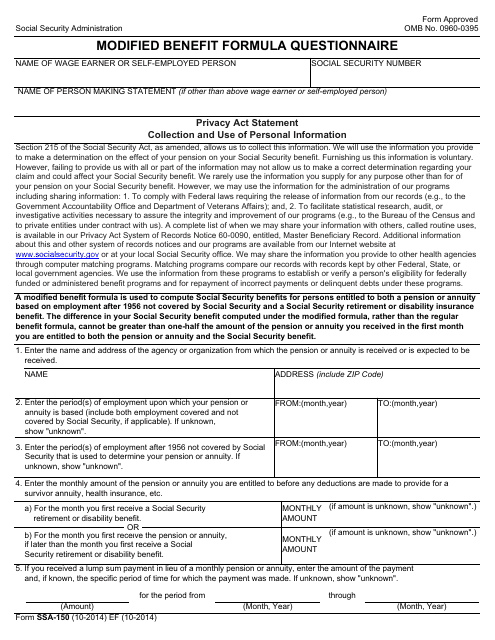

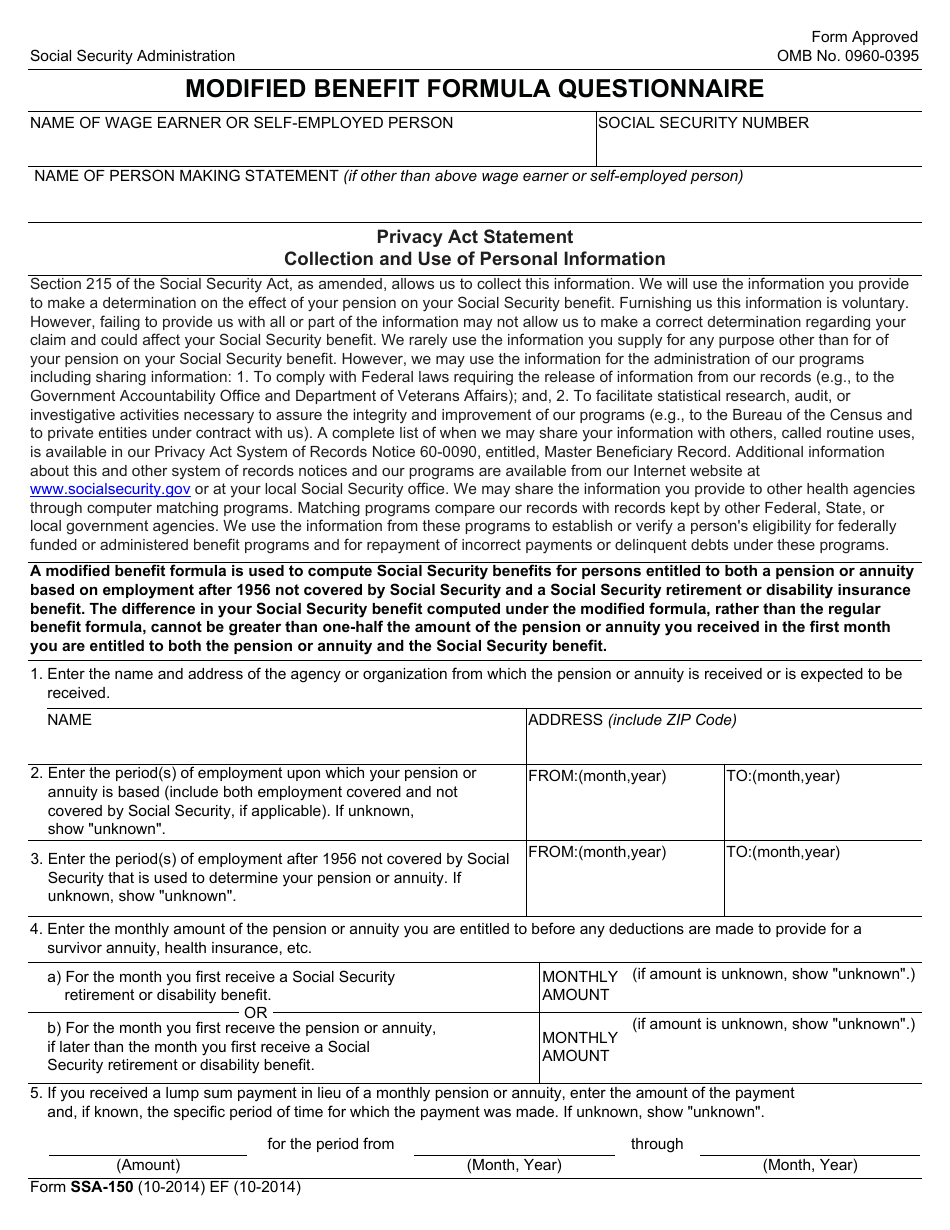

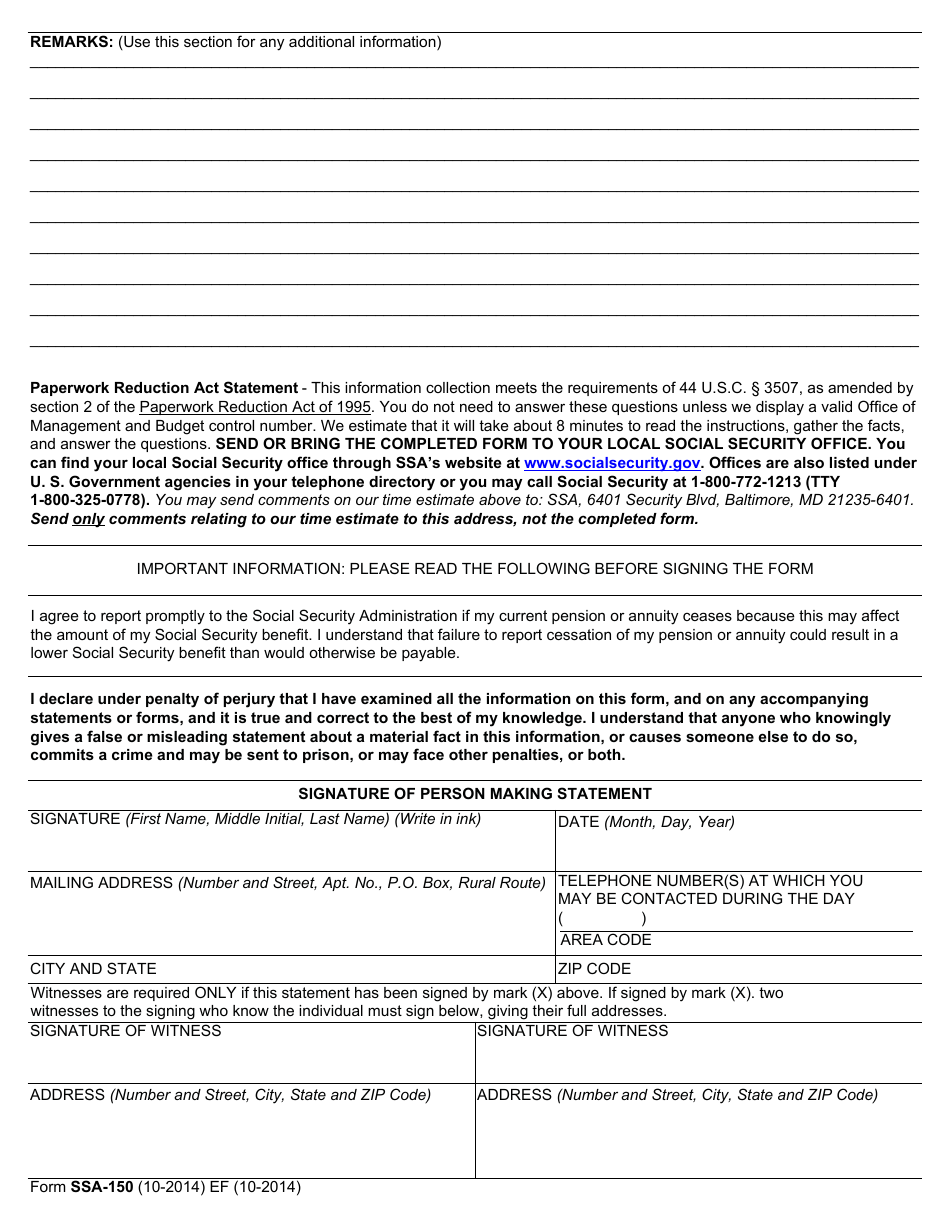

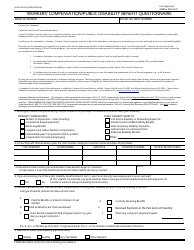

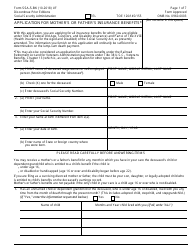

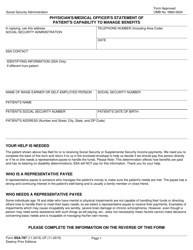

Form SSA-150 Modified Benefits Formula Questionnaire

What Is Form SSA-150?

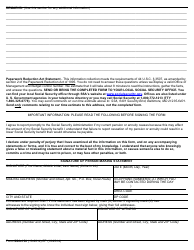

This is a legal form that was released by the U.S. Social Security Administration on October 1, 2014 and used country-wide. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form SSA-150?

A: Form SSA-150 is a questionnaire related to the modified benefits formula.

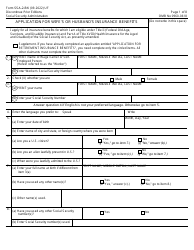

Q: What is the modified benefits formula?

A: The modified benefits formula is a calculation used to determine Social Security benefits.

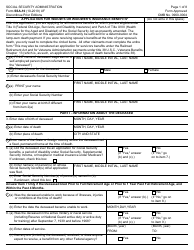

Q: Who needs to complete Form SSA-150?

A: Those who are eligible for Social Security benefits and are subject to the modified benefits formula.

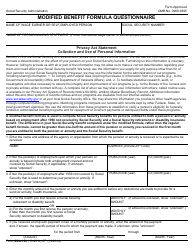

Q: What information is required on Form SSA-150?

A: The form requires information about your earnings, tax payments, and other relevant factors.

Q: Does completing Form SSA-150 guarantee that I will receive Social Security benefits?

A: No, completing the form is just one step in the process. Eligibility for benefits is determined by the Social Security Administration based on various factors.

Q: Is Form SSA-150 only for residents of the United States?

A: No, Form SSA-150 is also applicable to residents of Canada who are eligible for U.S. Social Security benefits.

Q: Are there any fees associated with submitting Form SSA-150?

A: No, there are no fees to complete and submit Form SSA-150.

Q: What if I have questions or need assistance with completing Form SSA-150?

A: You can contact the Social Security Administration for assistance or consult with a financial advisor.

Q: Is there a deadline for submitting Form SSA-150?

A: There is no specific deadline for submitting the form, but it is recommended to do so as soon as possible to avoid any delays in processing your benefits application.

Form Details:

- Released on October 1, 2014;

- The latest available edition released by the U.S. Social Security Administration;

- Easy to use and ready to print;

- Yours to fill out and keep for your records;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form SSA-150 by clicking the link below or browse more documents and templates provided by the U.S. Social Security Administration.