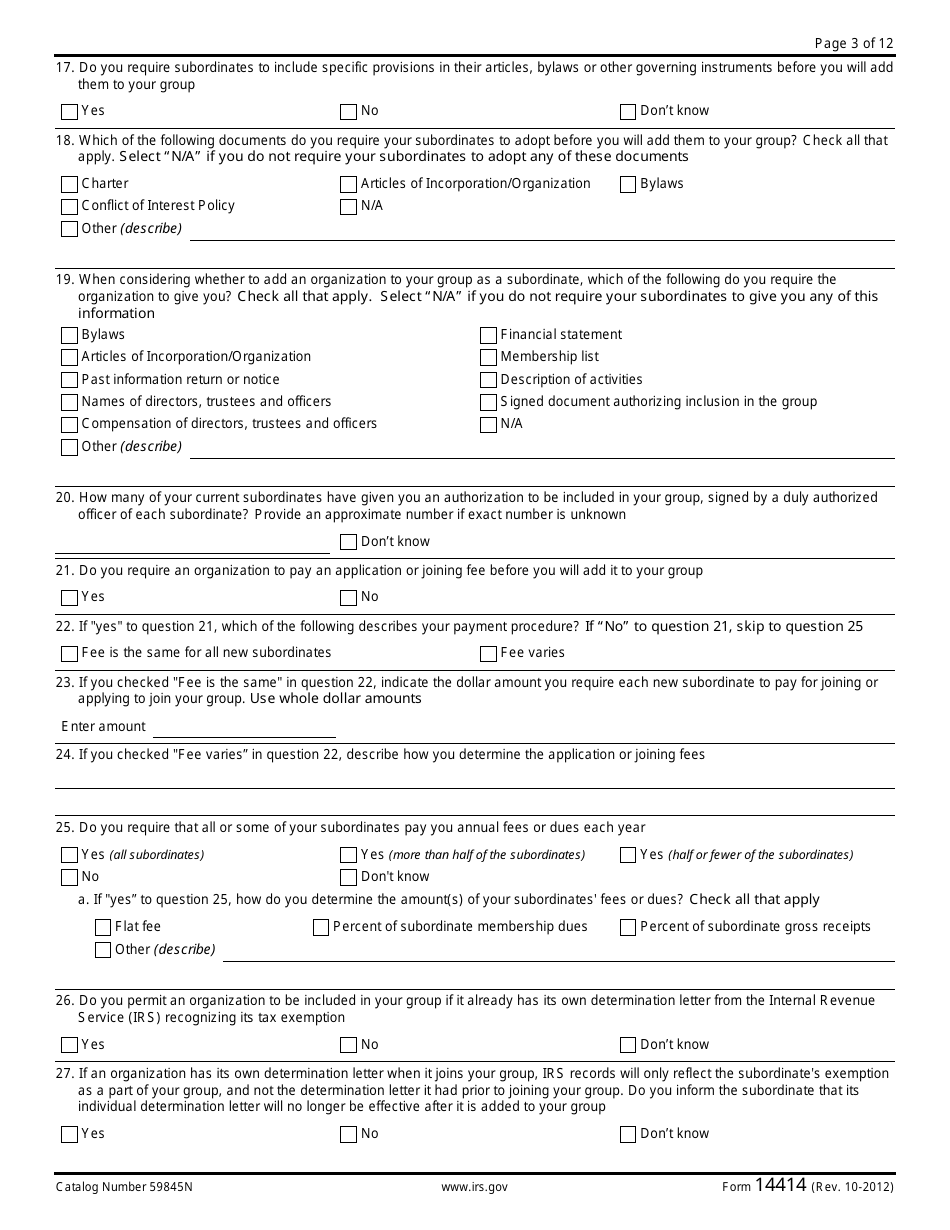

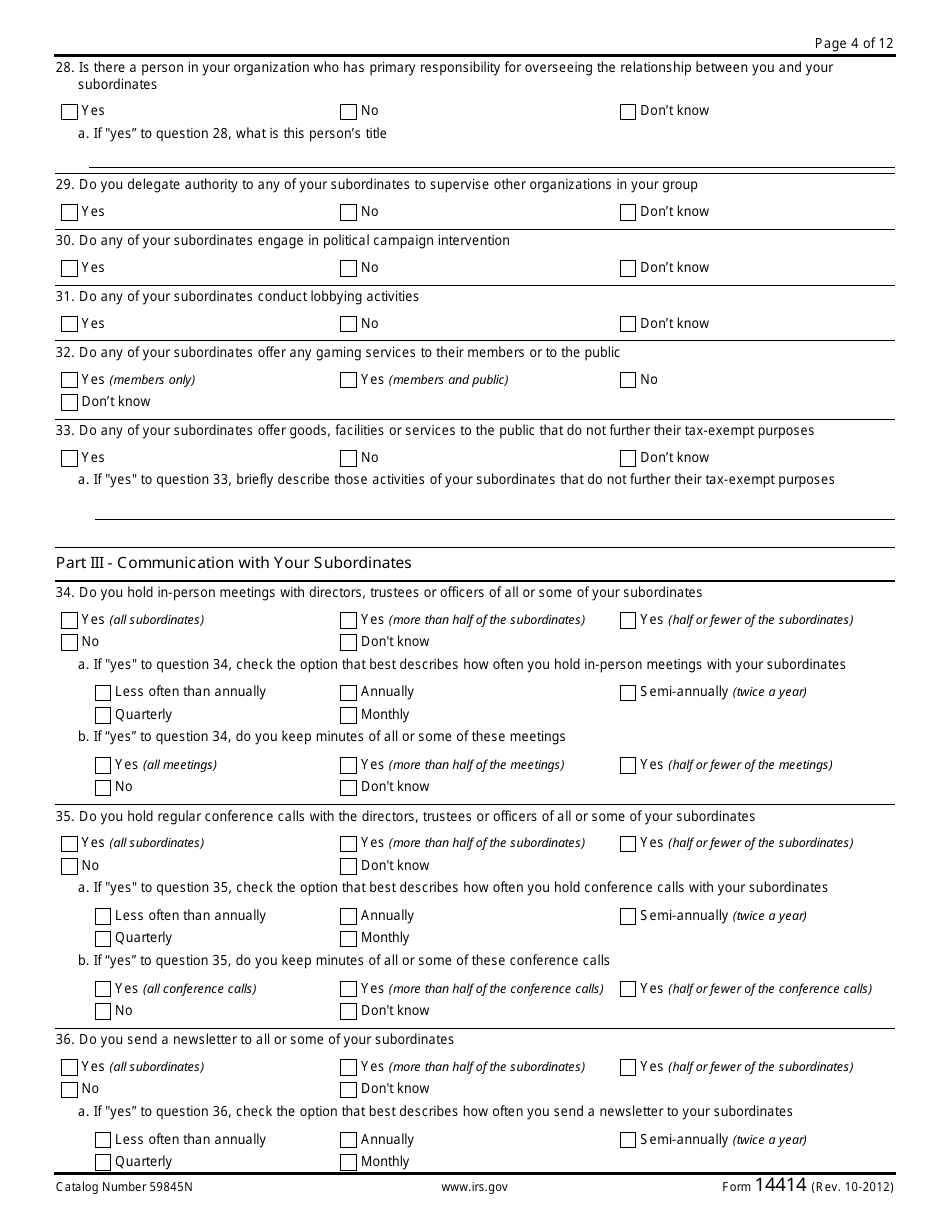

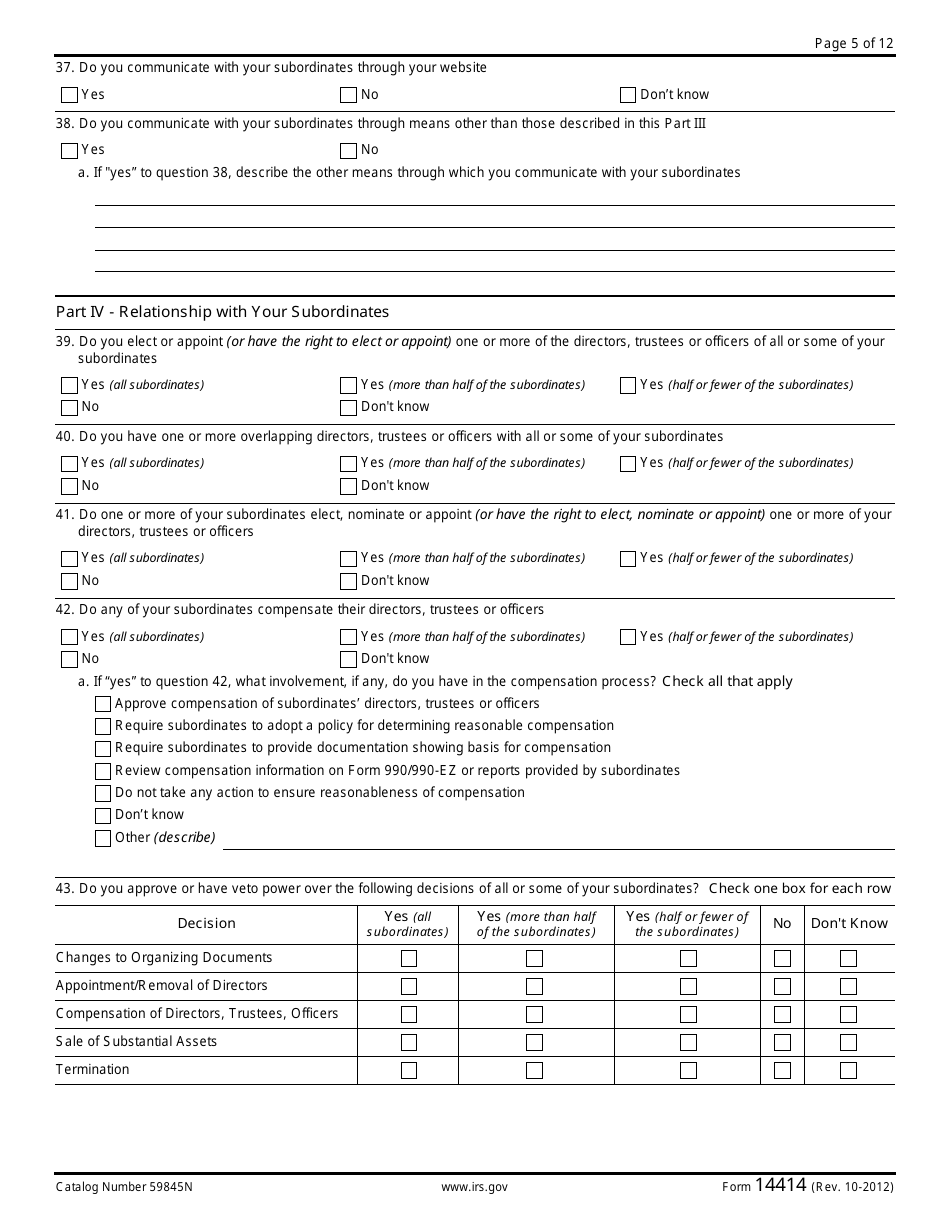

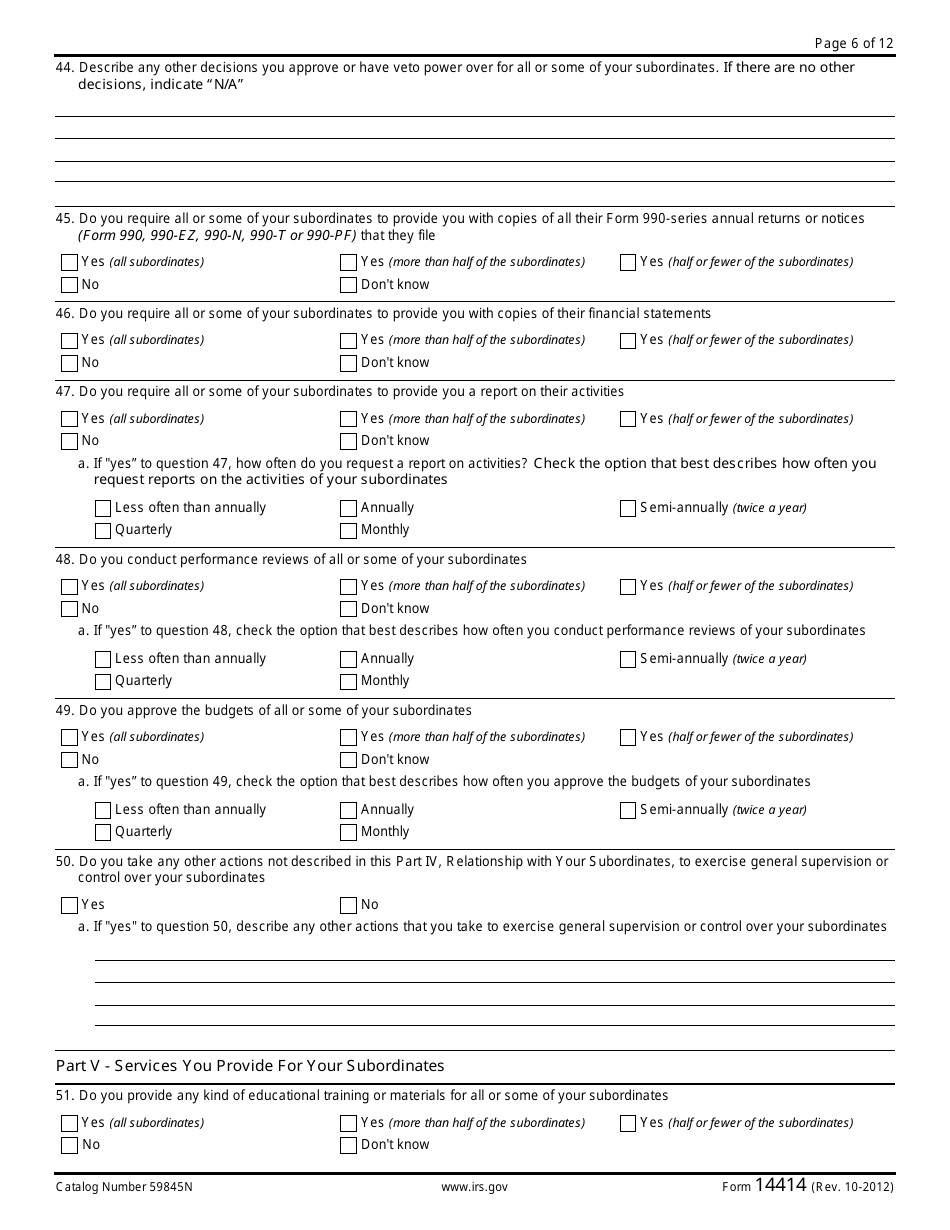

