This version of the form is not currently in use and is provided for reference only. Download this version of

IRS Form W-8ECI

for the current year.

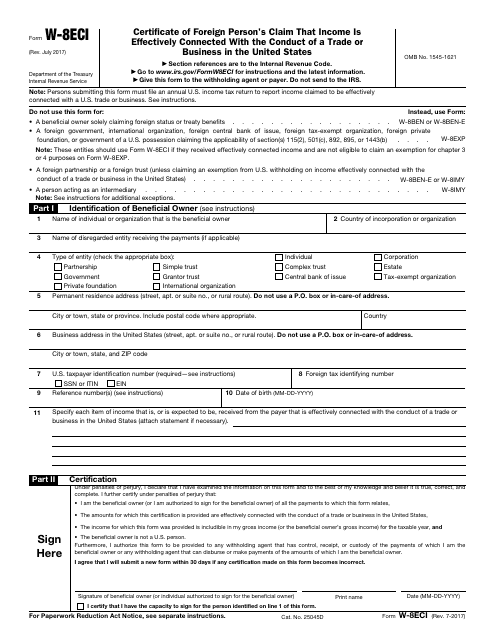

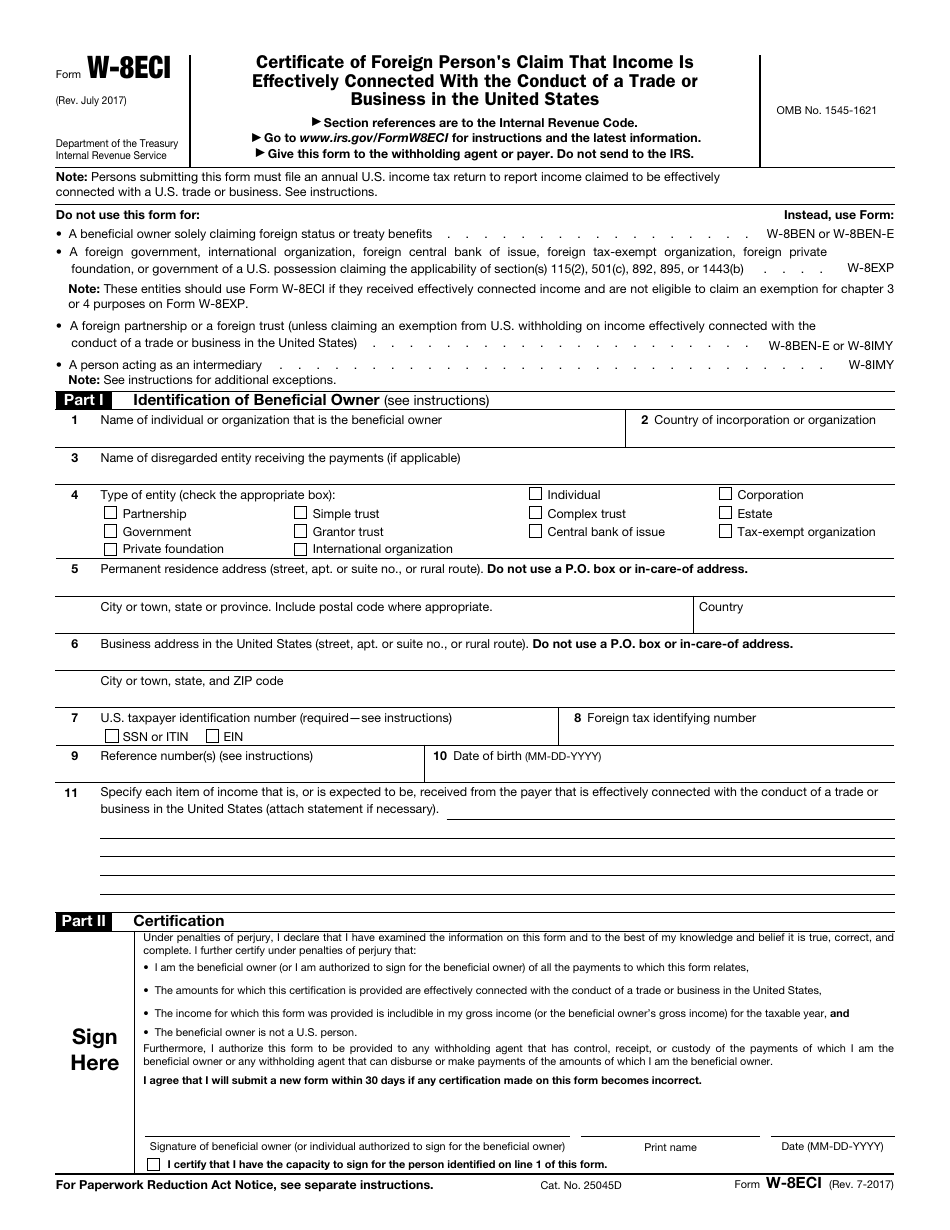

IRS Form W-8ECI Certificate of Foreign Person's Claim That Income Is Effectively Connected With the Conduct of a Trade or Business in the United States

What Is IRS Form W-8ECI?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury on July 1, 2017. Check the official IRS-issued instructions before completing and submitting the form.

FAQ

Q: What is IRS Form W-8ECI?

A: IRS Form W-8ECI is a certificate used by foreign persons to claim that their income is connected to a trade or business in the United States.

Q: Who uses IRS Form W-8ECI?

A: Foreign persons who have income that is effectively connected with the conduct of a trade or business in the United States use IRS Form W-8ECI.

Q: Why is IRS Form W-8ECI important?

A: IRS Form W-8ECI is important because it allows foreign persons to claim a reduced rate of withholding tax on income that is effectively connected with a trade or business in the United States.

Q: What information is required on IRS Form W-8ECI?

A: IRS Form W-8ECI requires foreign persons to provide their identification information, certification of their trade or business activities in the United States, and other relevant details about their income.

Q: How often is IRS Form W-8ECI required to be filed?

A: IRS Form W-8ECI is typically required to be filed once for each income recipient, unless there are changes in their circumstances that affect their claim of being engaged in a trade or business in the United States.

Form Details:

- A 1-page form available for download in PDF;

- Actual and valid for filing 2023 taxes;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form W-8ECI through the link below or browse more documents in our library of IRS Forms.