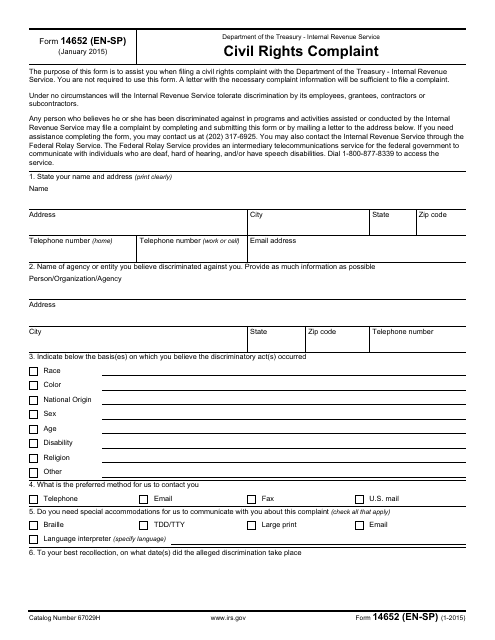

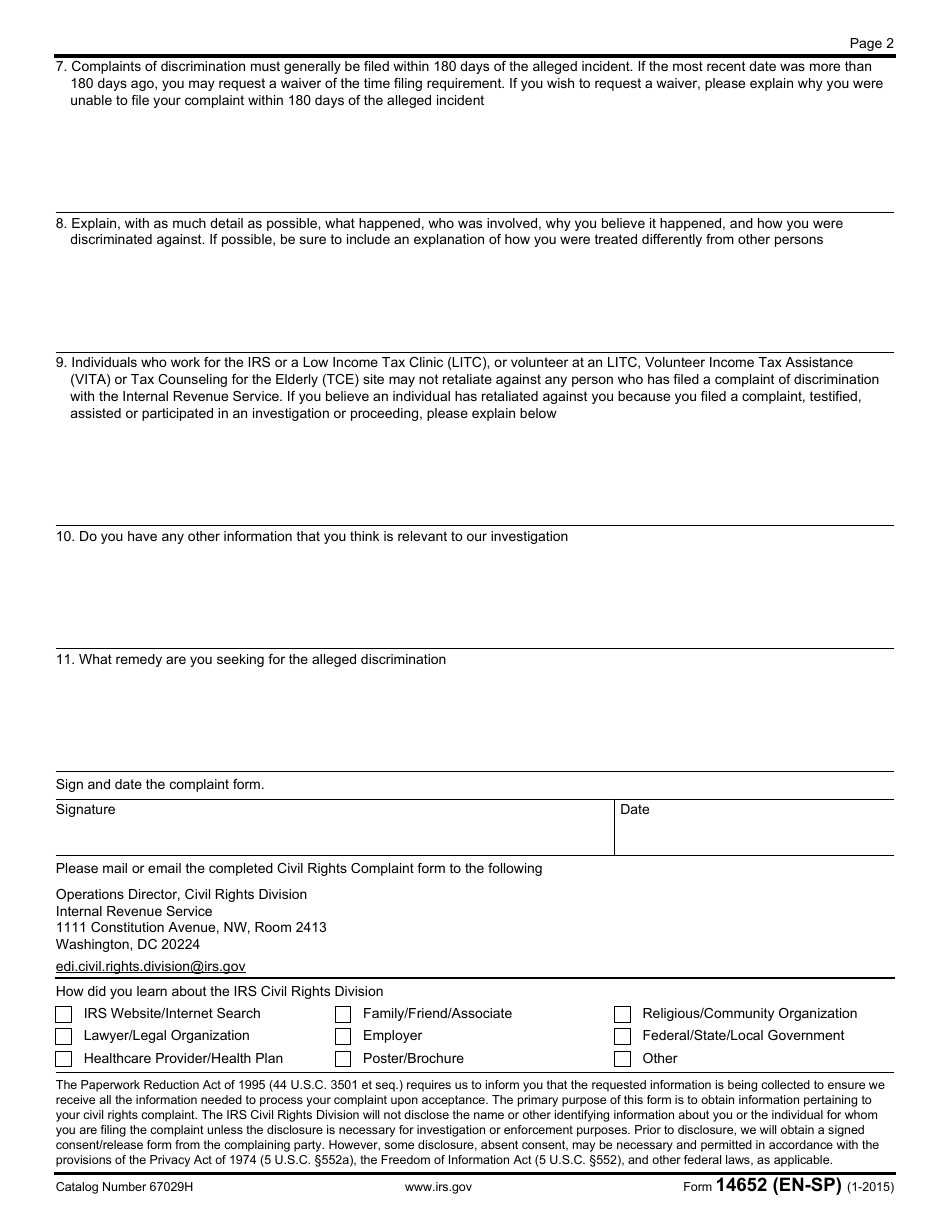

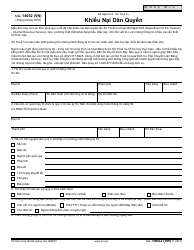

IRS Form 14652 (EN-SP) Civil Rights Complaint

What Is IRS Form 14652 (EN-SP)?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury on January 1, 2015. As of today, no separate filing guidelines for the form are provided by the IRS.

