This version of the form is not currently in use and is provided for reference only. Download this version of

IRS Form 14568-G Schedule 7

for the current year.

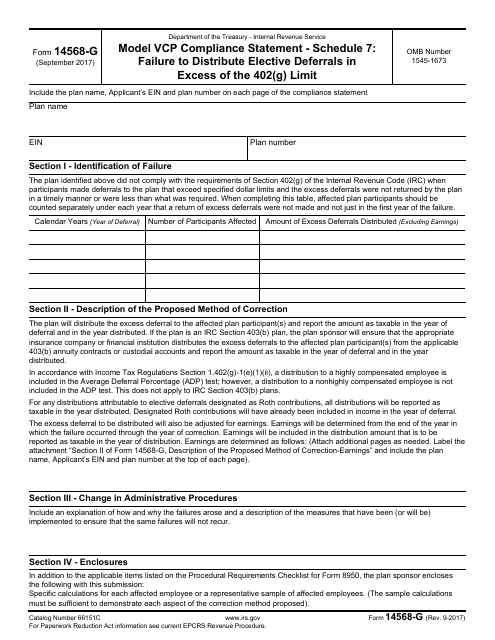

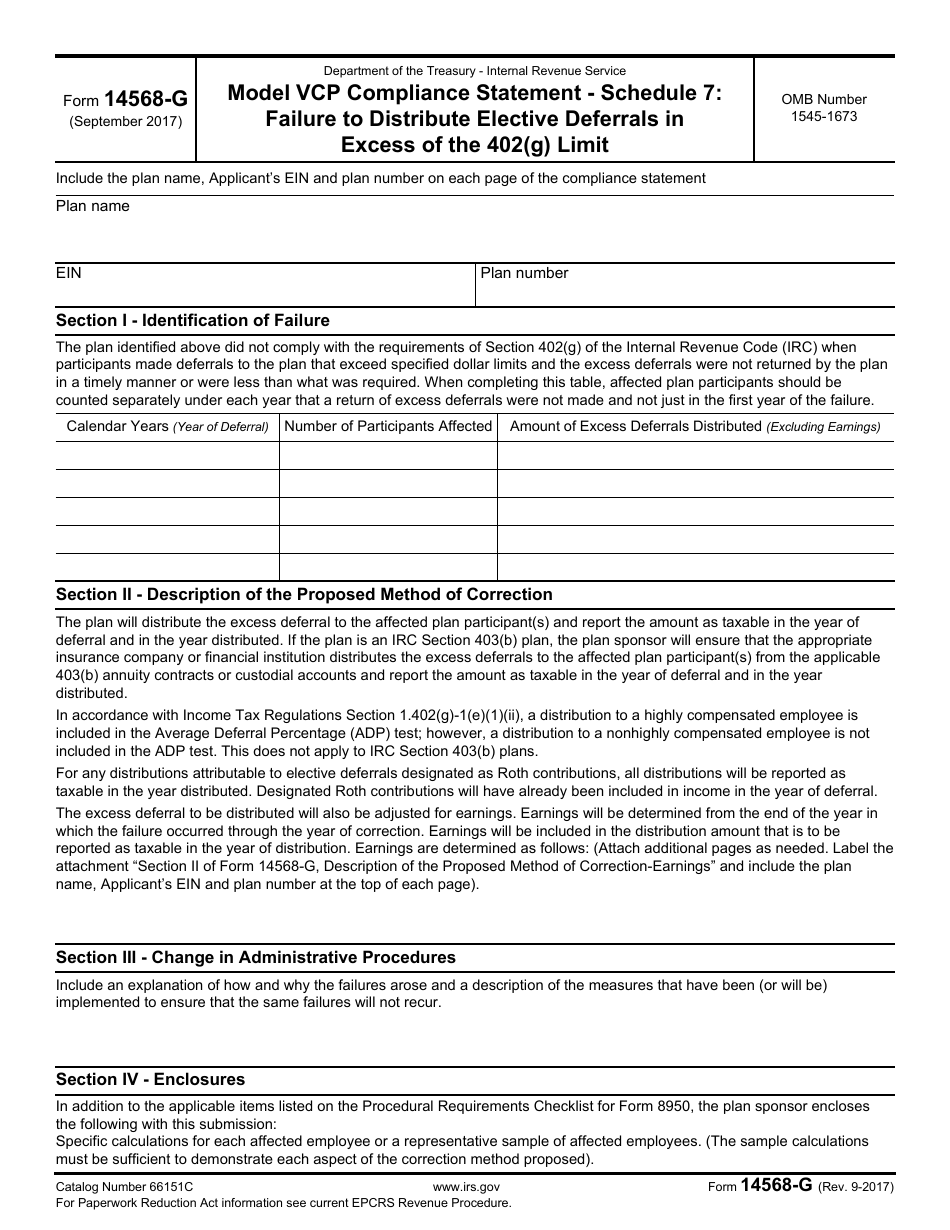

IRS Form 14568-G Schedule 7 Failure to Distribute Elective Deferrals in Excess of the 402(G) Limit

What Is IRS Form 14568-G Schedule 7?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury on September 1, 2017. As of today, no separate filing guidelines for the form are provided by the IRS.

FAQ

Q: What is IRS Form 14568-G Schedule 7?

A: IRS Form 14568-G Schedule 7 is a document used for reporting failure to distribute elective deferrals in excess of the 402(G) limit.

Q: What does the 402(G) limit refer to?

A: The 402(G) limit refers to the limit on elective deferrals that can be made to a retirement plan, such as a 401(k) or 403(b).

Q: When should I use IRS Form 14568-G Schedule 7?

A: You should use IRS Form 14568-G Schedule 7 when you need to report a failure to distribute elective deferrals in excess of the 402(G) limit.

Q: What happens if I fail to distribute elective deferrals in excess of the 402(G) limit?

A: If you fail to distribute elective deferrals in excess of the 402(G) limit, you may be subject to penalties and additional taxes.

Form Details:

- A 1-page form available for download in PDF;

- Actual and valid for filing 2023 taxes;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 14568-G Schedule 7 through the link below or browse more documents in our library of IRS Forms.