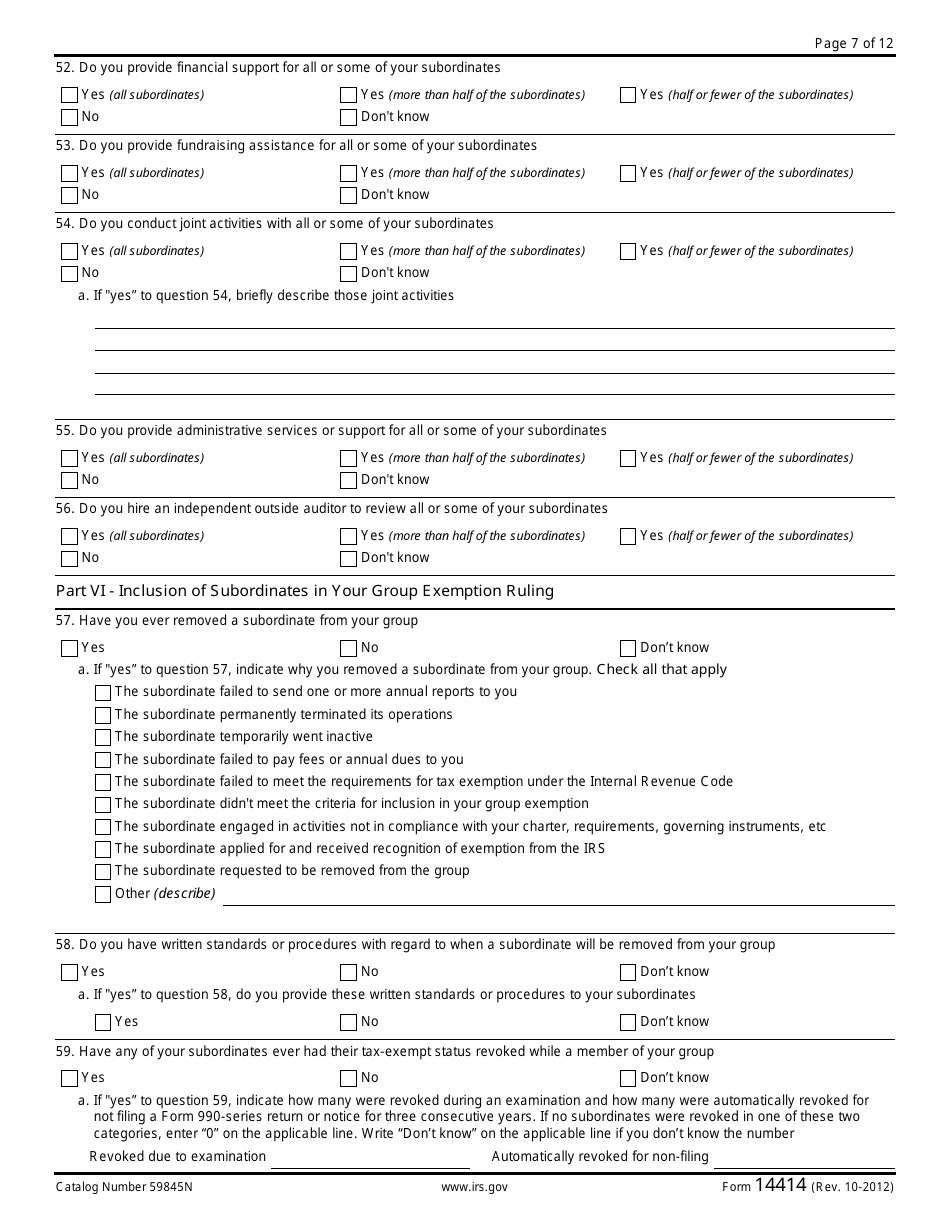

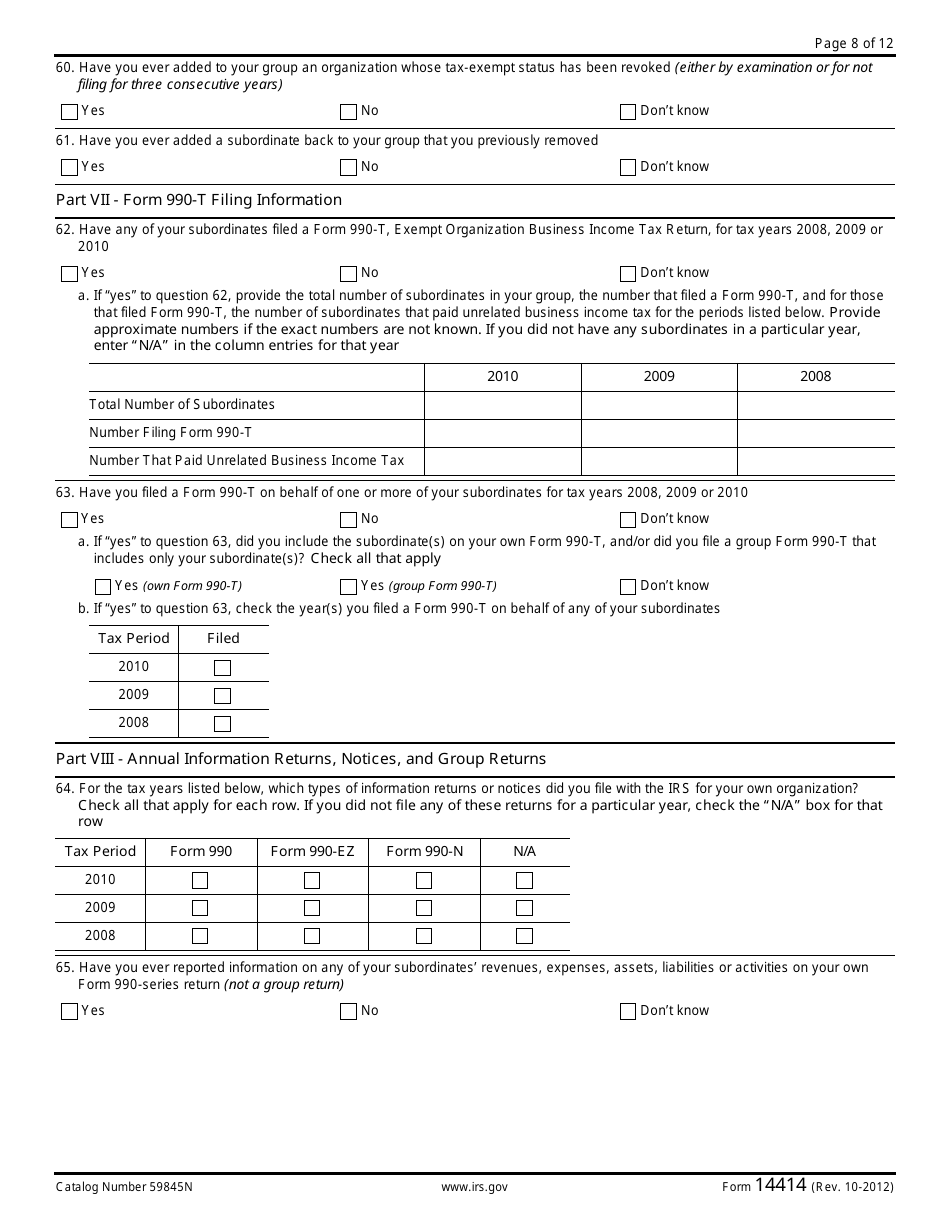

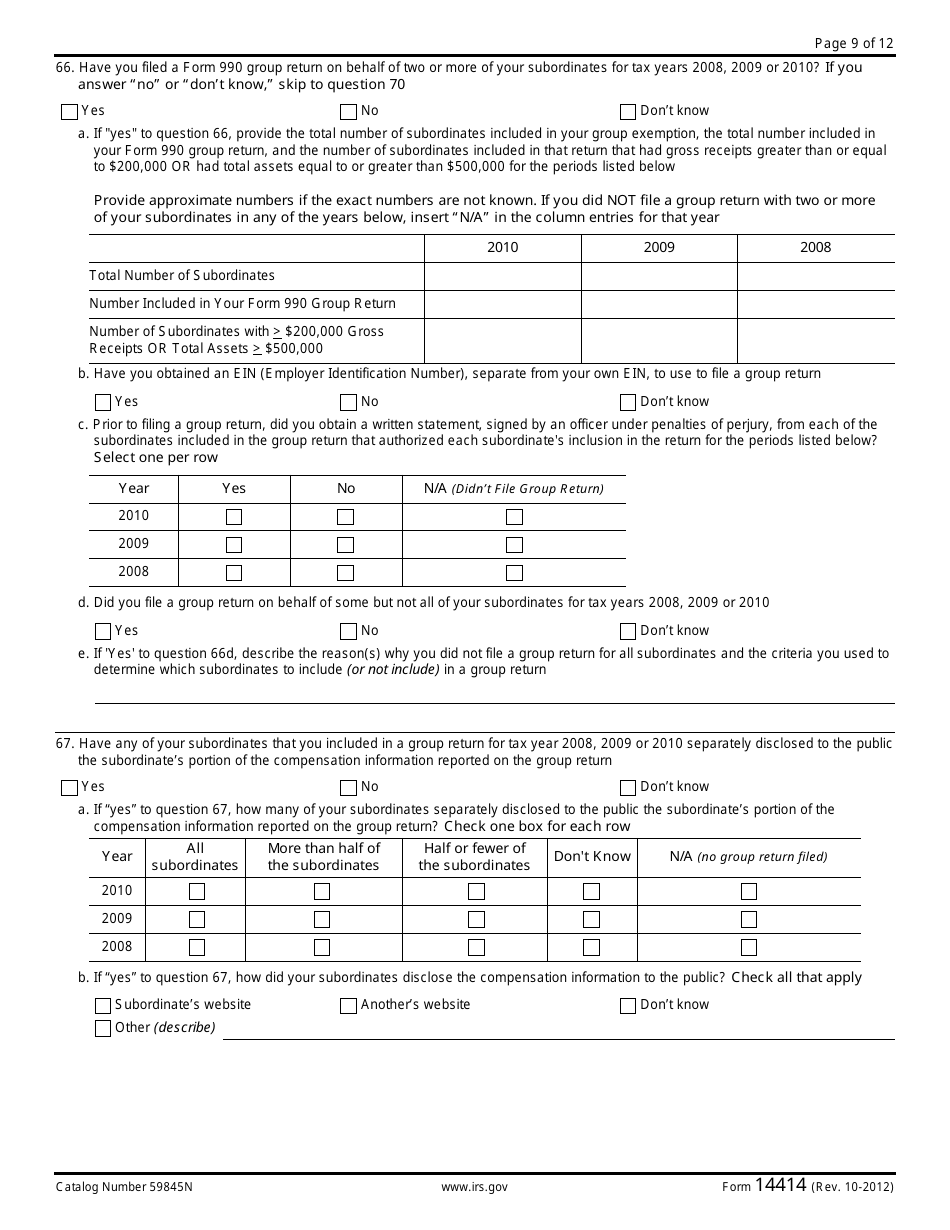

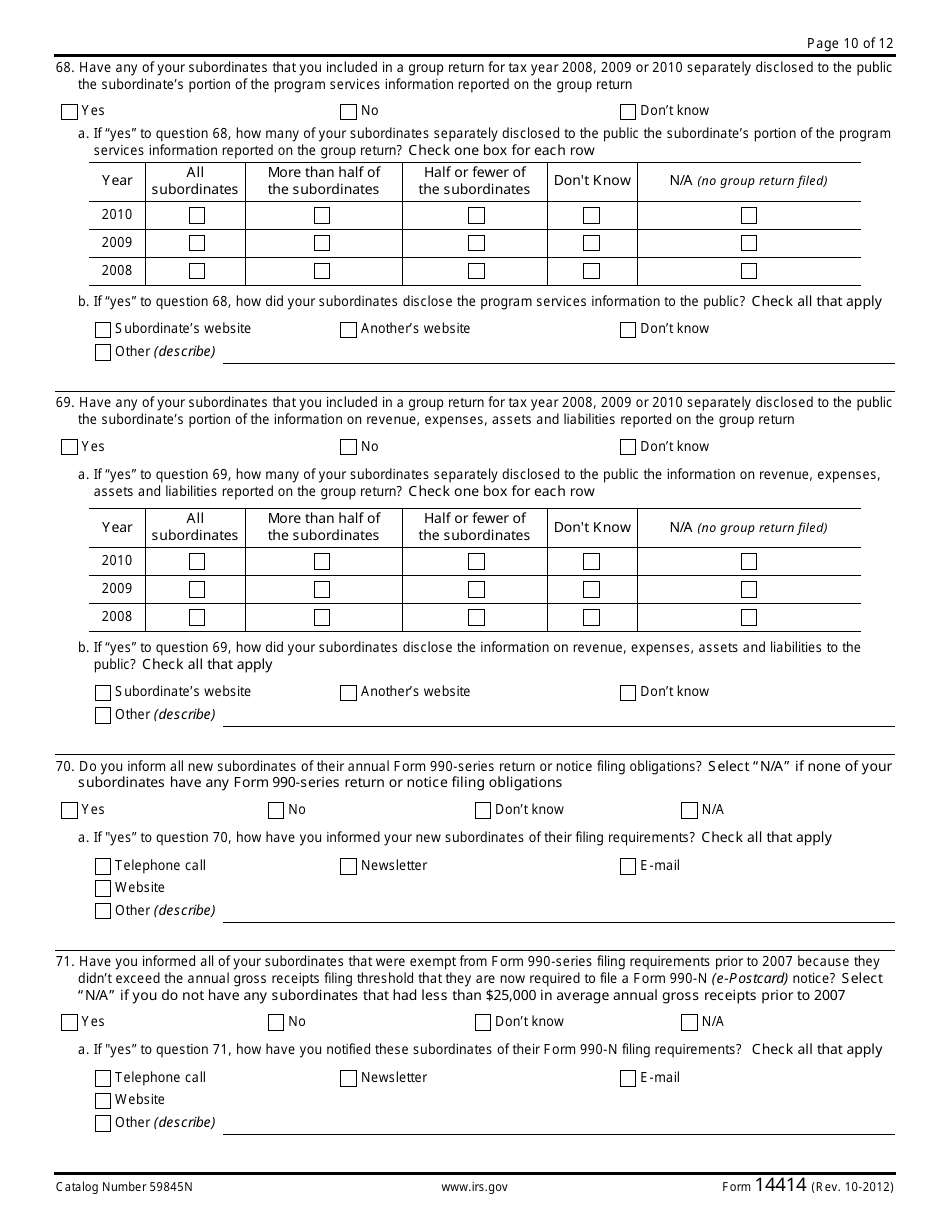

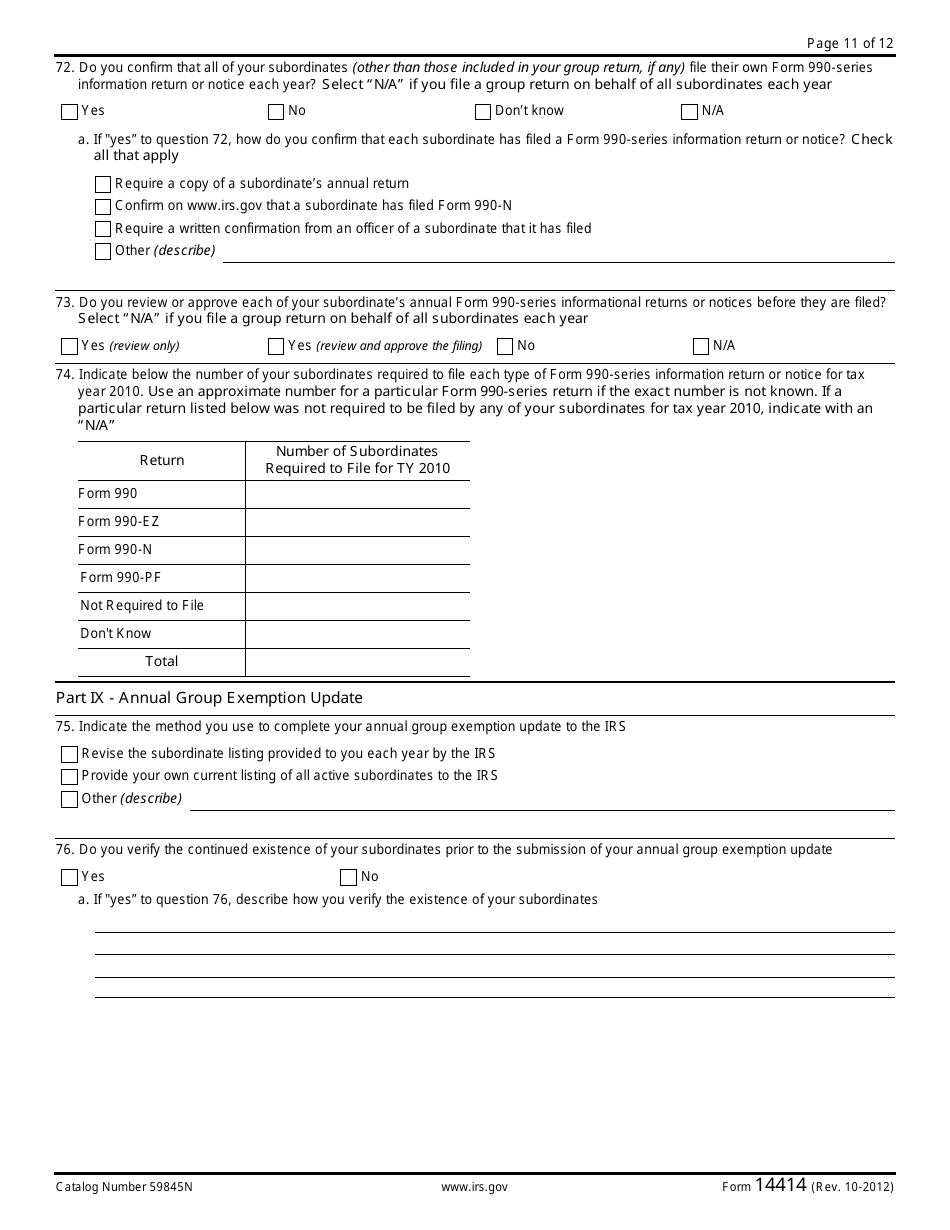

