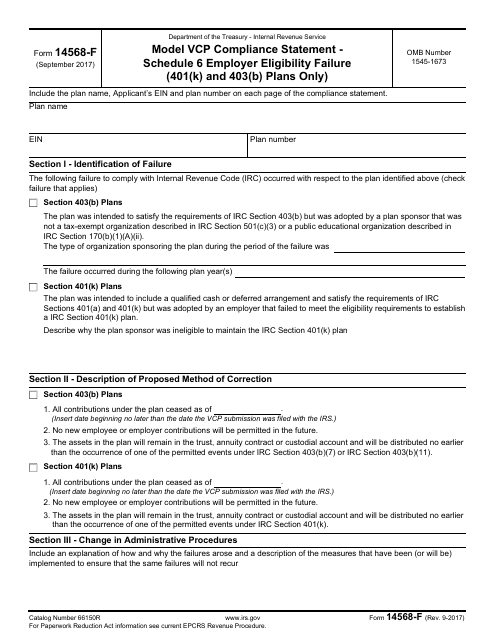

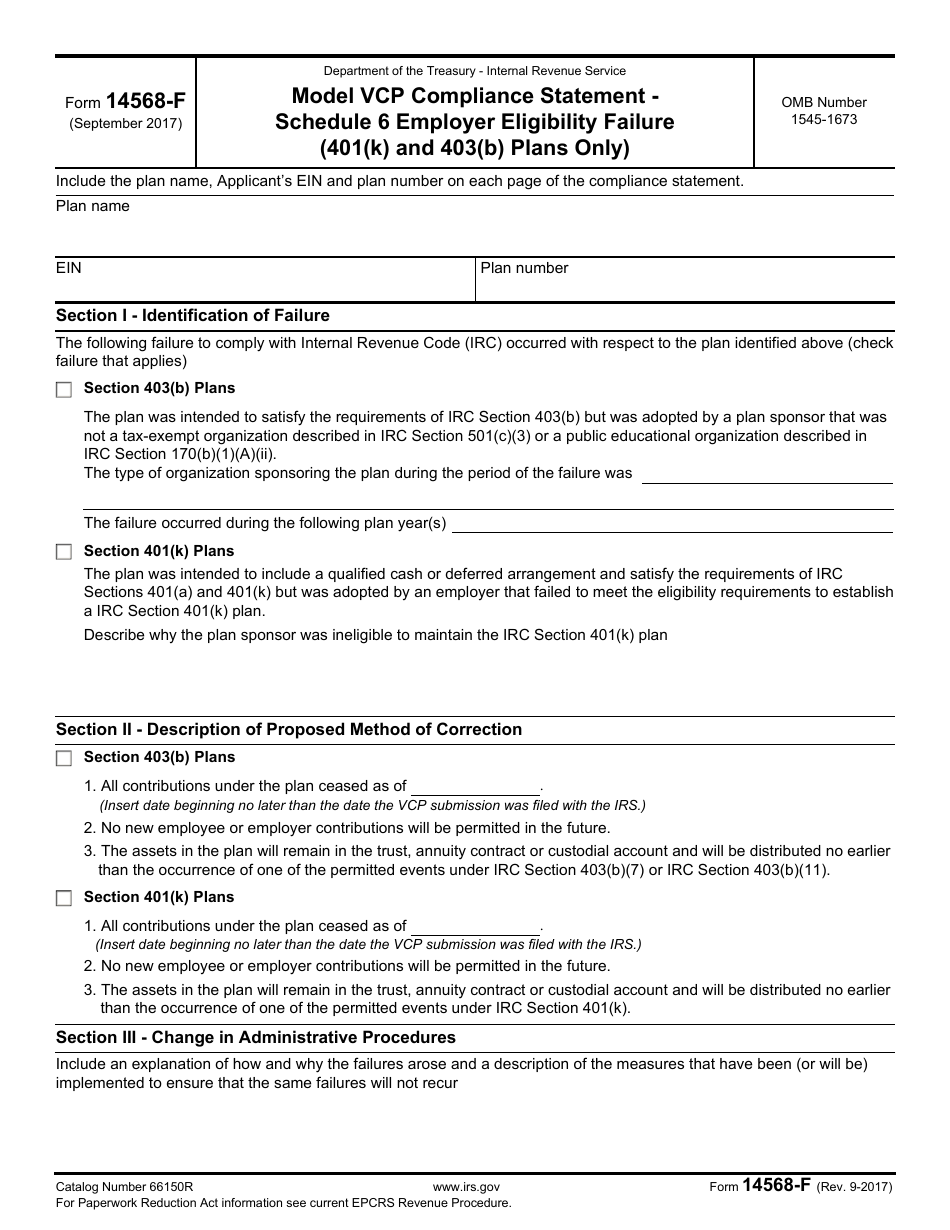

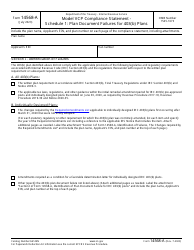

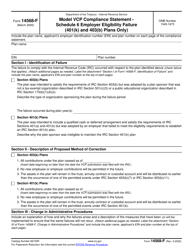

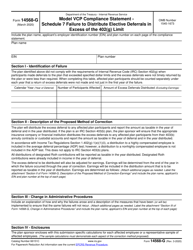

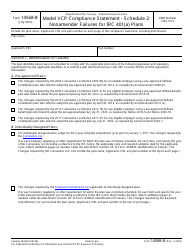

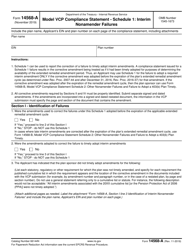

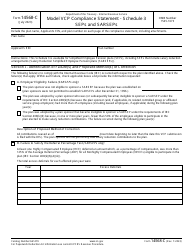

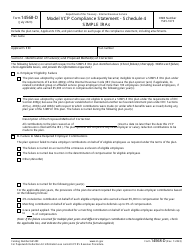

IRS Form 14568-F Model Vcp Compliance Statement - Schedule 6 Employer Eligibility Failure (401(K) and 403(B) Plans Only)

What Is IRS Form 14568-F?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury on September 1, 2017. As of today, no separate filing guidelines for the form are provided by the IRS.

FAQ

Q: What is IRS Form 14568-F?

A: IRS Form 14568-F is a Model Vcp Compliance Statement - Schedule 6 that is used for employer eligibility failure specifically for 401(k) and 403(b) plans.

Q: What is the purpose of IRS Form 14568-F?

A: The purpose of IRS Form 14568-F is to report and correct employer eligibility failures related to 401(k) and 403(b) plans.

Q: Who should use IRS Form 14568-F?

A: Employers who have discovered eligibility failures in their 401(k) and 403(b) plans should use IRS Form 14568-F.

Q: What is an employer eligibility failure?

A: An employer eligibility failure refers to a situation where an employer fails to meet the eligibility requirements for their 401(k) and 403(b) plans.

Q: What is Schedule 6 on IRS Form 14568-F?

A: Schedule 6 on IRS Form 14568-F is specifically designed to address employer eligibility failures for 401(k) and 403(b) plans.

Q: Are there any penalties for employer eligibility failures?

A: Yes, there may be penalties for employer eligibility failures, but using IRS Form 14568-F can help employers correct the failures and potentially avoid or minimize penalties.

Form Details:

- A 1-page form available for download in PDF;

- Actual and valid for filing 2023 taxes;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 14568-F through the link below or browse more documents in our library of IRS Forms.