This version of the form is not currently in use and is provided for reference only. Download this version of

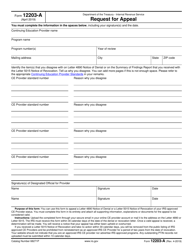

IRS Form 13711

for the current year.

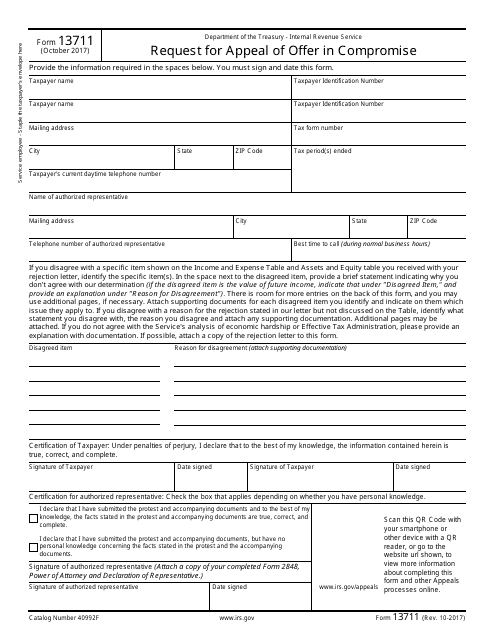

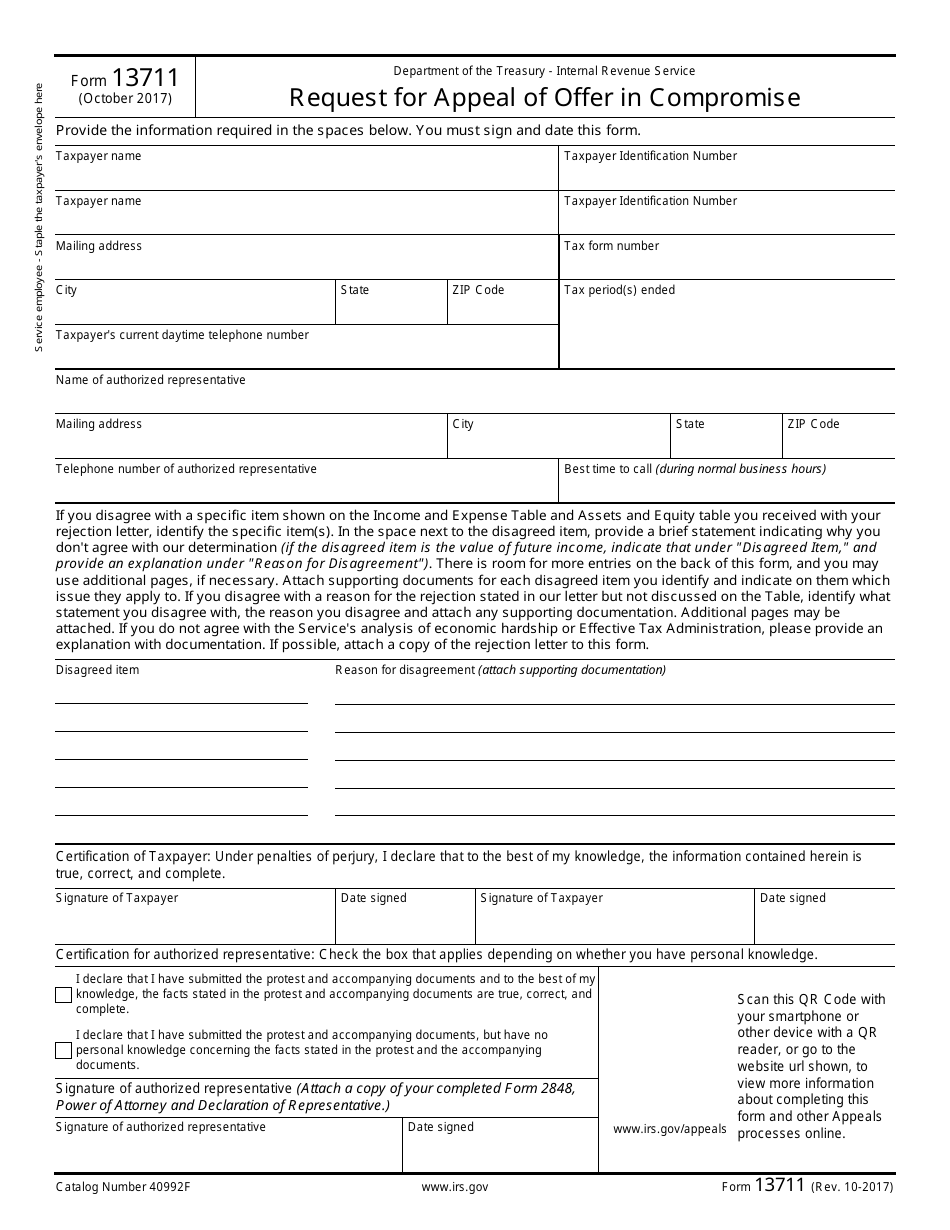

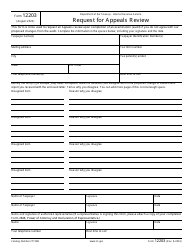

IRS Form 13711 Request for Appeal of Offer in Compromise

What Is IRS Form 13711?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury on October 1, 2017. As of today, no separate filing guidelines for the form are provided by the IRS.

FAQ

Q: What is IRS Form 13711?

