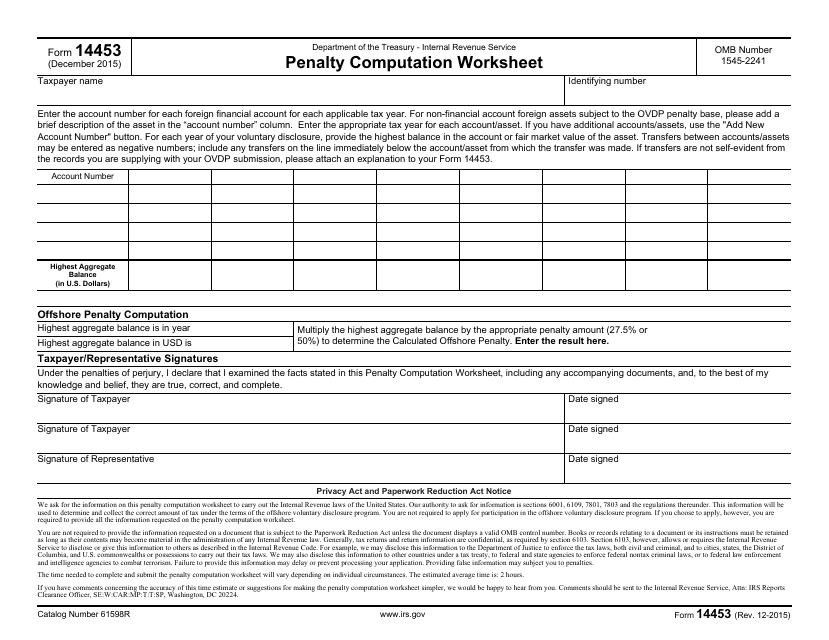

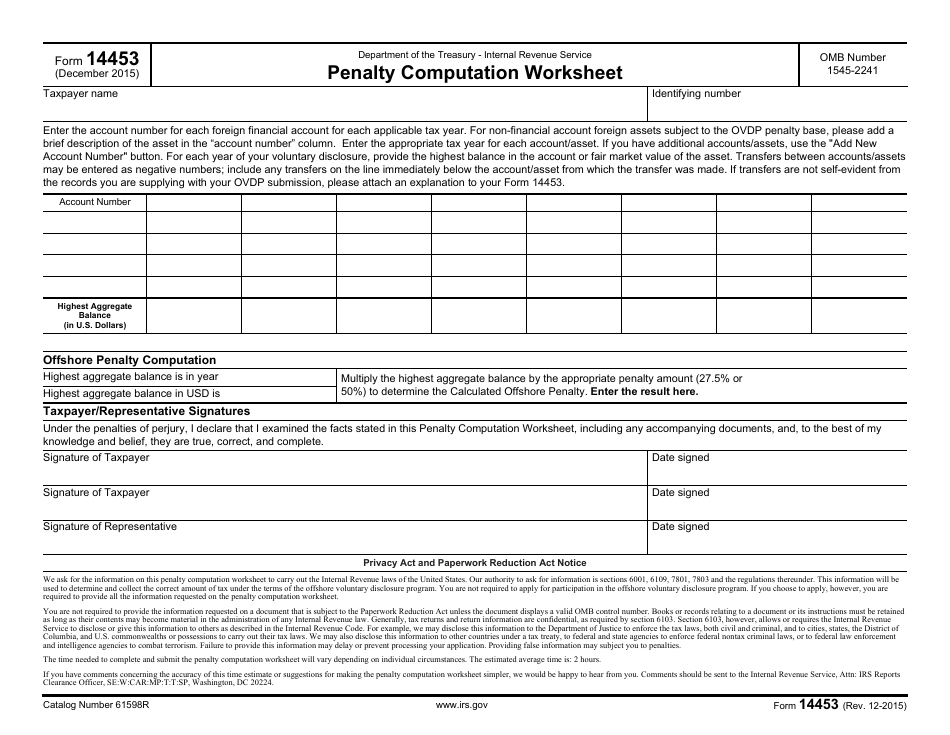

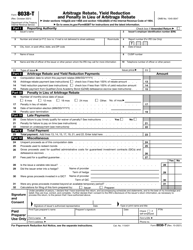

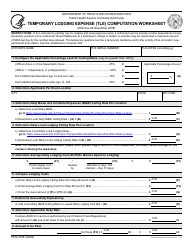

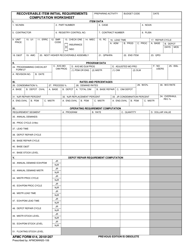

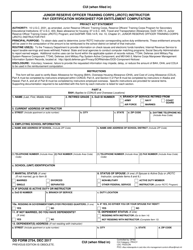

IRS Form 14453 Penalty Computation Worksheet

What Is IRS Form 14453?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury on December 1, 2015. As of today, no separate filing guidelines for the form are provided by the IRS.

FAQ

Q: What is IRS Form 14453?

A: IRS Form 14453 is a Penalty Computation Worksheet.

Q: What is the purpose of IRS Form 14453?

A: The purpose of IRS Form 14453 is to calculate penalties.

Q: Who needs to fill out IRS Form 14453?

A: Taxpayers who have underpaid their taxes may need to fill out IRS Form 14453.

Q: How is the penalty calculated using IRS Form 14453?

A: The penalty is calculated based on the amount of underpaid tax and the duration of the underpayment.

Q: Are there instructions for filling out IRS Form 14453?

A: Yes, the IRS provides instructions on how to fill out IRS Form 14453.

Q: Can filing IRS Form 14453 help reduce penalties?

A: Filing IRS Form 14453 can help taxpayers understand and calculate their penalties, but it does not guarantee a reduction.

Form Details:

- A 1-page form available for download in PDF;

- Actual and valid for filing 2023 taxes;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 14453 through the link below or browse more documents in our library of IRS Forms.