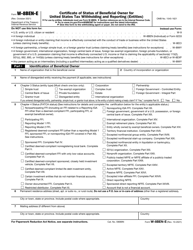

This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for IRS Form W-8EXP

for the current year.

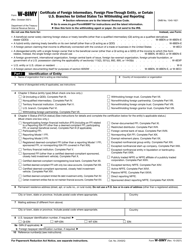

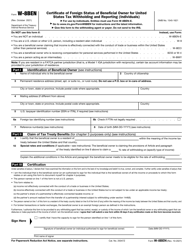

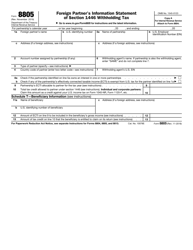

Instructions for IRS Form W-8EXP Certificate of Foreign Government or Other Foreign Organization for United States Tax Withholding and Reporting

This document contains official instructions for IRS Form W-8EXP , Certificate of Foreign Government or Other Foreign Organization for United States Tax Withholding and Reporting - a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury. An up-to-date fillable IRS Form W-8EXP is available for download through this link.

FAQ

Q: What is IRS Form W-8EXP?

A: IRS Form W-8EXP is a certificate used by foreign governments or foreign organizations to claim an exemption or a reduced rate of withholding on income received from the United States.

Q: Who needs to fill out Form W-8EXP?

A: Foreign governments or other foreign organizations that are eligible for an exemption or reduced rate of tax withholding in the United States need to fill out Form W-8EXP.

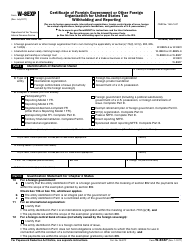

Q: What information is required on Form W-8EXP?

A: The form requires information about the foreign government or organization, including its name, address, tax identification number, and the type of income for which the exemption or reduced rate is being claimed.

Q: When should Form W-8EXP be submitted?

A: Form W-8EXP should be submitted to the withholding agent, usually the payer of the income, before the income is paid or credited. It is recommended to submit the form as soon as possible to avoid any delays or potential penalties.

Q: Are there any additional requirements for Form W-8EXP?

A: Yes, foreign governments or organizations may need to provide supporting documentation along with Form W-8EXP to substantiate their claim for exemption or reduced withholding. The specific requirements are outlined in the instructions for the form.

Q: What happens if Form W-8EXP is not submitted?

A: If Form W-8EXP is not submitted, the withholding agent is generally required to withhold tax at the standard rate and report the income to the IRS. Failing to submit the form may result in higher tax withholding and potential penalties.

Q: How long is Form W-8EXP valid?

A: Form W-8EXP is generally valid until the last day of the third calendar year after the year in which the form is signed, unless there are changes in circumstances that make the form unreliable or incorrect.

Q: Can Form W-8EXP be used for multiple payments?

A: Yes, once Form W-8EXP is validly submitted, it can be used for multiple payments of the same type of income within the specified validity period, provided there are no changes in circumstances that make the form invalid.

Instruction Details:

- This 9-page document is available for download in PDF;

- Actual and applicable for filing 2023 taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.