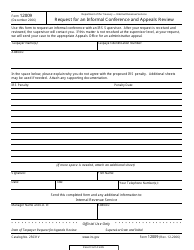

A: IRS Form 13711 is a request for appeal of an Offer in Compromise.

Q: What is an Offer in Compromise?

A: An Offer in Compromise is a program that allows taxpayers to settle their tax debt for less than the full amount owed.

Q: When should I use IRS Form 13711?

A: You should use IRS Form 13711 when you want to appeal the decision made on your Offer in Compromise.

Q: What information is required on IRS Form 13711?

A: IRS Form 13711 requires information such as your name, address, social security number, and the reasons for your appeal.

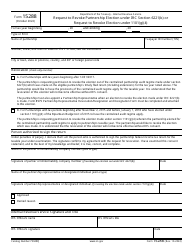

Q: Is there a deadline for submitting IRS Form 13711?

A: Yes, there is a deadline for submitting IRS Form 13711. It must be filed within the specified timeframe provided by the IRS.

Q: Can I submit IRS Form 13711 electronically?

A: No, IRS Form 13711 must be submitted by mail or fax.

Q: What happens after I submit IRS Form 13711?

A: After you submit IRS Form 13711, the IRS will review your appeal and make a decision.

Q: Can I appeal the decision made on my IRS Form 13711 appeal?

A: Yes, you can appeal the decision made on your IRS Form 13711 appeal by following the appropriate procedures outlined by the IRS.

Q: Is there a fee for filing IRS Form 13711?

A: No, there is no fee for filing IRS Form 13711.

Form Details:

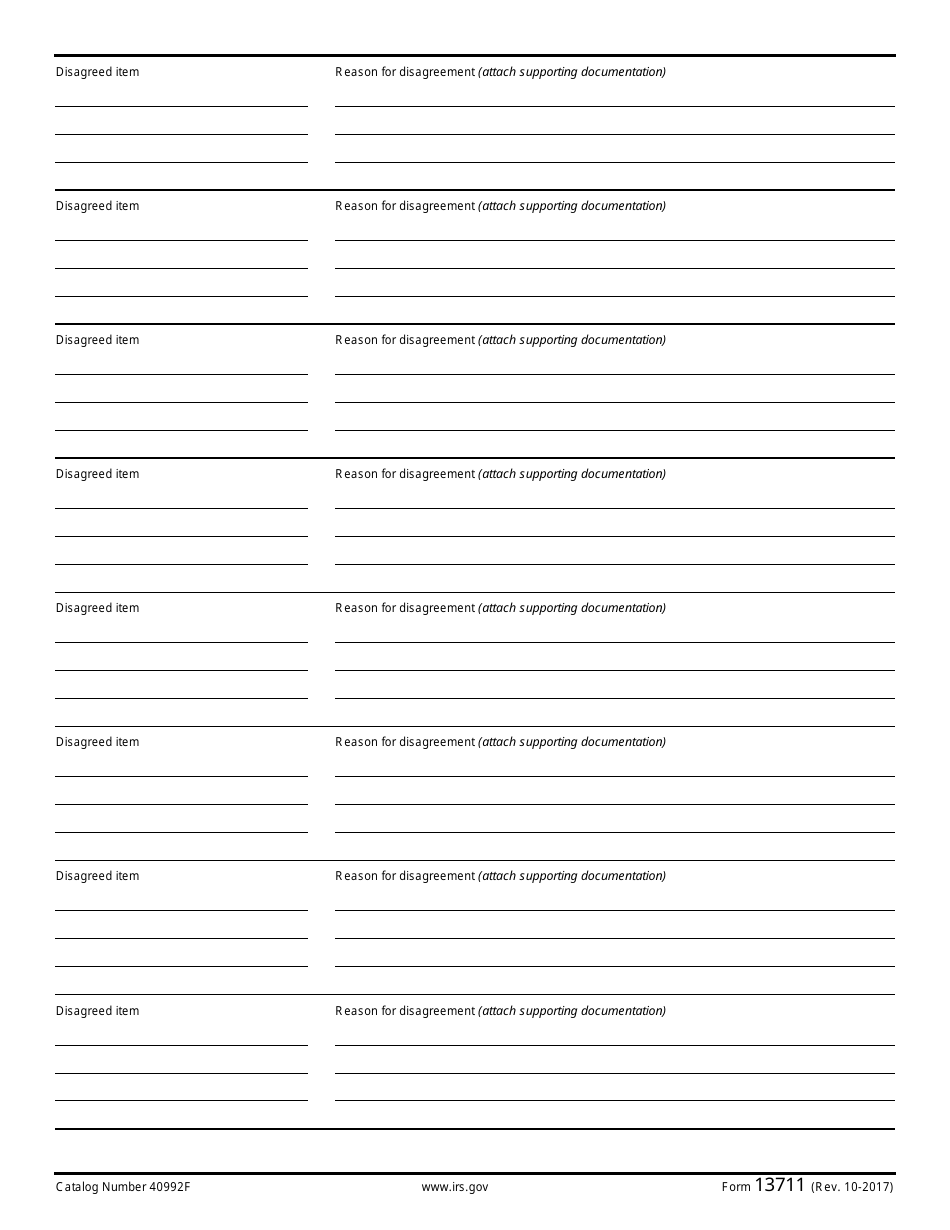

- A 2-page form available for download in PDF;

- Actual and valid for filing 2023 taxes;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 13711 through the link below or browse more documents in our library of IRS Forms.