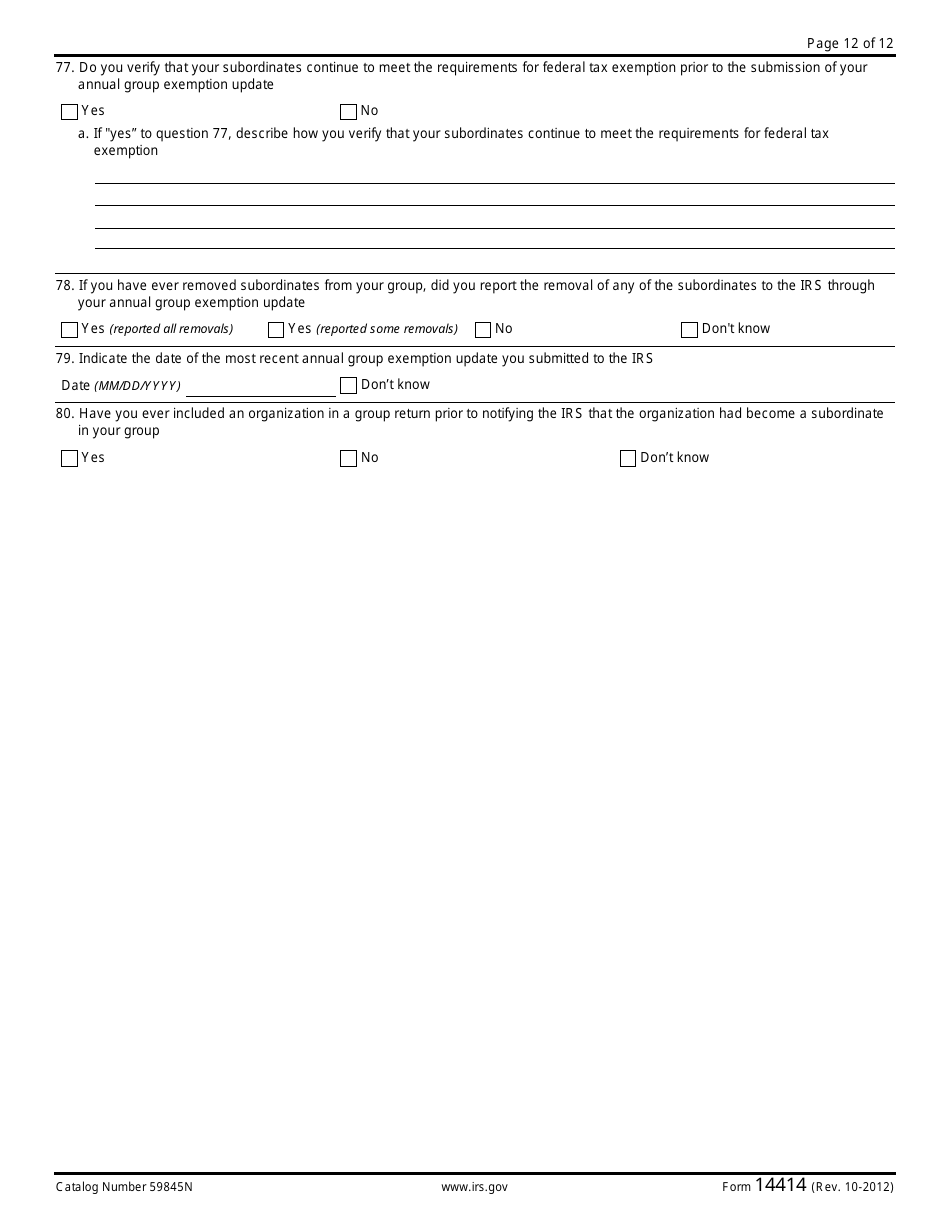

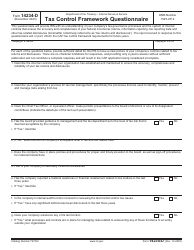

IRS Form 14414 Group Rulings Questionnaire

What Is IRS Form 14414?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury on October 1, 2012. As of today, no separate filing guidelines for the form are provided by the IRS.

FAQ

Q: What is IRS Form 14414?

A: IRS Form 14414 is the Group Rulings Questionnaire.

Q: Who needs to fill out IRS Form 14414?

A: Nonprofit organizations seeking a group exemption letter from the IRS need to fill out Form 14414.

Q: What is a group exemption letter?

A: A group exemption letter allows a central organization to hold a tax-exempt status on behalf of its subordinates.

Q: Why is IRS Form 14414 important?

A: Completing Form 14414 is necessary to apply for a group exemption letter and maintain tax-exempt status for subordinate organizations.

Form Details:

- A 12-page form available for download in PDF;

- Actual and valid for filing 2023 taxes;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 14414 through the link below or browse more documents in our library of IRS Forms.