FAQ

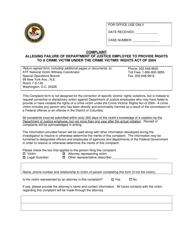

Q: What is IRS Form 14652?

A: IRS Form 14652 is a Civil Rights Complaint form that can be used to report any discrimination or civil rights violations by the Internal Revenue Service (IRS).

Q: Who can use IRS Form 14652?

A: Anyone who believes they have been discriminated against or experienced civil rights violations by the IRS can use IRS Form 14652 to file a complaint.

Q: What should I include in my complaint on IRS Form 14652?

A: In your complaint on IRS Form 14652, you should include detailed information about the discrimination or civil rights violation, as well as any supporting documentation.

Q: Is there a deadline for filing IRS Form 14652?

A: Yes, there is a deadline for filing IRS Form 14652. You should file your complaint within 180 days from the date of the alleged discrimination or civil rights violation.

Q: What happens after I file IRS Form 14652?

A: After you file IRS Form 14652, the IRS will review your complaint and investigate the allegations. They will then communicate their findings and any actions taken.

Q: Can I file IRS Form 14652 anonymously?

A: No, IRS Form 14652 does not allow for anonymous complaints. You are required to provide your personal information when filing the form.

Q: What if I need assistance in filling out IRS Form 14652?

A: If you need assistance in filling out IRS Form 14652, you can contact the IRS or seek assistance from a civil rights organization or legal professional.

Form Details:

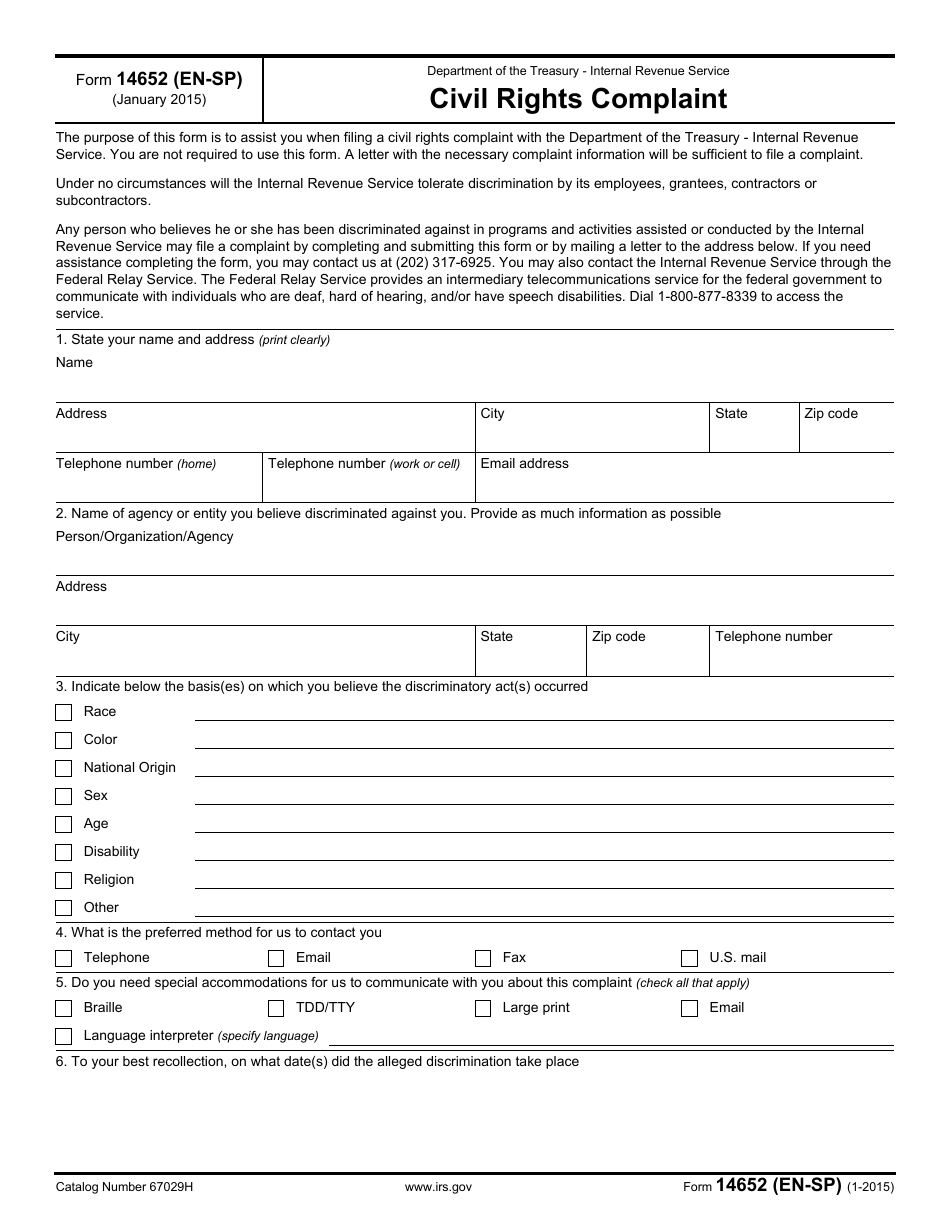

- A 2-page form available for download in PDF;

- Actual and valid for filing 2023 taxes;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 14652 (EN-SP) through the link below or browse more documents in our library of IRS Forms.