This version of the form is not currently in use and is provided for reference only. Download this version of

Form SSA-10-INST

for the current year.

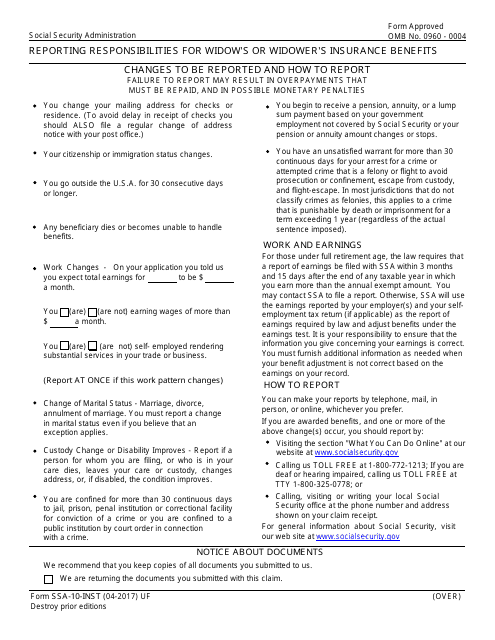

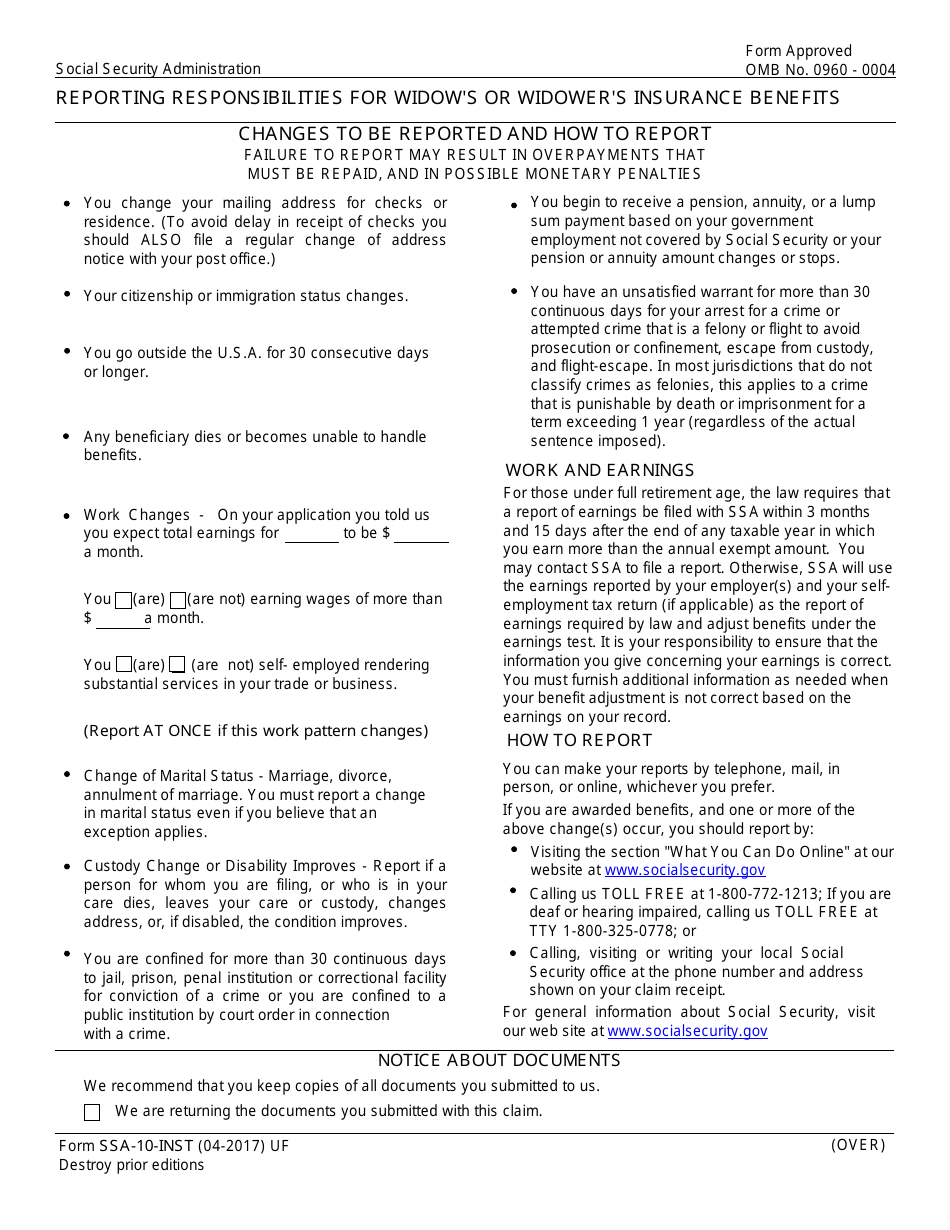

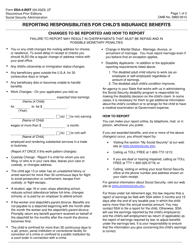

Form SSA-10-INST Reporting Responsiblities for Widow's or Widower's Insurance Benefits

What Is Form SSA-10-INST?

Form SSA-10-INST, Reporting Responsibilities for Widow's or Widower's Insurance Benefits , is a form used to inform the recipient of widow's or widower's insurance benefits about the reporting responsibilities. The document provides a list of changes you must report and the means to report them.

Alternate Name:

- SSA Form 10-INST.

The form was issued by the U.S. Social Security Administration (SSA) on April 1, 2017 , with all prior editions are obsolete. A fillable Form SSA-10-INST is available for download and digital filing below. The form - along with Form SSA-10, Application for Widow's or Widower's Insurance Benefits - is used to apply for the Social Security widow's or widower's insurance benefits.

Form SSA-10-INST Instructions

Form SSA-10-INST contains detailed information on the cases you need to report to the SSA. If you do not report these changes on time, you may be forced to repay the overpayments. You also may be subjected to monetary penalties. Report the following changes to the SSA:

- Change of mailing address to avoid any delays in receiving checks.

- Leaving the U.S. for 30 days in a row or longer.

- Change of your citizenship or immigration status.

- Death of beneficiary or the inability of the beneficiary to handle benefits.

- Change in your work status and expected income you reported via Form SSA-10.

- Any changes in your marital status, including divorce, marriage, and marriage annulment.

- If you are condemned to a public institution by the court order or to an arrest in a penal institution or correctional facility for more than 30 days in a row.

- If you start to receive pension or annuity payments not covered by the SSA.

- Changes in the amounts of your annuity payments.

- Stop of annuity payments or pension.

- An unsatisfied warrant for more than 30 days, flight to avoid prosecution, or escape from custody.

If you are under the full retirement age, you also need to report your earnings every taxable year, in which you earn more than the exempt amount within 3 months and 15 days after the end of the year. If you do not report these changes, your benefits will be adjusted based on the earnings reported by your employer and your self-employment tax return. Below are several ways to report the above-listed changes:

- Visit your local Social Security office; the address of the office you need will be provided on your claim receipt.

- Call your local office at the phone number provided on your claim report.

- Call the SSA toll-free number provided on the form and on the SSA's official website.

- Visit the official website and report the changes in the section "What You Can Do Online."

The SSA recommends you copy all the documents you submit to the agency and keep these copies for future references.