This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for IRS Form 1094-C, 1095-C

for the current year.

Instructions for IRS Form 1094-C, 1095-C

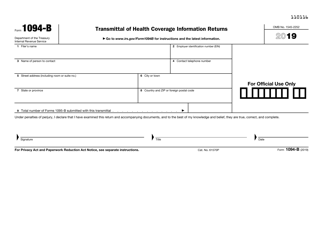

This document contains official instructions for IRS Form 1094-C , and IRS Form 1095-C . Both forms are released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury.

FAQ

Q: What is IRS Form 1094-C?

A: IRS Form 1094-C is an annual transmittal form that employers use to report information about their employees' health insurance coverage offered as part of the Affordable Care Act (ACA).

Q: What is IRS Form 1095-C?

A: IRS Form 1095-C is a form that employers provide to their employees which includes information about the health insurance coverage they offer.

Q: Who needs to file IRS Form 1094-C?

A: Employers with 50 or more full-time employees, including full-time equivalent employees, must file IRS Form 1094-C.

Q: What information is required on IRS Form 1094-C?

A: IRS Form 1094-C requires employers to provide information about the number of full-time employees, whether they offered health insurance coverage, and details about the coverage.

Q: When is the deadline to file IRS Form 1094-C?

A: The deadline to file IRS Form 1094-C is typically February 28th, or March 31st if filing electronically, following the end of the calendar year.

Q: Is IRS Form 1094-C used by employers in both the United States and Canada?

A: No, IRS Form 1094-C is specific to employers in the United States. Canadian employers have different reporting requirements.

Q: Are there any penalties for not filing IRS Form 1094-C?

A: Yes, failure to file IRS Form 1094-C may result in penalties imposed by the IRS. Penalties can vary depending on the size of the employer and the reason for non-compliance.

Instruction Details:

- This 17-page document is available for download in PDF;

- Not applicable for the current tax year. Choose a more recent version to file this year's taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.