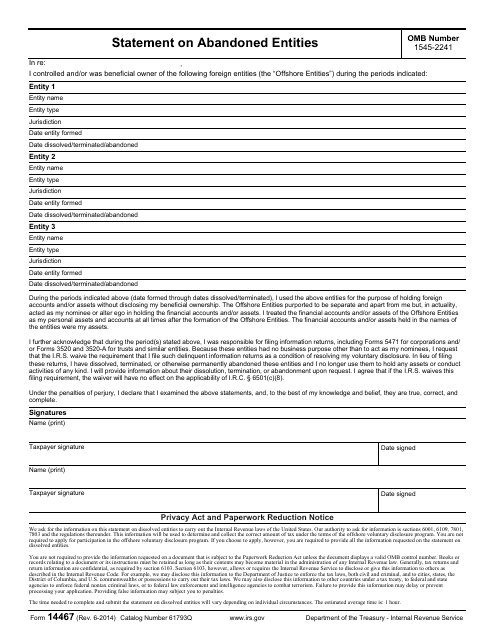

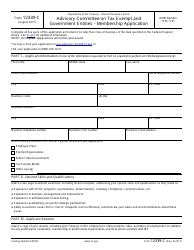

IRS Form 14467 Statement on Abandoned Entities

What Is IRS Form 14467?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury on June 1, 2014. As of today, no separate filing guidelines for the form are provided by the IRS.

FAQ

Q: What is IRS Form 14467?

A: IRS Form 14467 is a statement on abandoned entities.

Q: What is the purpose of IRS Form 14467?

A: The purpose of IRS Form 14467 is to report and provide information on abandoned entities.

Q: Who needs to file IRS Form 14467?

A: Any person or entity with knowledge of an abandoned entity is required to file IRS Form 14467.

Q: What is considered an abandoned entity?

A: An abandoned entity is an entity that has ceased business operations and has no known assets or liabilities.

Q: What information is required on IRS Form 14467?

A: IRS Form 14467 requires information such as the abandoned entity's name, address, taxpayer identification number, and the dates of abandonment.

Form Details:

- A 1-page form available for download in PDF;

- Actual and valid for filing 2023 taxes;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 14467 through the link below or browse more documents in our library of IRS Forms.